kscarbel2

Moderator-

Posts

19,084 -

Joined

-

Days Won

114

Content Type

Profiles

Forums

Gallery

Events

Blogs

BMT Wiki

Collections

Store

Everything posted by kscarbel2

-

I don’t subscribe to conspiracy theories. That said, my gut feeling is these two former navy seals didn’t die from an overdose. ------------------------------------------------------------------------- CBS News / February 24, 2014 Police on the island nation of Seychelles say that two former U.S. Navy SEALs found dead aboard the ship Maersk Alabama died of respiratory failure and were suspected to have had heart attacks, possibly from drug use. The police said Monday that a syringe and traces of heroin were found in their cabin. Police said samples are being sent to Mauritius for analysis to establish if the men had consumed "a substance" that could have caused the health failures. Officials named the two men as Mark Daniel Kennedy, 43, and Jeffrey Keith Reynolds, 44. They worked for the Virginia Beach, Virginia-based maritime security firm The Trident Group. The U.S. Coast Guard is also investigating the deaths. The two men worked for U.S.-based Trident Security. Former military personnel frequently provide security on board ships sailing through the waters off Somalia to provide security against pirate attacks. Trident Security was founded by former U.S. Navy SEALs in 2000 and employs former special warfare operators to provide security. -------------------------------------------------------------------------------------------------- A new report circulating in the Kremlin today prepared by the Main Intelligence Directorate of the General Staff of the Armed Forces (GRU) states that Aerospace Defence Forces (VKO) experts remain “puzzled” as to why the United States Navy “captured and then diverted” a Malaysia Airlines civilian aircraft from its intended flight-path to their vast and highly-secretive Indian Ocean base located on the Diego Garcia atoll. According to this report, Malaysia Airlines Flight 370 (also marketed as China Southern Airlines flight 748 through a codeshare) was a scheduled passenger flight from Kuala Lumpur, Malaysia, to Beijing, China, when on 8 March this Boeing 777-200ER aircraft “disappeared” in flight with 227 passengers on board from 15 countries, most of whom were Chinese, and 12 crew members. Interesting to note, this report says, was that Flight 370 was already under GRU “surveillance” after it received a “highly suspicious” cargo load that had been traced to the Indian Ocean nation Republic of Seychelles, and where it had previously been aboard the US-flagged container ship MV Maersk Alabama. What first aroused GRU suspicions regarding the MV Maersk Alabama, this report continues, was that within 24-hours of off-loading this “highly suspicious” cargo load bound for Malaysia Airlines Flight 370, the two highly-trained US Navy Seals assigned to protect it, Mark Daniel Kennedy, 43, and Jeffrey Keith Reynolds, 44, were found dead under “suspicious circumstances.” Both Kennedy and Reynolds were employed by the Virginia Beach, Virginia-based maritime security firm The Trident Group which was founded by US Navy Special Operations Personnel (SEAL’s) and Senior US Naval Surface Warfare Officers and has long been known by the GRU to protect vital transfers of both atomic and biological materials throughout the world. Upon GRU “assests” confirming that this “highly suspicious” cargo was aboard Malaysia Airlines Flight 370 on 8 March, this report notes, Moscow notified China’s Ministry of State Security (MSS) of their concerns and received “assurances” that “all measures” would be taken as to ascertain what was being kept so hidden when this aircraft entered into their airspace. However, this report says, and as yet for still unknown reasons, the MSS was preparing to divert Flight 370 from its scheduled destination of Beijing to Haikou Meilan International Airport (HAK) located in Hainan Province (aka Hainan Island). Prior to entering the People Liberation Army (PLA) protected zones of the South China Sea known as the Spratly Islands, this report continues, Flight 370 “significantly deviated” from its flight course and was tracked by VKO satellites and radar flying into the Indian Ocean region and completing its nearly 3,447 kilometer (2,142 miles) flight to Diego Garcia. Critical to note about Flight 370’s flight deviation, GRU experts in this report say, was that it occurred during the same time period that all of the Spratly Island mobile phone communications operated by China Mobile were being jammed. China Mobile had extended phone coverage in the Spratly Islands in 2011 so that PLA soldiers stationed on the islands, fishermen, and merchant vessels within the area would be able to use mobile services, and can also provide assistance during storms and sea rescues. As to how the US Navy was able to divert Flight 370 to its Diego Garcia base, this report says, appears to have been accomplished remotely as this Boeing 777-200ER aircraft is equipped with a fly-by-wire (FBW) system that replaces the conventional manual flight controls of an aircraft with an electronic interface allowing it to be controlled like any drone-type aircraft. However, this report notes, though this aircraft can be controlled remotely, the same cannot be said of its communication systems which can only be shut down manually; and in the case of Flight 370, its data reporting system was shut down at 1:07 a.m., followed by its transponder (which transmits location and altitude) which was shut down at 1:21 a.m.

-

In the middle of the night, two fishermen near the Malaysia-Thailand border saw a plane flying low over the South China Sea -- at the same time that air traffic controllers lost contact with Flight 370 over the same body of water, at 1:30 a.m. or almost 50 minutes after takeoff. Fisherman Azid Ibrahim and a friend had taken people fishing that night off the coast of Kota Bharu. "I was fishing when I saw the plane -- it looked strange. Flying low. I told my friend that's not normal. Normally, it flies at 35,000 feet. But that night it touched the clouds. I thought the pilot must be crazy," Ibrahim said. "It was really low. I saw the lights they looked like the size of a coconut," he said. Their fishing grounds lay under a flight path, but the predawn plane was unusual to see because of its low altitude, they said. The fishermen filed a police report about their sighting, but Malaysian officials never commented.

-

A British yachtswoman believes she saw a burning aircraft over the Indian Ocean on the night that flight MH370 vanished. Katherine Tee, 41, from Liverpool, described spotting what looked like a jet with ‘orange lights’ and trailing a plume of smoke. The 41-year-old, who had been at sea for about 13 months with her husband, had kept the spotting of the plane to herself as she was unaware of its significance at the time. But now, she's decided to break her silence and has filed an official report with authorities. Ms Tee said she thought she was ‘mad’ when she spotted the fiery object in the night sky while sailing from Cochin, India with husband Marc Horn, 50. She was alone on deck when she saw the aircraft. 'I was on a night watch. My husband was asleep below deck and our one other crew member was asleep on deck,' she said.. 'I saw something that looked like a plane on fire. That's what I thought it was. Then, I thought I must be mad… It caught my attention because I had never seen a plane with orange lights before, so I wondered what they were. 'I could see the outline of the plane, it looked longer than planes usually do. There was what appeared to be black smoke streaming from behind it.' 'There were two other planes passing well above it – moving the other way – at that time. They had normal navigation lights. I remember thinking that if it was a plane on fire that I was seeing, the other aircraft would report it,' she said. 'And then, I wondered again why it had such bright orange lights. They reminded me of sodium lights. I thought it could be some anomaly or just a meteor. 'It was approaching to cross behind our stern from the north. When I checked again later, it had moved across the stern and was moving away to the south.' Ms Tee explained that she kept her observance to herself as the long voyage had taken a toll on her marriage. She hadn't spoken to her husband for about a week and it wasn't until she arrived in Phuket on March 10 that she first heard of the MH370 tragedy. Ms Tee said she told local yachties what she thought she had seen. 'Some suggested I should say something, that [what I saw] might have been it. Most said that the flight was heading toward Vietnam. I wasn't sure of the date or time [of the sighting]. I am still not,' she said. 'I did think that what I saw would add little, and be dismissed with the thousands of other sightings that I assumed were being reported. I thought that the authorities would be able to track [the plane's] GPS log, which I assumed was automatically transmitted, or something like that. 'Most of all, I wasn't sure of what I saw. I couldn't believe it myself, and didn't think anyone would believe me when I was having trouble believing my own eyes. 'I didn't even consider putting out a Mayday at the time. Imagine what an idiot I would have looked like if I was mistaken, and I believed I was. So I dismissed it, and got on with the business of fixing myself and my marriage.' It was only when she heard some news on a radio report last Saturday explaining that a survey ship involved in the search for MH370 was returning to port due to technical problems. This is what prompted Ms Tee to tell her husband and then began reviewing her yacht's log. 'That is when we checked our GPS log and realized that perhaps I really did see it,' she said. It was then discovered that the couple's 40-foot vessel was near one of the projected flight paths for MH370. A map was created by Cruisers Forum member 'europaflyer' by using Google Earth to show the yacht's position compared with the projected flight path for MH370. The map unveiled that the plane would have passed the yacht astern from port to starboard, which is just as Ms Tee had recalled. 'This is what convinced me… to file a report with the full track data for our voyage to the relevant authorities,' she said. The couple filed the report with the Joint Agency Coordination Center (JACC) on Saturday and the Australian organization tasked with coordinating the search for MH370 in the southern Indian Ocean. They also followed up with a second email to the JACC on Sunday.

