kscarbel2

Moderator-

Posts

19,100 -

Joined

-

Days Won

114

Content Type

Profiles

Forums

Gallery

Events

Blogs

BMT Wiki

Collections

Store

Everything posted by kscarbel2

-

Scania Group Press Release / August 29, 2016 .

-

Scania Group Press Release / September 6, 2016

-

Scania Group Press Release / September 6, 2016

-

Daimler Press Release / September 6, 2016 Innovation: as the first truck manufacturer to do so, Mercedes-Benz is introducing the Digital Service Booklet across 30 European countries Maintenance work undertaken on a truck will henceforth be digitally documented and always accessible Shorter workshop visits thanks to ability to plan repair and maintenance work better The world of connectivity is now also extending to the service booklet as evidence of maintenance work undertaken: from October 2016, Mercedes-Benz Trucks will be introduce a Digital Service Booklet (DSB) in 30 European countries. This replaces the conventional paper-based service book entries and ensures seamless online documentation of all maintenance work undertaken. The booklet will be available for Mercedes-Benz Actros, Antos, Arocs, Atego and Econic, and its use brings benefits for the customer and the workshop in equal measure. For truck customers, a visit to the workshop normally involves the loss of valuable time that could be spent carrying goods. At this point the Digital Service Booklet becomes relevant. Of particular note here is that all maintenance and servicing work on the truck is now fully documented in digital form, while a print-out can be provided to the customer at any time upon request. This immediate and comprehensive data transparency makes it easier for the workshop to log the job as well as to plan repair and maintenance work or emissions and safety inspections, and thus shorten the stay in the workshop. For trucks travelling on transnational routes, far away from the home workshop, the Digital Service Booklet also provides valuable assistance. Even in another country, it is a straightforward step for workshops to access the Digital Service Booklet in their own language in order to be able to see relevant data and information. The system can be used by all authorised Mercedes-Benz service outlets, but also by independent workshops who have previously registered to do so. This brings clear benefits above all to authorised fleet operators, who are able to access the complete service history of a vehicle online. This is stored for the full operating life of the vehicle. The Digital Service Booklet also proves its worth when a vehicle is sold: the transparency it gives over completed maintenance work, and its seamless tracking of the vehicle's mileage, provide protection against attempts to manipulate data – the maintenance history remains verifiable, thus adding to the resale value of the Mercedes-Benz truck. Even in the event of a service report being lost, any authorised Mercedes-Benz workshop is still able to access the information at any time and provide information as necessary.

-

MAN Truck & Bus Press Release / September 6, 2016 Boasting our new 15.2-liter "D38" engines, the MAN TGX brings a perfect synthesis of power and efficiency to the roads – giving your performance a major improvement. With power outputs from 520 hp to 640 hp, and torque ratings from 2,500 to 3,000 Nm, the engines set the standard in terms of performance, reliability and efficiency. A slight touch on the accelerator and you can enjoy pure driving dynamics. But more importantly is the economic advantage. Experience a driveline in a class all of its own: https://www.mantruckandbus.com/D38 .

-

Will your next powertrain feature hybrid drive technology?

kscarbel2 posted a topic in Trucking News

Jack Roberts, Fleet Owner / September 6, 2016 A couple of weeks ago, in the wake of the release of the final rule for the U.S. Environmental Protection Agency's Phase 2 Greenhouse Gas regulations, I told Fleet Owner readers the different ways I thought that ruling would affect powertrain development over the next decade. As I noted, one of the likely new technologies we'll start to see in the next decade will be hybrid-electric drivetrains, which will be optimized to give heavy duty trucks a big torque boost in lower gears to get the vehicle moving in a much more efficient manner. Hybrid-electric drivetrains aren't new, of course. They first appeared in the late 1990s, most notably as a joint medium-duty offering from Eaton and International Trucks. In this incarnation, hybrid-electric drives functioned much as they likely will in the future, providing instantaneous electric torque to drive wheels. But, designers at the time also envisioned hybrid trucks as rolling power stations. The vehicles were outfitted with massive, heavy, battery packs that stored powered and enabled trucks to run a wide array of equipment with it. In most cases, this showed up on bucket trucks, or mobile drill rigs or service trucks. The idea seemed so promising at the time that light-duty OEMs quickly followed suit, with GM, in particular, offering hybrid-electric options for Silverado and Sierra pickup trucks. Alas, it all came to naught. As it happened, hybrid-electric drivetrains on the medium-duty side of the market proved to be too costly for municipal fleets to purchase in large numbers. Hybrid production never scaled up, and remained prohibitively expensive throughout its production run. Another problem was maintenance. By and large, the systems were reliable. But when problems did occur, they proved difficult and expensive to repair. The trucks' complex high-voltage electrical systems were particularly tough to trouble-shoot and repair. In the end, most fleets simply decided the fuel economy gains and modest convenience of having a mobile power pack didn't justify the added costs of the vehicles. Over time, they pretty much faded away. But now, thanks to the EPA, hybrid-electric drives appear poised to make a come-back. And while I fully understand if you're not turning cartwheels at this bit of news, stop and consider that the hybrid-electric drives of the near future will not be the hybrid-electric drives of 20 years ago. As is often the case, I felt that after-market suppliers actually ID'd the optimal hybrid-electric drive powertrain configuration. At the height of trucking's hybrid drive flirtation, after-market suppliers began developing and selling hybrid modification kits that could be installed on a light-duty van or truck transmission to provide a "light" hybrid power boost when the vehicle was getting under way. These systems did away with the heavy and complex battery packs featured on heavier trucks, and didn't bother with trying to store energy to use later on. The system was simplified and optimized to give the drivetrain a boost at low engine RPMs, and that was it. I have a feeling this is the route Class 8 OEMs will take when they opt to add hybrid-electric drive lines to trucks as part of their GHG 2 strategy over the next decade. Clearly, there simply isn't room for large battery systems on Class 8 trucks to be viable. And I don't need to point out that the weight penalty associated with those battery packs is a non-starter for fleets. But, a highly-optimized, light-hybrid system that can capture kinetic energy during braking and put that power to use to get heavy trucks up and moving quicker makes an awful lot of sense to me. Remember, fuel burn on a Class 8 truck increases exponentially when it is starting out in lower gears, and then drops off dramatically once the rig is up and moving in higher gears. Clearly, the systems will need to be carefully designed to keep weight and space requirements low. And it will need to be a robust system that is fairly easy to maintain and repair. But if those goals can be met, my suspicion is that hybrid-electric drivetrains may eventually prove to be a fuel-saving technology that fleets will feel is a winner. -

