kscarbel2

Moderator-

Posts

18,544 -

Joined

-

Days Won

112

Content Type

Profiles

Forums

Gallery

Events

Blogs

BMT Wiki

Collections

Store

Everything posted by kscarbel2

-

Truck News / July 19, 2019 BLOOMINGTON, Indiana – Preliminary U.S. trailer orders for June fell to the lowest level since September 2009 to 5,500 units, freight transportation forecaster FTR reported. It said the orders were down 53% month-over-month, and 70% year-over-year. Dry van orders were weak and cancellations high, as fleets adjusted orders previously placed according to their second-half needs. Refrigerated vans followed a similar pattern and flatbed orders remained feeble. Van production stayed fairly stable at high rates, while there is continued softening in the flatbed market. Sales are expected to moderate sometime in the second half of the year, as supply catches up with demand. Trailer orders for the past 12 months now total 343,000 units. “Only a couple OEMs have started taking orders for 2020 and fleets did not respond much to this move in June,” said Don Ake, vice-president of commercial vehicles at FTR. “It would appear that the market is returning to normal ordering cycles, with fleets evaluating their next year requirements during the summer and then starting to place those orders around October.”

-

Commercial Carrier Journal (CCJ) / July 19, 2019 A group of seven Caterpillar dealerships have formed the RIG360 independent truck service centers network, designed to provide an all-makes approach to truck parts and service. The network initially will consist of 65 locations with 450 service bays across 12 states, with potential for other Cat dealers to join. The RIG360 network has a “90-Minute Promise,” which states it will make an initial diagnosis of a truck’s condition, troubleshoot the issue, and deliver a verdict within 90 minutes. Within an additional 90 minutes customers will receive an initial estimate on cost and time to repair. “These dealers liked the on-highway business and wanted to stay in it,” says Ed Cullen, strategic consultant. “They had the facilities, the people and the training, and they also recognized there’s a lot of power in working together.” Cat announced it would exit the on-highway diesel engine business in 2008 and had short-lived foray into vocational trucks, which ended in 2016. Initial RIG360 participating Cat dealers are Cleveland Brothers Equipment, Foley Equipment, MacAllister Machinery/Michigan Cat, Ohio Cat, Thompson Machinery, Thompson Tractor and Yancey Bros. Other Cat dealers will probably join the network as the initiative progresses, Cullen says. Caterpillar itself has no affiliation with or investment in this venture. “In doing our research, we found that folks can bring a truck into a repair facility and it will sit there,” Cullen says. “So we decided to make a commitment that if someone comes into a shop we’ll give an initial diagnosis so they can make an informed decision about what to do next. They’ll know where they stand within the first 90 minutes.” Cullen says RIG360 also offers truck owners necessary service capacity. “With all the vertical integration that’s happened in the trucking industry, there’s been a strain on the truck manufacturer’s dealer networks. We’ve got the bays and we’ve got the technicians, so that really positions us well to be able to turn trucks around more quickly.” Each dealer has its own identity in the network, such as Cleveland Brothers RIG360 Truck Centers and Foley RIG360. “We are excited to help form and launch the new RIG360 network and bring even more truck parts and service capabilities to our customers,” says Jon Robinson, vice president of Foley Equipment and RIG360 board chair, in a release announcing Foley’s participation in the network. “Combined with our HDA Truck Pride launch last year, we have expanded our ability to serve all makes and models from radiator to rim, whether that is in Kansas, Missouri or beyond.” .

-

-

During WW2, many freighters were sunk by German U-boats within eyesight of beach goers. https://en.m.wikipedia.org/wiki/USS_Turner_(DD-648) https://en.m.wikipedia.org/wiki/USS_Plymouth_(PG-57) https://en.m.wikipedia.org/wiki/USS_Cythera_(PY-26)