-

Fresh testimonies from a small island community in the Maldives has reignited reports that missing Malaysia Airlines flight MH370 could have crashed over 5000 kilometres away from the official search led by Australian authorities. Locals from the island of Kudahuvadhoo, located in the southern area of the Dhaalu Atoll in the Maldives, reported witnessing 'a low-flying jumbo jet' on the morning of March 8 last year, when the flight disappeared while travelling from Kuala Lumpur to Beijing with 239 people on board. The reports come as acoustic scientists from Curtin University refuse to rule out the possibility that 'distinctive' data they recorded from the area at the assumed time of the crash may have come from the impact of the aircraft as it hit the Indian Ocean. Despite an exhaustive search that is underway along a 600 square kilometre arc approximately 1800 kilometres southwest of Perth, locals from the island believe they identified red and blue markings, similar to those of the missing plane, on a large passenger jet which flew over the island on the morning of the MH370's disappearance. Villagers from the community of 3500 say many on the island saw the passenger plane, and were interviewed by police and testified with signed statements to what they witnessed. 'I'm very sure of what I saw on a very clear and bright day, and what I saw was not normal- the plane was very big, and low. I did not know until later that other people saw it too. I don't know if it's the Malaysia plane', said Ahmed Shiyaam, 34, an IT manager. Abdu Rasheed Ibrahim said he saw the plane flying towards him over the water, and did not know at the time that it could be the missing Malaysian Airlines flight. 'I didn't know that a plane was missing. I went straight home and told my wife about it. I told my family, "I saw this strange plane". This is the biggest plane I have ever seen from this island...I have seen pictures of the missing plane- I believe I saw the plane...I strongly felt those people who were searching should come here,' Mr Ibrahim said. The Maldvies National Defence Force released a statement in March last year which denied that there had been any aircrafts in the area at the time of the disappearance, which locals have branded as an attempt to hide the limitations of their radar facilities. A local media outlet reported that witnesses saw the plane was travelling north to southeast, and that the plane was travelling so low it's doors could be seen. 'I've never seen a jet flying so low over our island before. We've seen seaplanes, but I'm sure that this was not one of those. I could even make out the doors on the plane clearly,' an eyewitness said.. 'It's not just me either, several other residents have reported seeing the exact same thing. Some people got out of their houses to see what was causing the tremendous noise too.' The plane dropped off the civilian radar after its transponder and other equipment were switched off shortly after takeoff from Kuala Lumpur. It was then tracked by Malaysia’s military radar heading towards the Indian Ocean. The reports from Kudahuvadhoo follow information released from Curtin University that a 'clear acoustic signal' was recorded at a time reasonably consistent with the timeline of the plane's disappearance. Dr Alec Duncan and his associates from the university's Centre for Marine Science and Technology began investigating a low-frequency underwater sound signal which was recorded west of Rottnest Island just after 1:30 am UTC on March 8. The Centre, along with United Nations’ Comprehensive Nuclear-Test-Ban Treaty Organisation (CTBTO) and Geoscience Australia were involved in investigating data that might prove helpful to the search, and originally determined that the noise's source was close to the Maldives and Kudahuvadhoo. 'Data from one of the IMOS (Integrated Marine Observing System) recorders showed a clear acoustic signal at a time that was reasonably consistent with other information relating to the disappearance of MH370,' Dr Duncan said in a statement released by Curtin University. 'The crash of a large aircraft in the ocean would be a high energy event and expected to generate intense underwater sounds.' Dr Duncan said that the noise may have been due to a geological event, including a small earth tremor, but the timing piqued the interest of his research team. 'It would be more correct to say that our team has identified an approximate possible location for the origin of a noise that is probably of geological origin, but cannot be ruled out as being connected with the loss of MH370,' he said.

-

A Malaysian woman on a flight across the Indian Ocean claimed to have seen an aircraft in the water near the Andaman Islands on the day the jet disappeared. The Kuala Lumpur wife was so convinced about what she saw at 2.30pm on March 8, several hours after MH370 vanished, that she filed an official report with police that very day, five days before the search for the plane was expanded to the area around the Andaman Islands. Mrs Latife Dalelah, 53, said she had received scorn about her account, including from a pilot who said the aircraft she was on would have been too high for her to have seen anything on the ocean below. But she insists that she saw a silver object in the shape of an aircraft on the water as she was flying from Jeddah to Kuala Lumpur. It was about an hour after her aircraft had flown past the southern Indian city of Chennai. 'Throughout the journey I was staring out of the window of the aircraft as I couldn't sleep during the flight,' she told the New Straits Times. The in-flight monitor showed that her plane was crossing the Indian Ocean and she had seen several ships and islands - before she saw the silvery object. 'I took a closer look and was shocked to see what looked like the tail and wing of an aircraft on the water,' she said. 'I woke my friends on the flight but they laughed me off,' she added. The same reaction has come from a pilot who questioned how anyone flying at about seven miles above sea level could see anything like a boat or ship from so high up. But Dalelah insisted to the paper: 'I know what I saw. I am convinced that I saw the aircraft. I will not lie. I had just returned from my pilgrimage.' A large part of what she thought was an aircraft was submerged, she said. When she tried to tell an air stewardess what she had seen, she was told to get some sleep. When her plane landed at Kuala Lumpur at about 4pm on that Saturday she told her children what she had seen. 'That is when they told me that MH370 had gone missing.' 'My son-in-law, a policeman, was convinced that I had seen an aircraft and asked me to lodge a police report the same day. The islands lie across a route MH370 could have taken after radar contact was lost and it would easily have been able to reach them before Mrs Dalelah's sighting at 2.30pm. After its transponder was turned off at 1.21am on March 8 the plane, with enough fuel to last 2,500 miles, turned west, following an established route towards India. An ephemeral satellite ping registered at 8.11am suggested the plane was heading in one of two directions - south to where the potential debris was spotted, or north into China and central Asia. The Andaman Islands lie 890 miles to the north-west of Kuala Lumpur, well within range. Officials still haven't ruled out MH370 being found in a northerly location, with aircraft and ships renewing their search in the Andaman Sea between India and Thailand on Friday.

-

New Zealand oil field worker Mike McKay is adamant he saw the burning wreckage of infamous Malaysian Airlines flight MH370 crash into the South China Sea last year. The Boeing 777 with its 239 passengers and crew vanished en route from Kuala Lumpur to Beijing on March 8 2014. But 57-year-old Mr McKay believes the search effort was in the wrong area. "Almost a year has passed, but I stand by what I saw," he says. "I've thought about it and thought about it, over and over and while I cannot say for certain that the burning object in the sky was definitely MH370, the timing fits in with when the Malaysian plane lost contact. "If it was MH370 I cannot imagine how it could have continued flying. It could only have come down in the South China Sea. "I have been trying to disprove that what I saw was the aeroplane ever since." McKay believed he saw Flight MH370 ablaze as it flew over the horizon in the South China Sea. The reported sighting took place after McKay had gone to bed on the oil-rig Songa Mercur, off the coast of Vietnamese town Vung Tau, at around 7pm. The New Zealander got up at around midnight looking for a cigarette and a coffee. "I got up at around midnight Vietnam Time, which is one hour ahead of Malaysian time, and wandered around to an area at the back as usual for a cigarette and a coffee," he said. "It was a beautiful night with good visibility because it had been raining, which always tends to clear the air. "I saw a sudden glow of fire above the horizon – which caught my immediate attention – although, of course I could not have known whether it was definitely an aircraft or not." Mr McKay penned an email to Vietnamese officials describing the incident three days later. "I believe I saw the Malaysian Airlines plane come down. The timing is right," he wrote. McKay wrote in his email that he had tried to contact Malaysia and Vietnamese officials "several days earlier" before. In his letter, he records the longitude and latitude of his location when he saw the "sudden glow of fire". He added: "I observed (the plane?) burning at high altitude on a compass bearing of 265 degrees to 275 degrees from our surface location. "While I observed the burning (plane) it appeared to be in ONE piece. "From when I first saw the burning (plane) until the flames went out (still at high altitude) was 10-15 seconds. "There was no lateral movement, so it was either coming toward our location, stationary (falling) or going away from our location." (sic) The oil-rig worker, who worked in the oil and gas exploration industry for some 30 years, was "kicked off" the Songa Mercur rig after his email went public. McKay later made a statement to New Zealand Police for Interpol on his return home from the rig. "There's a lot about this whole affair that niggles me and I've considered numerous questions as to whether there has been a cover up or there has been a show of inefficiency," he added. "I learned that Malaysian military had picked up a possible signal over Penang [an island off the west coast of the Malaysian peninsular] but didn't report it immediately. "Of course, if it was from the plane, it means that contrary to my belief that it had come down in the South China Sea it had managed to turn around and fly back across the mainland. "But what has also annoyed me is the fact that the Vietnamese searchers were stood-down after performing one flight based on my observation before the whole search effort was moved to the other side of the peninsular."

