kscarbel2

Moderator-

Posts

19,100 -

Joined

-

Days Won

114

Content Type

Profiles

Forums

Gallery

Events

Blogs

BMT Wiki

Collections

Store

Everything posted by kscarbel2

-

Chicago Tribune / August 10, 2018 The Norfolk Southern Railway apologized on Friday for its controversial "bait truck" operation in Chicago's Englewood neighborhood and said it wouldn't use the tactic again. In a letter in response to a Tribune editorial, Herbert Smith of Norfolk Southern acknowledged that the undercover operation “eroded trust between law enforcement and the community.” “We sincerely regret that our actions caused further unease, and we don’t plan to use this method in the future,” wrote Smith, the railroad’s manager of community and legislative relations in Illinois, Iowa and Michigan. The joint investigation with Chicago police — dubbed "Operation Trailer Trap" — used a truck loaded with goods that was left parked near 59th Place and Princeton Avenue in Englewood as a lure for potential thieves. The probe, however, came under fire from the American Civil Liberties Union of Illinois and others after video footage of the operation went viral. Despite the railroad’s apology, Smith said in the letter to the editor that community residents “deserve more context” about the investigation he said was prompted by ongoing cargo theft from parked and locked containers and trailers in that area. Those break-ins included thefts of guns and ammunition “that found their way in the local community,” he said. “At the time, local residents and officials told us we needed to do more to prevent this, and we have responded,” Smith wrote. “Norfolk Southern, in coordination with local, state and federal officials, employs a wide range of preventative and surveillance methods (seen and unseen) to deter crime. We regularly change and improve enforcement tools, but unfortunately thefts continue.” After noting that the FBI estimates that freight thefts total more than $27 million a year, Smith said the railroad has reached out to local officials “to discuss how to best prevent freight theft, improve community relations and rebuild mutual trust.” A video shot last week and posted on the Facebook page of community activist Charles Mckenzie appeared to show Chicago police officers arresting a man after he allegedly broke into a "bait truck" in the Englewood neighborhood. People on the video argued that community members were being set up for arrest. Three people were arrested during the operation, according to Susan Terpay, a Norfolk Southern spokeswoman. But felony burglary charges have been dropped against each of the three defendants, said Robert Foley, a spokesman for Cook County State’s Attorney Kim Foxx. Foley declined to elaborate on why other than to say “it was in the interest of justice.” One defendant still faces a misdemeanor assault charge in the case, Foley said. Thomas Ahern, a Chicago police spokesman, said the department was not part of the “operational plan” with Norfolk Southern and only assisted the railroad with arrests. Ahern said the goal of the operation was to respond to the numerous cargo thefts, including the stolen guns. He said authorities want to interview suspects in the case to try to determine if they knew of the previous gun thefts. The tactic is controversial, however, because some consider it a form of entrapment. After Mckenzie's video footage was first reported by the news website Vox, the ACLU of Illinois condemned the practice. "Police in Chicago must focus on building trust and better relationships within the communities they serve, not engage in stunts like bait trucks," said Karen Sheley, its director of the police practices project. Mayoral candidate Lori Lightfoot, former head of the Chicago Police Board, also blasted the operation, calling it “an appalling display of misplaced priorities and a step backwards on the path to trust and legitimacy.” In one of two videos posted on Vox, a white semitrailer truck can be seen under "L" tracks as passers-by angrily walked toward a group of Chicago police officers. "Watch for the bait truck. They're getting everybody out here, man," one person said. At one point, a man can be seen standing with his hands behind his back surrounded by officers. .

-

Synthetic won't grow metal back, but it is extremely good lubricant. Mack TO-A Plus approved oils for manual transmissions including your T2180, both conventional and synthetic, are listed on page 19 (link below). https://www.macktrucks.com/-/media/files/pv776-89149448.pdf?la=en I'd probably choose Amsoil, which I see meets the Mack spec. https://www.amsoil.com/lit/databulletins/g2902.pdf https://www.amsoil.com/shop/by-product/transmission-fluid/manual/sae-50-long-life-synthetic-transmission-oil/ Then again, using Mack Bulldog Syn Trans Lube is another strategy.