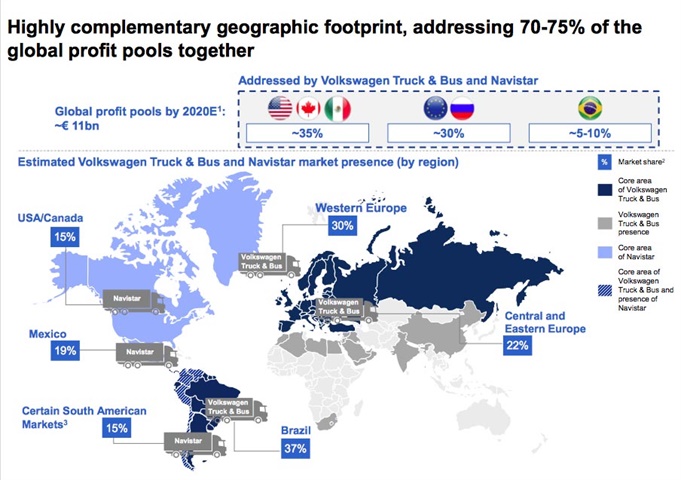

Navistar-Volkswagen deal: What can customers expect? Fleet Owner / September 6, 2016 Two years after taking over Swedish truck maker Scania and combining it with MAN, Volkswagen has agreed to take a 16.6% piece of Navistar International Corp. in a move that will give the German company a foothold in the North American market while boosting the capabilities (and bank account) of Navistar. But what will it mean to truck buyers on this side of the Atlantic? Stay tuned, explained Navistar President and CEO Troy Clarke on a conference call with Wall Street analysts and news media. And he wasn’t being evasive: It’s simply too early to know the products that might emerge from the deal, one that has only been recently negotiated by small teams of top officials from each company, Clarke noted, and he characterized the initial, strategic aspects of the alliance as the “30,000-foot view.” Clarke did point out that the current N-series 13-liter engine is derived from a previous licensing agreement with MAN, and so the companies already share “a very close engineering working relationship” on the platform. “We have plenty of opportunities over the next months to see what we can do to align our product portfolios,” Clarke said, and he agreed that “it would seem logical” that Navistar would produce Volkswagen engines in North America. He also hinted that a powertrain product could be developed by 2019, an “illustrative” timeframe that’s “not tomorrow, but not well into next decade.” Likewise, Andreas Renschler, CEO of Volkswagen Truck & Bus, explained the timing is critical, as the truck unit is developing a common, global powertrain platform for MAN and Scania. “It’s the right timing to do so, because now Navistar can be there from Day 1,” he said. Renschler also noted that, in his previous role with Daimler, he had been involved in developing the global truck manufacturing strategy. “It’s always good, if you have the experience, that you don’t make the same mistakes,” he said. “Don’t ask me what kind of mistakes, but with that experience you can expect something from [the new alliance]. As to suppliers that might be displaced with an integrated powertrain platform, Clarke emphasized that “Cummins is a great partner for us. The Cummins engine is truly an outstanding product that’s given us a lot of traction in the market. We work very closely with them, and we anticipate that we’ll continue to offer Cummins products for a period of time. We’re not speculating on that today.” So far this year, 73% of Navistar Class 8 trucks built have used a Cummins engine, according to an investment note from Stifel, in contrast to the shrinking share of third party engines used by PACCAR (Kenworth and Peterbilt truck brands) and Daimler (Freightliner, Western Star). “In fact, we wonder whether supplying engines to the North American market might be the largest motive of the deal from Volkswagen’s perspective, given Volkswagen’s capabilities in that area through its MAN and Scania nameplates,” the report suggests. However, “we believe the OEMs will continue to offer all available engines to all customers, many of which have a preference for the Cummins 15-liter engine.” More broadly, the agreement “relieves anxiety” for some International Truck customers, Clarke explained. “If you buy trucks, you don’t want to buy something that leaves you stranded when the technology is discontinued at some time in the future. It disrupts the residual value that you often rely upon for payment for the next truck,” Clarke said “This will get at that in a big way. We’re already improving our market share, just not as fast as we had hoped. This will accelerate consideration of our products. This is just the first step, then we’ll concentrate on the next step, and the next step. With this kind of alliance, it gives us the opportunity to get some good stuff done it the market.” As for the Project Horizon rollout—a series of new product announcements slated to begin next month and continue through 2017—Clarke suggested that there’s nothing in alliance with Volkswagen to distract customers or “disrupt the very positive sentiments that will be created” with the pending launch. While the deal won’t result in any new products in the near term, customers can expect to see immediate benefits from the global sourcing alliance with Volkswagen, Clarke added. “There’s a whole bunch of great reasons to consider the International product today,” he said. “This [alliance] is just another great reason.” .

-

An individual who needs to take a long walk down a short pier on the River Thames. ----------------------------------------------------------------------------------------------------------------------------------------------------- Britain's Anjem Choudary jailed for ISIS support CNN / September 6, 2016 Notorious hate preacher Anjem Choudary, who led a flag-burning demonstration outside the US embassy in London on the anniversary of the 9/11 attacks and voiced support for jihad, has been jailed for inviting support for ISIS [Why not expelled ?]. The former lawyer was sentenced to [a mere] five years and six months in prison. His supporters shouted "Allahu Akhbar" as he was led away from the dock in London's Old Bailey court. Choudary has courted controversy over two decades, skirting the edges of the law, backing extremism but with no proof of actually inciting violence. He earned the wrath of Britain's tabloid newspapers, making him - by his own admission -- the country's "most hated man." In 2014, he pledged allegiance to ISIS and its leader Abu Bakr al-Baghdadi, bringing him under scrutiny and leading to his arrest. British authorities say they were able to link him to the battlefields of Iraq and Syria; UK police say they don't know exactly how many of the 850 Britons who have traveled there were directly influenced by Choudary, but they say he is a "key" figure in ISIS's recruitment drive. "These men have stayed just within the law for many years," Commander Dean Haydon, of the Metropolitan Police's Counter Terrorism Command, said when he was convicted. "But there is no one within the counter terrorism world that has any doubts of the influence that they have had, the hate they have spread and the people that they have encouraged to join terrorist organizations." ISIS pledge of allegiance Despite his vocal support for the terrorist group, Choudary has previously insisted he is not a danger to the public. "I don't pose a threat to anyone in this country," he said in 2014."I pose an ideological or political threat, definitely." But British authorities say Choudary has been linked to the radicalization of a string of the terrorists who have stood trial in the UK over the past 15 years [He’s an accessory to murder]. Together with Omar Bakri Muhammad, he founded the now outlawed radical Islamist organization Al-Muhajiroun. Bakri Muhammad was later banned from the UK over links to al Qaeda. He was pictured at a protest with Michael Adebolajo, later convicted of the violent murder of British soldier Lee Rigby, and he was linked to Siddhartha Dhar, suspected by authorities of replacing Jihadi John as ISIS executioner. But rather than traveling to Syria himself, he has stayed in Britain, where he was born and raised, and taken on the role of a vocal supporter for ISIS and radical Islam. "Sometimes the propaganda and the verbal jihad is even stronger than the jihad of the sword," he says. A jury at London's Old Bailey found Choudary (and his associate Mohammad Mizanur Rahman, 33) guilty of "inviting support for a proscribed organization" - a charge he had denied. Who is Anjem Choudary? Choudary used to party hard at university -- where, as a young law student, he was known as Andy -- but is now a hard-line Islamist, advocating the introduction of laws based on the teachings of the Quran. "I believe that the Sharia is the best way of life," he says. "I believe that one day it will come to America and to the rest of the world." If that comes to pass, he says: "of course, alcohol will be banned, drugs will be banned, pornography will be banned, gambling will be banned." He is a vocal supporter of jihad "I preach jihad everywhere in the world but how that manifests itself is different," he said while on bail in December 2015. "From here we can support the Muslims around the world. In other places Muslims are fighting." In an earlier interview, he claimed: "The best death is one of martyrdom. I would love to die defending myself and my community, but of course death is in the hands of God; our life span will end when he decides." Defending his own decision not to go to Syria, he explained: "My passport has been taken away ... I will continue to struggle, wherever I am." He thinks the Islamic State is paradise "There is peace. There's no corruption, there's no bribery, there's no usury, there's no alcohol, gambling -- all of the vices which you're used to in America and other parts of the world don't exist there." "I believe that Abu Bakr Al Baghdadi -- may Allah protect him -- has brought in the dawn of a new era," he told CNN's Nima Elbagir while on bail awaiting trial in December 2015. And that "moderate" Islam does not exist "There is no such thing as a 'radical' or a 'moderate' form of Islam," he insists. "A woman is either pregnant or not pregnant. "If you abide by Islam, you'll follow what is in the Quran and the traditions of the prophet." He believes notorious acts of terrorism are justified "What took place on 9/11 or 7/7, or on 3/7 in Madrid, I can see they have an Islamic justification," he says. Choudary insists attackers from al Qaeda and ISIS are following the teachings of Islam - a viewpoint refuted by more moderate clerics. "The Quran says, 'Whatever the prophet did, do it; whatever the prophet forbade, forbid it ... the prophet himself sent many people to assassinate others," he said in 2015. In the wake of the Charlie Hebdo killings in Paris, he said the cartoonists who died had brought the attack on themselves by "dishonoring" the prophet Mohammed. "I think the cause has an effect; if I need to condemn, I need to condemn the provocation ... I cannot condemn them [the killers] ... they have a juristic opinion which they are following." He's an unapologetic propagandist for ISIS "I am very proud and happy to lay the seeds of Islam in the hearts and minds of Muslim youths. There is nothing wrong with that," he insists. "My love for Allah, his messenger, love for the sharia, love for the khilafah [caliphate], love for even jihad. This is part and parcel of Islam, however much people might demonize it." .