-

Reuters / July 19, 2019 FRANKFURT -- Diesel engine maker Cummins Inc. has made an offer for Volkswagen Group's MAN Energy Solutions unit, people close to the matter said, as the automaker seeks to slim down its portfolio of disparate assets. Volkswagen announced in May that it is exploring a sale or partnership for its MAN Energy Solutions as part of a restructuring of the German cars, trucks and bus empire. VW has held talks with Cummins, and received an offer from the U.S. company for MAN Energy Solutions, the sources said. A Cummins spokesman said: "We do not comment on rumors or speculation in the marketplace." VW CEO Herbert Diess has vowed to simplify the group which has 12 brands, trucks, buses, motorbikes, cars and electric bicycles as part of its business. MAN Energy makes large diesel engines used in ships and power stations. A Volkswagen spokesman on Friday reiterated that VW is reviewing all options for the business, but refused to comment further on Cummins. Although VW has not yet appointed advisory banks for the sale, it has approached several companies to gauge their appetite for the asset, which is expected to fetch about 3 billion euros ($3.4 billion) the sources said. To maximize price, Volkswagen has also engaged in talks with Advent-owned engine maker Jenbacher, a former General Electric business, as well as at least one Asian peer, they added. Advent declined to comment. Mitsubishi Heavy Industries and Wartsila have been named as possible bidders in the past. "Volkswagen originally wanted to strike a sweetheart deal with Cummins, but is now opening up holding talks with some other strategic players," one of the people said, adding that the automaker hopes to sign a deal before year-end. The VW unit, formerly known as MAN Diesel & Turbo, which also makes turbochargers used in the oil and gas industry, in 2018 reported operating earnings of 133 million euros ($149 million) on sales of 3.1 billion euros ($3.5 billion.) Volkswagen has struggled to slim down in the past after the company's works council, which has veto power over major restructuring moves, blocked efforts to sell motorbike brand Ducati and transmissions maker Renk. MAN Energy Solutions was originally a part of VW's trucks brand MAN, but some of MAN's assets were transferred to Volkswagen last year as part of efforts to streamline Traton ahead of its listing.