-

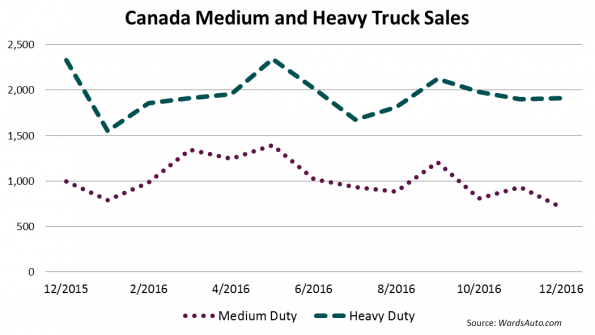

Canada Medium- and Heavy-Duty Truck Sales Sink in December Wards Auto / January 13, 2017 Canadian truck makers undersold in December, down 21.1% to 2,620 units from like-2015’s 3,322. Class 8 deliveries totaled 1,911 units for December, down 17.9% from year-ago. Group leader Paccar gained a mere 0.2%, balanced out from Kenworth’s increase of 0.7% and Peterbilt’s decrease of 0.5%. All other truck makers in this segment posted double-digit losses, including Daimler (-22.1%), International (-15.1%) and Volvo Truck (-25.7%). With all brands in the segment posting year-to-date losses, heavy-trucks totaled 23,037 deliveries for the year, down 22.1% from 2015’s total. Medium-duty truck sales plummeted 28.7% to 709 units from 995 in same-month 2015, with year-to-date losses in each segment. Class 7 sales fell 9.2% from year-ago’s 260 units to 236. Kenworth sunk 35.7% and sister brand Peterbilt rose 11.1%, leaving PACCAR with a 21.7% drop to 47 units. Group leader International posted a large gain of 44.8%. Ford’s sales cut in half, dropping to six units. Freightliner and Hino also saw double-digit losses of 28.6% and 20.3%, respectively. Over the 12-month period, Class 7 sales shrunk to 4,370 units, an 8.8% fall from 2015’s 4,792. In Class 6, an 88.9% dive in Peterbilt sales and a 65.6% plunge posted by Freightliner drove the segment to a 57.9% loss. Hino (-35.7%) and International (-61.9%) also posted large losses. Ford remained flat with 4 deliveries. Year-to-date sales in this class dropped 17.3% to 1,068 units. With its domestic line dropping 33.4% and imports falling 23.6%, Class 5 deliveries totaled 336 units, an overall decline of 30.1% from year-ago’s 481. Volume leader Ford dropped 37.5% with 135 units. Hino saw the smallest decline of only 1.2% to 80 units, while International posted the largest loss of 80% delivering only one unit in December. FCA and Isuzu also saw large declines of 18.3% and 43.4%, respectively. Deliveries in Class 4 fell 34.4% to 84 units. Isuzu’s domestic line rose 850% but on small volume. Group leader Ford fell 43.8% to 50 units. Hino (-14.3%) and Isuzu’s import line (-62.5%) also posted losses. For the year, domestic sales increased 0.7% and imports dropped 30.8%, leaving a Class 4 combined loss of 6.6% on 1,434 units compared to like-2015. Over the 12-month period, medium-and heavy-truck deliveries totaled 35,281 units, 18.2% less than the same period in 2015. .

-

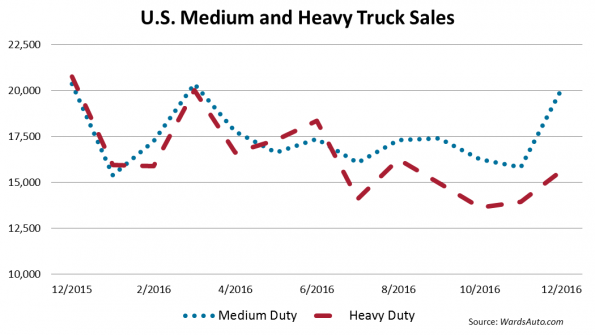

U.S. Big Trucks Down 9.9% in December Wards Auto / January 13, 2017 U.S. sales of medium- and heavy-duty trucks in December fell 9.9% from like-2015 to 35,725 units. Class 8 sales sunk the most in December, down to 15,629 units, a 22.0% decrease from year-ago’s 20,773 units. PACCAR’s Kenworth increased 5.8% to 3,079 units, while all other companies dropped. The largest declines came from International (-39.2%), Daimler (-31.6%) and Volvo (-23.1%). Class 8 year-to-date deliveries also plummeted, down 22.6% to a 2016 total of 192,662. Volvo’s 12-month total dropped the most in the group, down 33.6% to 20,543 units. For December, medium-trucks rose 2.3% on 20,096 deliveries. Year-to-date, the group rose 3.6% to 207,694 units, up from 200,529 from like-2015. Class 7 sold 4,810 units, a 3.9% drop from year-ago. PACCAR’s Kenworth had the biggest gain, 12.7% over year-ago, and its sister company, Peterbilt, also grew, up 10.3% to 689 deliveries. Hino saw the largest drop in the group, down 38.9% to only 158 units from 2015’s 268. Ford also posted a double-digit loss of 21.8% on only 166 deliveries. Freightliner fell 8.2%, while International remained nearly flat, rising 0.9% to 1,188 units. Year-to-date, Class 7 increased 1.7% to 59,917 units from 58,888 in 2015. Class 6 was the only segment to post a double-digit gain for the month, up 14.1% on 5,623 units. Group leader Peterbilt more than doubled in sales, up 127.2% on 46 deliveries. Its sister company Kenworth declined 6.6%, leaving PACCAR with a 2.4% increase over like-2015 on 308 units. Hino saw the largest drop in this group as well, down 25.5% to 580 units. Ford (32.2%) and Freightliner (16.4%) posted positive gains. Year-to-date, Class 6 performed 11.2% better than 2015, with 61,287 trucks delivered. Class 5 came in with 7,880 units, a 2.4% drop from last year’s 8,370, due largely to the 3.3% drop in domestics. Imports rose 4.6% to 1,015 units. Daimler’s Freightliner and Mitsubishi Fuso posted large drops of 59.4% and 82.2%, respectively, bringing Daimler down 61.0% to 192 units. FCA (47.1%), Isuzu (22.6%) and Peterbilt (3.7%) were the only brands to increase from year-ago. Kenworth plummeted 74.1%, International dove 73.0% and Hino sunk 42.5%. Despite the large declines, Class 5 remained nearly flat for the 12-month period, up only 0.1% to 72,241 units from like-2015. Year-to-date, Class 5 imports rose 4.9%, but domestics dropped 0.4%. Class 4 imports fell 10.5%, but domestics soared 25.7%, leaving Class 4 up 8.8% in total on 1,783 units. Isuzu’s domestic line posted the largest gain in the group, up 29.1% on 777 deliveries. Mitsubishi Fuso dropped the most to only 15 units, an 83.5% drop from like-2015’s 94 units. Ford (-25.7%) and Hino (-27.7%) saw large double-digit losses, while Isuzu’s import line fell only 4.8%. In the 12-month period, Class 4 domestic line rose 15.6%, while imports fell 18.3%, leaving Class 4 year-to-date dropping only 0.8% to 14,249 units. U.S. big-truck sales finished the year with 400,356 deliveries, down 10.9% from year-ago’s 449,333. December finished with a 73-day supply of medium-duty trucks in inventory, down from only 74 in like-2015. A 55-day supply of Class 8 heavy-duty trucks was down sharply from 2015’s 70 day-supply. .