-

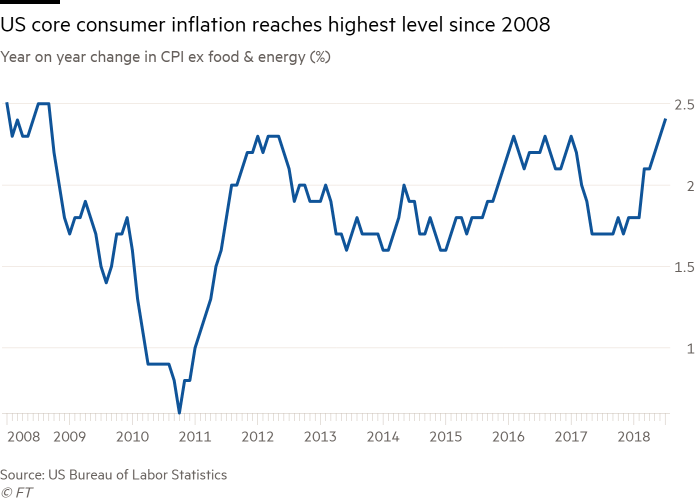

US core inflation rises at fastest pace in 10 years The Financial Times / August 10, 2018 Strong data keep Fed on track to raise interest rates two more times this year Core consumer prices in the US rose by their quickest pace in a decade in July and topped market forecasts, keeping the Federal Reserve on track to raise interest rates twice more this year. The data add to a robust picture of the US economy, which grew by a speedy annual rate of 4.1 per cent in the June quarter. The unemployment rate is close to its lowest level in 18 years. Core inflation, which strips out volatile energy and food prices and is closely followed by the Fed, rose 2.4 per cent year on year in July and up from 2.3 per cent in June. That was the fastest annual pace of core inflation since September 2008, and topped market forecasts for 2.3 per cent. Growth in headline consumer prices held steady with June at 2.9 per cent year on year in July from a year ago, buoyed by higher fuel prices and in line with the median forecast among analysts surveyed by Thomson Reuters. While headline inflation is rising more quickly than average hourly earnings, Michael Feroli, US economist at JPMorgan Chase, said he expected wages to pick up given the strength of the labour market. The picture, he said, is “pretty close to Goldilocks”, leaving the Fed well positioned to carry on tightening policy at its current pace, with no reason to either speed up or slow down. The Fed was last year surprised by the weakness of inflation readings, but more recently price growth has fallen closer in line with its expectations given the broader strength of the economy. The Fed has already raised interest rates twice this year, and is expected next month to pull the trigger on the first of two additional rate increases forecast for the remainder of 2018. Jay Powell, the Fed’s chairman, said last month in his half-yearly testimony to the Senate Banking Committee that with a strong job market and inflation close to the central bank’s target of 2 per cent, the Federal Open Market Committee “believes that — for now — the best way forward is to keep gradually raising the federal funds rate”. The US dollar was relatively steady following the inflation data. The DXY index, tracking the US currency against a weighted basket of global peers, was up 0.8 per cent following the inflation figures, having been up 0.6 per cent before the data release. The index rose above 96 on Friday for the first time in 11 months. With the US locked in a trade war with China and other nations, Gregory Daco at Oxford Economics suggested that higher tariffs could gradually filter through to producer and consumer prices, supporting expectations of a gradual pick-up of inflationary pressures. “Solid economic momentum supported by fiscal stimulus should underpin further gains in inflation,” he added. “Barring a rapid escalation of trade tensions that would disrupt economic activity, we foresee another two Fed rate hikes before the end of the year.” .

-

"U.S. bombs. U.S. targeting. U.S. mid air support. And we just bombed a SCHOOL BUS. The Saudi/UAE/U.S. bombing campaign is getting more reckless, killing more civilians, and strengthening terrorists inside Yemen. We need to end this - NOW." Senator Chris Murphy (D-CT) “By backing the Saudi coalition’s war in Yemen with weapons, aerial refueling, and targeting assistance, the United States is complicit in this atrocity. No one can seriously claim that our support for this war is actually making us safer. In fact, the opposite is true. Not only is this war fomenting hatred against the U.S. but, as we learned from recent reports, the Saudi coalition has been cutting deals with Al Qaeda in Yemen, one of the terrorist group’s most dangerous branches, which has the stated goal of attacking the United States. It’s time to end our support for this war and focus our efforts on a UN-brokered cease-fire and a diplomatic resolution.” Senator Bernie Sanders (VT) The United States “supplied a tremendous amount of weaponry and the data for targeting to the Saudis” [Response: State Dept. spokesperson Heather Lauert laughs]. Matt Lee, Associated Press State Department Press Corps Correspondent .

-

Heavy Duty Trucking (HDT) / August 10, 2018 The Kenworth T680 on-highway flagship and Kenworth T880 and T880S vocational trucks are now available with the Cummins Westport L9N near zero NOx emissions natural gas engine. The L9N engine is certified to the California Air Resources Board’s optional low NOx standard for emissions, representing a 90% reduction from engines operating at the current Environmental Protection Agency NOx limit. The L9N features on-board diagnostic capability, a three-way catalyst, closed crankcase ventilation system, and an engine control module designed for durability. On the Kenworth Trucks, the 8.9-liter L9N is rated at 320 horsepower and 1,000 lbs.-ft. of torque. It can be powered by either compressed natural gas or liquefied natural gas and is also compatible with renewable natural gas, which offers a further reduction in greenhouse gas emissions. “The Kenworth T680, T880, and T880S specified with the Cummins Westport L9N near zero emissions engine are ideal for pickup and delivery, vocational and refuse fleets focused on reducing their environmental impact and decreasing operating costs,” said Kurt Swihart, Kenworth marketing director. .

-

- 1

-

-

Transport Topics / August 10, 2018 A trailer makers group is asking a federal appeals court to require that two federal agencies state when they plan to make a final decision on a 2016 Obama-era heavy-truck greenhouse gas rule. Whether revised or kept in place, the rule would regulate trailers for the first time. The Truck Trailer Manufacturers Association claims that the U.S. Environmental Protection Agency and National Highway Traffic Safety Administration essentially have been keeping them in the dark for the past year on how soon they plan to complete their review of the trailer mandate. “If the agencies are unable to commit to either issuing a new proposed rule or announcing that they intend to retain the current final rule within the next 90 days, TTMA will con- sider moving this court to lift the abeyance and set a briefing schedule in this case,” the Aug. 6 court filing by TTMA said. The trailer association said it wants the agencies to provide a detailed status report or it will attempt to lift the court stay and proceed to trial. Despite agreeing to put the lawsuit on hold, the trailer makers now say EPA and NHTSA “have sought repeated delays and abeyances.” The agencies are co-authors of the Phase 2 rule. The trailer association said all three of the status reports filed with the court by EPA and NHTSA “repeat the same language verbatim, except that they change the date for the next status report.” “Counsel for TTMA have conferred with counsel for the agencies, but counsel for the agencies have not provided additional information concerning the status or timing of their decision-making process,” the trailer association’s motion said. “None of the status reports offer any information about the agencies’ progress; what if anything has been accomplished; or what if any schedule the agencies have in mind for completing their review or even completing any initial step in their review.” Phase 1 on GHG emissions began in 2014 and was tightened in January 2016. Trailer rules were new for Phase 2, as the earlier rule dealt only with trucks and their engines. Trailer manufacturers have criticized the Phase 2 rule, and in December 2016, TTMA filed the request for review of the rule with the U.S. Court of Appeals for the District of Columbia Circuit. In a move to respond to concerns by the trailer and glider truck industry, EPA announced in August 2017 that it planned to “revisit” its Phase 2 provisions on greenhouse gas emissions and fuel efficiency for medium- and heavy-duty engines. “TTMA would prefer to resolve this matter without litigation. Its members should not have to wait in an indefinite holding pattern without any indication from EPA as to when and whether it intends to announce a reconsideration of the rule,” the trailer makers’ motion said. Attorneys for EPA have argued that it’s possible the agency’s administrative proceedings “could obviate the need for judicial resolution of some or all of the issues raised by trailer petitioner.” For that reason, they have advocated that the case be “put on the shelf” with status reports every 90 days. In its most recent report to the court, EPA said it is “working to develop a proposed rule to revisit the rule’s trailer provisions.” “NHTSA continues to assess next steps after granting trailer petitioner’s request for rulemaking. Respondents will submit their next 90-day status report on Oct. 22,” NHTSA said. Before the court stay, the Phase 2 rule was to start EPA regulation of trailers Jan. 1, 2018. Under the Phase 2 rule, provisions for trucks will go into effect in three stages: 2021, 2024 and 2027. The rule also requires low- rolling-resistance tires and automatic tire inflation or tire monitoring systems for all trailers. .