-

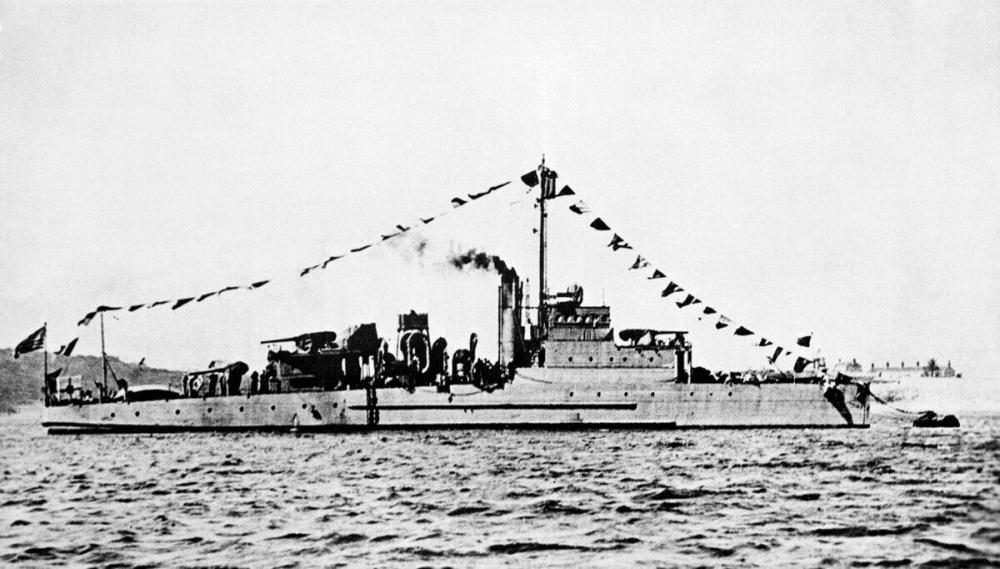

This Navy warship went down in World War II with 49 crew members aboard. Divers finally found it after 75 years Michelle Lou, CNN / July 19, 2019 The USS Eagle PE-56 was supporting Navy training exercises off the coast of Maine when an explosion tore it in half in April 1945. Only 13 people survived, and 49 officers and crew members went down with the ship. For 75 years, no one knew exactly where the submarine hunter -- and its crew -- rested at the bottom of the ocean. But in June 2018, a team of eight wreck divers working with the Smithsonian Channel finally located it about six miles from Maine's shore. The group of divers, known as the Nomad Exploration Team, spent four years searching for the wreck until they stumbled upon it with the help of sonar technology from Garry Kozak. "When we found her initially and found subsequent pieces later on, we were just in absolute awe and there was an incredible amount of respect for the sailors who are still entombed with the Eagle 56," Ryan King, one of the divers, told CNN. The wreckage sits more than 250 feet below the surface, King said. The ship's steel plating is starting to rust away, but the site has been designated a war grave "and has all the protections associated with that," King said. Finding the shipwreck was a challenge: Diving off the coast of Maine means that it's cold and visibility is often less than 20 feet. "It's not a wreck that's in shallow waters. It's significantly deeper than recreational diving," King said. "Decompression on these dives will last 1.5 to 2 hours, sometimes longer." The sinking was originally thought to be an accident The USS Eagle PE-56 was the last American warship sunk off the East Coast during World War II, according to the Smithsonian Channel. The US Navy originally dubbed the April 23, 1945, sinking an accident from a boiler explosion, but survivors reported that a Nazi U-boat (U-853) had in fact torpedoed the ship. Naval historian Paul Lawton and archivist Bernard Cavalcante's research proved the initial assessment inaccurate, and in 2003, the Navy reclassified the sinking as a combat loss. It also recommended that Purple Hearts be awarded to the 49 dead and 12 survivors. The reclassification made the USS Eagle PE-56 the Navy's largest single combat loss in New England waters. . .

-

Ford tells U.S. dealers to repair small-car transmissions for free Michael Martinez, Automotive News / July 18, 2019 Ford Motor Co. has told its U.S. dealers to give free repairs to any Focus and Fiesta owners who complain about problems with the cars' PowerShift dual-clutch transmission, according to a memo obtained by Automotive News. The offer, made after a Detroit newspaper published a lengthy report that said Ford knowingly launched the cars with faulty transmissions, lasts until Friday but could be extended. In the July 12 memo, Ford says dealerships should "arrange to diagnose the vehicle and repair as necessary." The fixes can be applied to 2011-17 models, many of which are out of warranty. Previous class-action lawsuits have covered 2011-16 models with transmissions that customers complained would shudder, jerk and hesitate. Dealers were told to expect another update by Friday. The memo, first reported by the Detroit Free Press, followed a July 11 report by the newspaper that said Ford knew about the transmission defects yet sold them anyway. The automaker responded Wednesday, saying the report made "conclusions that are not based in fact." Automotive News reported this month that former Ford CEO Mark Fields has been called to testify in ongoing litigation surrounding the troublesome gearboxes, which have haunted the automaker for years. Ford reached a settlement in 2017 in a class-action lawsuit covering 1.9 million owners, but the deal is being challenged in California federal court on the grounds that not enough owners would be compensated. A separate mass-tort case involving thousands of customers is pending in Michigan.