-

Fleet Owner / January 17, 2016 U.S. sales of medium- and heavy-duty trucks in December fell 9.9% from like-2015. In Canada, truck sales were down 21.1% in December. Class 8 sales in the U.S. were down to 15,629 units, a 22.0% decrease from year-ago’s 20,773 units. Kenworth increased 5.8% to 3,079 units, while all other companies dropped. The largest declines came from International (-39.2%), Daimler (-31.6%) and Volvo (-23.1%). Class 8 year-to-date deliveries also plummeted, down 22.6% to a 2016 total of 192,662. Volvo’s 12-month total dropped the most in the group, down 33.6% to 20,543 units. For December, medium-trucks rose 2.3% on 20,096 deliveries. Year-to-date, the group rose 3.6% to 207,694 units, up from 200,529 from like-2015. In Canada, Class 8 deliveries totaled 1,911 units, down 17.9% from year-ago. Paccar gained 0.2%, balanced out from Kenworth’s increase of 0.7% and Peterbilt’s decrease of 0.5%. All other truck makers in this segment posted double-digit losses, including Daimler (-22.1%), International (-15.1%) and Volvo Truck (-25.7%). Medium-duty truck sales plummeted 28.7% to 709 units from 995 in same-month 2015, with year-to-date losses in each segment.

-

Car & Driver / January 17, 2017 There is one constant in the world of pickup trucks—year after year, trucks become more capable and more powerful. Two years after re-entering the mid-size-truck market, the 2017 Chevrolet Colorado hits the streets carrying the same mass yet packing more power and more gears. Here we go again: Another escalation in the pickup-truck arms race. For 2017, the Colorado—and its GMC Canyon sibling—is propelled by General Motors’ all-new V-6, coded LGZ, a variant of the LGX V-6 found in the Chevrolet Camaro, Buick LaCrosse, and GMC Acadia, among others (the LGZ designation references a different oil pan and the lack of auto stop/start). It’s a distant cousin of the former LFX V-6 that it replaces, and while the 3.6-liter displacement may suggest that this engine is essentially the same, it’s not. The redesigned six shares with its predecessor only its 60-degree included angle between its cylinder banks. This V-6 has cylinder deactivation, which shuts down two cylinders under light loads. Good for 308 horsepower and 275 lb-ft of torque, it’s up 3 hp and 6 lb-ft over last year’s Colorado. (The LGZ makes less power in this truck than the LGX in the cars, but GM says that’s just a product of intake and exhaust restrictions.) Significantly, a new competitor emerged last year in the Honda Ridgeline, which offers a little less power but proved quicker than the GM trucks in our tests of the 2016 Honda. Now, the muscled-up Colorado stretches its power margin over Honda’s V-6 to 28 horsepower and 13 lb-ft, enough to put it back in front. Also contributing to the improved performance is the Colorado’s new eight-speed automatic. Built in-house, the Hydra-Matic 8L45 provides quick and smooth shifts, and its additional two gears help keep the engine rpm near the torque sweet spot. The four-wheel-drive example we tested recorded a 6.1-second sprint to 60 mph, a full second quicker than a similarly equipped 2015 Colorado and 0.5 second ahead of the all-wheel-drive Ridgeline. Its quarter-mile time improved, too, requiring only 14.8 seconds to cross the line at 95 mph, gains of 0.7 second and 4 mph and again shading the Ridgeline’s 15.2-second run. The Toyota Tacoma with a V-6 and four-wheel drive trails these two by a wide margin, needing 7.9 seconds to get to 60 mph and 16.1 for the quarter-mile. The 2017 Colorado also feels a little livelier in everyday driving, although the 60-degree V-6 still sounds coarse—and rougher still when it is sipping fuel in four-cylinder mode. The new transmission, however, keeps both the revs and the noise down at highway cruising speeds. As we’ve reported in earlier tests of the Colorado and its GMC Canyon sibling, the term mid-size applies loosely here. The Silverado’s little brother is nearly as long as the full-size truck, although its width, nearly six inches narrower, eases the task of navigating Home Depot parking lots. The slimmer cabin does feel more carlike, and it uses gauges, switchgear, and infotainment systems found in other platforms across Chevrolet’s lineup. The overall cabin volume is nearly identical to that of an Impala, and the Colorado makes a comfortable commuter, offering an ideal seating position and supportive front seats. The electrically assisted power steering is lighter than we’d prefer but communicates well with the Goodyear Wrangler Fortitude HT rubber as the truck approaches its 0.75-g cornering limit. The brake pedal feels firm and is easy to modulate during normal driving stints, but we noted heavy fade after repeated panic stops in testing. Still, the truck stopped from 70 mph in 183 feet despite weighing 4493 pounds, which is 12 feet shorter than the aforementioned Ridgeline that weighs 70 pounds less. One might expect that a new V-6 redesigned for efficiency and paired with a gearbox housing more ratios would improve fuel economy. Not according to the EPA: The 2017 model wears a 19-mpg combined rating versus 20 mpg in 2016, more a reflection of stiffening EPA testing scrutiny than the changes in hardware; the 17-mpg city and 24-mpg highway ratings are unchanged. During this Colorado’s brief stay at C/D headquarters, we measured 18 mpg, the same figure we recorded for the 2015 model. Many similarly equipped full-size trucks cost at least $45,000, making the sticker on the crew-cab, all-wheel-drive Colorado in LT trim look reasonable at its $34,465 base price. Our tested example had options that swelled the as-tested figure to $38,985. The $1080 Luxury package includes power-adjustable and heated front seats, automatic climate control, an auto-dimming rearview mirror, heated power outside mirrors, and chrome cladding for the door handles and the rear bumper. The leather-appointed seats in Jet Black and Dark Ash add $950, while the LT Convenience package ($690) brings a sliding rear window and defroster, remote start, a dampened tailgate, and front fog lamps. Tack on another $495 for Chevrolet’s 8.0-inch MyLink infotainment system with Apple CarPlay/Android Auto connectivity and $500 for the premium Bose audio system. An automatic locking rear differential adds $325, while accessing the Colorado’s top tow rating of 7000 pounds requires the $250 Trailering Equipment package. The $230 trailer-brake controller helps slow heavy loads. While the revised powertrain makes this Chevy the quickest entry in the mid-size pack, it’s now even capable of beating up on some full-size models. With Ford fixing to re-enter this segment with a new Ranger, the mid-size segment arms race is just getting started. Given that the Colorado can already do more than most buyers really require, maybe automakers could start calling these models their full-size trucks and relabel the big rigs as oversize, which is what decades of unrelenting focus on improved capability from year to year has made them. Photo gallery - http://www.caranddriver.com/photo-gallery/2017-chevrolet-colorado-v-6-8-speed-automatic-4x4-instrumented-test

