kscarbel2

Moderator-

Posts

17,891 -

Joined

-

Days Won

86

Content Type

Profiles

Forums

Gallery

Events

Blogs

BMT Wiki

Collections

Store

Everything posted by kscarbel2

-

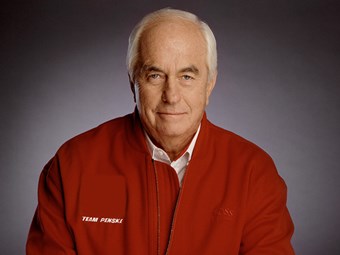

Steve Brooks, Owner/Driver / June 16, 2016 In his first interview in three years, Roger Penske exclusively talks to Steve Brooks about his history, the Penske brands, Detroit Diesel, the Australian market, and everything in-between Automotive industry mogul and car racing icon Roger Penske insists he has a long-term strategy to forge a significant stake in the Australian and New Zealand truck and diesel engine markets. In his first and only interview since taking control in 2013 of Transpacific’s commercial vehicle group comprising Western Star, MAN and Dennis Eagle brands for a reported $219 million, and soon after acquiring the MTU Detroit Diesel Australia engine business, Penske says his main goal for now is to achieve a 10 percent stake of the Australian heavy-duty truck industry. Renaming the businesses Penske Commercial Vehicles and Penske Power Systems respectively, he concedes the past two years have been difficult, particularly for the flagship Western Star brand with fiercely competitive pricing cited as the major reason for a considerable slide in sales. It is, however, an emphatic Penske who says, "This is a long-term investment. Not everybody wants to get into this business and for me it’s about building a team of responsible, qualified people. What we need to do is train and build the best team and if we do that, we’ll be a winner. "I feel really good about it. I like the country, I like the people and to me it’s an extension of what we already do. "We have a truck fleet in the US of around 230,000 vehicles, so a few more out here just adds on to that." Viewed by some industry executives as the man with the Midas touch, and with personal wealth estimated at several billion dollars, the 79-year-old Penske remains a dynamic businessman and automotive entrepreneur with a sharp eye for opportunity and potential. Perhaps Penske’s greatest success came when he took control of Detroit Diesel from General Motors in the US in the late 1980s. Recognising the incredible potential of the then newly developed Series 60 engine, he took Detroit Diesel to the top of the North American heavy-duty diesel engine business before selling the entire operation to Daimler. As the chairman of Penske Automotive Group, he controls an operation which around the time of the purchase of Transpacific’s commercial vehicle operation had almost 350 retail automotive franchises representing 39 different brands, with the group selling more than 402,000 vehicles (cars and trucks) and generating revenues of US$13.2 billion. His commercial vehicle interests include ownership of Penske Truck Leasing which operates more than 230,000 vehicles servicing customers in North America, South America, Europe and Asia, and is one of the largest purchasers of commercial trucks in North America. Many of those vehicles are Daimler products and his ties with the German giant remain strong. In the Australian and New Zealand markets, he makes no secret of an intention to expand his current Penske Truck Rental operation and, similarly, grow the truck leasing business. "We are totally committed to this market," he asserts. Despite considerable speculation, Penske denies that his ultimate goal is to take control of Freightliner in Australia. "We are the number-one customer in the US for Freightliner and we wanted to grow the commercial vehicle side of our business, so a couple of years ago Daimler contacted me and said this business might be available," he says. "I had some idea of Transpacific and the (commercial vehicle) business looked like something that fitted our plans over the longer term. "And quiet honestly, I like this marketplace, I knew a lot of the customers, so it was a perfect fit. "Then, as part of our plan here, we had the opportunity to get Detroit Diesel," he continues. "Combined with the MTU engine business, it gave us a thousand people and probably a 500 to 600 million dollar business operating in marine, defence, on-highway and off-highway, power generation, and it really fits our plan, particularly in service and parts. "When I look at our business, 30 per cent of our revenue generates 70 or 80 per cent of our gross margin and that comes from service and parts. "So when you put it all together, I wouldn’t trade it with anybody. Not at all," a determined Roger Penske concludes. .

