kscarbel2

Moderator-

Posts

19,101 -

Joined

-

Days Won

114

Content Type

Profiles

Forums

Gallery

Events

Blogs

BMT Wiki

Collections

Store

Everything posted by kscarbel2

-

Scania tests fast wireless charging in urban traffic

kscarbel2 replied to kscarbel2's topic in Trucking News

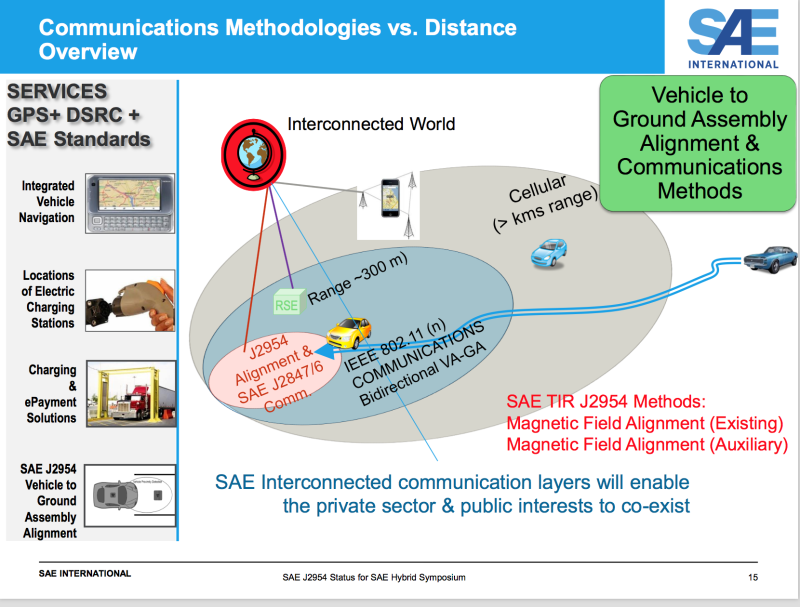

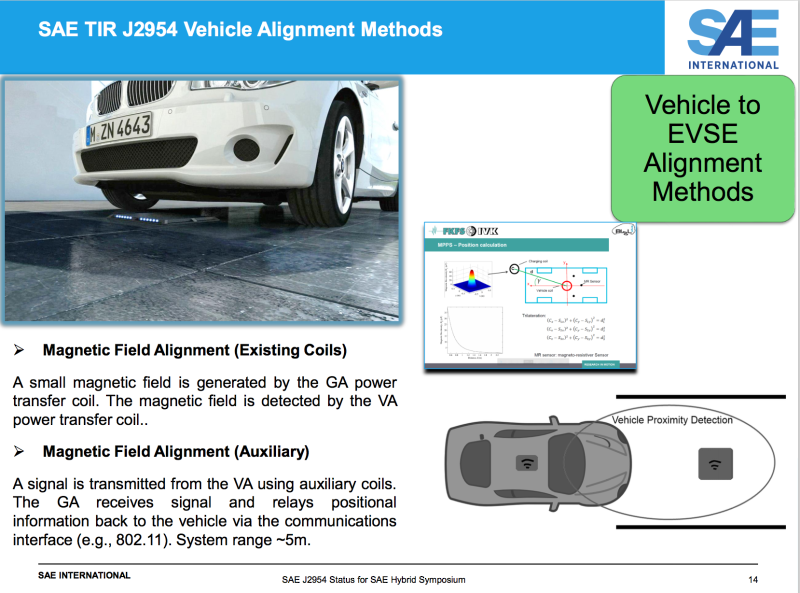

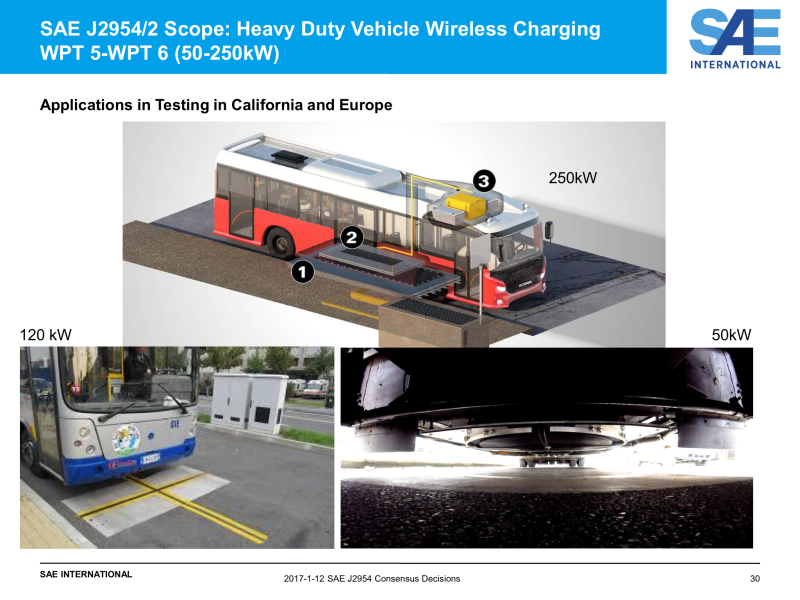

Wireless charging J2954 testing to 11 kW in 2017 for LD, HD starting up to 250 kW; autonomous charging and infrastructure proposal for California Green Car Congress / February 13, 2017 SAE International is working to ensure that electric vehicle wireless power transfer systems from diverse manufacturers will interoperate seamlessly with each other to prepare for commercialization in 2020. The SAE TIR (Technical Information Report) J2954 provides guidance to ensure performance and safety of Wireless Power Transfer (WPT) Systems provided from one vendor as well as interoperability when parts of the system are provided from different vendors. SAE International is engaged with the Idaho National Lab and US Department of Energy (DOE) in bench-testing of WPT 3 (11 kW) levels in 2017, said Jesse Schneider, chair of the SAE J2954 task force, in his presentation at the SAE 2017 Hybrid and Electric Vehicle Technologies Symposium last week in San Diego. In addition, eight OEMs have light-duty vehicle testing planned to begin in third quarter for WPT 1-3 which is scheduled to be completed in 2018. In December 2016, interoperability between the so-called Double D (DD) and Circular Topologies was demonstrated between 3.7 to 7.7 kW (WPT 1 and WPT 2 power levels) with efficiencies exceeding 85-90% under aligned conditions. (Earlier post.) The Recommended Practice SAE J2954 will also contain guidance for vehicle alignment methods and determine a common location for the wireless charging ground assembly. Currently, magnetic field alignment through triangulation using the existing coils and alignment using an auxiliary antenna are being evaluated for this decision. The goal is to provide one methodology to align in order to be able to charge with high efficiency all SAE J2954 stations. This is for both manual (self-parking) and autonomous (automated) alignment possibilities. It is important to know that the only way to charge an autonomous vehicle automatically is to use wireless charging and SAE J2954 Recommended Practice will standardize this. —Jesse Schneider Further, SAE International has made a proposal to Electrify America to start a build-out of multiple hundreds of Light Duty Wireless Chargers starting in 2019 in public locations in California and ZEV states in three stages. The first stage, for light duty vehicles, creates an infrastructure based on J2954 (for example in malls, large workplaces, condominium complexes, etc). SAE also proposes 100 Heavy Duty Chargers in 2020 based on SAE J2954/2 (for example public transit agency, truck stops for anti-idling, etc.) in 2021 to create a wireless charging infrastructure with alignment communications for autonomous vehicles (for example, taxi fleets). This will also help independent organizations or government organizations to quantify how much wireless charging may increase the eVMT (electric Vehicle Miles Traveled) for wireless charging (inductive charging) vs. plug-in (conductive charging) electric vehicles. This could also be quantified in the form of a CO2 reduction potential by implementing wireless charging both in the home and in public locations. In addition, this could also provide some data to help to understand the potential of wireless charging to reduce the pulse in criteria pollutants emitted with the engine cold start of a range extender engine. (The last, noted Ryan Hart from the California Air Resources Board (ARB) in his talk at the SAE symposium, is not a negligible problem.) With a coordinated preliminary rollout of this technology, statistical information to gauge customer acceptance of both this new charging methodology as well as increased acceptance of the electric vehicle (for instance with convenience less or no range anxiety using wireless charging) can be gauged. Additionally, the heavy-duty wireless charging standardization initiative SAE J2954/2 is kicking off on 10 February in San Diego following the SAE symposium to standardize wireless power transfer at 50 kW-250 kW. This is to address opportunity charging at bus stops (similar to the Scania testing in Sweden, (earlier post). In addition, the meeting will launch an investigation of the optimized wireless charging power level to offset idling for heavy duty trucks at truckstops (and address the anti-idling laws). . -