-

GM flexes engineering muscle with radical Corvette overhaul Richard Truett, Automotive News / July 18, 2019 TUSTIN, Calif. -- One of the biggest challenges for the eighth-generation Corvette -- the first production model with the engine behind the driver -- doesn't have anything to do with how fast the car can reach 60 mph or carve up a corner. The 2020 Corvette Stingray looks to be one of the most technically advanced vehicles General Motors has built since it tested the world's first fuel cell vehicle in 1966 and, five years later, built the propulsion and suspension system for the Lunar Rover that drove on the moon. The new Corvette -- introduced here Thursday -- is a barometer of GM engineering in an era of rapidly changing technology. It will provide a strong test of GM's product development system, its testing and validation methods, and its quality control processes. If the Corvette launches cleanly with no technical issues from adopting GM's new wire-reducing digital electrical architecture, its advanced lightweight, mixed-material chassis that uses die-cast aluminum parts made in an engine factory, the electric brakes and other innovations, it could bode well for GM as it pushes closer to production of fully autonomous vehicles, which will share some of the same technologies with the new Corvette. And most important, the retooled Corvette's computer systems, and the speed at which they communicate internally and externally, will determine how seamlessly GM transitions to autonomous vehicles and the vast amount of data processing they require. Nuts and bolts GM will begin producing the 2020 Corvette late this year at its Bowling Green, Ky., plant. Since 2015, GM has invested $439 million to retool the factory to build the midengine Corvette. In addition to new production equipment, the plant is equipped with a new paint shop and a low-volume engine production facility called the Performance Build Center, which was previously in suburban Detroit. "Corvette has always represented the pinnacle of innovation and boundary pushing at GM," GM President Mark Reuss said in a statement. "The traditional front engine reached the limit of its performance, necessitating the new layout. In terms of comfort and fun, it still looks and feels like a Corvette, but it drives better than any vehicle in Corvette history." At the car's formal introduction late Thursday, at an old military aircraft hangar, Chevrolet officials ticked off a long list of high-tech items featured in the new Corvette. They include: A new version of Chevrolet's classic small-block V-8 engine. This one retains the 6.2-liter displacement of the previous motor, but has a new block that lowers the crankshaft an inch to mate to the transaxle. The layout helps improve handling, GM says. The naturally aspirated engine is rated at 495 hp and 470 pound-feet of torque. When the Corvette is equipped with an optional performance package, it can propel the car to 60 mph in less than 3 seconds -- the fastest base-model Corvette in history. GM did not mention any future engines in statements released before the media event. However, as part of the plant investment at Bowling Green, a new engine line for the twin-turbo "Blackwing" Cadillac V-8 has been installed. It's possible that higher-performance models of the Corvette could get a version of that engine. Chevrolet's first eight-speed dual-clutch transmission, a gearbox manufactured by Tremec, that allows the driver to shift the car manually or drive it as an automatic. "The performance shift algorithms are so driver-focused, they can sense when you are doing spirited driving, regardless of driving mode, and will hold lower gears longer for more throttle response," said Tadge Juechter, Corvette executive chief engineer. No manual transmission will be available at launch -- a first for the Corvette in decades. A reengineered suspension system that features coil over dampers, revised electric steering and the Corvette's first electric brake system, which eliminates the vacuum-powered brake booster. That has been replaced with an electronic unit that can be tuned and adjusted for different driving conditions. Other suspension features include a system that automatically raises the front of the car by about 1.5 inches to protect the lower bodywork from damage by potholes, speed bumps and steep driveways. It can be programmed to operate through GPS and can store as many as 1,000 locations. The digital vehicle platform that is the bedrock for GM's future electronics technologies. GM says it reduces wiring and allows for faster signal transmission between different vehicle systems. Vehicles that use the new electrical architecture can be updated via over-the-air programming, similar to how Tesla rolls out new model features. A chassis constructed using the mixed-material process introduced on the Cadillac CT6 and then used in high volume on the Chevrolet Silverado and GMC Sierra pickups. With mixed materials, GM engineers use different metals of varying thicknesses in different parts of the chassis -- the right metal in the right amount in the right place. The approach reduces weight but increases strength. The new Corvette uses what GM calls the Bedford Six. They are six high-pressure, die-cast aluminum components that minimize the number of joints in the chassis. Fewer joints yields a stiffer body, which improves handling, especially under strenuous track conditions. The aluminum parts are made at GM's Bedford, Ind., powertrain plant. Significant weight savings from new materials. The front and rear tubs and dashboard are molded from ultralightweight fiberglass and proprietary resin. GM says the material is so light that it floats in water. The new Corvette also has a carbon-fiber curved rear bumper beam, an industry first, GM says. The lightest 2019 Corvette checked in at 3,298 pounds. The entry-level 2020 model is slightly heavier at 3,366 pounds. All-new interior The 2020 Stingray's midengine configuration gave GM design chief Mike Simcoe's team the opportunity to make the biggest changes to the Corvette -- inside and out -- since the car was introduced in 1953. Simcoe says the new exterior design is inspired by fighter jets and Formula One race cars. But the car's aerodynamic shape also helped dictate the interior's styling. First, because there is no engine between the front wheels, the cockpit has been moved forward by 16.5 inches over the outgoing Corvette. Ultrathin air conditioning vents help lower the instrument cluster, which contains a 12-inch reconfigurable display. A long strip of buttons, between the seats on the center console, controls the seats, HVAC system and other items. Customers can choose from three types of seats, those designed for street driving to full-on competition seats for track use. The interior is decked out in cut-and-sew leather, real metal inlays, stainless steel speaker grilles and optional carbon-fiber trim.Unlike many other two-seat cars, the new Corvette has what appears to be reasonable cargo room -- and that could prove to be a major advantage over cramped roadsters and coupes battling for sales in a market that is shifting to SUVs, pickups and crossovers. The car has two trunks and can transport two golf bags or luggage. Cargo room totals 12.6 cubic feet. Big change An all-new Corvette is rare. For most of the 66 years since the car debuted, it has been built basically the same way --- with the engine up front, the transmission in the middle and drive axle in the rear -- and with the body mounted to the frame. There have been several iterations of the car's underpinnings over the years, and GM has tinkered a few times with a midengine layout, but none ever made production. Despite the major technical changes, there's no guarantee the car will be a profit-making vehicle for GM. Sports car sales have collapsed. Even inexpensive two-seaters, such as the Mazda MX-5 Miata, have struggled. Through June, Porsche has sold just 4,620 911s in the U.S. The budget Porsche 718 has fared even worse with 2,155 sold through June. The highest-volume Porsche is a crossover, the Macan, with U.S. sales of 9,711 this year. "Corvette mobilizes a passionate fan base but it's a small group and they don't necessarily represent the next generation of Chevrolet customers," said Jessica Caldwell, an analyst with Edmunds. "Moving to a midengine format shows Chevy isn't afraid to take risks to keep Corvette relevant, but you have to wonder if it will be enough to excite younger buyers." Chevrolet dealers in the U.S. sold 9,731 Corvettes in the first half of the year, down roughly 5 percent over the same 2018 period. Affordable? Though final pricing has not been set, and the car can now be reserved, Reuss said Thursday the 2020 Corvette will be priced below $60,000. Suburban Detroit Chevrolet dealer Paul Stanford of Les Stanford Chevrolet in Dearborn, Mich., has collected 160 deposits for the 2020 Corvette through Wednesday. He said the car has the potential to draw buyers from the Porsche 911 and other more expensive sports cars. Stanford believes GM will price the new model within a few thousand dollars of the outgoing model -- $56,995 with destination -- keeping it a bargain among high-performance sports cars. "They are going to make it affordable," said Stanford, who is on the Chevrolet dealer advisory board. "That's hugely important to the everyday buyer who we've come to know. The Corvette has always been a value proposition in the market. I am honestly thinking we are going to see improved sales. "I've seen the car," he said Wednesday. "It's mind-blowing." Les Stanford Chevrolet was among the nation's top three dealers in Corvette sales last year. And for the first time in Corvette history, the car will be manufactured in right-hand drive, opening up exports markets in such places as Japan, the United Kingdom and Australia. That tactic has worked well for Ford, which boosted volumes of the latest Mustang by adding right-hand drive versions. . . . . . . .