-

-

Kamaz Trucks Press Release / June 15, 2016 Russian transporter Tempo-Logistics yesterday took delivery of 24 new KamAZ model 5490 4x2 tractors. The event was attended by KamAZ Sales & Service Deputy Director Sergey Afanasiev, KamAZ Finance Company Director Andrey Ignatyev, Tempo Technical Director Kamil Shakirov and Tempo-Logistcs Senior Director Ilgiz Kadirov. This is not the logistics company’s first purchase. Last year, it purchases 100 of Kamaz’s popular flagship model 5490 tractor. The effectiveness of last year’s trucks led to the new order. The trucks will be operating out of the city of Naberezhnye Chelny, transporting goods for TEM-PO Naberezhnye Chelny Tube Works (http://eng.ntz-tempo.ru/) and Kama Tempo Steel Structures plant (http://kzmktempo.ru/en/), the largest in the Volga Federal District. KamAZ website (model 5490) - http://kamaz.ru/en/production/serial/tractor-units/kamaz-5490/ .

-

Transport Brazil / June 15, 2016 Volvo has launched a high capacity 32-ton (70,548lb) VM range based on the global market FMX vocational platform. The VM 6x4 “Off-Road” Series, unique to Brazil, is a medium-heavy (baby 8) truck offered as a rigid, tractor or tipper. The new 32-ton 6x4 can carry 5.3 tons (11,685lb) more than the standard version. "We are continually investing to always have the best solution for commercial transport," says Bernardo Fedalto, director Volvo Trucks Brazil. "The VM with PBT of 32 tons is to meet the market demand for vehicles with excellent value for money in the off-road segment," says Francisco Mendonça, manager Volvo Trucks. "Developed and produced at our plant in Curitiba, the VM wins for its low fuel consumption and high availability in various applications. Now we are further expanding our offer, "said Nilton Roeder, director of strategy, business development and sales support trucks of Volvo Latin America Group. "It is a sector that needs trucks with intermediate load capacity and suitable for applications where the intensity and severity not require higher power vehicles," adds Alvaro Menoncin, sales engineering manager at Volvo Latin America. Equipped with a 330 horsepower 7.2-liter [MWM-International] engine and 6x4 axle configuration, it is also the lightest truck in its class, from 275 kg to 1050 kg. lighter than its competitors. FMX Components "The 32-ton VM “Off-Road” shares some of its main components with our severe service global market FMX line, facing the heavy transport in extreme conditions," says Ricardo Tomasi, sales engineer at Volvo Latin America. “It has, for example, the robust planetary hub reduction, as well as the straight beam front axle, and the same 12-speed I-Shift transmission as the FMX," says Tomasi. In addition, the heavu-duty VM maintains the same attributes by which the VM line is recognized in Brazil: high availability, low fuel consumption, low maintenance and a cabin for easy access, and provides great comfort to the driver. "We have no doubt that the new VM off road will contribute significantly to increase the profitability of the carrier, which is now experiencing an economic environment highly competitive," says Roeder. The VM330 “Off-Road” leads in robust construction and load capacity. Volvo introduced several innovations to increase load capacity by 20%. Changes to the VM’s suspension and upgraded axles result in GVWs from 26.7 tons to 32 tons. "We dare say it is the best vehicle in its class," says Bernardo Fedalto, director of Volvo trucks in Brazil. The previous 6.7 ton (14,771lb) front axle has been replaced with an 8 ton (17,637lb) unit. The previous 20 ton rear axles have been upgraded to 24 ton units with planetary hub reduction which feature driver-controlled inter-axle and inter-wheel locks. The front suspension, rated at 8 tons, features parabolic springs, high-capacity, double-acting shock absorbers and stabilizer bar. Already the rear suspension consists beam semielípticas springs and designed to withstand 24 tons. It is more robust and provides easy maintenance as, if necessary, it is possible to change just one of the blades. "The less time the truck stand, the greater the productivity of the transport operation," said Tomasi. Brake chambers are mounted up high, protecting them from damage. Other features include a reinforced radiator guard screen, oil sump guard and LED rear lights. Volvo Brazil website (VM) - http://www.volvotrucks.com/trucks/brazil-market/pt-br/trucks/Volvo_VM/Volvo_VM/Pages/Introduction.aspx .