-

Trump says Europe is in trouble. He has a point. Sebastian Mallaby, The Washington Post / January 17, 2017 Germany’s foreign minister reports “astonishment and agitation.” The French president protests indignantly about unsolicited “outside advice .” Even Secretary of State John F. Kerry sees behavior that is “inappropriate.” President-elect Donald Trump’s weekend interview, in which he casually predicted the breakup of the European Union, has certainly attracted attention. But despite the consternation, there is some truth in Trump’s message. The E.U., he observed, is dominated by Germany. “People, countries want their own identity,” he said. The most obvious vindication of Trump’s warning comes from Britain, whose prime minister, Theresa May, has just laid out her plans for a hard break with the European Union. May could have interpreted June’s Brexit referendum differently, seeking the “Norway model” of continued membership in the E.U.’s Single Market even while withdrawing from the E.U.’s political structures. But, to paraphrase Trump, the prime minister evidently believes that Britain must have its own identity. She is determined to curb E.U. migration, even though migrants contribute positively to the economy; she wants out of the European Court of Justice, even though that court has upheld British commercial interests in the past. Combined, these two positions rule out continued Single Market membership. The E.U. is losing its second-biggest economic power. Britain has always been a semi-attached member of the European Union, so the malaise at the heart of continental Europe is even stronger evidence that Trump is on to something. Ironically, all the pressures that are commonly wheeled out to explain Trump’s election are far more evident on the other side of the Atlantic: sluggish growth, poor prospects for workers, a backlash against migrants, disaffection with elite governance. Americans may feel that their recovery since the financial crisis has been anemic. But, adjusted for inflation, the U.S. economy has actually grown by a cumulative 12 percent since 2008. In contrast, the 28 countries in the European Union managed combined growth of just 4 percent . And in the subset consisting of the eurozone minus Germany, output actually fell. Even though the strong dollar may help Europe this year, most of the Mediterranean periphery has suffered a lost decade. Naturally, this horrible performance has taken an enormous human toll. The unemployment rate in the euro area stands at 9.8 percent, more than double the U.S. rate. Unemployment among Europe’s youth is even more appalling: In Greece, Spain, France, Croatia, Italy, Cyprus and Portugal, more than 1 in 4 workers under 25 are jobless. America’s ability to put its economic house in order after 2008 shows that there was nothing foreordained about this. Europe has suffered an optional catastrophe. It has a lost generation to match its lost decade. The decisions that delivered this destruction were made overwhelmingly in Germany, just as Trump seems to suspect. Angela Merkel, the country’s sober, deliberate and altogether un-Trumpian chancellor, systematically slow-walked measures that could have accelerated Europe’s recovery. Budget stimulus, bank recapitalizations and, at least early on, monetary policy were sluggish because of German resistance. At some points in this process, Merkel was protecting German taxpayers, which is both reasonable and yet at the same time supportive of Trump’s view that national interests beat euro cohesion. At other points Merkel has been protecting nothing more vital than Germans’ phobia of even modest public borrowing and inflation — and never mind the plight of Mediterranean youth. Merkel’s cautious leadership of Europe has sown the seeds of a populist backlash. This has been a surprisingly long time coming: For several years after the onset in 2010 of the euro crisis, austerity and mass unemployment did remarkably little to turn voters against establishment leaders. But a recent Italian poll suggests that, if an election were held today, the anti-globalization and anti-euro Five Star Movement would take as many votes as the leading establishment party. In France, polls have the anti-E.U. Marine Le Pen as the joint front-runner in this spring’s presidential election. In Merkel’s Germany, support for the anti-migrant AfD party has jumped from about 5 percent in 2013 to 16 percent now. If you take Trump literally, his recent comments on Europe were exaggerated and confused. Populists may be on the rise, but we are a long way from a crackup of the European Union. But if you take Trump seriously rather than literally, then it has to be admitted that the president-elect has a point here. Europe is in deep trouble. It is time for its leaders to recognize that incremental policies are failing the continent’s people. Sebastian Mallaby is a Post contributor and Paul A. Volcker senior fellow for international economics at the Council on Foreign Relations. He is author of “The Man Who Knew: The Life and Times of Alan Greenspan.”

-

Trump team questions the almighty dollar The Financial Times / January 17, 2017 Donald Trump has threatened to overturn two decades of US economic policy by questioning the strong value of the dollar, raising fears that his presidency could set off a new round of currency wars between the world’s major economies. On Monday, Trump appeared to break from the longstanding “strong dollar” policy of successive administrations, declaring that the currency was too high and that this was preventing US companies from competing with Chinese counterparts. “Our companies can’t compete with them now because our currency is too strong. And it’s killing us," he said in an interview with the Wall Street Journal. Speaking in Switzerland after Trump’s comments, Anthony Scaramucci, a leading figure in the transition team, said the administration would need to take heed of the problems of a buoyant currency. “In the Trump administration, there will be a lot of symbolism in terms of reaching out for lower-class families and middle-class families,” he said, adding that in doing so “we have to be careful about the rising currency because of not just what is going on internationally, but it’ll have an impact internally in the US”. But Scaramucci also suggested that if the new administration could create fast growth, it would allow the US to deal with the tighter monetary conditions that come with a higher currency. Previous incoming administrations have ritualistically sworn fealty to a strong dollar, saying this was in the interests of the US economy — even when the currency’s value was arguably doing more harm than good at the time. This was part of a broader US strategy aimed at allowing the currency to find its own value rather than trying to micromanage the exchange rate. With the dollar trading near 14-year highs against a basket of its peers, however, Trump’s team faces a serious barrier to its goal of reducing the US trade deficit. The danger is that if the US starts suppressing the value of its currency, it could trigger a broader currency war far greater in magnitude than the skirmishes seen in the wake of the 2008 global crisis. Besides China, such a war would draw in economies in Europe and Japan. It also would mark an unwinding of the longstanding G7 consensus that markets ought to set the value of currencies. “We haven’t seen anything yet. If the president of the United States begins talking the dollar down, then we will have currency wars and it will make a mockery of the previous things that we thought were wars,” said Marc Chandler, global head of currency strategy at Brown Brothers Harriman. He argued that Trump could end up unwinding the G7 consensus, triggering instability in financial markets and discouraging foreign investors from investing in US assets. “This is a case where the stirrings of a currency war could set the ground for a broader trade war,” said Eswar Prasad, a Cornell economist and author of The Dollar Trap. “It does raise the specter of trade tensions with many of the US trading partners. Once you give up the strong dollar policy and start focusing more on the [level of the] currency it does raise the prospect of bringing to a head many of the trade tensions with key trading partners including Europe, Japan and China.” Some analysts question the potency of such verbal interventions — especially at a time when Trump’s apparent willingness to advocate deficit-widening tax cuts could bring forward interest-rate increases and add to the dollar’s strength. What’s more, Trump’s decision to criticize Chinese foreign exchange policies seems out of date: recently Beijing has not been seeking to push down its currency but rather to prop it up. However, C Fred Bergsten, senior fellow at the Peterson Institute for International Economics, said Trump was right to think the strong dollar policy was now misplaced, adding that the US currency was by his calculations overvalued by at least 10 percent. He said the exchange rate might prove the best route towards addressing the deficit compared with alternatives such as throwing the US economy into recession or erecting trade barriers. “If you could nudge it down through oral intervention, which this is, that is probably less risky than alternative efforts,” he said. The complication, however, was that Trump’s other economic policies could end up pushing the currency higher. “Donald Trump comes in having made quite a high priority in reducing the US trade deficit. The question is how is he going to do that — particularly since his own economic policy — tax cuts, stronger growth probably inducing the Fed to tighten more rapidly — is going to make the dollar go up even more.” That message was echoed by Lael Brainard, a member of the Federal Reserve board, on Tuesday. The governor and rate-setter said that more “expansionary” fiscal policy in the US could increase expectations of a divergence between US and overseas economic conditions and so push the exchange rate higher. The US has notionally stuck with its strong-dollar mantra since the 1990s, but during the election campaign Trump showed little regard for the policy. “It sounds good to say ‘we have a strong dollar’. But that’s about where it stops,” he said. His new interventions recognize that a strong dollar represents one of the main obstacles to his campaign promises to create manufacturing jobs in the Rust Belt states that swept him to power. “In this one respect at least, Trump is certainly putting economic realism ahead of macho nationalistic bluster,” said Cornell economist Eswar Prasad. “I think he, as a businessman, recognizes the importance of the dollar’s value towards accomplishing what he wants to accomplish, which is trying to preserve US jobs in declining industries.”