-

Navistar, Volkswagen forge global partnership Fleet Owner / September 6, 2016 The Volkswagen Truck & Bus (VW) division of Volkswagen is buying a 16.6% stake in U.S. truck maker Navistar – a new stock issuance priced at $15.76 per share, equaling some $256 million in fresh cash – as part of a new global joint venture between the two companies that aims to deliver VW-built powertrain options to International-branded trucks starting in 2019, along with “significant” cost savings for both companies especially in terms of global sourcing and parts procurement. “This is a major milestone on way to create a ‘global champion’ truck business,” noted Andreas Renschler, CEO of Volkswagen Truck & Bus, in a conference call with analysts and reporters. Renschler, who formerly headed up Daimler AG’s global truck business before joining VW back in early 2015, added that this partnership also enables VW to gain access to the North American truck market. “It is a highly attractive alliance since it brings together two companies with a complementary geographic footprint,” he added. “Together we cover 25% of global [truck] market. We strongly believe this a very, very powerful global position. Combined, the two companies will build 226,000 commercial vehicle units per year. That gives us significant global scale.” In terms of savings, Navistar said it expects the alliance to be accretive beginning in its first year, with “cumulative synergies” to ramp up to at least $500 million over the first five years. By year five, the alliance is expected to generate annual synergies of at least $200 million for Navistar, with its annual “run rate” expected to grow materially thereafter as the companies continue to introduce technologies from the collaboration. Walter Borst, executive vice president and chief financial officer at Navistar, added that he believes the majority of the deal’s expected savings won’t kick in until the early part of 2019 and will come from procurement and “more efficient spend” in regards to “structural costs,” especially on engineering side of business. “I feel very feel comfortable with our liquidity position and even more comfortable with it with this deal,” he noted on the call. “I sleep better knowing we have over $1 billion in cash on hand [as] we need $500 million to run the business.” Troy Clarke, president and CEO of Navistar, added during the call that both companies will benefit from the ability to better integrate powertrains thru the deal plus optimize the overall capital spend for both, while lowering the costs associated with developing “next generation” powertrains. Clarke told Fleet Owner telematics represents another big potential area of cooperation and savings for both Navistar and VW. “If you think about it, all [commercial] trucks are slowly fitting into the same ‘box’ where emissions and connected vehicles are concerned,” he said. “The software may be different but the hardware is the same. Personally I am excited about the opportunities for collaboration here.” Clarke stressed, though that new partnership won’t substantively affect Navistar’s effort to renew its “entire truck portfolio” in 2018; an effort dubbed “Project Horizon” that will witness a new product introduction every four to six months on average, with the first to be introduced at the end of this month. “But now we will be able to go in and align product platforms,” he pointed out. “We are certainly counting on structural efficiencies. There is a well-established trend in the global [truck] industry along vertical integration, though it is pacing out differently for countries and participants in the market.” Clarke emphasized, though, that products springing from the Navistar/VW will be “steered by what customer want” and offers in his words “a tremendous opportunity for us both to be even more customer focused -- not just in terms of products but services going forward.” A few other key points made during the call: Renschler noted that VW Truck & Bus generated gross revenues of 30.4 billion Euros (some $27.17 billion U.S.) in 2015, employs 76,000 worldwide and built 179,000 commercial vehicles units worldwide last year. The deal provides VW with the opportunity to claim two seats on Navistar’s board of directors. Clarke said Navistar’s gross revenues topped $10 billion in 2015 and said the company’s network of over 800 dealers providing 8,000 service bays and 7,600 technicians is a key focus of the alliance. Clarke added that the 13 liter engine Navistar currently offers – its N-13 unit – is derived from a previous deal made with VW subsidiary MAN. “So we have a close engineering relationship with MAN [and] this was the genesis of the opportunity we saw together.” He noted VW’s engine portfolio plays up into the 15-liter “big bore” realm and down into 9 and 10 liter displacement as well. “We will work over the next few months to align our product portfolio,” Clarke said. Borst said neither company has filed the necessary paperwork yet to consummate the partnership but that he does not expect to face too many regulatory challenges. “We’ve got a few in the U.S. and a few other jurisdictions: Mexico, Canada and Brazil other key ones,” he said. “Hopefully regulators see this as we do; that there are no issues in this area.” Neither side mentioned how Cummins, a major supplier of engines to Navistar, will be affected by the new partnership. “The Cummins engine in our product truly outstanding; we anticipate offering [the] Cummins product for a long period of time,” Clarke noted. “So we are not speculating or making announcements on that today.” Clarke pointed out that while truck orders “are thin for everyone” right now, he believes the new partnership with VW with “eventually” translate into increased market share. “The [truck manufacturing] industry as a whole has to get through this valley, this fall in orders, and get back to order volumes that reflect demand.,” he explained. “That will give us a clearer view. Our products are more than competitive now and [the VW partnership] now gives access the global scale of technology. It gives customers one more good reason to consider Navistar. It allows us to get better and get better fast.” Clarke added that the deal would also “relieve anxiety” on part of customers about Navistar’s powertrain systems and its ability to integrate technology. “They don’t want to buy stranded technology; that affects residual values which they use for the down payment on their next truck,” he said. “This deal will get at this in a big way. This also gives us an opportunity to get back on the balls of our feet in the market.”

-

VW jolt not enough to end Icahn trucking nightmare Antony Currie, Reuters / September 6, 2016 The author is a Reuters Breakingviews columnist. The opinions expressed are his own. Carl Icahn is trapped in a long-haul trucking nightmare. The investor’s 20 percent stake in sputtering U.S. manufacturer Navistar International got a welcome jolt on Tuesday after the company announced a partnership with Volkswagen’s truck unit. Even after the 40 percent-plus surge in Navistar’s stock by early afternoon, though, it still needs to rise by another 50 percent or more just for Icahn to break even on the $500 million he has invested. It has been a downhill ride for the activist since he first jumped into the cab with an almost 10 percent stake in late 2011. Back then, it looked as if he would try to mesh Navistar with rival Oshkosh, another of his holdings. A deal might have produced enough cost cuts to cover a big premium and leave plenty more upside for both sets of shareholders to enjoy. Icahn and former protégé Mark Rachesky, whose MHR Fund Management has also been a Navistar shareholder for years, helped oust then Chief Executive Dan Ustian in August 2012. He had invested in diesel technology which failed and almost crashed the company. The recovery has been slow. Navistar lost money in 14 of the past 15 quarters. And its EBITDA margin may only hit 6.6 percent this year, compared with 11.3 percent at rival Volvo, according to Thomson Reuters data. Even if that metric improves by around a percentage point a year for the next three years, as analysts project, Navistar would still be a laggard. Icahn and Rachesky, whose fund also owns a 20 percent interest, between them control four of Navistar’s nine board seats. Fellow activist Mario Gabelli, who owns some 12 percent of the company, has for years wanted Navistar to sell itself. Tuesday’s less decisive deal with VW shows the paucity of options available to turbocharge the business. The $256 million investment from the German giant is welcome, but the $200 million of annual savings Navistar expects to find after five years is only 2 percent of total operating costs in the company’s most recent full year. Executives may find more gas in the tank as the joint venture progresses. But such improvements take time. Icahn, Rachesky and Gabelli – already five years into their campaign with nothing to show for it – will have to patiently ride shotgun for a while yet.