Chevrolet 2017 Cruze Diesel EPA-rated at 52 mpg highway, 37 mpg combined Green Car Congress / February 13, 2017 The 2017 Cruze Diesel Sedan (earlier post) fitted with the six-speed manual transmission offers an EPA-estimated highway mileage of 52 mpg (4.52 liters/100 km)—the highest highway fuel economy of any non-hybrid/non-EV in the US. The six-speed manual model returns an EPA-estimated city mileage of 30 mpg (7.83 l/100 km), resulting in 37 mpg (6.35 l/100 km) combined. Cruze Diesel with the nine-speed automatic achieves an EPA-estimated highway economy of up to 47 mpg and 31 city mpg, which results in 37 mpg combined. The 2017 Cruze Diesel Sedan, due to go on sale this spring, features a new B20-capable Ecotec 1.6-liter inline four-cylinder turbo-diesel engine—already proven in Europe and other global markets—offering an SAE-certified 137 horsepower (102 kW) and 240 lb-ft of torque (325 N·m). Cruze Diesel passed all stringent US environmental standards and validation, including Tier 3 Bin 125 emissions standards. The EPA Tier 3 Bin 125 (California LEV III ULEV125) calls for 125 mg/mi of NMOG + NOx, and 2.1 g/mile of CO2. Under Tier 3, the numerical value of the seven bins corresponds to the NMOG + NOx milligram limit. The bins are 160; 125; 70; 50; 30; 20; and 0. The former individual NMOG and NOx limits were combined under LEV III and Tier 3 to provide vehicle manufacturers additional flexibility in meeting the combined limit values rather than the individual limits required under the older LEV II or Tier 2. By 2025, when it is fully implemented, LEV III will result in a 75% reduction in NMOG plus NOx emissions across the California fleet; the federal fleet achieves an 80% reduction in NMOG + NOx and a 70% reduction in PM with Tier 3. Based upon the EPA highway estimate, Cruze Diesel with the six-speed manual transmission has an estimated range of up to 702 highway miles on one tank of diesel fuel. Buyers will be able to option their Cruze Diesel Sedans with either a standard six-speed manual or a new, optional Hydra-Matic nine-speed automatic transmission that includes fuel-saving stop/start technology. A suite of connectivity features includes available OnStar with 4G LTE connectivity and built-in Wi-Fi hotspot and available Android Auto and Apple CarPlay compatibility through Chevrolet MyLink. Pricing for 2017 Cruze Diesel Sedan starts at $24,670 including $875 destination charge. Base price of the entry-level gasoline-powered Cruze is $17,850. Cruze Diesel Hatch will follow Cruze Diesel Sedan later this year for the 2018 model year.

-

Now this.....it should read "too, not "to" Wrong "no challenge is to great." Correct "no challenge is too great." .

-

Certainly not my area of expertise, but it appears that the Oroville's weakness is by design, in that it is an earthfill "embankment dam". In my mind, this type of dam carries with it more risks. https://en.wikipedia.org/wiki/Embankment_dam

-

There was an minor issue, but Barry has resolved it. I run Firefox (as does Barry) and have not encountered any problems using it. If you run Firefox with the add-ons BetterPrivacy, Ghostery, NoScript and uBlock Origin, you'd be hard pressed to find a more secure browsing experience.

-

Nearly 200,000 people told to flee crumbling California dam spillway Reuters / February 13, 2017 Evacuation orders for nearly 200,000 people living below the tallest dam in the United States remained in place early on Monday after residents were abruptly told to flee when a spillway appeared in danger of collapse. Authorities issued the evacuation order on Sunday, saying that a crumbling emergency spillway on Lake Oroville Dam in north California could give way and unleash floodwaters onto rural communities along the Feather River. "Immediate evacuation from the low levels of Oroville and areas downstream is ordered," the Butte County sheriff said in a statement posted on social media. The California Department of Water Resources said on Twitter at about 4:30 p.m. PST (0030 GMT Monday) that the spillway next to the dam was "predicted to fail within the next hour." Several hours later the situation appeared less dire, as the damaged spillway remained standing. The state water resources department said crews using helicopters would drop rocks to fill a huge gouge, and authorities were releasing water to lower the lake's level after weeks of heavy rains in the drought-plagued state. By 10 p.m., state and local officials said the immediate danger had passed with water no longer flowing over the eroded spillway. But they cautioned that the situation remained unpredictable. "Once you have damage to a structure like that it's catastrophic," acting Water Resources director Bill Croyle told reporters. But he stressed "the integrity of the dam is not impacted" by the damaged spillway. Asked about the evacuation order, Croyle said "It was a tough call to make." He added: "It was the right call to make." 'DO NOT TRAVEL NORTH' Butte County Sheriff Korey Honea told an earlier news briefing he was told by experts that the hole forming in the spillway could compromise the structure. Rather than risk thousands of lives, the decision was made to order evacuations. Officials said they feared the damaged spillway could unleash a 30-foot wall of water on Oroville, north of the state capital Sacramento. They said evacuation orders remained in place for some 188,000 people in Oroville, Yuba County, Butte County, Marysville and nearby communities and would be re-evaluated at dawn. The Yuba County Office of Emergency Services urged evacuees to travel only to the east, south or west. "DO NOT TRAVEL NORTH TOWARD OROVILLE," the department warned on Twitter. Evacuation centers were set up at a fairgrounds in Chico, California, about 20 miles northwest of Oroville, but major highways leading south out of the area were jammed as residents fled the flood zone and hotels quickly filled up. Javier Santiago, 42, fled with his wife, two children and several friends to the Oroville Dam Visitors Center in a public park above the dam and the danger zone. With blankets, pillows and a little food, Santiago said: "We’re going to sleep in the car." The Oroville dam is nearly full following winter storms that brought relief to the state after four years of drought. Water levels were less than 7 feet (2 meters) from the top of the dam on Friday. State authorities and engineers on Thursday began releasing water from the dam after noticing that large chunks of concrete were missing from a spillway. California Governor Jerry Brown asked the Federal Emergency Management Agency on Friday to declare the area a major disaster due to flooding and mudslides brought on by the storms. The earthfill dam is just upstream and east of Oroville, a city of more than 16,000 people. At 770 feet (230 meters) high, the structure, built between 1962 and 1968, is the tallest U.S. dam, exceeding the Hoover Dam by more than 40 feet (12 meters). Photo gallery – http://www.reuters.com/article/us-california-dam-idUSKBN15S04W Video - https://www.theguardian.com/us-news/video/2017/feb/13/tallest-dam-in-us-on-brink-of-bursting-aerial-video