-

MarketWatch / July 18, 2019 STOCKHOLM--Volvo AB (VOLV-B.SK) on Thursday reported bumper earnings in its second quarter as sales of vehicles and services drove higher, but a sharp drop in orders for new trucks will lead to production cuts during the second half of the year. The Swedish truck maker said net profit for the period ended June 30 was 11.13 billion Swedish kronor ($1.19 billion) compared with SEK9.22 billion a year earlier, beating analysts' forecasts of SEK9.5 billion. Sales rose 16% to SEK120.69 billion, beating analysts' forecasts of SEK111.73 billion, while the group's adjusted operating margin grew to 12.5% from 11.1%. Truck volumes grew by 10% in the quarter, but order intake fell 21%, Volvo said. In Europe, even though transport activity has remained solid, customers have become more cautious to invest in new trucks, while in North America, the decline is related to the exceptionally strong order activity in 2018 and the fact that customers have ordered what they need for 2019. Customers are awaiting more visibility on the economic development in 2020 before placing new orders, Volvo said. Volvo had previously guided for North American retail sales of 310,000 heavy-duty trucks in 2019 and 300,000 in Europe while Chinese demand for heavy- and medium-duty trucks in 2019 was projected at 1.15 million vehicles. However, the company didn't include any guidance on this in its report Thursday. In a separate announcement, Volvo said it has entered a strategic alliance with Samsung SDI to develop battery packs for Volvo's electric trucks. The alliance will cover joint development of battery packs specifically developed for Volvo Group's truck applications.

-

Have you heard every Autocar truck is custom-engineered? True now, true when this one-of-a-kind 1958 DC-105 was built for Gilbane Building Co. in Rhode Island. Now, who can tell us about that badass shovel? #TBT #ThrowbackThursday #Lowboy #AutocarDC Thanks to Mike Lusher. .