-

Navistar: Why Volkswagen Deal is Bad News…For Cummins Barron’s / September 6, 2016 We view the reports as being potentially negative for Cummins since, at least based on reports we are aware of so far, Volkswagen plans to supply Navistar with engines. Third-party engine manufacturers have not been major players historically in the commercial vehicle manufacturing industry in Europe, as they have historically in North America. Vertical integration is already one of the most discussed threats to Cummins with, for instance, PACCAR producing about 40% of its own engines currently, up from 0% before 2010. The trend had also been toward vertical integration at Daimler, the largest commercial vehicle OEM in North America. To date, Navistar has bucked that trend and has more heavily utilized third-party suppliers in the wake of the 2010 emissions standards and Navistar’s own failings with its in-house engines. YTD in 2016, 73% of Navistar Class 8 trucks used a Cummins engine. If reports are correct that Volkswagen intends to sell engines in Navistar trucks, Cummins could face vertical integration risk at Navistar as well, the only OEM which has not yet been a headwind for the company in the North American market. In fact, we wonder whether supplying engines to the North American market might be the largest motive of the deal from Volkswagen’s perspective, given Volkswagen’s capabilities in that area though its MAN and Scania nameplates.

-

Freightliner introduces next-generation Cascadia

kscarbel2 replied to kscarbel2's topic in Trucking News

-

Volkswagen Truck & Bus enters into strategic alliance with Navistar Volkswagen Truck & Bus Press Release / September 6, 2016 • Volkswagen Truck & Bus has agreed to subscribe to a capital increase of US-based commercial vehicles manufacturer Navistar International Corporation, resulting in a 16.6% stake of the outstanding shares • The two companies will pursue a strategic technology and supply cooperation and establish a procurement joint venture Volkswagen Truck & Bus GmbH ("Volkswagen Truck & Bus") and Navistar International Corporation ("Navistar"), the US-based commercial vehicles manufacturer, today announced that they have formed a far-reaching alliance that includes framework agreements for a strategic technology and supply cooperation and a procurement joint venture. Volkswagen Truck & Bus will furthermore acquire a 16.6% equity stake in Navistar through a primary share issuance. With the completion of this transaction, Volkswagen Truck & Bus, which includes the brands MAN, Scania, and Volkswagen Caminhões e Ônibus, will gain access to the key North American market, where it was not previously represented. Andreas Renschler, CEO of Volkswagen Truck & Bus and member of the Board of Management of Volkswagen AG responsible for commercial vehicles, said: "Closer collaboration among our existing brands was a top priority for our commercial vehicles business and we are well on track in this context. We are now taking the next step on our way to becoming a Global Champion in the commercial vehicles industry. The strategic alliance with Navistar is an important milestone and will be very beneficial for both sides." "We are very pleased to partner with a global leader who shares our view of the world, in an alliance that will deliver multiple benefits and is consistent with our open-integration strategy," said Troy Clarke, President and CEO of Navistar. "Starting in the near term, this alliance will benefit our purchasing operations through global scope and scale. Over the longer term, it is intended to expand the technology options we are able to offer our customers by leveraging the best of both companies and enabling Navistar to deliver enhanced uptime. Volkswagen Truck & Bus's equity investment will strengthen our liquidity position and expand our financial flexibility, while aligning us with a valuable strategic partner." Volkswagen Truck & Bus will purchase from Navistar newly issued common shares representing, pro forma for such issuance, a 16.6% stake in Navistar for a price per share of $15.76 and an aggregate purchase price of approximately $256 million (or approximately €229 million at current exchange rates). In connection with this investment, Truck & Bus will be represented on Navistar’s Board of Directors. In addition, both companies have agreed to collaborate closely. Matthias Gründler, CFO of Volkswagen Truck & Bus, said: "Our collaboration, especially with regard to the powertrain, will considerably increase our synergy potential. Navistar will be able to profit from excellent powertrain technologies and we, in turn, will benefit from significantly higher volumes. Initiating this strategic alliance now will enable us to implement the requirements of Navistar into our joint component platforms from the get-go." With the strategic technology and supply cooperation, Volkswagen Truck & Bus will become one of Navistar’s most important technology partners. While the partnership will focus on common powertrain systems, it will also enable collaboration in many aspects of future commercial vehicle development. Additionally, Volkswagen Truck & Bus and Navistar have agreed to establish a procurement joint venture that will pursue joint global sourcing opportunities. The strategic alliance will receive oversight from an Alliance Board consisting of top-level representatives from both sides. Under the umbrella of Volkswagen Truck & Bus, Andreas Renschler has been heading the process of bundling medium- and heavy-duty trucks and buses of Volkswagen AG into a robust commercial vehicles group. The Company's strategy includes plans to expand into new regions. Within the next decade, Volkswagen Truck & Bus aims to become a worldwide leading commercial vehicles group in terms of profitability, innovations for its customers and global presence. The closing of the transaction and the implementation of the strategic alliance is subject to certain regulatory approvals and other customary closing conditions. The closing of the share acquisition by Volkswagen Truck & Bus is further subject to the finalization of the agreements governing the procurement joint venture and of the first contract under the technology and supply cooperation. Closing is expected to be completed in late 2016 or early 2017. Volkswagen Truck & Bus was advised by Rothschild as financial advisor, and Davis Polk & Wardwell LLP, CMS Germany and Bär & Karrer as legal advisors.

-

Volkswagen powertrain coming to Navistar trucks by 2019 Truck News / September 6, 2016 Volkswagen powertrains will be coming to Navistar trucks by 2019, the two companies revealed during a conference call this morning. There was no immediate word on what the newly formed strategic alliance will mean for Cummins, Navistar’s current engine supplier. “Cummins is a great partner for us and the Cummins engine in our product is an outstanding product,” said Troy Clarke, president and CEO of Navistar. “I anticipate we’ll continue to offer Cummins products for a period of time…we’re not speculating or making announcements in that regard today.” Volkswagen announced today it has taken a 16.6% stake in Navistar. Andreas Renschler, CEO of Volkswagen Truck & Bus, said the time was right to partner with Navistar, because of where Volkswagen is in the production cycle of its next generation powertrain. Partnering now allows the companies to work together on development of the powertrain and integrating it into International trucks in North America. “For us, it was the right timing,” said Renschler. “Because we are at the moment designing new powertrain components for the whole world…Now Navistar joins us at the right time so we can develop them together and start to see real economies of scale.” Clarke said the strategic alliance is built on four pillars: A US$256 million cash injection from Volkswagen will improve its liquidity position; the two companies will jointly pursue strategic technological and supply collaboration; the truck makers will conduct the strategic sourcing of parts globally; and a separate board will be formed to oversee the joint venture. Volkswagen will also add two members to the Navistar board of directors. Current Navistar board members James Keyes and Michael Hammes have resigned from the board. Clarke said the partnership should bolster confidence among Navistar customers that the brand is on solid footing. “This will relieve anxiety on the part of some of our customers,” he said. “I fully anticipate we’ll increase consideration of our products, which will drive market share…it gives us the opportunity to get on the balls of our feet again.” While North American truck orders are currently soft, Clarke said Navistar has increased its order share for eight consecutive months. Bringing a vertically integrated powertrain to its products with the help of Volkswagen will benefit customers, Clarke said. “There is a well established trend in the industry globally along vertical integration,” he said. “We can deliver a captive powertrain for Navistar,” Renschler added. In the meantime, Navistar continues to update its complete product line. Clarke said the first vehicle to be launched as part of its Project Horizon will be revealed later this month. Renschler predicted the partnership will make Volkswagen one of Navistar’s most important technology partners going forward. With the alliance announced, the two companies will begin working together on product development that will include not only the engine, but also axles, transmissions and aftertreatment systems, Renschler said. The two truck makers now boast global truck and bus production of about 260,000 units per year.