-

Power Torque Magazine / February 2017 It’s often said that the Australian road transport operation is one of the most efficient in the world. Certainly, other countries envy our ability to run B-doubles and road trains, already one jump ahead of the Europeans with their single semitrailers. While the Europeans are experimenting with the idea of platooning, we are already way past the idea of having multiple prime movers, each running with one trailer, travelling so closely to each other that every one in the group relies on autonomous technology intervention to avoid an accident. With multiple trailer combinations such as we operate in road train application, Australia offers the productivity that Europe is trying to achieve, but with the added benefit of using just one high-horsepower prime mover out the front hauling multiple trailer combinations. The advent of Performance Based Standards (PBS) has resulted in further opportunities to improve productivity, aligned with higher safety standards. But in order to take advantage of what PBS approval can offer, it takes an operator with foresight and determination to carry through a project from the ideas stage to completion. Melbourne-based Maxwell Freightlines (MFL) has taken delivery of two new A-double PBS High Productivity trailer sets, adding to its growing interstate linehaul fleet. Developed in conjunction with Vawdrey Trailers and the NHVR, these first two A-double combinations are soon to be joined by a further two combinations, and, as they prove their effectiveness, there are further orders in the pipeline. The A-double road train combinations are at 30 metres in length and can run up to HML weights of 85.5 tonnes, providing exceptional efficiency possibilities to MFL’s expanding customer base. Coupled with the latest IAP Tracking technology and safety equipment including EBS, ABS, roll stability and E-Max weighing systems, the commencement of these A-double combinations on interstate running from Melbourne places MFL at the forefront of efficiency and safety. The attraction of improved productivity and efficiency means that for every two A-double road trains brought into the fleet, the company is able to carry the same volume and weight that previously required three B-doubles. Given that the industry is very concerned about current, and in particular future driver shortages, this initiative is capable of going a long way to assisting Australian operators to handle the forecast increase of the freight task. MFL is not the first operator to run A-double road train combinations from the eastern states, as NSW-based Hills Tankers is using A-doubles to carry up to an increase of 30 percent in payload. This is achieved while offering a greatly reduced carbon footprint and benefiting the environment with the lowest emissions per tonne of carbon carried on an Australian road today. With EBS and ABS throughout the entire combination, Hills Tankers is using Volvo FH prime movers that incorporate all the latest levels of driver intervention technology such as adaptive cruise control, blind-spot alert and Wabco reverse warning systems. What makes the MFL A-double operation unique is how the company took up the challenge itself to organise all the necessary planning and approvals of road and bridge weight analysis through a two-year consultation programme with local authorities and shires. Once the approvals were granted, it enabled MFL to become the first Victorian-based transport operation to commence an interstate A-double road train service from Melbourne. In similar fashion to the experience of Hills Tankers, MFL is therefore able to benefit from the increased productivity of the A-double concept, that in MFL’s case enables it to operate as two 20-pallet trailers within a 30 m overall length. The Vawdrey Titeliner trailers were built specifically for this operation with a focus on low tare weight to achieve maximum payloads. Total operating flexibility is also ensured through the new trailer sets being supplied in straight-deck and in drop-deck configuration incorporating two mezzanine decks. Using Hendrickson INTRAAX axles with HXL7 hubs, the Vawdrey Titeliner trailers feature Super Strap load restraint curtains, lightweight aluminium extruded floors and alloy gates throughout, plus Alcoa alloy wheel rims. Jost Australia was selected to provide landing legs and fifth wheel couplings, with the dolly featuring a Jost JSK37 greaseless fifth wheel. Lighting is by Hella Australia, and Emax Air-Weigh digital on-board weighing systems are featured throughout the trailers and dolly. The A-doubles are currently able to operate at CML weights of 81.5 tonnes, and this weight level may be subject in the future to an increase to 85.5 tonnes once further bridge assessment reviews have been completed. The prime movers are themselves rated for road train application at 90 tonnes. MFL has never been afraid to pioneer different ideas in transport, with experience in operating quad/quad skeletal trailers and B-doubles. Since MFL was established in 2008, the MFL fleet has grown to its current position where it operates more than 30 interstate linehaul rigid and B-double combinations. Because of the overall length restrictions applicable to A-double combinations, the company has moved from its traditional selection of Mack prime movers to that of Volvo FH and Kenworth K200 6×4 units. As Tony Tomarchio, general manager of Maxwell Freightlines, told PowerTorque: “Above all, we pride ourselves on our service and safety records. We had to find different ways of being more productive and responsive to the needs of the industry. “We are a general freight carrier, not an express freight operation. From a profitability point of view we have done the numbers and it comes down to how the A-doubles fit in to our style of operation. “We know the future of transport is to have less combinations on the road, where two A-double units can carry the same load as three B-double combinations. “As the A-doubles come into play, bonneted trucks are not going to suit this application, so cabovers are the future for this type of operation. “For our B-double operation we currently run Macks rated at 650 hp, Volvos rated at 700 hp and Kenworths rated at 600 hp, all fitted with automated manual transmissions (AMTs). We fit all cabs with TVs and fridges and we try to get the biggest bunks we can, as driver comfort is very important to us. At the end of the day, that is their workplace. We don’t do two-up anywhere and where possible we work to a one-driver/one-truck regime. “In A-double application the Volvo FH700 and Kenworth K200 with PBS approval authorised by the NHVR have produced an exceptional focus on safety, with Wabco EBS, ABS, roll stability and Emax Air-Weigh onboard weighing systems. We also include adaptive cruise control, lane departure warning and blind-spot monitoring systems. “We don’t need to upgrade our horsepower and torque ratings to move from B-doubles to A-doubles, but the prime movers are not interchangeable between the two different applications. “Under PBS requirements the prime movers have to be designated to run with the A-double combination and are limited to a maximum road speed of 90 km/h, with different gear ratios and final drives. “All have IAP units so we are able to monitor everything, and we aim to maintain a one driver per truck system,” added Tony. The difference in vehicle specification due to the higher weights of PBS-approved A-doubles and the maximum permitted road speed of 90 km/h sees a typical rear axle ratio of 4.56:1 for Kenworth and 3.78 for Volvo. The prime movers operating currently on B-double work have diff ratios of 4.33:1 for Kenworth, 3.4:1 for Volvo and 3.73:1 for Mack. In terms of tyre fitment, MFL has a tyre maintenance programme administered by Samuels Tyres running with Kumho KRT01 275/70R22.5 tyres on the trailers with inflation pressures of 90 psi. The fitment of Hendrickson TIREMAAX PRO automatic tyre inflation systems, as standard, safeguards tyre performance and the average tyre life is said to be 250,000 to 300,00 km. Other tyre preferences include Michelin Multi-D and Bridgestone M766 drive tyres, running at inflation pressures of 95 psi, and Toyo steer tyres. Haulmax 11R22.5 sized tyres are fitted to the road train dolly. “With the fleet consisting predominantly of new prime movers, the service requirements are completed under a contract maintenance programme with the manufacturer through the local dealership network,” said Tony Tomarchio. “That gives the benefit of a complete paper trail. We know how it works out on a fuel economy basis. If you know your fixed costs then you can lock in for that TCO with just a few variables. With a locked-in contract maintenance programme in place for 48 or 60 months, dependent on the application, you know your costs. “The Volvos are slightly better on fuel with little variation between KW and Macks in B-double work. We think that in the long term Volvo might be superior, but we have not been running them for long enough at this stage, with all of them being at Euro 5 emissions levels with AdBlue. The Kenworth K200s are good on AdBlue, usually around 4.0 percent of fuel use. It doesn’t vary much. “Driver training takes a high priority in MFL, with regular requirements for medical checks, and alert systems in place for upgrades and renewals. We don’t have a major driver turnover, which is to our advantage. “The drivers are very accepting of the new safety intervention systems. They appreciate they are there to assist them, and if this technology is available why would we not introduce it? It’s part of our usual business regime to have the safest, most cost effective vehicles on the road. “We are not an express freight operation so our trucks are generally off the road at midnight. We keep the drivers to a regular regime as the safest way to operate and have found that in the long term it pays dividends. All the things we need to do ensure our safety and the safety of our drivers,” added Mr. Tomarchio. .