-

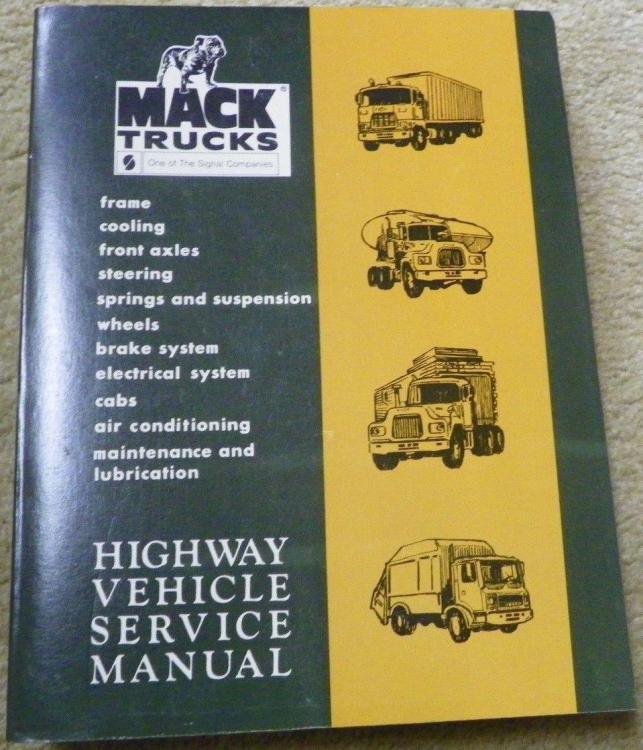

If your truck is older than 5 years, Volvo's Mack brand doesn't provide you with a corporate contact number for assistance. But you can try +1 (866) 298-6586. Your question will be, does the Mack brand publications department (if it still exists) still offer the TS442 service manual (pictured below). This book will largely cover your truck. If Volvo no longer sells it, you can look on eBay. .

-

The best look yet at Chevy's mid-engine Corvette Michael Wayland, Automotive News / August 10, 2018 A racing version of the next-generation mid-engine Chevrolet Corvette has broken cover, providing the best look yet at what the production version of the sports car will look like. The race car, reportedly called the C8.R, was caught testing at Road America in Elkhart Lake, Wis., after the IMSA WeatherTech SportsCar Championship there. Unlike previous spy shots of the production model, the racer has no heavy camouflage. The race car is expected to share similar characteristics with its production counterpart. Overall, the vehicle retains front-end characteristics of recent Corvettes, while adding a much more sculpted and sleek appearance thanks to the midengine layout, including the rear of the car. (The spoiler on the production model is expected to be smaller, though.) While GM has not confirmed plans for a mid-engine Corvette, the long-rumored and highly anticipated car is expected to arrive in the next year or so as a 2020 model. It is expected to be produced alongside the C7 until 2022, when the current generation will complete its life cycle. Based on audio of the C8.R obtained by Sportscar365, the racing media outlet believes the racer was powered by a twin-turbo V-8 power plant, which aligns with other media reports about the production model. Autoweek has reported that the newest Corvette could be offered with a choice of three internal combustion engines and in a battery-electric or plug-in hybrid variant. A 6.2-liter V-8 engine that generates around 500 hp is expected to be the base engine, while a 4.2-liter twin-turbo V-8 with about 650 hp may be the mid-level power plant. The racer is expected to compete in the GT-class and replace the current C7.R. .

-

Do you need an operator's handbook, service manual, pump manual or ?

-

Continuing to move downward, Ford set a new 52-week low today of $9.72.

-

Ford's China sales fall 32% July on lack of fresh models Reuters / August 10, 2018 BEIJING -- Ford Motor Co. on Friday said its sales in China fell 32 percent in July from a year earlier to 57,662 vehicles, as the U.S. carmaker continued to suffer from a lack of fresh models in the world's largest auto market. The latest figure followed a 38 percent tumble in June, leading to the automaker's worst-ever first-half year in China since starting operations in the country in 2001. For January-July, Ford's China sales dropped 26 percent versus the same period a year earlier to 458,105 vehicles. On Wednesday, Ford said it would launch an "entry-level" crossover early next year in China, developed jointly with local partner Jiangling Motors Corp., as part of efforts to revive its slumping business. The Territory is one of 50 new or redesigned vehicles Ford plans to launch in China from this year through 2025. Those vehicles include a redesigned Focus scheduled for launch later this year. Ford officials have said the automaker's business in China will remain pressured this year by a dearth of new or significantly redesigned models in its product lineup, a situation they indicated could last through the end of 2018 or early 2019.