-

Navistar, Volkswagen Announce 'Wide Ranging Strategic Alliance' Heavy Duty Trucking / September 6, 2016 Volkswagen Truck & Bus is taking a 16.6% equity stake in Navistar International Corp. as part of a “wide-ranging strategic alliance” that will initially focus on providing powertrains for Navistar trucks starting in 2019. The joint venture is based on four pillars: 1. The equity investment: Volkswagen Truck & Bus will acquire 16.2 million newly issued shares in Navistar, representing 16.6% of post-transaction undiluted common stock (or 19.9% of pre-transaction outstanding common stock). It will pay $15.76 per share or a 25% premium over Navistar’s 90-day volume weighted average price as of Aug. 31, or 12% over Navistar’s closing price on Sept. 2. Navistar will receive $256 million from the equity investment to be used for general corporate purposes. 2. Technology sharing: The two companies will collaborate on technology for powertrain systems, as well as other advanced technologies. It will focus on powertrain technology solutions, with VW supplying engines and other powertrain components by 2019, according to Andreas Renschler, CEO of Volkswagen Truck & Bus. It also will explore collaboration in other areas, including advanced driver assistance systems, connected vehicle solutions, platooning and autonomous technologies, electric vehicles, and cab and chassis components. This collaboration will allow the companies to share some of the costs of future vehicle development. 3. A procurement joint venture: Pursuing joint global sourcing opportunities for parts for both companies will give both greater scale and competitiveness. It also can create improved pricing for end customers. 4. Governance: Navistar will add two Volkswagen Truck & Bus representatives to its board of directors, and a separate board will be formed to oversee the alliance. When asked how the deal will affect Navistar’s deal with Cummins, which is supplying some three-quarters of the engines going into International trucks, Troy Clarke, Navistar president and CEO, said, “We anticipate we will continue to offer Cummins products for a period of time. We’ve got a great partnership with them as well. We’re not speculating or making announcements on that today.” For Volkswagen, the move is “a major milestone on our way to crating a global champion,” said Renschler, noting that the alliance “allows us access to the North American market and create synergies on the technology and on the human side.” He pointed out that the alliance offers complementary geographic footprint, with VW being strong in Europe and South America, and Navistar strong in North America and Latin America, especially Brazil. There has long been speculation that VW would move to acquire Navistar. When asked about potential plans for a further investment in Navistar, Renschler said, “We believe with the alliance we are forming at the moment … is the right thing … It’s a starting point. Our companies can get to know each other … and I think for us it’s a perfect entry and in a couple of years we can see…. All our options are open.” The timing was right, he added, because VW is currently starting work on its new global powertrain platform and can get Navistar involved in early stages. Navistar expects cumulative synergies for Navistar to ramp up to at least $500 million over the first five years. By year five, it expects the alliance will generate annual synergies of at least $200 million. That amount is expected to grow as the companies continue to introduce technologies from the collaboration. In addition, explained Clarke, the deal can help “relieve anxiety on the part of some of our customers [who may have been concerned whether] Navistar [would] have the ability to have access to new technology going forward. If you’re a company that buys trucks you don’t want to find that technology is stranded at some point in the future. This, I think, will get at that in a big way, and I fully expect will increase consideration of our products. We are improving our market share, it’s just not as fast as we had hoped, and this should increase that. This gives us the opportunity to get on the balls of our feet again.” Meanwhile, Navistar is preparing to unveil the first of the new trucks in its Project Horizon line later this month.

-

Freightliner introduces next-generation Cascadia

kscarbel2 replied to kscarbel2's topic in Trucking News

-

Heavy Duty Trucking / September 6, 2016 Orders for Class 8 trucks in the month of August will be slightly above expectations and a 36% improvement over July’s terrible numbers, according to projections from industry analysts. Class 8 truck orders in August will be around 14,200 units for the month, a significant rebound from July’s dismal 10,358 units ordered. July’s order numbers were the worst recorded since the first quarter of 2010. After a weak June and a dismal July, Class 8 orders rebounded in August to 14,200 units, or nearly 16,000 units on a seasonally adjusted basis. While rising 37% from July, August demand failed to meet the year-ago order volume for an eighteenth consecutive month, falling 29% from August 2015. Despite the gains, Class 8 order activity for August was the weakest for the month in six years and is down 35% compared to 2015. Class 8 truck orders have totaled 206,000 units for the last 12 months. Truck orders are expected to remain moderate in September before jumping in October, giving analysts the first look at what to expect for 2017’s truck market. Late-summer orders are generally weak seasonally, however, and the August order total still remains significantly below last year’s level, say analysts. October is expected to be the next truly meaningful order month, as it should be the first month which reflects orders for model-year 2017 tractors, which should give insight into expected production next year.

-

Transport Topics / September 6, 2016 Volvo Group’s two North American operating companies have agreed to exhibit at the North American Commercial Vehicle Show in Atlanta a year from now, and will either reduce or drop their connection with the Mid-America Trucking Show in 2017. The confirmation from Mack Trucks came on Sept. 1 as part of the original equipment manufacturer’s ride-and-drive press event here. A Volvo Trucks spokesman added a statement on Sept. 3. “Mack has signed a letter of intent to exhibit at the first North American Commercial Vehicle Show. We are still working through our position on MATS,” says John Walsh, Mack’s marketing vice president.. “Volvo Trucks will be at the North American Commercial Vehicle Show but will not be attending MATS in 2017,” says VTNA spokesman John Mies. (In July 2015, Volvo spokesman Avery Vise told Transport Topics that Volvo would return to MATS in 2017, the opposite of John Mies’ statement today.) In May, NACV Show executives announced similar deals with Daimler Trucks North America and Navistar International Corp. The inaugural exhibition will be Sept. 25-29 at Atlanta’s Georgia World Congress Center. Those two OEMs said their subsidiaries or some dealerships might choose to maintain a presence at Mid-America, but their large, corporate-wide exhibits will move to NACV for at least its first three shows, in 2017, 2019 and 2021. NACV was created to run in odd-numbered years as a North American complement to the IAA Commercial Vehicles show in Hanover, Germany, which runs in even-numbered years for the European industry. Kenworth Trucks and Peterbilt Motors have not yet announced decisions on their 2017 marketing plans. MATS, held every spring in Louisville, Kentucky, since 1972, has been North America’s largest truck show, but this year none of the seven manufacturers of heavy trucks displayed there, saying they want to switch to an every-other-year model. Related reading - http://www.bigmacktrucks.com/topic/40797-volvo-becomes-second-oem-to-pull-out-of-mats-next-year/