-

Power Torque Magazine / February 2017 Two years since the preview of the International ProStar at the last Brisbane Truck Show, IVECO is starting to ramp information as to the detailed specification of the trucks that form the return of the American brand name to the Australian market. The key to its intended success from day one depends on the work completed by the engineering team to ensure that the Pro-Star is not just viewed as a right hand drive version of an American truck, but is engineered to incorporate design changes that will enable the Pro-Star to rival any other existing conventional on the Australian market .These attributes are focussed on durability, class-leading aerodynamics, good visibility and excellent ride and handling. Having worked on the development of the CAT Truck for the Australian market, Adrian Wright, in his new role of International’s local Engineering Manager, says the project followed a comprehensive integrated product development process that left nothing to chance. “We began by working out the key requirements for this market,” he said. “Obviously, one was RHD – fortunately the cab was designed from the outset to accommodate either LHD or RHD, so we had a solid place to start from, we also wanted a short bumper to back of cab for B-double applications, and a 15 litre 550 horsepower engine.” “The Cummins X15 was the obvious choice – it is the evolution of the ISXe5, an engine now well proven in Australian conditions.” Cummins have the local expertise on the 15 Litre SCR engine, Australia being the lead market where the engine platform was introduced, and the company assisted with both the engine installation and certification and testing. The ProStar models will be aimed at operational requirements in the truck and dog segment and will be suitable for 34 pallet B-double, 36 pallet B-double and even B-triple and two trailer road train work. Other benefits of the model include superior aerodynamics when compared to other bonneted vehicles, resulting in up to a 10 per cent drag reduction – this combined with the latest engine technology from Cummins has shown impressive fuel consumption figures in local trials. As well as aiding aerodynamics, the sloping hood provides exceptional forward visibility, while the interior cabin has been designed to provide a more car-like driving position with optimised ergonomics for reduced driver fatigue on extended hour routes. .

-

Big Rigs / February 12, 2017 IVECO reckons it's done well in the Australian market through the past 12 months with its revitalised product range combined with increased management stability and growing professional Dealer Network. This has reflected extremely positively in Australia and New Zealand, with IVECO achieving a combined full year volume growth of over 25 per cent in 2016. IVECO New Zealand recorded its best sales performance on record, with a 45 per cent volume increase on 2015 full year results. In Australia, IVECO achieved a 6 per cent full year volume increase, the brand's best sales performance since 2013. IVECO Australia Marketing Manager Darren Swenson said the company was pleased with the result as it marked a turnaround for the brand and would help build a foundation for additional future growth. "The last two to three years has seen considerable change at IVECO, a new management structure has been implemented, our manufacturing facility has undergone restructuring and there has been considerable time and effort devoted to better meeting the needs of our customers,” Mr Swenson said. "Wholesale changes of this nature obviously take time to effect, so it's exciting to already be seeing some early benefits as an organisation as well as for our customers.” Boasting one of the widest product ranges of any manufacturer in Australia and New Zealand, from car-licence van and cab chassis through to road train-capable prime movers (Australia only) and an off-road range second to none, IVECO will continue with its new model releases and product upgrades into 2017. Due for launch this year is the award-winning Euro6 Eurocargo, International Truck of the Year 2016, while Daily van, cab chassis and Daily 4x4 models would also benefit from upgrades along with selected Stralis variants to name just a few. Exciting new products aside, Mr Swenson also nominated the brand's continued investment in its Dealer Network and promoting its aftersales products and services, as key priorities for 2017. "The Dealer Network has grown markedly over the past 12 months and now encompasses over 60 outlets comprising of full line, light duty and parts and service outlets,” he said. "This number will expand in 2017 with additional strategic appointments and the further evolution of existing outlets. "Similarly, through our successful 'Trusted' messaging, we'll further promote the brand's aftersales offerings in an effort to increase buyer awareness of Dealer servicing and our range of extended warranties, program maintenance contracts and related products. "A big thank you to all the buyers who supported IVECO in 2016 - rest assured that the company is focused on continuing to meet their transport requirements well into the future.” .