-

Medium-Duty US Retail Sales in June Fall Flat

kscarbel2 replied to kscarbel2's topic in Trucking News

I'm noticing more F-750s on the road as well (I would like to know what percentage are derated to 26,000lb for non-CDL status). -

Ford Trucks International Press Release / July 18, 2019 We have delivered ten model 1842T 4x2 Ford Cargo heavy tractors to Timlog, the official transporter for Afriquia, the leading oil company in Morocco with more than 500 stations. .

-

TRATON Boss Says VW Truck Unit "Not Interested" In Acquiring Navistar FreightWaves / July 18, 2019 Navistar International shares fell nearly 6.5 percent on Wednesday (July 17) after the head of Volkswagen's trucking group TRATON said it was "not interested" in a full acquisition of Navistar. TRATON CEO Andreas Renschler told the German newspaper Handelsblatt that owning 16.8 percent of Navistar's stock and controlling two board seats is sufficient. We are very satisfied with our partnership with Navistar as it is," Renschler said. "To be honest, many takeovers – even in other industries – are unsuccessful." In 2018, Renschler said acquiring Navistar would be a "good idea." Been here before David Leiker, senior research analyst at Robert W. Baird & Co., said TRATON, formerly the Truck & Bus Group of Volkswagen, has made similar comments since paying $256 million in September 2016 for its stake in Navistar. "In the past, comments suggesting a longer process for acquiring Navistar have created pullbacks in Navistar's stock, and today is no different," Leiker said. "We firmly believe TRATON will eventually acquire Navistar to maximize the synergies and financial returns from its investment." Geographic synergies TRATON began trading on the Frankfurt Stock Exchange and Nasdaq Stockholm under the ticker 8TRA on June 28. That raised investor speculation that it would add Navistar to its MAN and Scania brands as it pursues Daimler and Volvo for global truck leadership. TRATON's core markets are Europe and South America. It reported revenue of 25.9 billion euros in 2018 with truck sales of 233,000 units. North America accounts for only 1.5 percent of TRATON's vehicle deliveries. It has about 81,000 employees and 29 production and assembly facilities in 17 countries. Navistar holds about 14 percent of the U.S. market for heavy- and medium-duty trucks. It generated $10.3 billion in revenue during its 2018 fiscal year ending in October 2018. Navistar's $3.3 billion market cap is roughly one-quarter of TRATON's value. The two collaborate on engine technology, the sale of engines and contract manufacturing. TRATON formed a strategic partnership with Japan's Hino Motors Ltd. in April 2018 to cooperate on conventional, hybrid and electric powertrains, connectivity and autonomous driving systems as well as purchasing and logistics. Toyota owns 50.1 percent of Hino. Investment timing TRATON's investment came at a critical time for Navistar. Its market share had cratered because of the defective Maxxforce engine that cost billions in recalls and repairs and damaged the company's reputation. Navistar recently set aside $158 million to cover a class action and other customer claims. Since the alliance was formed, Navistar has also benefited from TRATON's purchasing might. VW and Navistar said they anticipated five-year savings of $500 million from working together. "The alliance with TRATON is reducing costs through the procurement joint venture and cost-effective access to next-generation technologies," Navistar CEO Troy Clarke said on the company's earnings call June 4.

-

Ford to add 1,200 jobs, shift in South Africa Reuters / July 17, 2019 JOHANNESBURG -- The South African unit of Ford Motor Co. said Wednesday it would hire an additional 1,200 workers at one of its assembly plants, an increase of more than 25 percent, to add an extra shift and boost production. The additional shift, which will increase output to 720 vehicles per day, is the result of a 3 billion rand ($215 million) investment in South Africa that was announced in 2017, aimed at increasing annual production to 168,000 units. Ford currently employs around 4,300 in South Africa at the plant in the Silverton suburb of Pretoria, which will add the extra shift, and at another site in the coastal city of Port Elizabeth. "The third shift will allow us to ramp up our production from the current 506 vehicles assembled per day to a peak of 720 units to satisfy the strong demand from customers in South Africa, as well as for our crucial exports to 148 markets around the world," said Ockert Berry, vice president of operations for Ford Middle East and Africa. Ford joins a number of other global automakers in ramping up production on the continent, where growth is expected while trade tensions threaten manufacturing operations elsewhere. The South African arm Nissan Motor Co. also announced a similarly sized investment this year, increasing output at its local plant by 30,000 units, while BMW production chief Oliver Zipse said earlier this month that it had moved some production from the U.K. as a result of Brexit, and that British plants no longer built South African components. Around a third of Ford's locally produced vehicles are sold in South Africa and other sub-Saharan African countries, with the rest exported. The additional shift will start in August and will be focused on the new Ranger, Ranger Raptor and Everest models. The locally-built Ranger is ranked as the top-selling pickup in Europe and leads light commercial vehicle exports. .