-

FTA calls for postponement of French minimum wage rule

kscarbel2 replied to kscarbel2's topic in Trucking News

Absolutely ridiculous. -

Heavy Goods Vehicles UK / June 14, 2016 The UK’s Freight Transport Association (FTA) has called for urgent postponement of a new employment law in France which means all foreign truck drivers passing through the country have to carry documents proving they earn the French minimum wage. From 1 July, foreign vehicles operating on French soil will have to implement new reporting requirements to demonstrate compliance – and with just 15 days before the deadline, the situation for operators remains woefully unclear. The French government has still not given full guidance to foreign operators, promised in a ‘frequently asked questions’ document. FTA is calling for a postponement of the application of the new provisions until more clarity is made. Moreover, FTA urges the European Commission to support its request for a postponement and also to speed up publication of the Commission’s own investigation into the legal basis of these provisions on the Single Market. Chris Yarsley, FTA’s EU Affairs Manager, said: “It is unacceptable that the French government has not given industry full information and guidance on these new measures, only days before they come into force. The sector must be given more time to adapt business practices before any enforcement takes place.” The new law requires the transport company operating in France to submit a ‘posting’ certificate for each worker, which must be renewed every six months. The employer of this mobile worker must also appoint a company representative in France, responsible for liaising with staff of the enforcement body for the duration of the transport operation plus 18 months. This requirement will be particularly problematic for companies that do not have an office or branch in France. Drivers must keep in their vehicle a copy of their employment contract and the certificate of posting – any breach of the rules will lead to a fine. Mr Yarsley added: “The requirement to keep paper documents on board the vehicle is a step backwards and will lead to documents getting lost as drivers are moved around. And who are these ‘representatives’ that are supposed to hold private information on the drivers working on a UK contract? We must be given more information by the authorities.” FTA is working with other trade associations and industry sectors to increase pressure on the French authorities to hold back any enforcement of these new rules until the situation is much clearer.

-

??? http://www.engineking.com/catalog/index.php?main_page=product_info&cPath=21_27&products_id=421 ??? http://www.endurancepower.com/media/News_07_07.pdf Paul, there are still E9s running in Oz. I'm curious, if you would give Mack Oz a call (1300696225 ) and ask them if they still supply reman E9 heads, or what is a bloke supposed to do?

-

Truck News / June 15, 2016 Five years after its launch, the Detroit Connect Virtual Technician integrated remote diagnostic system hardware has hit a major milestone – its 200,000th installation. The 200,000th Virtual Technician hardware unit was installed on a Freightliner Cascadia Evolution truck equipped with a Detroit DD15 engine delivered to Penske Truck Leasing. “The Detroit Connect team found a solution that provides the data we need from Virtual Technician and delivers it directly into our own IT environment. This is a great combination of the OEM’s knowledge of the truck applied to our own internal systems and processes,” said Paul Rosa, senior vice-president, procurement and fleet planning for Penske Truck Leasing. “We appreciate customers like Penske who have selected Detroit Connect for their remote diagnostics and performance data needs. We are not only providing them with the information to make service decisions, the data also helps them have better insights into what’s behind fault codes,” said Matt Pfaffenbach, director, telematics for Daimler Trucks North America. “Since our launch five years ago, our goal has always been to provide connected solutions that contribute to uptime and lower maintenance costs.” Virtual Technician is standard on all Freightliner and Western Star trucks equipped with Detroit heavy duty engines, including the DD13, DD15 and DD16. Detroit Connect is a central part of DTNA’s long-term vision for truck connectivity. Over the next several years, DTNA will continue to add new service packages to its telematics offerings, and also make its platforms accessible to third party software integration. . “We are going to continue to develop new technologies that deliver vehicle performance and health insights to our customers that will have positive impacts on their businesses,” added Pfaffenbach. “By deepening our telematics offerings, we will remain on the forefront of integrating intelligent solutions with our vehicles to benefit not only our customers, but the transportation industry.” For more information, go to www.DemandDetroit.com/Connect.