-

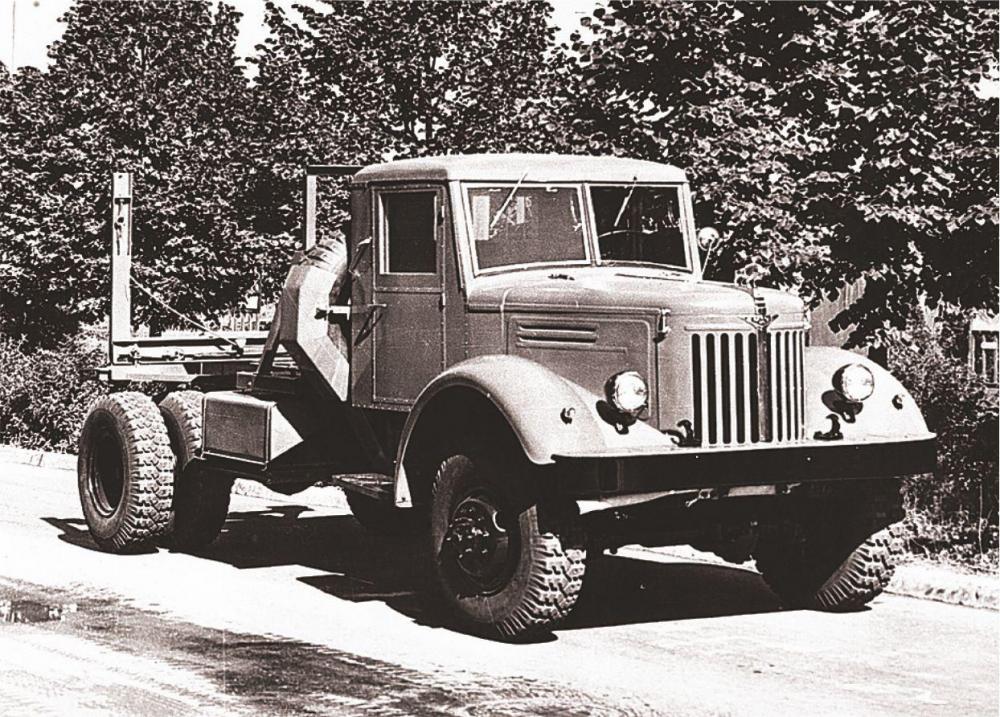

MAZ Trucks Press Release / August 8, 2018 MAZ Trucks (aka. Minsk Automobile Plant) is celebrating its 74-th anniversary from the date of establishment. Years pass but one thing is always constant, the workshops of the plant produce high quality trucks that are in demand not only in the Republic of Belarus, but also far abroad. Not only trucks are produced at MAZ. There is a number of buses, autocranes, autohydraulic elevators, special vehicles and KD kits in today's production line. Active cooperation with different partners allows to open new possibilities and markets for our vehicles. And the main wealth of our plant is people who work here. These are experienced employees who have been working here for decades, as well as their younger colleagues who bring new knowledge and new ambitions. Happy birthday, MAZ! Historical photo gallery - http://maz.by/ru/about/history/history-avto/ .

-

J.T. Hall, Syracuse New Times / August 8, 2018 Consider this quote: “I believe that ultimately the electric motor will be universally used for trucking in all large cities,” the author predicted. “It will not be long before all the trucking in New York City will be electric.” Those words could reasonably have come from Elon Musk, the founder of the electric car maker Tesla, a company about to market a battery-powered semi-truck. Or from Sweden’s Volvo, or from Germany’s Daimler or from the Workhorse Group in Cincinnati or from the Chinese manufacturer BYD, all of which are either marketing or are about to market electric trucks. But, surprisingly or not, it was Henry Ford, the pioneering producer of affordable gasoline- powered cars, looking ahead in 1915. Even at that early point in auto manufacturing, electric vehicles were nothing new. Traceable back to the mid-19th century and the invention of the rechargeable lead-acid battery in 1859, electric cars rivaled their gasoline-powered cousins in appeal and sales in the early 20th century before fading away due to convenience and cost issues. About the same time, 1909, the Brockway Carriage Works, the Cortland-based carriage maker established in 1875, reinvented itself as the Brockway Motor Company, and by 1912 was manufacturing commercial gasoline, and later diesel-powered trucks. Brockway offered models for every common commercial purpose: semis, tankers, flatbeds, stake racks, military vehicles and buses. Ornamented with a charging husky at the tip of the hood, Brockways eventually shared the highways of America with other imposing highway titans of the era, including Macks, Freightliners, Peterbuilts, Kenworths and extinct brands like Diamond Rio. Acquired by Mack Trucks in 1956, the Brockway Motor Company was shut down in 1977 due to labor and financial issues. As memorable as the heyday of Brockway diesels is in Huskytown, Cortland’s self-applied sobriquet, it may be that a brief and virtually forgotten moment in the company’s history stands out most significantly. Suffering from a serious dearth of conventional truck sales in the Depression, Brockway began building electric-powered trucks in 1933. An advertisement for the Brockway Show of 1934, a “Winter Tour” of the Northeast, presents the three initial models: the smallest 50E, a side-door delivery van with a payload of 500 to 3,000 pounds (“compact, easily turned, easy entry, good driver vision”); the 100E (“2 to 3 tons capacity”); and the largest 170E (“3 to 6 tons capacity, 14 to 17 mph”). Eventually expanded to six models, the Brockway electrics were “mechanically identical to standard Brockway models,” except for the motors, provided by both General Electric and Westinghouse, sharing chassis and other structural elements. Even then the technology Brockway used was well established. Nine years earlier, in 1924, Brockway had built five electric buses or “trackless trolleys” for use in Rochester’s urban rail system. All the Brockway electric trucks, like the buses, were made in Cortland. Yet most, if not all of the nearly 100 units produced were sold to businesses in New York City, where Brockway had a headquarters at 46th Street and 12th Avenue. There the “quiet, clean, and odorless” electrics served as delivery vehicles for businesses like the Dairymen’s League (Dairylea), the department store giant R.H. Macy, and Horn and Hardart, a chain of automats or “nickelodeon restaurants” where popular Depression-era entrees (macaroni and cheese, creamed spinach), sandwiches and desserts were available in glass-doored cubicles opened by dropping in a nickel. The same trucks also served Horn and Hardart’s retail stores, hauling cargos of pies, cakes and other items in overhead racks. The