-

It's a nice day to pour the foundation for a new Costco store - just park your Autocar ACX in the middle of the pad and reach the entire 360 foundation without budging. #AutocarConcrete #AlwaysUp .

-

Julian Borger, The Guardian / July 16, 2019 The US House of Representatives has called for an investigation into whether the spread of Lyme disease had its roots in a Pentagon experiment in weaponising ticks. The House approved an amendment proposed by a Republican congressman from New Jersey, Chris Smith, instructing the defence department’s inspector general to conduct a review of whether the US “experimented with ticks and other insects regarding use as a biological weapon between the years of 1950 and 1975”. The review would have to assess the scope of the experiment and “whether any ticks or insects used in such experiment were released outside of any laboratory by accident or experiment design”. The amendment was approved by a voice vote in the House and added to a defence spending bill, but the bill still has to be reconciled with a Senate version. Smith said the amendment was inspired by “a number of books and articles suggesting that significant research had been done at US government facilities including Fort Detrick, Maryland, and Plum Island, New York, to turn ticks and other insects into bioweapons”. A new book published in May by a Stanford University science writer and former Lyme sufferer, Kris Newby, has raised questions about the origins of the disease, which affects 400,000 Americans each year. Bitten: The Secret History of Lyme Disease and Biological Weapons, cites the Swiss-born discoverer of the Lyme pathogen, Willy Burgdorfer, as saying that the Lyme epidemic was a military experiment that had gone wrong. Burgdorfer, who died in 2014, worked as a bioweapons researcher for the US military and said he was tasked with breeding fleas, ticks, mosquitoes and other blood-sucking insects, and infecting them with pathogens that cause human diseases. According to the book, there were programs to drop “weaponised” ticks and other bugs from the air, and that uninfected bugs were released in residential areas in the US to trace how they spread. It suggests that such a scheme could have gone awry and led to the eruption of Lyme disease in the US in the 1960s.

-

Exactly. Paul told us in May 2018: "Things have been very crazy of late and very unsure of what the future will bring We sold our sugar cane farm in north Queensland after many years of trying and the wife and I decided we would take some time off and travel around a bit on a working holiday till we decide what we want to do" With such a huge change in Paul's life, it's no wonder he became less active. But he still loves us and we all love him. https://www.bigmacktrucks.com/topic/53404-mrsmackpaul/?tab=comments#comment-399268 I am hoping that Billy is well. Never a kinder fellow.

-

Truck News / July 16, 2019 LISLE, Illinois – Navistar has enhanced its dealer resources by launching an engineering hotline. The hotline will provide International dealers with direct, rapid access to the product experts who designed the vehicles. The hotline can be reached through a simple phone call from any International dealer. Calls are immediately directed to an application engineer who listens to the dealer’s request and offers support. During a pilot phase conducted earlier this year, the hotline quickly amassed well over 100 calls from dealers, the company said. Typical phone calls ranged from general questions on severe service truck configurations to advanced, application-specific questions from customers.

-

Trans INFO / July 11, 2019

-

Paul is a great example. His life has had some changes down in Oz and he doesn't have as much free time as he did for a period. So yes, we hear from Paul less than before (I miss his great videos), but it's not because he's upset with anything at BMT.

BigMackTrucks.com

BigMackTrucks.com is a support forum for antique, classic and modern Mack Trucks! The forum is owned and maintained by Watt's Truck Center, Inc. an independent, full service Mack dealer. The forums are not affiliated with Mack Trucks, Inc.

Our Vendors and Advertisers

Thank you for your support!