-

Commercial Carrier Journal (CCJ) / June 15, 2016 Values of used trucks continue to fall according to data released this week by American Truck Dealers (ATD). Year-to-date trends show model year 2013 Class 8 sleeper tractors have lost about 13 percent of their value ($36,500 average), model year 2012 lost about 18 percent of their value ($35,659 average) and trucks from model year 2011 have lost about 11 percent ($28,750 average) on the wholesale market. “These figures translate to retail pricing continues to catch up to wholesale, with the market sticking to our depreciation forecast of 4 to 5 percent per month,” Chris Visser, senior analyst and product manager, commercial vehicles for J.D. Power, says. “That’s not a bad decline given the major changes the market has seen over the past year, and better than the 4.7 percent average monthly loss in the second half of 2015.” Year-to-date, sleepers three to five years of age are retailing for $8,626 less than in the first four months of 2015, and fell 4.2 percent in April from March. Due to the lower volume of 3 to 5 year-old trucks, the average age of trucks sold in April jumped to 93 months — 11 months higher than March. “Trucks of model year 2012 have fared the worst in 2016 to date, losing 21.8 percent of their retail value from January to April,” Visser adds. “In the same period of 2015, that age group had lost only 4.5 percent. This past April was likely an outlier though, as an unusually large group of retail Freightliner Cascadias sold at a price typically brought in the wholesale market.” Trucks three and four years of age fared better, with 2014’s losing 2.3 percent of their value, and 2013’s gaining 0.7 percent month-over-month. The Kenworth T660 gained ground for the second month in a row, moving upward in 2013, 2012 ad 2011 model years. Related reading (beginning on page 8) - http://uta.org/wp-content/uploads/2016/04/UTA-APRIL2016.pdf

-

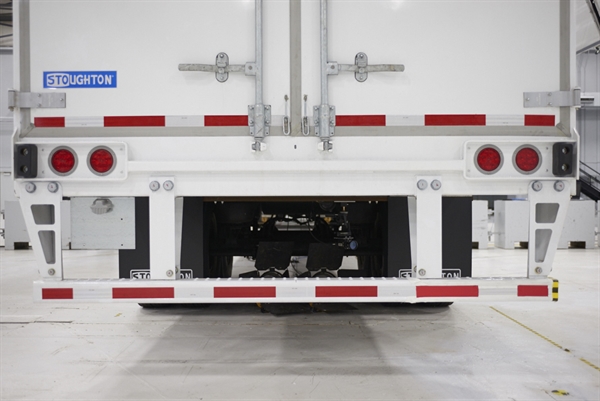

Heavy Duty Trucking / June 14, 2016 Stoughton Trailers has announced that its engineers have developed a new, stronger and safer rear underride guard. The company said it will make it standard in this year’s 4th Quarter. The patent-pending guard underwent extensive testing internally and through multiple independent testing agencies, including crash testing performed at the Insurance Institute for Highway Safety’s facility in Ruckersville, Va., said Bob Wahlin, Stoughton's president and CEO. The guard, based on IIHS recommendations, complies with all applicable U.S. and Canadian regulations. It adds no weight and does not affect aerodynamics or the strength of a trailer’s undercarriage and rear structure, he said. “After thorough testing, we are confident that this design will set the new standard for rear underride safety in our industry,” Wahlin said. “We place such a high value on the safety of both our customers and the driving public that we have chosen to provide this improved level of safety and performance as a standard feature, at no additional cost.” The underride guard includes two additional bolt-on vertical supports on the outer ends of the horizontal bar. The four supports are integrated into the bar and fastened to the undercarriage to strengthen the guard. The new underride guard will be available in painted carbon steel, galvanized steel or stainless steel. .