-

Hino Dakar 2017 photo gallery - http://www.hino-global.com/dakar/gallery/index.html

-

Transport Engineer / February 9, 2017 The first of a second order for 3,000 new Schmitz Cargobull S.CS curtainsider semi-trailers has been delivered to Søren Lund and Flemming Steiness – director of equipment and deputy equipment manager, respectively – of DSV Road Holding on Monday (6 February 2017). The first tranche of 3,000 semi-trailers was delivered in batches to DSV – one of the largest international transport and logistics companies in the world – during 2015 under its framework agreement. This latest order is due to be fulfilled over the next two years. This latest order includes Universal and Mega trailers, which can all be loaded onto trains. “Over the past few years, Schmitz Cargobull has proven itself to be a reliable partner,” comments Lund. “The semi-trailer quality, quick and on-schedule delivery, and Europe-wide availability of spare parts are all decisive factors in meeting the quality standard we promise to our customers,” he adds. All of the new DSV trailers have been specified with Ultra-Seal tyre sealant (applied through the tyre valves) and Westlake tyres. “This makes punctures a thing of the past,” explains Steiness. “Ultra-Seal is a repair solution that lasts the complete life of the tyre,” he continues. “Extensive practical tests at DSV have led to impressive results, which made the choice easy to fill every tyre on a DSV trailer with Ultra-Seal.” Schmitz Cargobull board member Boris Billich says: “We are proud that the framework agreement has been extended by another 3,000 semi-trailers and that we were able to live up to the trust placed in us. “Our customer values our efforts to set the benchmark for intelligent and efficient transport solutions for the commercial vehicle industry.” .

-

Transport Engineer / February 9, 2017 Eddie Stobart is rolling out a new telematics solution across its 2,000-strong fleet, which will include in-cab ruggedised tablet devices. The deployment of Microlise Fleet Performance and Journey Management follows a competitive tender, with the operator evaluating several solutions and comparing them with its incumbent system. They predict the Microlise system – to be called Eddie Stobart Link – will deliver better driver support and safety, help to increase fleet utilisation and efficiency, and reduce fuel costs. Key is the ability to compare ‘plan v actual’ routes, as is the Microlise DPM app, for driver performance monitoring. Each tractor will also be fitted with a Microlise DriveTab – a 7-inch ruggedised, Eddie Stobart branded tablet giving access to truck-specific maps for navigation, journey information, two-way messaging and hands-free voice calls. Eddie Stobart will also use the Microlise Safety Module, with its incident data recorder to provide information about driver and vehicle activity 30 seconds before and after any incident. Microlise engineers are currently installing telematics hardware on the Stobart fleet, with the system planned to go live in the spring. John Court, Eddie Stobart’s chief information officer, says investing in new technology is an important part of supporting business expansion: “Through Eddie Stobart Link, we will be right at the cutting edge of technology for our sector and continue to set the standards that others then undoubtedly follow.” .

-

Waitrose launches fleet of CNG-fuelled trucks with 500-mile range Commercial Fleet / February 9, 2017 Supermarket group Waitrose has introduced a fleet of CNG (compressed natural gas)-powered trucks with a range of up to 500 miles. It has teamed up with CNG Fuel and will use technology developed jointly with Scania and Agility Fuel Solutions, a CNG fuel systems and cylinders company based in North America. This will help overcome concerns about the distance that CNG-powered lorries are able to cover before refuelling. Ten new Scania-manufactured CNG trucks entered operation for Waitrose in January and will be used to make deliveries to the company’s stores in the Midlands and the North. They are the first in Europe to use twin 26-inch diameter carbon fibre fuel tanks which store gas at 250 bar of pressure to increase range from around 300 miles to as much as 500. It will allow them to always run entirely on biomethane, which is 35% to 40% cheaper than diesel and emits 70% less CO2. The carbon fibre tanks, which are already in use in the US, were adapted and certified for the European market by Agility Fuel Solutions, thereby offering significant advantages over the standard European set-up of eight steel gas tanks. The vehicles are half a tonne lighter, hold more gas and can cover a greater distance depending on the load being carried. Each of Waitrose’s new CNG trucks costs 50% more than one which runs on diesel, but are expected to repay the extra costs in two to three years with fuel savings of £15,000 to £20,000 a year depending on mileage. Its vehicles are likely to operate for at least five more years, generating overall lifetime savings of £75,000 to £100,000 compared with a diesel equivalent. Each lorry will also save more than 100 tonnes of CO2 a year (versus diesel). Justin Laney, general manager central transport for the John Lewis Partnership, said: “With Europe’s most advanced CNG trucks, we will be able to make deliveries to our stores without having to refuel away from base. "Using biomethane will deliver significant environmental and operational benefits to our business. "It’s much cleaner and quieter than diesel, and we can run five gas trucks for the same emissions as one diesel lorry.” Philip Fjeld, CEO of CNG Fuels, added: “High pressure carbon-fibre fuel tanks demolish the ‘range anxiety’ concerns that have made many hauliers reluctant to move away from diesel to CNG. "Renewable biomethane is far cheaper and cleaner than diesel, and, with a range of up to 500 miles, it is a game-changer for road transport operators.”

-

CNG Fuels, the supplier of renewable biomethane fuel, and Waitrose, today announced that the supermarket group has introduced Europe’s most advanced fleet of CNG (compressed natural gas)-powered trucks with a range of up to 500 miles. Ten Scania-built trucks use twin carbon fibre tanks which store gas at 250 bar of pressure to increase range from 300 to up to 500 miles This new Waitrose fleet will use game-changing technology developed jointly with Scania and U.S.-based Agility Fuel Solutions. This will help overcome concerns about the distance that CNG-powered trucks are able to cover before refuelling. It also makes it easier for fleet operators to switch to renewable biomethane CNG, the most cost-effective and lowest carbon alternative to diesel for heavy goods vehicles (HGVs). Ten new Scania-manufactured CNG trucks entered operation for Waitrose in January and will be used to make deliveries to the company’s stores in the Midlands and the North. They are the first in Europe to use twin 26-inch diameter carbon fibre fuel tanks which store gas at 250 bar of pressure to increase range from around 300 miles to as much as 500. It will allow them to always run entirely on biomethane, which is 35% to 40% cheaper than diesel and emits 70% less CO2. The carbon fibre tanks, which are already in use in the US, were adapted and certified for the European market by Agility Fuel Solutions, thereby offering significant advantages over the standard European set-up of eight steel gas tanks. The vehicles are half a tonne lighter, hold more gas and can cover a greater distance depending on the load being carried. They are quicker to refuel and easier to maintain. Each of Waitrose’s new CNG trucks costs 50% more than one which runs on diesel, but will repay the extra costs in two to three years with fuel savings of £15,000 to £20,000 a year depending on mileage. Its vehicles are likely to operate for at least five more years, generating overall lifetime savings of £75,000 to £100,000 compared with a diesel equivalent. Each truck will save more than 100 tonnes of CO2 a year (versus diesel). Justin Laney, General Manager Central Transport for the John Lewis Partnership, said: “With Europe’s most advanced CNG trucks, we will be able to make deliveries to our stores without having to refuel away from base. Using biomethane will deliver significant environmental and operational benefits to our business. It’s much cleaner and quieter than diesel, and we can run five gas trucks for the same emissions as one diesel truck.” Philip Fjeld, CEO of CNG Fuels, added: “High pressure carbon-fibre fuel tanks demolish the ‘range anxiety’ concerns that have made many hauliers reluctant to move away from diesel to CNG. Renewable biomethane is far cheaper and cleaner than diesel, and, with a range of up to 500 miles, it is a game-changer for road transport operators.” Todd Sloan, Vice President Research and New Product Development, Agility Fuel Solutions, said: “We are seeing a shift to natural gas because it allows companies to control fuel costs, meet sustainability goals, and take care of drivers. CNG costs less than diesel and has lower tailpipe emissions. In addition, our high-capacity fuel tanks increase route efficiency and driver confidence. It’s a win-win for everyone.” David Burke, Specialist Sales Executive – Gas for Scania (Great Britain) Limited, said: "Together with Waitrose and CNG Fuels we are developing a new UK market sector for dedicated gas vehicles which we believe will supersede the heavier dual-fuel models seen up until now. In addition to being cleaner and quieter than dual-fuel vehicles, our dedicated gas trucks offer the considerable operational advantages which come with having Scania as the single source of supply."