-

Mazda successfully eliminates the spark plug

kscarbel2 replied to kscarbel2's topic in Odds and Ends

Tim, Mazda says it is a gasoline engine. http://www2.mazda.com/en/publicity/release/2011/201105/110517a.html -

Hyundai, Kia plan $3.1 billion U.S. investment, consider new plant Bloomberg / January 17, 2017 Hyundai Motor Co. and Kia Motors Corp. said they will spend $3.1 billion in the U.S. in the next five years, joining other vehicle manufacturers in announcing investment plans amid threats from President-elect Donald Trump of higher levies on auto imports from Mexico. The planned U.S. investment by South Korea’s two largest automakers is nearly 50 percent more than the $2.1 billion they spent in the previous five-year period, Hyundai Motor President Chung Jin-haeng told reporters in Seoul on Tuesday. The group is considering building a new factory in the U.S. and may produce Hyundai’s upscale Genesis vehicles and a U.S.-specific SUV in the country, said the executive, who also oversees the strategic planning for Kia. “We expect a boost in the U.S. economy and increased demand for various models as President-elect Trump follows through on his promise to create 1 million jobs in five years,” Chung said. “We will actively consider introducing new models that have increasing demand and profits.” Hyundai and Kia join a growing list of automakers announcing investments in the U.S., even though they have yet to be singled out by Trump. Toyota Motor Corp., Ford Motor Co. and Fiat Chrysler Automobiles said this month they’ll spend on U.S. plants after the president-elect threatened for months to slap Mexico-built vehicles with a 35 percent import tax. Carmakers are eager to cooperate with the incoming administration as they prepare to ask for favors including weaker fuel economy rules and lower corporate taxes. “When automakers such as Toyota announced their new strategies in response to the so-called Trump risk, the industry was nervous and asked, ‘Who’s next?’,” said Kim Jin-woo, an analyst at Korea Investment & Securities Co. in Seoul. “This is positive news that came at the right time as the automakers were facing capacity constraints in the U.S,” he said referring to Hyundai and Kia’s investment plans. Hyundai and Kia will invest about 30 to 40 percent of the $3.1 billion on new technologies such as autonomous driving and green cars. The rest will be spent on facilities and adding new models, according to the company. Hyundai has been considering expanding its plant in Montgomery, Ala., which produces the Sonata, Elantra sedans and Santa Fe crossover. The factory is running at its top capacity of 370,000 cars a year. Kia’s factory in West Point, Ga., is also at full tilt, producing 360,000 units of the Optima sedan and Sorento SUV a year. Kia opened a new $3 billion, 200,000-vehicle-a-year production line in Mexico two months before the U.S. presidential election, with plans to increase capacity there to 300,000 units this year and to 400,000 vehicles by the end of 2018. The automaker may add a new SUV model to the plant in the Mexican state of Nuevo Leon, though the decision isn’t final and the company has “flexibility” on its strategy, Chung said. Kia is targeting to export 80 percent of cars made in Mexico, mainly to the U.S. and Latin American markets. Hyundai and Kia have no additional plans to invest in Mexico and will not transfer production or jobs from the U.S. to Mexico, according to a company spokesman. “The U.S. market is strategically a very important market for us and success or failure there is a barometer of our success globally,” Chung said. “Our interest in the U.S. market is consistent regardless of the government of the day.”

-

GM to invest $1 billion in U.S. manufacturing, move axle work from Mexico Automotive News / January 17, 2017 General Motors today said it would invest $1 billion in its U.S. manufacturing operations to create or retain 1,500 jobs in this country. GM, in an announcement timed to ease pressure from President-elect Donald Trump, also said it would move production of pickup axles from Mexico to Michigan and create at least 5,000 more U.S. jobs in other parts of its business during the next few years. GM did not say how many of the 1,500 manufacturing jobs would be new as opposed to positions that otherwise would have been outsourced or eliminated without the investment. The company said insourcing axles for the next generation of its full-size pickups, expected to debut in 2018, would create 450 jobs in Michigan. “As the U.S. manufacturing base increases its competitiveness, we are able to further increase our investment, resulting in more jobs for America and better results for our owners,” said GM CEO Mary Barra. “The U.S. is our home market and we are committed to growth that is good for our employees, dealers and suppliers and supports our continued effort to drive shareholder value.” Barra said she expects GM’s financial arm, advanced technologies and other non-manufacturing growth areas to generate more than 5,000 additional U.S. jobs “over the next few years.” Trump indirectly referenced GM’s investment in a series of Twitter posts about 30 minutes after the company’s announcement. “With all of the jobs I am bringing back into the U.S. (even before taking office), with all of the new auto plants coming back into our country and with the massive cost reductions I have negotiated on military purchases and more,” he wrote, “I believe the people are seeing ‘big stuff.’” The news comes three days before Trump’s inauguration and follows similar investment announcements from Ford Motor Co. and Fiat Chrysler Automobiles. Trump, in a nationally televised news conference last week, praised those companies and said he hoped GM would follow suit. “I think they will be,” Trump said Jan. 11, though it was unclear whether he had knowledge of GM’s plan or if he was merely encouraging GM to do so. 'Mostly theater' “All of the decisions behind today’s announcement are good business decisions, and they have been in the works for some time," GM spokesman Pat Morrissey said. “There’s no question there is an emphasis on job creation in the U.S. right now. This was good timing for us to share what we are doing, including our ongoing commitment and track record for U.S. investment over the last several years.” The announcement is “mostly theater to play in the news cycle created by President-elect Trump’s tweets,” said industry analyst Michelle Krebs. “These investments and hiring plans have long been in the works and are a continuation of what the company has been doing in recent years -- trying to run a successful, profitable business. The only thing ‘new’ here is GM’s aggressiveness in announcing its plans.” Trump has threatened 35 percent tariffs on vehicles imported to the U.S. from Mexico. In addition to the Detroit 3, he has said Toyota Motor Corp. and BMW should build plants in the U.S. instead of Mexico if they want to sell those vehicles in this country. He told a German newspaper Bild that Germany had an unfair relationship with the U.S. because Germans don’t buy Chevys at the same rate that Mercedes-Benz sells in the U.S. GM dropped the Chevy brand in Europe in 2015 to focus on Opel instead. Latest U.S. investment GM said the investment is on top of $2.9 billion announced for its U.S. operations last year and $21 billion invested in its home country since 2009. In the past four years, it said it has created 25,000 U.S. jobs, including 6,000 hourly manufacturing positions and added nearly $3 billion in annual wages and benefits to the U.S. economy. Barra, who has been chosen to sit on an economic advisory panel to Trump, last week said she was looking forward to showing GM’s contributions to U.S. employment as the new administration considers any new manufacturing policies. “We look forward to having the conversation with the administration and with the president-elect to make sure they understand,” Barra told reporters. “When you look at our industry, and General Motors specifically, of how much we already contribute to jobs and the long-lead aspects of our business, that’s what we want to make sure is understood and we think that voice will be heard as any policy is set.” In addition to its own axle-making jobs, GM said one of its suppliers has committed to moving 100 jobs from Mexico to build unspecified components for the next-generation pickups in Michigan. UAW-GM Vice President Cindy Estrada, in a statement, said the GM announcement stemmed from the company's 2015 union contract agreement. “Today’s announcement continues GM investments that have emerged as a result of the 2015 national bargaining agreement. We are pleased that there will be over $1 billion in new investment for current and future UAW GM members. Through hard work and the quality products we build, UAW-GM members, their families and their communities will benefit. "We will continue to work with GM to bring more product to the United States and enhance the job security of our UAW members." Mexico focus Mexico has been the central focus of Trump’s criticism of GM and other automakers. In a Jan. 3 post on Twitter, Trump said GM should pay a “big border tax” to import Chevrolet Cruze hatchbacks from Mexico. He made that threat just hours before Ford said it was canceling a $1.6 billion plant in Mexico and instead expanding a plant in Michigan. FCA later said it would spend $1 billion to add 2,000 jobs in Michigan and Ohio. Both companies said the decisions were based on market conditions and not directly in response to Trump, but they also have more or less allowed the president-elect to take the credit. Ford said it still plans to move small-car production from Michigan to Mexico, a plan Trump has called “disgraceful.” ---------------------------------------------------------------------------------------------------------------------------- GM to build axles at Grand Rapids area plant The Detroit News / January 17, 2017 General Motors Co. will build axles for its next-generation full-size pickups at its Grand Rapids components plant, a move that is tied to investment and jobs that the automaker announced more than 18 months ago, according to two sources familiar with the automaker’s plans. The automaker said Tuesday it will add thousands of new jobs in the next few years, including in-sourcing axle work from a supplier that includes work now done in Mexico. GM said the move to operations in Michigan would create 450 U.S. jobs. A GM spokeswoman on Tuesday declined to name the supplier or where or when those jobs would come to the U.S. However, American Axle & Manufacturing Holdings Inc. confirmed Tuesday that it was losing the work. GM in June 2015 announced it would add about 300 new jobs and invest $119 million to produce future vehicle components at its components plant in Wyoming. That investment was part of $5.4 billion GM in April 2015 said it would spend in U.S. plants over three years, creating 650 jobs. One of the sources who asked not to be identified because GM has not announced its plans, said some of the jobs difference at the Grand Rapids plant is the addition of engineering-related salaried positions in Southeast Michigan, including at GM’s Warren Tech Center and its Milford Proving Ground. American Axle announced in July 2015 that it would retain an estimated 75 percent of sales content of the axle and driveshaft work for GM’s next-generation full-size pickup program. The Detroit-based supplier has since updated that figure to retaining 65 percent of that work. It currently builds axles for GM’s full-size pickups at its Three Rivers, Michigan, plant and at its Guanajutato Manufacturing Complex in Mexico. “GM’s announcement confirms our July 2015 announcement where AAM indicated that based on current design and program direction, we expect to retain a majority of the sales content provided to GM for the next generation full-size truck and SUV program,” Chris Son, an American Axle spokesman, said Tuesday. “AAM has covered approximately 90 percent of this expected sales impact of this sourcing transition with new and incremental business wins that will launch in the 2018 to 2020 time frame.” GM’s components plant, operated by its subsidiary GM Components Holdings LLC, has about 530 employees who work on three shifts to produce precision-machined automotive engine components. The automaker on Tuesday said it plans to add 7,000 U.S. jobs in the next few years and invest $1 billion in U.S. plants. The new plant investments will create or retain more than 1,500 jobs, though GM would not say how many would be new. The automaker said it expects more than 5,000 salaried jobs, with a significant portion in southeast Michigan, will come in key growth areas such as with its subsidiary GM Financial and in advanced technology. The announcement comes three days before President-elect Donald Trump’s inauguration. He has pressured automakers to add jobs and work in the U.S. instead of shipping work to Mexico.