smaller models served “milk, baking, brewing, laundry, express, and package delivery” outfits. It was further claimed that electrics were more efficient and faster (“The electric truck works faster as stops increase”) than gasoline-powered trucks on “multi-stop routes” of 30 to 40 miles, the trucks’ usable range. With lead/acid batteries recharged overnight at company garages, the “cab forward” design gave the Brockway electrics a more economical footprint, taking up “20 percent less garage space.” Even more reassuring, it was stated that Brockway electric trucks and vans were “safe to drive and leave unattended.” While specifics on the destiny of these elusive trucks seem to have faded into the murk of the past, there is a paper trail, however scanty. The Brockway production records, located at the Mack Truck Historical Museum in Allentown, Pennsylvania, since 1977, have yielded “build sheets“ (technical component data) on several models, including a 170E bought by Horn and Hardart in 1934, a 50E ordered by Macy’s in 1935 and a 125E sold to another customer in New York City. And promotional literature from 1933 to 1937, the Brockway electric’s production life span, touts the trucks’ “performance, suitability, and economy,” and notes that these models were “modern in design and appearance.” Indeed, surviving photos show designs that are both surprisingly contemporary and quaint at the same time, their cab-forward profile, round headlights and outboard fenders giving them an endearing charm. Brockway, however, was not alone in the electric truck market of the 20th century. The Walker Vehicle Company in Chicago produced electric delivery trucks from 1906 until 1942, when the demands of World War II superseded commercial vehicle production. Similar to the Brockways in form and function, including a 30- to 40-mile range at 12 to 15 mph, there are thought to be 10 surviving Walkers, including a completely restored 1911 “stand-and-drive” van at the Jcrist Museum in Manchester, Pennsylvania, and two others, one of them operable, at the Iowa 80 Trucking Museum. The Brockway electrics, however, seem to have dropped into a black hole, with no sign of a surviving milk, bread, or pie van. The fact that they required substantial recharging equipment meant that there was no secondary use for these vehicles, and it could be that they all wound up on the scrap heap. But who knows? Someone’s garage, barn or back lot may yet yield one of these precocious vehicles. It would be something that Cortland’s Brockway Museum would love to know about. And even though the sun had set on all these prescient electrics by the middle of the 20th century, they served as harbingers of a distant usefulness, presaging the dawning of a new age for their kind. As Henry Ford said more than 100 years ago, “All trucks must come to electricity.” Although there has not been a new Brockway truck produced in more than 40 years, these proud, upright road warriors are neither gone nor forgotten. Prized by collectors and preservationists, a few of the more than 91,000 Brockways produced can be seen at the Brockway Museum. A part of the Living History Center’s three-section museum, the truck museum includes models from 1914 through the 1970s, many of them completely restored, and most on loan for a period of one year from private owners. The other end of the former department store, which opened as a museum in 2012, houses the collection of Kenneth Eaton, a collector of military memorabilia from both world wars, the Civil War and the Korean conflict, including an Abrams tank (sans the motor) in the parking lot. And across the street, TOYS (Tractors Of Yesteryear) displays antique farm machinery, much of it, like the Brockways, carefully restored. The Living History Center is located at 4386 U.S. Route 11 in Cortland. The museum is open Tuesdays through Saturdays, 10 a,m. to 5 p.m. Admission is $10 for adults, $9 for seniors, $5 for ages 6 to 18, and free for ages 5 and under and active military members. Call (607) 299-4185 or visit cnylivinghistory.org. For a more extensive, close-up look at operable Brockway trucks, consider the 19th annual National Brockway Truck Show in downtown Cortland, running Thursday, Aug. 9, through Sunday, Aug. 12. A celebration of Cortland’s vehicle manufacturing past, the show includes food, fireworks, a parade (Saturday, Aug. 11, 8:30 a.m.), an auction and as many as 150 Brockways (gas and diesel; no electrics) lined up on Main Street, some of them still in active service on the road. Call (607) 299-4185 or visit brockwaytrucks.org. Photo gallery - https://www.syracusenewtimes.com/behind-the-wheel-brockway-museum-cortland-photos/ .