-

Alkane Truck inks truck deal with Brazil’s Agrale Commercial Carrier Journal / February 8, 2017 Alkane Truck Company has signed an agreement with Brazilian truck manufacturer, Agrale that gives the South Carolina-based truck manufacturer sole representation for sales and service in North America. Together, Alkane and Agrale will offer a new class 7 truck line and various commercial chassis options for recreational and public transportation vehicles. “We are very excited about having exclusivity with Agrale in the North American market,” says Alkane CEO Bob Smith. “The unique vehicles we will be offering through Agrale will fill existing market voids.” “We are ready to move forward and we anticipate the North American market will be very receptive to these rugged and durable vehicles,” Smith says. “This agreement is a unique and exciting opportunity for both companies, and we look forward to working together.” Alkane brings to the market a unique production and distribution model, using streamlined manufacturing and distribution to reduce costs and allow Alkane to offer more competitively priced vehicles in their respective markets. Alkane imports the main body and chassis as an assemblage of parts and incorporates U.S.-manufactured components such as engines, transmissions, fuel systems, wheels, tires, brakes, safety elements and other key components required for DOT compliance. Agrale Class 7 spec Model 14000 S (GVW 14,000kg/30,865lb) - http://www.agrale.com.br/pdf/en/trucks_medium_truck_agrale_14000_s_1.pdf?date=1486949438 .

-

Global bidders line up for Renault Trucks Defense Safran, an aeronautics equipment and defense company, is among European and American firms and investment funds that have considered bidding for Renault Trucks Defense (RTD). “Safran is studying it,” a defense source said. “Everybody is looking at the dossier.” CMI, a Belgian builder of turrets and guns for armored vehicles; Rheinmetall; and three venture capital companies are among those which have also taken a look at RTD, the source said. “Safran has always been on the list” of firms taking a close look at RTD, a second defense executive said. There was talk of Safran's interest a couple of weeks before Volvo issued a Nov. 4 statement on a planned sale of RTD. Other companies included BAE Systems, General Dynamics, Leonardo, Patria-Kongsberg and Rheinmetall. Leonardo was not interested in bidding, a source in Italy said. RTD is a key company in the Volvo group's government sales unit, or VGGS, which the Swedish truck maker plans to sell off once staff consultations have been held. Other firms in VGGS include Acmat, U.S. truck-builder Mack, and Panhard, one of the oldest names in French motor industry. Volvo has retained Rothschild as its bank adviser, two sources said. The industrial logic behind Safran’s interest lay in an equipment company acquiring a vehicle builder, and selling its own kit to equip the platform, the first source said. An indicator is the partnership between Safran and Panhard to build Wasp, a light 7.62mm remote weapon system for armored vehicles. Advent, Cinven and HIG are among investment funds which have looked at RTD, the source said. Safran in September picked Advent for exclusive talks to spin off its identity and security business, formerly known as Morpho. Last month, the equipment maker who built the Felin infantry system made an agreed offer for Zodiac Aerospace, a specialist in airliner seats, so management teams are heavily occupied. CMI is keen to bid for RTD, but the French Ministry of Defence (MoD)) previously issued a veto, as the government's preferred pick is KNDS, the Franco-German joint venture between Krauss-Maffei Wegmann and Nexter, La Tribune website reported Feb. 6. The Belgian firm is a “very logical” candidate, one which makes industrial sense, said a third defense source. CMI supplies cannons and turrets to General Dynamics Canada on a multibillion-dollar Saudi contract. A merger of CMI and RTD would create a European group of “very respectable size”. Among CMI board members is Gérard Longuet, a former French defense minister, Belga News reported in 2014. CMI has a French industrial presence with a factory in Distroff, northeast France, and an office just outside Paris, the third source said. Four to five months ago, Belgium told France the Belgian authorities want to buy Jaguar combat vehicles and Griffon troop carriers under the French Army’s Scorpion program, with the Belgian versions fitted with CMI turrets and guns and other locally sourced kit. The French MoD has resisted against accepting bids from investment companies, sources said. But the Ministry for the Economy and Finance is keen on venture capital firms, as that boosts the pricing. General Dynamics is seen as a candidate, as the company has a strong European presence, having won a $600 million Danish contract last year with its Piranha 5 troop carrier and bidding in a U.K. tender for its mechanized infantry vehicle program. BAE Systems, General Dynamics, Rheinmetall and Safran declined comment. Nexter, the French state-owned land weapons company, has been seen as the natural bidder for RTD, all the more so as Defence Minister Jean-Yves Le Drian has said the government is keeping a close eye on the sale and seeks to protect the national interest. France may have a say, but Volvo is steered by market economics and will look for the highest bidder, a French political source said. KNDS is interested in making a bid for RTD, a KMW spokesman said. A Nexter spokesperson said: “KNDS is interested in acquiring RTD. It is consistent with the KNDS strategy. “KNDS is an actor in the consolidation of European land defense. The sale of RTD by Volvo is an opportunity.” On the political front, the French MoD is watching the clock as a presidential election looms in May, followed by a parliamentary poll in June. That puts pressure on the ministry to reach an agreement, but Volvo will want to take its time to find a buyer, sources said. The MoD declined comment. In a few months, there will be a new president and ministers at defense, industry and economy, so it is far from certain that Nexter will win RTD, the third source said. The price for RTD is likely to be between €500-700 million (U.S. $533-747 million), or the equivalent of one year’s worth of sales, the first source said. Sales for this year are forecast at €600-€700 million, buoyed by a Canadian order won through Mack, and contracts for the French special forces, Kuwait, and Saudi Arabia to arm Lebanon. The acquisition price is usually eight to nine times operating profit, or one year’s worth of sales, the source said. The order book is worth €4-5 billion, offering six to seven years’ work. RTD had 2015 sales of €500 million. The ideal buyer for RTD would be a defense rather than a civil company, with a complementarity of products, a second industry executive said. For Volvo, it would be one which pays the most. RTD draws on its own funds to develop vehicles for the export market, which accounts for half of annual sales. There is fierce competition in exports from firms in Turkey, China, India, South Africa and Russia. There are also European and American competitors, and the European market is fragmented, as almost each country has a domestic producer.