-

BMT...........Simply the best knowledge base for truck information the world over.

-

Today, it was announced that the search for MH370 has been cancelled. As a frequent flyer, the disappearance of Malaysian Airlines flight MH370 from Kuala Lumpur to Beijing troubles me. The only thing for sure is the public isn't being told the truth. I doubt it's in the southern Indian Ocean west of Australia. Based on its behavior, someone was flying the plane. Why the 4 hour delay by Malaysia before launching a search? Why were reported and creditable sightings ignored? Last September, when Russian fighter jets turned off their transponders as they flew into Syria in an attempt to avoid detection, our government bragged that U.S. satellites rapidly saw that the aircraft were there. After all, we have the global satellite overage second to none. And yet, during MH370's alleged 7-1/2 hour flight to the unknown, not one satellite for even a minute saw this huge Boeing 777 aircraft ??? Ladies and gentlemen, that is impossible for me to believe.

-

Family affair Owner/Driver / January 4, 2017 The winner of best rigid at the 2016 Castlemaine Truck Show was the Doria's Dodge The Doria’s operate five trucks full time and have a couple of spares. They had four trucks at the show, the newest being a T404 body truck and the oldest a 34 Dodge. "We mainly cart fruit and vegies out of the markets and then we do some storage and distribution during the day," the Doria’s explained. "We start at midnight and after they finish the market work, we distribute to farms." The T404 was built in the Kenworth factory as a 14-palleter and it has a Cummins ISX 475hp engine. "It has a bit of character to it! It was actually built for a subby that ran for Toll doing their late freight, running up and down to Sydney. "From there, it went to Queensland and then to WA before we bought it. It’s a great truck and being so long gives an unbelievable ride, it’s an amazing truck to drive and is comfortable. "Our colours have always been red but it is too good a condition to paint." The whole family had come up for the show and they were looking forward to a great weekend. Photo gallery - https://www.ownerdriver.com.au/events-news/1612/castlemaine-truck-show-2016-11

-

Like father, like son Owner/Driver / January 6, 2017 The winner of best rig over 14 years at the 2016 Castlemaine Truck Show was this T601 On Saturday evening, Paul and Dan Askew were still hard at work polishing their Kenworth T601. Paul has owned the 601 for four years and had just finished restoring it from top to bottom. He did the chassis, engine, gearboxes and diffs. "We did the whole lot," Paul says. "It’s an old truck but we like the style. It’s got a 12-litre Detroit under the bonnet and we do local cartage around Melbourne and off the wharf." Paul has been driving for 30 years and been an owner-driver for the last six. This is the second truck that he has bought and it probably won’t be the last with his son Dan mad keen on them. "He is just waiting to get his licence and then he will be behind the wheel," Paul says. "This is the third year I have been here. It is a top weekend to come and have a few beers and chill out. "It’s good to be involved in a great weekend with your mates and have a few drinks and the whole weekend raises money for good causes." .

-

Owner/Driver / January 17, 2017 Tutt Bryant has led the way for more than 75 years, and choose Isuzu as the truck of choice. Isuzu trucks feature heavily in the Tutt Bryant loading depots and docks across the country. Construction work takes its toll on everything – from the equipment, to the tradies themselves – and only the industry’s best stand the test of time. For over 75 years, Tutt Bryant has weathered the trials and made a real contribution to the growth of Australia's construction industry. From humble beginnings back in 1938, they’ve risen to become one of Australia's largest crane, construction equipment hire and equipment distribution companies, with over 400 staff operating Australia-wide. Tutt Bryant’s general hire division provides some of the nation’s biggest contractors with plant and equipment hire for earthmoving, civil construction, rail maintenance, and mining. Tutt Bryant Fleet Maintenance Manager, Mick Collier, oversees all purchasing for the hire fleet in the southern region, and says Isuzu has been his number one choice since he joined the company in 2001. "Part of my role is to select the best possible equipment for the job, and to maintain it through its whole working life, right up to resale. "The last company I worked for had a wide range of trucks, including Isuzu and their competitors. We found the total cost of the truck life was better with Isuzu – they came out on top with servicing, reliability and re-sale value. "Some of the other states will shop around a little bit, but for us the service network and the whole package Isuzu provides is second to none, and with my previous knowledge, it’s a no-brainer. "In the hire division alone we have 25 Isuzus," Mick said. Mick’s most recent purchases span Isuzu’s light and medium-duty ranges, including two FSRs for water cartage, three of the new award-wining ready to work N Series Servicepack models, two F Series Tippers and an FRR for crane hire. And none of these vehicles gets a cushy lifestyle. "Our transport trucks can do 80,000 kilometres a year and the service vehicles do around 50 to 60,000. "The water cartage trucks don’t travel as far but they do a lot of idle-time work, constantly stopping and starting, so that needs to be taken into consideration too," Mick said. Stop-start work is ‘child’s play’ for Mick’s FSRs, as their Allison Auto 6 speed automatic transmission makes for a quick take off, every time, providing real fuel savings. "We have a mixture of automatic and manual transmissions in the fleet, but we’re starting to lean towards more automatics now for driver comfort and efficiencies. "We find an auto makes it a lot easier for our hire customers – they jump in the vehicle and drive away without having to think about different shift patterns in gearboxes. "And our drivers seem to really like the Isuzus’ reliability and comfort. "On one of the last trucks we purchased, the drivers in our Geelong branch had a lot of input into the buying process and the specialised body, and they’re all very happy with the outcome," Mick said. Cab comfort is covered in the new trucks by an ISRI air suspension driver’s seat, ensuring Mick’s team are kept comfortable on the longer runs, while the Digital Audio Visual Equipment (DAVE) unit with its 6.2" LCD touch screen, DAB+ digital radio and fully integrated Bluetooth, offers crystal clear sound and fingertip control. Mick also opted to add Isuzu Telematics to all of his new vehicles. Isuzu Telematics technology provides a range of operational and safety management efficiencies, such as live vehicle positioning, trip playback, geo-fencing and fleet and engine data information tools. The system also observes driver behaviour such as harsh braking, over acceleration, over revving and fuel usage. It’s all valuable operational information fleet managers like Mick can then utilise to improve fuel economy, implement driver training and create genuine efficiencies. "We have older, aftermarket telematics systems on our bigger trucks and earthmoving equipment that we use extensively and it’s an area we’re keen to utilise more," he said. "Telematics is one of the reasons we’re continuing with Isuzu trucks. We can run them all off Isuzu Telematics and keep an eye on all the trucks on the one system." Mick and his team are on and off commercial worksites constantly, so safety, in every sense of the word, is not only a priority, it’s a must. Mick’s new purchases tick all the boxes on that front and include standard safety features such as driver and passenger airbags along with seatbelt pretensioners, an ECE R29 compliant cab, an ECE-R93 compliant Front Underrun Protection Device (FUPD) and Anti-lock Braking System (ABS). "Safety is a key point these days and it’s a real factor in what we buy," he said. "The Isuzus are very safe and we’re really happy with them – we’ll definitely get more in the future. "We’re looking to expand our tipper and excavator hire, and Isuzu will be our pick when it comes time to buy again." .