-

Transport Topics / September 7, 2016 The growing importance of fleets being able to regulate the speed of individual trucks through remote, over-the-air engine updates should be taken into account as the federal government considers a mandate requiring heavy-duty vehicles to utilize speed limiters, the president of Daimler Trucks North America said. Martin Daum said DTNA maintains a neutral stance on the issue of a mandate and could easily comply with a final rule if and when one is issued. However, during a Sept. 1 interview with Transport Topics after the launch of the new Freightliner Cascadia, he outlined several potential pitfalls with a mandate that left him “hesitant.” An Aug. 26 proposal from the U.S. Department of Transportation called for a speed limiter on trucks, and sought feedback on maximum speeds of 60, 65, and 68 miles per hour. “ A market-driven, smart solution is always better than a rule,” Daum said, because with a rule comes requests for exceptions and a need for enforcement. Daum said many fleet customers have their own set speed limits, and they gain from the “good economic behavior” of higher fuel efficiency at lower speeds. He is concerned the effect a mandate could have on a just-in-time delivery model, which is “huge in the entire economy” and can be aided by remote engine updates. Daum used the example of a company that has chosen 63 mph as its top speed for the entire fleet. However, he said, if a truck with time-sensitive freight gets caught in traffic, fleet managers could temporarily adjust engine parameters to boost that speed closer to a highway’s limit through a telematics system to improve the likelihood it arrives on time. He also said a European mandate limiting large trucks to about 54 mph has created a speed differential between passenger cars and trucks that “is the biggest reason for congestion” on that continent’s highways. In the United States, DOT’s proposal is not expected to include language requiring the device to be tamper-proof. Daum said a desire for tamper-proof limiters is well intentioned but would raise complex legal questions. “Why should I be responsible if someone violates a law?” he asked. “I put [a limiter on a truck] which really respects the law and someone breaks the law by reprogramming it, so is it now my responsibility to assume that you are a criminal and then I make sure that you can’t do illegally what you want to do?” Separately, Daum also sounded a cautious tone on the timeline and expectations surrounding autonomous trucks. He said he cannot see any situation where a true driverless truck is operating on U.S. highways. He also was skeptical of a scenario in which a trucker was “absolutely not paying attention” to the road. However, looking out six to 10 years, Daum forecasted a scenario in which drivers’ feet are spending much less time on pedals. “A truck can brake safer and it can accelerate more economically than any human foot can do — even the most experienced one,” he said. Daum said he “could see platooning, where the first truck is driven by a driver and in the second truck, the driver is sleeping. That is for me not autonomous because the human brain makes all the crucial decisions.” He labeled a two-truck platoon an electronically-controlled, 160,000-pound combination that could split anytime, which is “better than a truck with four trailers and it is easier to maneuver, but the first one is making all of the decisions for the second one.” Still, before that could become reality, the system must become foolproof so there is never a headline about a highway accident that reads: “Robot Kills Man,” he said. During the interview, Daum also said DTNA is continuing to undertake a page-by-page review of the final rule on greenhouse gas emissions through 2027 issued in August but remains pleased it will provide a “stability for the next 14 years" The more than 1,500-page rule from the Environmental Protection Agency and National Highway Safety Administration shows that the agencies were extremely thorough, Daum said. He also reiterated DTNA’s previously announced endorsement of the rule. “We can reach the [emission reductions] with current technology that has to evolve certainly, but we won’t have a disruptive change,” he said. When fully implemented in 2027, the rule seeks reductions in carbon dioxide output and fuel use of 25% by highway tractors, including engine improvements, and 24% by vocational vehicles — compared with 2017 vehicles.

-

Bosch Sought VW Cover for Defeat Device in 2008 Bloomberg / September 7, 2016 Robert Bosch GmbH demanded eight years ago that Volkswagen AG indemnify it (secure against legal responsibility for their actions) for using the emissions-cheating defeat device that it helped the automaker create for its diesel engines, U.S. car owners said in a new version of their lawsuit against both companies. Bosch is accused in the lawsuit of conspiring with VW to develop technology that enabled diesel vehicles to evade pollution-control tests. After seeking legal protection from VW for its use of the device in the U.S., the German auto-parts supplier continued to participate in the conspiracy to hide the cheating from regulators, car owners said in a court filing citing a 2008 letter from Bosch to VW. “Plaintiffs do not have a full record of what unfolded in response to Bosch’s June 2, 2008, letter,” according to the filing. “However, it is indisputable that Bosch continued to develop and sell to Volkswagen hundreds of thousands of the defeat devices for U.S. vehicles” even after it acknowledged in writing that using the software was illegal in the U.S. Bosch previously rejected as “wild and unfounded” car owners’ claims that 38 of its employees conspired with VW. Matthew Slater, an attorney for Bosch, didn’t immediately respond to phone or e-mail messages seeking comment on the newly disclosed allegations. U.S. Settlements Volkswagen has already agreed to settlements that may total $16.5 billion (14.7 billion euros) to get 482,000 emissions-cheating diesel cars off U.S. roads. Those agreements cover car owners, the U.S. government and 44 states. That also includes $1.2 billion for VW dealerships, as well as a $603 million accord with states in the U.S. that isn’t part of the settlement to be considered for final approval later this year. Volkswagen still faces criminal probes, efforts by car owners in Europe to get U.S. Justice Department documents to buttress their own civil suits and a sales ban on many VW models in South Korea. The European Union, where most of the 11 million cars with the defeat devices were sold, is also pressuring VW to compensate car owners. Bosch, which isn’t part of any of the VW settlements, developed software to enable Volkswagen to beat emissions testing in the U.S. on its diesel vehicles, consumers claim. They’re seeking damages from Bosch beyond VW’s payments for additional compensation for owners and leasers of the vehicles. ‘Critical Role’ Lawyers for American car owners revised an earlier lawsuit in August to enhance accusations against Bosch over its alleged role in the decade-long scheme. A copy of the lawsuit filed Friday in a San Francisco federal court removed blacked-out portions to provide a more complete picture of the allegations against Bosch. “The evidence already proves that Bosch played a critical role in a scheme to evade U.S. emission requirements,” consumer lawyers said last month in a partially sealed filing. Among the details included in the unsealed version of the filing Friday was the demand for indemnification for anticipated liability arising from the use of the “defeat device,” as Bosch called it in the letter. “Volkswagen apparently refused to indemnify Bosch, but Bosch nevertheless continued to develop the so-called ‘akustikfunktion’ (the code name used for the defeat device) for Volkswagen for another seven years,” the consumer lawyers wrote. On/Off Switch The term akustikfunktion dated back to use by Audi in the 1990s when it “devised software that could switch off certain functions when the vehicle was in test mode,” the lawyers alleged. Bosch concealed its knowledge of the defeat device in communications with U.S. regulators when questions were raised about the emission-control system in VW vehicles and “went so far as to actively lobby lawmakers to promote Volkswagen’s ‘Clean Diesel’ system in the U.S,” they said. Bosch maintained a “tight grip” over the engine control module software used on the VW vehicles and any modifications made to it, the lawyers claimed. Bosch “knew that Volkswagen was using Bosch’s software algorithm as an ‘on/off’ switch for emission controls when the class vehicles were undergoing testing,” they said in the filing last month. “Written communications between and within Bosch and Volkswagen describe the ‘akustikfunktion’ in surprising detail,” according to the unsealed document. “In e-mails sent as early as July 2005 from VW AG’s Andreas Specht” to four Bosch employees, “Specht discussed emissions measurements from vehicles using the ‘akustikfunktion’ in connection with U.S. emission compliance.” The names of the Bosch people remain sealed. E-Mail Request In March 2007, an unidentified Bosch employee e-mailed VW requesting that it remove the description of the function from fuel pump specification sheets provided in the U.S., according to the complaint. Shortly after the exchange, VW developers confirmed to Bosch that the akustikfunktion wouldn’t be listed in the U.S. documentation, according to the filing. The consumers allege that Bosch misled U.S. regulators as they provided specific information “about how Volkswagen’s vehicles functioned and unambiguously stated that the vehicles met emissions standards.” Employees at Bosch’s North American unit “frequently communicated with U.S. regulators and actively worked to ensure the class vehicles were approved.” Bosch’s North American unit also “regularly communicated to its colleagues and clients in Germany about ways to deflect and diffuse questions from U.S. regulators,” particularly the California Air Resources Board, according to the unsealed complaint. The case is In Re: Volkswagen “Clean Diesel” Marketing, Sales Practices and Products Liability Litigation, 15-md-02672, U.S. District Court, Northern District of California (San Francisco).