-

Volvo Buses receives Belgian order for 90 electric hybrid buses

kscarbel2 replied to kscarbel2's topic in Trucking News

Volvo Buses receives order for 90 electric buses from Belgium Volvo Group / February 9, 2017 Volvo Buses has secured its largest ever order for complete solutions for electric bus traffic. The Belgian cities of Charleroi and Namur have together ordered 90 Volvo 7900 Electric Hybrid buses as well as 12 charging stations. The buyer is public transport company TEC Group. The charging stations will be delivered by ABB. The order from TEC Group covers 55 buses for Charleroi and another 35 buses for Namur. ABB will supply 4 charging stations to Charleroi and 8 charging stations for Namur. Delivery and installation will get under way this autumn. After the delivery, the TEC Group will have ordered in total 101 Volvo electric hybrids and 15 ABB charging stations. “This is extremely gratifying! The order is a new milestone in our electromobility drive and confirms the competitiveness of our offer. We can see that more and more of the world’s cities are choosing electrified city bus traffic in order to deal with poor air quality and noise. The common interface for fast charging of buses and trucks, OppCharge, is gaining ground. The use by many suppliers of a common interface will facilitate the transition to electromobility in the world’s cities, ” said Volvo Buses President Håkan Agnevall. The customer and operator, TEC Group, previously ordered 11 Volvo 7900 Electric Hybrids along with charging stations for Namur , a system that became operational in January this year. Once the 35 new buses take to the roads, 90 per cent of Namur’s public transport will be electrified. “As public transport company, the TEC Group is very proud to be a leader in the increase of the energy efficiency of its fleet. This strategic investment will participate in the improvement of the quality of life in the main city centers, and will allow the Walloon Region to achieve its environmental goals. The hybrid technology is the best compromise between the operational constraints and the energy efficiency for urban buses today”, said Vincent Peremans, CEO TEC Group. Volvo’s electric hybrids and ABB’s fast-charging systems are based on a common interface known as OppCharge, whereby the charging stations can also be used by electrified buses from other vehicle manufacturers. OppCharge is now being implemented as a common interface in more than 12 countries. The Volvo 7900 Electric Hybrid operates quietly and exhaust emission-free on electricity for about 70 per cent of its route. Battery recharging takes 3 to 4 minutes with so called opportunity charging. Energy consumption is about 60 per cent lower than for a corresponding diesel bus. Volvo’s electric hybrids have already entered service in cities such as Gothenburg, Stockholm, Hamburg, Luxemburg, Namur and Curitiba. Volvo 7900 Electric Hybrid • Propelled by electricity for about 70 % of the route. • Quiet and exhaust emission-free when running on electricity. • 60 % lower energy consumption compared with a corresponding diesel bus. • 75–90 % lower carbon dioxide emission1, depending on choice of fuel. • Equipped with an electric motor, batteries and a small diesel engine. • The batteries are fast-charged at one or both ends of the bus route and charging takes 3-4 minutes. 1) Estimated figure for a 10 km city bus route, compared with a Euro 6 diesel bus. ABB OppCharge (Opportunity Charging) station • Common interface between charging station and vehicles, based on the car industry CCS standard • Charging power 150, 300 or 450 kW. • Pantograph attached to the pylon makes it possible to use a cost-effective solution that adds little weight to the bus roof. • Conductive charging using current collectors, with communication between the bus and charging station via Wi-Fi. More information about OppCharge: www.oppcharge.org -

Green Car Congress / February 10, 2017 Volvo Buses has secured its largest order yet for complete solutions for electric bus traffic. The Belgian cities of Charleroi and Namur have together ordered 90 Volvo 7900 Electric Hybrid buses as well as 12 charging stations. The buyer is public transport company TEC Group. The charging stations will be delivered by Zürich, Switzerland-based ABB. The order from TEC Group covers 55 buses for Charleroi and another 35 buses for Namur. ABB will supply 4 charging stations to Charleroi and 8 charging stations for Namur. Delivery and installation will get under way this autumn. After the delivery, the TEC Group will have ordered in total 101 Volvo electric hybrids and 15 ABB charging stations. The customer and operator, TEC Group, previously ordered 11 Volvo 7900 Electric Hybrids along with charging stations for Namur, a system that became operational in January this year. Once the 35 new buses take to the roads, 90% of Namur’s public transport will be electrified. Volvo’s electric hybrids and ABB’s fast-charging systems are based on a common interface known as OppCharge, whereby the charging stations can also be used by electrified buses from other vehicle manufacturers. OppCharge is now being implemented as a common interface in more than 12 countries. The Volvo 7900 Electric Hybrid operates quietly and exhaust emission-free on electricity for about 70% of its route. Battery recharging takes 3 to 4 minutes with opportunity charging. Energy consumption is about 60% lower than for a corresponding diesel bus. Volvo’s electric hybrids have already entered service in cities such as Gothenburg, Stockholm, Hamburg, Luxemburg, Namur and Curitiba. .