-

I believe you'll find that you have a Stemco 343-4025.

-

GM squeezes pounds and pennies to attack Ford's pickup profit machine Joseph White, Reuters / August 9, 2018 Engineers for GM pickups took the Ford factory tour to scout F-150 production FORT WAYNE, Indiana -- When General Motors engineers were developing the 2019 Chevrolet Silverado and GMC Sierra pickup trucks, some of them joined public tours of Ford Motor Co.’s Dearborn, Mich., factory to watch aluminum-bodied F-series trucks go down the assembly line. The redesign of the Ford F-series trucks, launched in 2014, set a new standard for fuel economy and lightweight vehicle construction. But armed with stopwatches and trained eyes, the GM engineers believed they saw problems. “They had a real hard time getting those doors to fit,” Tim Herrick, the executive chief engineer for GM truck programs told Reuters. His team did more intelligence gathering. They bought and tore apart Ford F-series doors sold as repair parts. Their conclusion: GM could cut weight in its trucks for a lower cost using doors made of a combination of aluminum and high strength steel that could be thinner than standard steel, shaving off kilograms in the process. These pounds and penny-based decisions will have major implications in the highest stakes game going in Detroit: dominance in the world’s most profitable vehicle market, the gasoline-fueled large pickup segment. What’s more, GM is banking on strong sales of overhauled 2019 Silverados and GMC Sierras to fund its push into automated, electric vehicles -- a business many investors see as the auto industry’s long term future. The risks are high given the hits automakers have taken from U.S. President Donald Trump’s trade policies. Rising aluminum prices spurred by Trump’s tariffs are driving up costs on the Ford’s F-series, while rising steel and aluminum prices drag on GM results. GM also has a significant risk should the United States, Mexico and Canada fail to agree on a new NAFTA trade deal, given GM trucks built at its Silao, Mexico, factory could face a 25 percent tariff if NAFTA collapses. Interviews with GM executives and a tour at its factory here in northwest Indiana provide a detailed look inside GM’s plan for the most important vehicles in its global lineup. These big pickups are everything Tesla Inc.’s Model 3 or a Chevy Bolt electric car is not. The mostly steel body is bolted to the truck’s steel frame, rather than the one-piece body and frame electric vehicles. The majority of trucks will have a V-8 gasoline engine in front powering the rear wheels -- like the classic GM cars of the 1950s. Some Silverados will have new four-cylinder engines, but there is no electric or hybrid offering as of now. The new Silverado -- GM’s top-selling vehicle in the United States -- is a technology achievement of a different kind. It is taller and has a longer wheelbase than its beefy predecessor, which can help it more easily meet federal fuel efficiency rules. But it is 450 pounds lighter, and its V-8 engine achieves 23 mpg on the highway, which rivals smaller SUVs and crossovers. Big price, big profits Wall Street investors give Tesla and its electric vehicles a higher value than GM’s shares. GM is betting that its core customers in the American heartland will keep paying premium prices -- 27 percent of GM trucks sell for more than $55,000 -- for these vehicles capable of hauling a trailer by day and substituting for a luxury sedan by night. Large pickups generate at least $17,000 a vehicle in pre-tax profit for GM, the company has indicated in disclosures to investors. GM executives told Reuters that with the new trucks, GM will have a big cost advantage they can use to chop at Ford’s leading market share. “We think we have thousands of dollars advantage (over Ford) just in the aluminum costs. It’s big,” said Herrick during a walk through the Fort Wayne plant, which began shipping the new Silverados and Sierras late last month. He said GM plans to use its Silverado cost advantage to put more safety or entertainment technology in the trucks, fund programs such as a promised fleet of electric cars and return money to shareholders. At Ford, truck marketing manager Todd Eckert said the company plans to stick to its game plan. For 41 years, the F-series trucks have been the best-selling single model line in the United States. For the first half of this year, the F-series line -- which ranges from the light-duty F-150 to medium duty commercial trucks -- has a 59,000 vehicle lead over the combined Chevrolet and GMC large pickups. “There’s always been competition in this segment and there always will be,” Eckert said. Ford’s purchasing director Hau Thai-Tang at an investor conference on Wednesday called the F-series pickup “one of our profit pillars,” and said Ford plans to increase the share of its 2018-2022 product development budget allocated to trucks and commercial vehicles to 29 percent from 24 percent in its prior 2015-2019 plan. Ford said it cuts costs by recycling about 20 millions pounds of aluminum scrap every month in its operations, enough to build about 37,000 F-series bodies. Light metal duel For decades, Ford and GM matched each other’s moves closely and built trucks that were similar in design, technology and capability. With the launch of GM’s new trucks, the rivals’ technology strategies have diverged. Ford in 2014 launched a new generation of F-series trucks with all-aluminum body structures for its big pickup trucks, and challenged rivals to find a better way match the fuel efficiency and towing power achieved using the lightweight metal and turbo-charged, six-cylinder engines. Rising pressure from the U.S. government to slash carbon dioxide emissions made Ford’s move look smart. The debate within GM over whether to follow Ford’s aluminum strategy “was a really hotly contested item for us,” said Herrick. He recalled skeptical questions when he sought approval from GM’s board for the billions of dollars required to launch the new Silverados at three factories. “Son, it really costs this much to build all those trucks?” the 58-year-old executive recalled being asked by a member of the board. Herrick, and Global Product Development chief Mark Reuss, said the shareholders’ billions would be better spent on what they call a “multi-material” strategy. The new Silverado and Sierra got close to the Ford truck’s weight using seven different grades of steel in the cab, aluminum hoods, door exterior panels and tailgates. Reuss pushed development of a novel carbon fiber plastic that will be molded to make load beds for certain high-priced GMC models -- and perhaps be used in different ways in future GM models, Reuss said. Before GM’s direction was clear, a supplier to Ford sent Reuss a box of the rivets his competitor was using to fasten the F-series aluminum body panels together, anticipating he’d be ordering them, too. “They’re still on my desk,” Reuss said in an interview. The combination of weight reduction and engine technology produces a rear-wheel drive 2019 Silverado with a 5.3-liter V-8 and an eight-speed automatic transmission that averages 17 mpg in the city and 23 on the highway, with a combined rating of 19 mpg. Different versions of the truck get different mileage ratings. A Ford F-150 with a 3.5-liter turbo six-cylinder and optional equipment that boosts the payload to about 3,230 pounds is rated at 17 mpg in the city, 21 on the highway and 19 combined, according to the government. An F-150 with a lighter payload rating of about 2,640 pounds is rated at 18 mpg city, and 25 mpg on the highway, according to the government. Chevrolet claims a payload of 2,190 pounds for a 2019 Silverado with a 5.3-liter engine and an eight-speed transmission. Four doors for profit In some crucial ways, GM is following Ford. GM previously could not keep pace with demand for crew cab pickups -- models with four, sedan-style doors in the cab. Ford used its lead in crew cab design to develop luxury truck models, such as the F-450 Limited, that have sticker prices as high as $100,000. Average selling prices in the segment are around $42,000 to $45,000 -- higher than the industry average. GM has now dedicated two factories to building light duty pickups, in Fort Wayne and Silao, Mexico, which have the flexibility to build “darn near 100 percent crew cabs if we wanted,” Herrick said. The GMC marketing division, meanwhile, is putting more emphasis on its Denali luxury truck brand, while Chevrolet will market more luxurious versions of the Silverado such as the frontier-themed High Country, which has leather seats and a Bose sound system. GM executives said they want to increase the company’s share of trucks sold at prices above $55,000 from the current 27 percent. John Bergstrom, who owns a multi-brand network of dealerships based in Neenah, Wis., said the new GM trucks should pull in buyers who currently don’t drive a pickup. “We didn’t have the technology we needed,” Bergstrom said. With the new truck, “we’ve got that. They almost magically figured out how to get fuel economy out of these things.”

-

Navistar contracted for rocket-propelled grenade netting

kscarbel2 replied to kscarbel2's topic in Trucking News

US$29.6 million......an order I'd happily accept. -

The D16 (rebadged as MP10) was only discontinued in North America. Volvo couldn't exist in the global market without a 15-16 litre engine, the Australian market being a case in point. https://www.bigmacktrucks.com/topic/48491-volvo-cancels-d16-mack-cancels-titan-tractor/?tab=comments#comment-359572