-

Navistar Announces Wide-Ranging Strategic Alliance With Volkswagen Truck & Bus Navistar International Corp. Press Release / September 6, 2016 - Navistar and Volkswagen Truck & Bus to pursue strategic technology collaboration and establish procurement joint venture with Volkswagen Truck & Bus taking a 16.6% stake in Navistar - Volkswagen Truck & Bus to invest $256 million in Navistar at $15.76 per share and have the right to appoint two directors to Navistar's board of directors - Alliance will uniquely position Navistar to provide best-in-class products and services to customers - Navistar expects to realize cumulative synergies of $500 million over first five years Navistar International Corporation today announced that it has formed a wide-ranging strategic alliance with Volkswagen Truck & Bus, which includes an equity investment in Navistar by Volkswagen Truck & Bus and framework agreements for strategic technology and supply collaboration and a procurement joint venture. The agreements expected to be entered into in connection with the alliance will enable Navistar to offer customers expanded access to leading-edge products and services through collaboration on technology and the licensing and supply of Volkswagen Truck & Bus's products and components, while better optimizing its product development spend. The alliance will also strengthen Navistar's liquidity position. In addition, the procurement joint venture is expected to leverage the purchasing power of Volkswagen Truck & Bus's three major truck brands, Scania, MAN and Volkswagen Caminhões e Ônibus, in addition to Navistar's own International® and IC Bus brands, providing Navistar with enhanced global scale. Navistar expects significant synergies from both the strategic technology collaboration and the procurement joint venture. The company expects the alliance to be accretive beginning in the first year, and for cumulative synergies for Navistar to ramp up to at least $500 million over the first five years. By year five, it expects the alliance will generate annual synergies of at least $200 million for Navistar. This annual run rate is expected to grow materially thereafter as the companies continue to introduce technologies from the collaboration. "We are very pleased to partner with a global leader who shares our view of the world, in an alliance that will deliver multiple benefits and is consistent with our open-integration strategy," said Troy Clarke, President and CEO, Navistar. "Starting in the near term, this alliance will benefit our purchasing operations through global scope and scale. Over the longer term, it is intended to expand the technology options we are able to offer our customers by leveraging the best of both companies and enabling Navistar to deliver enhanced uptime. Volkswagen Truck & Bus's equity investment will strengthen our liquidity position and expand our financial flexibility, while aligning us with a valuable strategic partner." "Closer collaboration among our existing brands was a top priority for our commercial vehicles business and we are well on track in this context," said Andreas Renschler, CEO of Volkswagen Truck & Bus and member of the Board of Management of Volkswagen AG responsible for commercial vehicles. "We are now taking the next step on our way to becoming a Global Champion in the commercial vehicles industry. The strategic alliance with Navistar is an important milestone and will be very beneficial for both sides." Navistar will remain a leading, independent truck, bus and engine company, focused on providing best-in-class products and related services to its customers globally and delivering value for its shareholders. "We expect this alliance will create significant global scale, yielding considerable cost savings for both companies," said Walter Borst, Executive Vice President and Chief Financial Officer, Navistar. "We believe working collaboratively, the two companies can optimize the capital and engineering expenditures associated with next-generation truck and bus engine development, while providing both Navistar and Volkswagen Truck & Bus with opportunities for substantial procurement savings. This alliance marks another step in Navistar's journey to be a stronger, more profitable company." Equity Investment As part of the alliance, Volkswagen Truck & Bus will acquire 16.2 million newly issued shares in Navistar, representing 16.6% of post-transaction undiluted common stock (or 19.9% of pre-transaction outstanding common stock). It will pay $15.76 per share or a 25% premium over Navistar's 90-day volume weighted average price as of August 31, 2016, or 12% over Navistar's closing price on September 2, 2016. Navistar will receive $256 million from the equity investment to be used for general corporate purposes. To underscore the long-term nature of the alliance, Volkswagen Truck & Bus has agreed to hold these shares for a minimum of three years. Reflective of its shareholding post-transaction, Volkswagen Truck & Bus will have the right to appoint two directors to Navistar's board of directors. Procurement Joint Venture The procurement joint venture will help source parts for both companies, providing Navistar and Volkswagen Truck & Bus with greater scale and competitiveness. It will also provide additional opportunities for Navistar suppliers to gain access to potential global sourcing opportunities, and create improved pricing for end-customers. Technology Sharing The strategic technology and supply partnership builds on Navistar's open integration strategy of partnering with the best global companies in the industry to integrate cutting-edge technology. It is expected the partnership will focus on powertrain technology solutions, as well as explore collaboration in all aspects of commercial vehicle development, including advanced driver assistance systems, connected vehicle solutions, platooning and autonomous technologies, electric vehicles, and cab and chassis components. This enhanced collaboration will enable the alliance to share the overall costs associated with future vehicle development. Navistar products will benefit from Volkswagen Truck & Bus components and technology through licensing and supply agreements entered into pursuant to the framework agreement for strategic technology and supply collaboration, which longer term will generate increased parts sales. Governance The strategic alliance will receive oversight from an alliance board, comprising top-level executives from both parties, which will align the product development and procurement processes between the companies. Timing and Conditions to Close The closing of the share purchase agreement implementing the strategic alliance is subject to certain regulatory approvals, the finalization of the agreements governing the procurement joint venture and the first contract under the technology and supply framework agreement and other customary closing conditions. J.P. Morgan is acting as financial advisor to Navistar and Sullivan & Cromwell LLC is acting as legal advisor to Navistar.

-

VW Buys Stake in Icahn-Backed Navistar in Bet on U.S. Trucks Bloomberg / September 7, 2016 Volkswagen AG will buy a stake in Navistar International Corp. to gain a foothold in the U.S. heavy-truck market, taking a gamble on a struggling U.S. manufacturer as the German company still grapples with the fallout from the emissions-cheating scandal. Navistar shares soared as much as 67 percent. VW will pay $256 million for a 16.6 percent holding and assume two board seats as part of a deal that includes technology sharing and joint purchasing, the companies said Tuesday. The Wolfsburg-based automaker will pay $15.76 a share, 12 percent more than Navistar’s most recent close. The holding, which VW said it may increase later, puts it on par with the largest shareholders, activist investors Carl Icahn and Mark Rachesky. “Navistar has always made sense as an expansion target for Volkswagen, which has no presence in the North American commercial-vehicle market,” said Brian Sponheimer, a Gabelli & Co. analyst in Rye, New York. “And Navistar has been burning through cash. This allows dealers to tell their customers that Navistar will be here, in the North American market, well into the future.” Gaining traction in the U.S. heavy-truck market, dominated by Daimler AG, Volvo AB and Paccar Inc., is key to VW’s plan to forge a global commercial-vehicle operation with higher profit margins than rivals. The marriage isn’t without risk given Navistar’s shrinking market share in the U.S., a country that has also confounded VW. Even before the diesel-cheating scandal, Volkswagen’s car sales were slipping behind competitors in the region. “Closer collaboration among our existing brands was a top priority for our commercial vehicles business and we are well on track in this context,” Andreas Renschler, head of the Volkswagen Truck & Bus division, said in a statement. “We are now taking the next step on our way to becoming a global champion in the commercial-vehicles industry.” Navistar surged 44 percent to $20.28 at 12:34 p.m. in New York after reaching $23.45 for the Lisle, Illinois-based company’s biggest percentage gain since at least 1980. Volkswagen’s American depositary receipts rose 0.7 percent to $29.54. Cummins Inc., a maker of engines for Navistar, fell as much as 6.6 percent to $117.84 on concern that VW will take over as the supplier. Working with Navistar will provide VW with access to technology and designs targeting customers in the U.S., where model lines are very different from offerings in the rest of the world. Many U.S. truck drivers prefer vehicles with an elongated nose, while European operators buy trucks with a flat face due to length restrictions. Volkswagen, Europe’s biggest carmaker, hired Renschler away from Daimler’s truck unit to push a stalled plan to deepen cooperation between its MAN and Scania brands. Munich-based MAN and Swedish counterpart Scania don’t sell vehicles in the U.S., and the group’s only other large truckmaking operation is a VW-brand division in Brazil focused on Latin America. MAN has a Chinese joint venture with local affiliate Sinotruk Hong Kong Ltd. that sells models in Asia. Entering the U.S. will give VW access to a market a bit smaller than its current home region. Around 240,000 trucks will be sold this year in the U.S., while 290,000 will be bought in Europe, according to estimates from Volvo. Spending Cuts Volkswagen Truck & Bus was created in 2015 after the carmaker accumulated majority control of MAN and Scania over the previous decade. The unit has been largely unaffected by the diesel-emissions scandal that erupted at the group’s car operations a year ago. It’s targeting 1 billion euros ($1.12 billion) in long-term cost savings through closer collaboration among its brands. Renschler reiterated in a conference call with analysts Tuesday that VW is keeping all options open as part of his expansion strategy, including increasing its stake in Navistar and a possible share sale of VW’s trucks division. But he indicated that an initial public offering might not be imminent as “VW has no actual plan” to spin off the unit. VW and Navistar said they expect to reap combined synergies of $500 million over the next five years. Navistar posted its first profit in 14 quarters in the three months through April, helped by spending cuts under Chief Executive Officer Troy Clarke. Navistar is no stranger to dramatic consequences from emissions-related troubles. The truckmaker had to kill most versions of its so-called premium vocational models in 2010 because they lacked diesel engines that complied with U.S. federal air-pollution rules. Navistar’s market share has tanked since its pollution-control technology failed to meet industry standards and brought the company to the brink of collapse. Joint Work Clarke said on the call with analysts that the VW deal “is another great reason to consider our products -- that you want to do business with somebody who is going to be participating in leading global technologies, and will have that kind of scale going forward.” Navistar has had a license to build engines designed by MAN since 2005. The two companies have held periodic talks about additional strategic initiatives since then and began intensive discussions about six months ago that led to Tuesday’s announcement, Clarke said in an interview. The CEO said Navistar was motivated in part by new U.S. emissions regulations, the first phase of which take effect in 2021. When fully implemented, the rules mean that heavy trucks for the 2027 model year will be 25 percent more carbon-efficient than those sold as 2018 models. Volkswagen is starting work on a new set of engines to meet the U.S. regulations, as well as similar requirements in Asia and Europe, and will turn to Navistar as an engineering partner, Renschler said. Cooperative Benefits “We have a plan to be compliant without this cooperation with Volkswagen, but the cooperation allows us to do it far more efficiently, and with a higher probability not only of compliance but of success,’’ Clarke said. “Engineer it once and use it many times around the world -- that’s going to be our approach.’’ Some VW engine components will start appearing in Navistar’s U.S. products in 2019. Clarke said on the call that it’s logical to think that Navistar could build Volkswagen engines in the U.S., but that no decisions have been made. He also said he had no change to announce on Navistar’s contracts with Cummins for engines. Icahn said in a regulatory filing Tuesday that Navistar agreed that the company won’t support any effort to increase the size of the board to more than 12 directors, as long as an Icahn nominee is a member of the board. Navistar currently has nine directors. The U.S. company said in a separate statement Tuesday that two directors, James Keyes and Michael Hammes, will retire when shares are issued to Volkswagen or at Navistar’s 2017 shareholders meeting, whichever comes first. Icahn on Tuesday also agreed to buy the shares of auto-parts supplier Federal-Mogul Holdings Corp. he doesn’t already own for $9.25 each. Icahn, who holds a stake of almost 82 percent, initially offered $7 a share in February, when the stock was trading at $4.98. He had raised his bid to $8 in June.