-

Car & Driver / February 2017 About 150 million years ago, shifting sand dunes in the Nevada desert created the natural world’s precursor to modern-day Las Vegas. The Valley of Fire’s orange and red sandstone formations radiate with as much intensity as the Strip’s neon tubes 50 miles to the southwest. And while humans are scarce out here, early inhabitants left their ancient graffiti in the form of petroglyphs found along the rockscape. On the northern edge of the valley, at the Logandale trailhead, a herd of heavy-duty off-roaders waits restlessly. The 2017 Ram Power Wagon is ready to leave its own markings in the sand. The Power Wagon begins its life as a Ram 2500 Crew Cab 4x4, but it isn’t your typical heavy-duty pickup. Its 10,030-pound towing capacity is topped by some light-duty trucks, but that’s a trade-off made in favor of serious off-road skills. The transformation starts with a 2.0-inch lift that elevates the ground clearance to 14.3 inches. Bilstein monotube dampers do their best to control 7300 pounds of Power Wagon over the red sand whoop-de-dos, but any attempts at speed will provide the same sensation as riding a mechanical bull. The Power Wagon is not a desert racer in the vein of the Ford F-150 Raptor. That’s not its mission; the Power Wagon is a tool for picking your way over rocks and slogging through mud bogs, and some trick hardware aids this heavy-duty rig in that task. As with the previous Power Wagon, thrust comes via Chrysler’s 6.4-liter Hemi V-8, producing 410 horsepower and 429 lb-ft of torque. It’s mated to a six-speed automatic transmission and a manually shifted BorgWarner 44-47 two-speed transfer case that sends torque to either the rear or all four wheels. Our Save the Manuals! campaign might not encompass transfer cases but perhaps it should, as there’s a special satisfaction in yanking a mechanical lever to engage four-wheel drive. When you’re out on the trail, the last thing you want is an electrical failure stranding you at the bottom of the climb back to civilization. The 2017 Power Wagon’s rear axle has a 11.5-inch ring gear, while the front axle remains at 9.3 inches. Both ends contain an electronically locking differential with a 4.10:1 final drive. Beefier axle shafts measuring 1.4 inches in diameter up front and 1.5 inches in the rear deliver torque to the wheels. When low range is selected, throttle sensitivity is dialed back, idle rpm is raised from 650 to 750 to maximize crawling ability, and stability control is partially deactivated. The Power Wagon’s 2.64:1 low range delivers effortless climbs up the loose-gravel, two-track trails and many elevation changes in the Logandale trail system. The 33-inch Goodyear Wrangler DuraTrac tires never lose their bite on the way to the summit. Because what goes up must come down, the Power Wagon has hill-descent control, which turned our downhill runs into a pedal-free drive. The manual gear-selector toggle on the column-mounted shifter is used to set descent speed. Articulation that Rocks Axle articulation is key when crawling over challenging terrain. To enhance the Power Wagon’s abilities, an extra joint in the front axle’s leading arms, which Ram calls Articulink, increases the range of motion. To provide up to 26 inches of front wheel articulation, Ram installs an electronically disconnecting front anti-roll bar—made by American Axle—that can separate at speeds up to 18 mph. With trail guides watching to make sure our wheels never fell into craters, this simple, effective device allowed the Power Wagon’s tires to maintain contact with terra firma, as the big truck clambered like a native bighorn sheep over jagged sandstone rocks. The Power Wagon boasts some impressive stats, with an approach angle of 33.6 degrees, a departure angle of 26.2 degrees, and a breakover angle of 23.5 degrees. These numbers may not mean much to flatlanders, but they’re crucial when you drive up to a smooth sandstone wall in this giant rig, climb—say—a 70 percent slope, and crest over the top with only the edge of a rocker panel nicking the ground. In the event that the Power Wagon—or a fellow four-wheeler—becomes stuck, this mighty three-quarter-ton pickup is ready, thanks to its standard 12,000-pound Warn winch with 90 feet of cable mounted behind the front bumper. All Day Drivability For a vehicle built for extreme off-road environs, the Power Wagon is surprisingly well mannered on the asphalt. Only a slight hum from the aggressive all-terrain tires is present in the cabin, and the hydraulically assisted recirculating-ball power steering feels light and loose off-center. The Power Wagon’s coil-sprung front and rear live axles have softer springs than the standard Ram 2500 pickup and provide a compliant ride while driving to and from your off-roading adventure. They’re cushy enough that you might think you’re riding on the 2500’s optional rear air springs, but those aren’t available on the Power Wagon. Heavy-duty trucks like this escape full scrutiny from the EPA, meaning there are no estimated mpg figures. The in-dash computer, however, indicated that the Power Wagon possesses an undeniable thirst for gasoline. Even with the Hemi V-8’s cylinder-deactivation system, our previous test of a 2014 Ram Power Wagon returned 11 mpg. There’s no reason to expect that will improve much. Newer: In and Out Minor upgrades appear throughout the interior for 2017. The cloth seats feature inserts embossed with the tires’ tread pattern. Select the creature-comfort-packed $4995 Leather & Luxury group and the seat bolsters are embroidered with Power Wagon logos. Either way, three-person front seating is retained despite having bucket seats for the driver and the right-front passenger. The floor-mounted console dictates that any middle-seat occupant must ride as if straddling a horse. Outside, the new grille is shared with the Ram Rebel, and the front and rear bumpers receive a powder-coat treatment. Whereas the bedside graphic on previous Power Wagons looked as if the truck were shedding its own sheetmetal, the new vertical Power Wagon logo is simplified, paying homage to the late-1970s Dodge W150 Macho Power Wagon. New 17-inch wheels are specific to this model. Ram’s claim that the Power Wagon is “the most off-road-capable” pickup will certainly raise some eyebrows in Dearborn. However, there is a clear division between the Ford Raptor and this truck. While a Raptor is a desert-racing hypertruck, the Ram Power Wagon is the go-anywhere, all-terrain, heavy-duty off-road machine. Starting at $53,015, Ram Power Wagon pricing falls right in line with that of the Raptor. How would you prefer to carve your line in the sand? Photo gallery - http://www.caranddriver.com/photo-gallery/2017-ram-power-wagon-first-drive-review

-

Reuters / January 12, 2017 The CEOs of 18 major automakers and their U.S. units urged President Trump to revisit a decision by the Obama administration to lock in vehicle fuel efficiency rules through 2025. In a letter sent late Friday and viewed by Reuters, the chief executives of General Motors, Ford Fiat Chrysler Automobiles (FCA), along with the top North American executives at Toyota, Volkswagen, Honda, Hyundai, Nissan and others urged Trump to reverse the decision, warning thousands of jobs could be at risk. On Jan. 13, the head of the U.S. Environmental Protection Agency (EPA) finalized a determination that the landmark fuel efficiency rules instituted by then President Barack Obama should be locked in through 2025, a bid to maintain a key part of his administration's climate legacy. As part of a 2012 regulation, EPA had to decide by April 2018 whether to modify the 2022-2025 model year vehicle emission rules requiring average fleet-wide efficiency of more than 50 miles per gallon through a "midterm review." The agency in November moved up the timetable for proposing automakers could meet the 2025 standards. The auto CEO letter asked Trump to reopen the midterm review "without prejudging the outcome" and praised Trump's "personal focus on steps to strengthen the economy in the United States and your commitment to jobs in our sector." Days after Trump was elected, automakers quickly appealed to Trump to review the rules, saying they impose significant costs and are out of step with consumer preferences. Gloria Bergquist, a spokeswoman for the Alliance of Automobile Manufacturers, said Sunday, automakers are "seeking a restoration of the process -- that's all. This is a reset." The chief executives of Ford, GM and Fiat Chrysler also raised the issue in a White House meeting with Trump last month. The letter warned the rules could "threaten future production levels, putting hundreds of thousands and perhaps as many as a million jobs at risk." Environmentalists say the rules are working, saving drivers thousands in fuel costs and shouldn't be changed. Luke Tonachel of the Natural Resources Defense Council, said lowering the standards would "cost consumers more, increase our dependence on oil and put Americans at greater risk from a changing climate." Trump EPA nominee Scott Pruitt told a Senate panel he will review the Obama administration's decision. In 2011, Obama announced an agreement with automakers to raise fuel efficiency standards to 54.5 miles per gallon. This, the administration said, would save motorists $1.7 trillion in fuel costs over the life of the vehicles, but cost the auto industry about $200 billion over 13 years. The EPA said in July that because Americans were buying fewer cars and more SUVs and trucks, it estimated the fleet will average 50.8 mpg to 52.6 mpg in 2025.

BigMackTrucks.com

BigMackTrucks.com is a support forum for antique, classic and modern Mack Trucks! The forum is owned and maintained by Watt's Truck Center, Inc. an independent, full service Mack dealer. The forums are not affiliated with Mack Trucks, Inc.

Our Vendors and Advertisers

Thank you for your support!