-

Big Rigs / January 16, 2017 Fines for minor spillages under the Heavy Vehicle National Law (HVNL), towns complaining, arguments over liability for spillage between livestock carriers and primary producers. It's all a bit of a mess. We're talking about effluent, that mix of faeces and urine - cow, pig and sheep sh*t! New South Wales is hitting livestock carriers hard with $550 fines for dropping small amounts of effluent. These fines do not come under environmental or council legislation but under the improper restraint clauses of the HVNL. The future is clear, no matter how ridiculous it might be, effluent management systems for livestock hauliers are coming for all Australia, even if some years down the track for more remote regions. Industry associations like the Australian Livestock and Rural Transporters Association (ALRTA) and its state subsidiaries are jockeying to stem the surge towards national law by invoking the sharing of liability for effluent spillage "up the chain” within COR legislation. After all, "it's not our effluent”, one association member told Big Rigs, saying that the client owned the livestock and therefore any forthcoming effluent. The ALRTA says it has successfully argued to the Queensland Parliamentary Transport and Utilities Committee that the application of chain of responsibility laws to effluent control must be clarified. The Queensland Minister for transport has directed the NTC to clarify the matter within the next 12 months. "We are putting all options on the table including a full exemption under the Heavy Vehicle National Law.” Graham Hoare from Martin's transport is the south-east Queensland delegate for the LRTAQ and he said many livestock transporters are trying to keep ahead of the game, especially close to the metropolitan areas of south-east Queensland. "All the abattoirs and meatworks are in the Brisbane area and while we have fitted effluent tanks there is nowhere to empty them before we come into the metropolitan area,” he told Big Rigs. Mr Hoare agrees that the RMS in New South Wales is savage on effluent and said Queensland operators are trying to be proactive before legislation moves on the issue. All new livestock trailers must be fitted with effluent tanks "but we need somewhere to empty the tanks, like near the new Toowoomba bypass. That would be ideal”. While Mr Hoare says the industry is responding, the government and councils need to keep up and match the operator's investments in effluent facilities. "We want to lead the way and we are looking at the example of New Zealand to find out ways around this problem.” Mr Hoare said cattle producers and feed lot management are not buying into the liability of effluent, saying once the cattle are on the truck, it's the operator's responsibility. CEO of the Australian Livestock and Rural Transport Association based in Canberra is Matthew Munro. He said effluent control is a core part of the livestock transport process. He said the root cause locks in to the chain of responsibility and a cattle producer providing cattle to a transporter is an integral link in the chain. If there is a breach under the restraint clauses of the NHVL, that producer and their role fits into the HVNL definition of packer therefore carries responsibility under COR. He said while producers and livestock handlers are resisting liability, this is not an excuse to expect the transport operator to break the law. He uses the example of fresh seafood having to be carried from the coast several hundred kilometres to where it will be sold with the inherent need for it to arrive fresh. But in this case there is no expectation for the transport operation to break the speed limit legislation to get it to its destination in a more fresh condition. He said there is a need for transport operators, producers and livestock companies to work together to find a harmonious solution to this issue by having the cattle in the most appropriate condition, possibly after a curfew, before loading so keeping the best balance between livestock weights at the saleyard and the transport operator meeting the requirements of the law. The other alternative, says Mr Munro, is that the definitions under the HVNL be changed so that effluent is no longer covered under the restraint conditions. "Cattle producers are aware and they don't really want the transport operator to break the law, however their outlook is driven by market incentives and the way I see forward is a combination of the transport operator using effluent tanks on livestock trailers, that suitable dumping facilities for effluent are provided in appropriate places and the condition of livestock when loaded are suitable for transport in that there has been a curfew if the cattle are coming off green feed.” Mr Munro said the livestock associations are working towards setting up a set of guidelines that will keep both the producers and the transporters safe and that risk is assessed before the transport task. The south-east Queensland town of Kilcoy is currently an effluent hotspot. Big Rigs contacted the Somerset Regional Council for comment. Biosecurity The ALRTA is concerned that effluent is a prime vector of disease. For example in the case of a foot and mouth outbreak in Northern Australia, Mr Munro says that such an outbreak could cost the nation $60 billion. However effluent control and a simple alkaline or acid detergent wash at facilities could stop the spread of the disease. "$50 million spent now could save billions and entire industries in the future,” Mr Munro said, ending the report. .

-

. . . . . . .

-

Being reminded of Isuzu’s ceramic engine causes me to mention Cummins’ adiabatic engine research. Adiabatic is a thermodynamic term meaning no heat loss. The engine retains virtually all the heat created by the combustion of the fuel, and thereby requires no cooling system. Cummins and the United States Army experimented with such an engine in a five-ton model M813 6x6. The Army was interested in the project because it found that 60 percent of its vehicle-related failures involved problems with cooling systems. The Army’s Tank Automotive Command (TACOM) at Warren, Michigan, and Cummins jointly developed this first generation adiabatic engine by modifying the NHC250 normally found in the M813. The major changes involved making the pistons, cylinder liners, cylinder head, valves and exhaust manifolds out of a ceramic-metallic mixture which could tolerate temperatures exceeding 2,000 degrees Fahrenheit. By retaining most of the heat generated by fuel combustion and converting it into energy, the efficiency of the engine was improved almost 100 percent. A normal engine is only able to convert about one third of the heat created into usable power. The other two thirds is lost through the cooling system or out the exhaust pipe. Fuel economy was also improved with the adiabatic NHC250 version by almost 30 percent. Other advantages to the adiabatic NHC250, particularly in military applications, included the ability to install the engine within a vehicle in any position, since there was no requirement for airflow, or the need to be near a radiator for cooling. Without the need of a radiator, hoses and water pump, a weight savings of 338 pounds was realized with the adiabatic version. Lastly, because of the adiabatic engine’s very high combustion chamber temperatures, it could run well on a wide variety of fuels. Related reading: http://papers.sae.org/830314/ http://papers.sae.org/840428/ .

-

Mazda successfully eliminates the spark plug

kscarbel2 replied to kscarbel2's topic in Odds and Ends

That was Isuzu, as I recall. Please correct me if I'm wrong. ------------------------------------------------------------------------------------------------------------ October 27, 1983 Isuzu Motors said Thursday it has developed a ceramic internal combustion engine that is capable of generating more power than the conventional type while cutting fuel consumption by half. The prototype, a 1,995 cc turbo-charged diesel model, will be displayed at the Tokyo Motor Show opening Friday. Developed together with Kyocera, the leading Japanese industrial ceramics products maker, the combustion chamber of the ceramic engine is built with the highly heat-resistant material that is capable of withstanding up to 2,000 degrees (C) of heat without a cooling system. Test results show that the ceramic engine can generate 30 percent more power at half the level of fuel consumption. Isuzu, however, stressed that the model is only a prototype and that the company still has to iron out durability and other unspecified technical problems before the engine can be put into commercial use. Specifically Isuzu engineers will have to make the ceramics more durable. The material, while highly heat-resistant, cracks easily, auto experts said. The Isuzu spokesman confirmed durability is among the unresolved technical problems but indicated the Isuzu engineers would be able to overcome them. ------------------------------------------------------------------------------------------------------------ United States patent on ceramic engine design - https://www.google.com/patents/US5063881 ------------------------------------------------------------------------------------------------------------

BigMackTrucks.com

BigMackTrucks.com is a support forum for antique, classic and modern Mack Trucks! The forum is owned and maintained by Watt's Truck Center, Inc. an independent, full service Mack dealer. The forums are not affiliated with Mack Trucks, Inc.

Our Vendors and Advertisers

Thank you for your support!

.thumb.jpg.bbc72ab893b079af7959c811964caa82.jpg)

.thumb.jpg.bbc30f6333f24754dc9f3d457708265f.jpg)