-

Volkswagen Taking 16.6% Stake in Navistar The Wall Street Journal / September 6, 2016 Purchase of truck company’s shares will cost the German auto maker $256 million Volkswagen AG ’s new development alliance with Navistar International Corp. fuels the German company’s ambition to chase rival Daimler AG into the about $30 billion a year North American heavy-duty truck market. Volkswagen’s shares of such truck sales are larger in Europe and Latin America and it has a joint venture with Sinotruk (Hong Kong) Ltd. in China. But Daimler entered the U.S. long ago, and has built a business that now accounts for about 40% of U.S. heavy-duty truck sales. Volkswagen sought to even the score on Tuesday with its $256 million investment in Navistar, a 16.6% stake that will give it two seats on the Lisle, Ill.-based truck maker’s board. The stake and related development-and-procurement alliance will broaden Volkswagen’s U.S. footprint and global truck-market operations. Behind the intensifying rivalry are two executives who have switched sides in the battle between the two German automotive giants. Andreas Renschler, chief executive of Volkswagen’s Trucks and Buses business, was the architect of Daimler’s U.S. strategy. Passed over as chief executive, he left Daimler at the end of 2014 and was tapped by Volkswagen patriarch Ferdinand Piech to mold the fragmented truck businesses into a global enterprise. Mr. Renschler’s former colleague and rival, Daimler Trucks Chief Executive Wolfgang Bernhard, is benefiting from the business that he built. But he wouldn’t compare Volkswagen and Daimler’s bids to grow in North America. “You can ask that question of somebody else in 10 years,” he said in an interview on Tuesday. Mr. Bernhard knows Volkswagen well. A decade ago he ran Volkswagen’s namesake car brand, pursuing an aggressive strategy to standardize components and streamline the business. At Daimler Trucks, he has driven efforts to create common truck platforms and develop new technology. Messrs. Renschler and Bernhard are approaching the U.S. and global truck business with similar strategies. Both are trying to bring the German auto industry’s obsession with standardization and common vehicle platforms to a U.S. market equally obsessed with freedom of choice. “We’re trying to do something that the passenger car guys started already decades ago, what they call the platform strategy,” Mr. Bernhard said. “You use components in one vehicle and try to disperse that in your lineup as much as possible and by that you create economies of scale.” Daimler owns truck maker Freightliner and engine supplier Detroit Diesel that have put its North American operations far ahead of Navistar. The parent company of Mercedes-Benz has quietly amassed 40% of heavy duty truck sales in North America in recent years. Detroit Diesel builds engines that are standardized enough to keep development costs down even while producing versions of the same engine for the U.S., European and Japanese markets. “These are the beginnings of a platform strategy. Now we are rolling it out to transmissions, we are rolling it out to axles and we are rolling it out to medium duty engines,” he said. Creating a global truck platform that can allow Volkswagen to share components across many different brands and models was a big driver of this week’s Navistar deal. Volkswagen’s investment in Navistar, at $15.76 a share, represents a 12% premium to Friday’s closing price. The two companies expect regulatory approvals of the deal by early next year. Navistar anticipates cost savings of $500 million within the first five years of the venture and annual savings of $200 million after that. Initially, those savings were expected to come in the form of cheaper raw materials and commodity components through Navistar’s wide-ranging procurement alliance with Volkswagen. Navistar CEO Troy Clarke said the alliance provides Navistar access to engine technology that should help it reclaim share lost to competitors a few years ago due to engine reliability problems. Navistar has about 11% of heavy-duty truck sales in North America, down about half from five years ago. “We want to get as much of that market as we can,” Mr. Clarke said on Tuesday. The alliance “will increase [customer] consideration of our products.” Volkswagen’s investment also provides a measure of stability for cash-strapped Navistar, which has battled worries from customers and investors that it would run out money. “It gives some of their customers a sigh of relief to know that [Navistar] is going to be around for the long haul,” said Eric Starks, CEO of transportation consultancy FTR in Indiana. The deal, details of which were first reported on Monday by The Wall Street Journal, comes as Navistar deals with the fallout from a run-in over emissions regulations and a declining market share that has left it trailing rivals in a North American commercial truck market wrestling with a slump. The bulk of potential savings from the venture aren’t expected to be realized until after 2019, when Volkswagen plans to launch a new global platform for its heavy-truck brands MAN and Scania and that it will now jointly develop with Navistar. Volkswagen’s MAN unit took a restructuring charge of more than €200 million last year as part of Mr. Renschler’s push to boost earnings and savings by more closely integrating the German truck maker with VW’s Swedish manufacturer Scania. Development of the new truck platform is still in the early stages and was one of the reasons why Volkswagen wanted to do the Navistar deal now. “We are working on common powertrain platforms with MAN and Scania and now Navistar is part of it and can be there from day one,” said Volkswagen’s Mr. Renschler. “We want to have a powertrain-based platform that will be used around the world.”

-