-

Power Torque Magazine / August 2018 Purchasing his first cab-over Kenworth in 1981, William Shaw set the foundation stone for a successful Darwin road express freight service, firstly as a subcontractor to a major national carrier, then as his own company. Now, some 37 years later, Shaw’s Darwin Transport has grown to boast a fleet of 47 Kenworth prime movers, 126 trailers, 60 dollies and 22 Isuzu rigid trucks, employing around 150 staff. William Shaw is still a shareholder in the business, choosing to reside in the UK these days with visits from time to time to view operations. A decision was made in 2011 to pass the company’s control over to a board of five directors, made up of ten years+, long-standing key managers, to take over operations. Shaw’s Darwin Transport head office and depot is in western Sydney, with additional depots in Darwin, Brisbane and Perth, with in-house workshop facilities in the Sydney, Darwin and Perth depots. Weekly, express and general services to Darwin are operated out of Sydney, Brisbane and Perth return, with additional return services east to west between Sydney to Perth. Shaw’s chooses not to run B-double or AB-triples, preferring to stick to their proven road train, double and triple combinations for their freight movements, utilising dog runners to get the multiple trailers to their respective assembly areas. With their Darwin depot situated on an 11-acre site comprising 7200 square metres of warehouse space, located at East Darwin, road train combinations can be run in as complete units. Operating under mass and maintenance management schemes, Shaw’s Darwin Transport runs triple road trains up to 110 tonnes GCM, to a maximum length of 53 metres in triple form, on the 3500-4000-kilometre (one way) routes covered. Express runs are completed by two drivers with freight arriving in Darwin in as little as 56 hours from despatch. It’s this highly efficient and time-sensitive service to local clients and the oil and gas industries that underscores the difference in operating parameters, based around the benefits of utilising Darwin as their support base. General freight makes up the bulk of loads carried by Shaw’s Darwin Transport, with refrigerated goods filling in the rest. However, according to Jim Backhouse, the company’s fleet maintenance manager and one of the five directors, new contracts with major supermarkets and produce returning from the north, have resulted in its temperature-sensitive freight work expanding, particularly in and out of their Brisbane depot. Jim has been mates with William Shaw for 35 years and has been working within the company for the past 18, holding the position of a director since 2011. With extensive Kenworth knowledge gained from years working at Kenworth dealers and other maintenance roles, Jim is well versed in the benefits that the company’s choice of equipment and specifications brings to the table. “We have in our fleet, 47 Kenworth prime movers and 22 Isuzu local delivery rigids. The prime movers range from the line haul 900-series Kenworths down to our smaller local and regional 400-series models, some of these trucks have in excess of three million kilometres on the them,” explained Jim. “Kenworths have always been utilised for our work; although, unlike our current Cummins powered units, the early days saw Shaw’s trucks powered by Detroit Diesels. We have moved with the Cummins evolution from series-one and two Signature engines through to EGR, ISXE5 and now with our most recent trucks, the X15 powerplant. “The latest X15 generation of engine is proving itself well for us, and we adapt to the new technology as it evolves from the manufacturers”. While adaptation of new technology is embraced by the company in some areas, other developments and options are a little slower to be implemented, with old-school functionality, reliability and durability still influencing design specifications for the company fleet. An example of this is the company’s remaining preference for not adopting airbag suspension systems, preferring the use of steel spider wheels. “We prefer the Kenworth six-rod suspension for its durability and ability to take all kinds of punishment that our drivers may encounter on the sealed, but somewhat sad, road surfaces on which they travel. Simplicity of design, with fewer moving parts, and the ability to affect a “bush repair” should a component fail in a remote location, drives our choice of suspension system,” explained Jim. Airbag suspension systems are starting to work their way into Shaw’s trailers, and, according to Jim, this has been mainly driven by customer requirements. “Spider wheels are still a common sight on our trucks. However, around five or six years ago, Kenworth became unable to supply spiders as the foundry in Toowoomba wound up, affecting supply. This resulted in us starting to run on alloy disc wheels for our trucks. “This is a slow and difficult transition for our fleet as we had our tyre and wheel replacement procedures all set around our existing stock of two-piece wheels, but, we are getting there, and as time goes by and more and more of our replacement vehicles enter the fleet with disc wheels, it should become easier to manage,” said Jim. “Our choice of specification for our trucks has been learned by many years of operation, and trial and error. We have experimented with various power and torque ratings, final drive ratios and ancillary components, to come up with what we believe is the best and most reliable design for the work that we do. “We use three different manufacturers for our trailing equipment, these being Haulmark, FTE and a few Barker trailers. Up until recently we used Dana axles, now preferring to use BPW,” said Jim. Wherever possible, all maintenance is carried out in-house by Shaw’s workshops. The exception to this is in relation to warranty work or a specialised task not viable to carry out themselves, for which the vehicles go back to their original manufacturer. Extended oil drain intervals are followed on the Kenworth trucks at 40,000 km oil drain periods. The company’s fleet of Kenworth trucks, including all of those used for local, regional and line haul heavy-duty specifications, together with its range of Isuzu commercial vehicles, have been purchased through Gilbert & Roach Trucks Huntingwood, with whom Jim said they have built up a good relationship of trust. Gilbert & Roach has just completed delivery of a new T909 to Shaw’s Darwin Transport’s Sydney depot, and this truck will shortly be put to work out of their Brisbane depot on refrigerated work. Bill Anderson, Gilbert & Roach’s sales manager, and Lloyd Moran jointly processed the purchase. “Between the two makes of Kenworth and Isuzu, Shaw’s averages a couple of new truck purchases from us each year. We have a good relationship with them and we make sure everything is tailored to their exacting requirements for their unique freight operation,” explained Bill. Specifications for the company’s latest T909 include the Cummins X15 engine, rated at 600 hp and 1850 ft-lb torque and Eaton Road Ranger 18-speed manual transmission. Final drive ratios are 4.56:1 with the rear axle spread stretched out to 56 inches, over the commonly used 52-inch spread. “We prefer the wider axle placement for a broader footprint and stability; also, in conjunction with the conveyor rubber guards, we find this results in greater cooling efficiency in that area,” said Jim Backhouse. Fuel capacity is achieved through the fitment of four rectangular tanks, two 650-litre tanks on the near side, plus a 650-litre and a 420-litre on the off side, taking care of the long distances covered, and a 225-litre AdBlue tank sits between the two off-side tanks. LED headlights and bullbar-mounted driving lights do their best to point out night hazards and minimise animal strikes. On the subject of animal strikes, Jim explained that the choice of the T909 with the large bonnet yielded two main benefits, one being the thermal efficiency of the large frontal cooling area, and the other being increased safety and protection provided to their drivers from impacts with wildlife in general. “Camels are a real problem because of their height. Despite the large frontal area of the truck, if a camel is struck, these animals usually punch the bonnet up into the windscreen,” said Jim. Transporting freight to a destination some 4000 km away over a vast hot country in a timely manner for your clients, while maintaining profits for your business, takes a good deal of experience, with reliable people and the right equipment to help make that happen. Shaw’s Darwin Transport has gained invaluable insight into the Darwin freight route over the last 37 years, and with reliable industry partners continues to service our northernmost capital. .

-

New Zealand Trucking / August 2018 With a fleet upgrade and some new signage, East Otago Transport has emerged out of the shadows to become one of the smartest looking fleets in the south. When you mention the small town of Waikouaiti to most people, their answer is, “Where is that?” Situated within the city limits of Dunedin, Waikouaiti has a population of just over a thousand and is home to East Otago Transport. The yard is situated on State Highway 1 just north of the main township and was the premises of A S Clulee Limited between 1959 and 1998, and then Clulee Cartage Limited until they were purchased by Kevin Byrne and Ian Ritchie back in 2006. The company name was then changed to East Otago Transport. Ian Ritchie only spent a short time with the company before returning to the farming sector. It was time for a fresh start, so owners Kevin and Jodie Byrne decided to give the fleet a whole new look. With East Otago Transport having a base colour of green with yellow writing (also the local sporting colours), Jodie thought the look had become a bit ‘plain Jane’, and with a new Freightliner arriving, the timing was right for a change. She’d seen the farm scene vinyl wrap on some of the Woodley Transport fleet, which at the time were passing through Waikouaiti quite often. Jodie’s idea was to arrange photos of the local landmarks on the crates, but with the crates being ribbed on this unit the idea was shelved. Instead the plain bold yellow swoop was developed to represent the bay of Waikouaiti Beach, and the historical farm region of Matanaka, home to the country’s oldest surviving intact farm buildings. With this design established, and the addition of some silver and black incorporated in a graphic around the name on the cab door, the look fell into place. The expansion of the fleet continued with the addition of a 2015 Freightliner Argosy for bulk work, two Isuzu 530s (stock and bulk combinations), and two HPMV 9800i International Eagle 9-axle bulk truck and trailer units. The Freightliner Argosy stock unit has also had a Fruehauf 5-axle stock trailer added, with new Delta crates for both truck and trailer. The ground spreading division has also received a boost recently with the addition of a second Scania to cope with demand in the area. On the day New Zealand Trucking magazine visited, company driver Randy Tupaea, who incidentally also doubles as the company’s stock controller, picked up a load of hoggets from Bendigo Farm, not too far from Waikouaiti, and transported them, truck only, out through Dunback, climbing the winding hills to Macraes Flat. Usually Randy would take the trailer on this trip but the poor condition of the roads due to recent heavy rain in the region meant the trailer was left at the yard. Randy is well known in the area, and a well-respected member of the East Otago Transport team. He takes great pride in his Freightliner Argosy, arguably the flagship of the fleet. Another key to the success of the company is operations manager Nathan Butler. Nathan moved to Waikouaiti about six and a half years ago. He walked into Waikouaiti Auto and Engineering (also owned by Kevin and Jodie) one snowy morning asking if there was any work available. He was told to come back the next morning. He never left! As it turned out Nathan started work for Kevin at another of his companies, Southern Water Blasting, starting off as a water blaster/painter before moving into the manager’s role. Kevin then offered Nathan the management role at East Otago Transport. “Managing the transport side is very challenging,” Nathan explains, “as the industry is extremely competitive and a low margin type business. This has been a major role for me, coming from a normal 40-hour week with little responsibility, to having the phone ring nearly 24/7. It can be character building to say the least.” Nathan’s current role still includes looking after the Southern Water Blasting business, as well as another of the Byrne’s interests, East Coast Couriers 2006 Ltd. “I enjoy the busy interchangeable role. At times it seems that the busier you are the easier it gets,” says Nathan. The courier business was acquired after the former courier firm went into liquidation a few years ago. Two vehicles, a Toyota Hiace van and an Isuzu 4-tonne truck, provide a daily service from Dunedin through to the Maniototo area via Oceania Gold at Macraes Flat. Recently Kevin and Jodie purchased another local freight company called Waikouaiti Freight, which will now become part of the courier operation. In conjunction with this expansion, a new Isuzu 6x4 freight truck has been added, allowing the payload to increase from six to 12 tonne. And the services and sidelines don’t stop there. East Otago Transport also has a log truck to bring firewood into the yard to be processed in the new Blockbuster 22/22 heavy-duty firewood processor imported from America in January. This allows the company to supply clean dry product direct to the customer. Nathan said recent investments in new trucks and equipment have been a major boost to the company. “Quality gear brings quality staff and a more professional approach to work. Our customers have certainly noticed the changes, with renewed support coming from all directions.” The East Otago Transport yard is a regular hive of activity, with a public weighbridge, and a number of products available at the yard including bark chip, wood nuggets, pea straw, cement, gravel and lime. Waikouaiti, it isn’t just a small town you pass through; look closer and you’ll find it’s as energetic and enterprising as anywhere in the country. .

-

Australia's first 'Fuel Super Truck' delivers massive gain

kscarbel2 posted a topic in Trucking News

Owner-Driver / August 8, 2018 Volvo Trucks Australia Vice President Sales Clive Jones announced the Fuel Super Truck’s results today, proudly claiming a staggering 20 per cent real-world fuel efficiency gain. "The Volvo Fuel Super Truck is more than just a concept. It is a real-world truck specially engineered for Australian conditions with a fuel efficiency-optimised driveline and streamlined aerodynamics," Jones says. "The truck is designed to run on the least amount of diesel possible, without compromising productivity or performance. With fuel accounting for one-third of operator costs, the industry is looking for answers to the problem of how to maximise fuel efficiency while still getting the job done. "The good news for owners and operators looking to reduce fuel consumption is that the majority of features in the Volvo Fuel Super Truck are available for ordering now. Volvo Trucks Australia is committed to working with every customer in order to find the best specification for their unique operational conditions." Australian trials of the concept put the trucks through rigorous testing and the Fuel Super Truck, which uses a slightly de-tuned version of the 16-litre FH16 powertrain, delivered a fuel efficiency gain of 20 per cent over the base line FH16. The concept truck was designed in-house at the Wacol Facility in Queensland by Volvo Group Trucks Technology (GTT) engineers, with support from the Volvo team in Sweden. It was built around a FH16 and while other concept trucks have been based on single trailer configurations, this is the first B-double concept truck in the world. "Nearly two years in the making, this truck is a testament to Australian ingenuity and engineering skill, along with the great benefits gained from the partnership of Swedish and local engineering teams," Jones says. "In addition to engineering developments in the driveline and aerodynamics, other concept trucks have been single trailer vehicles, whereas the Volvo Fuel Super Truck is first B-double concept truck in the world. "We look forward to introducing the Volvo Fuel Super truck to customers around Australia over the coming weeks and months, and to updating the industry on further exciting developments we are making in the fuel efficiency space." . -

The first new promotional videos from Mack Australia in no less than 6 months......half a year.

BigMackTrucks.com

BigMackTrucks.com is a support forum for antique, classic and modern Mack Trucks! The forum is owned and maintained by Watt's Truck Center, Inc. an independent, full service Mack dealer. The forums are not affiliated with Mack Trucks, Inc.

Our Vendors and Advertisers

Thank you for your support!