-

Fleet Owner / June 15, 2016 Kenworth has published a new sales brochure for its T680 Class 8 truck Brochure – http://www.kenworth.com/media/52923/t680-brochure-0316.pdf The T680, which was launched four years ago in 76-in. sleeper and day cab variants, is now available with 52-in. and 76-in. mid-roof sleepers as well as Kenworth's new space saver 40-in. sleeper. The company says the T680 provides "an excellent, fuel-efficient, productive and driver-friendly truck for over-the-road fleets and truck operators in line haul, pickup and delivery, and regional hauling applications." The 34-page T680 brochure provides information on things like Kenworth TruckTech+ telematics; driver performance technology; power management technology; the Kenworth Idle Management System; interior colors and options; and Kenworth seats, which feature adjustability, ride suspension and personal climate control. Kenworth PremierCare parts and service programs also are highlighted. The Kenworth T680 comes standard with the PACCAR MX-13 engine rated up to 500 hp. and 1,850 lbs.-ft of torque, and it's available with the new PACCAR MX-11 engine with up to 430 hp. and 1,550 lbs.-ft of torque. According to Kenworth, the two engines "offer optimum performance, industry-leading reliability and durability, and a quiet operating environment for drivers."

-

RB Tractor?

kscarbel2 replied to masterwelder's topic in Antique and Classic Mack Trucks General Discussion

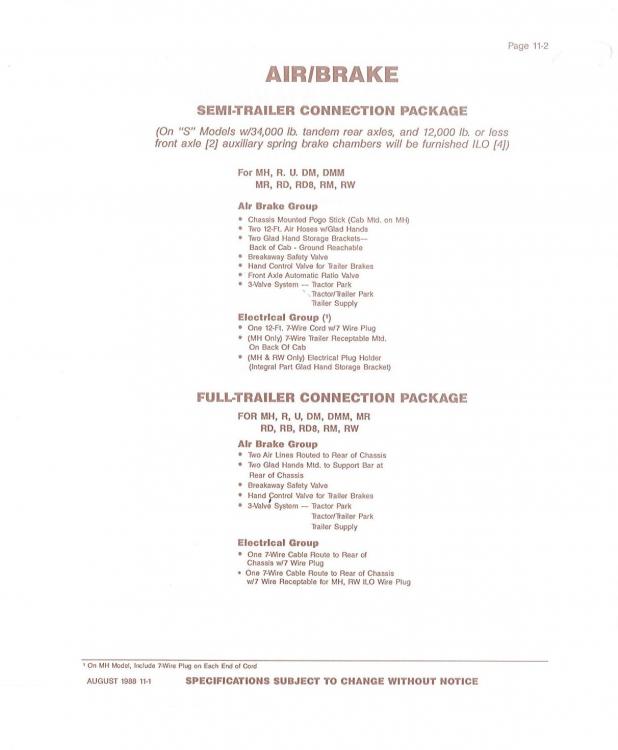

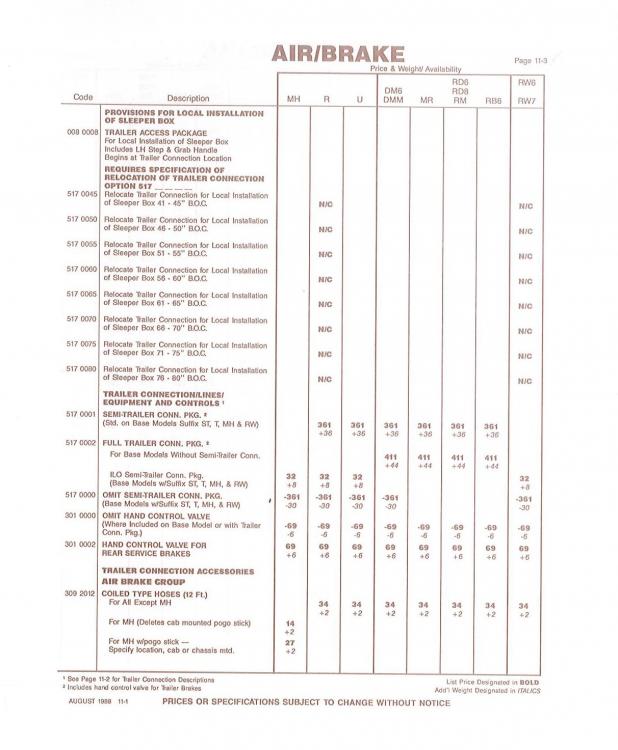

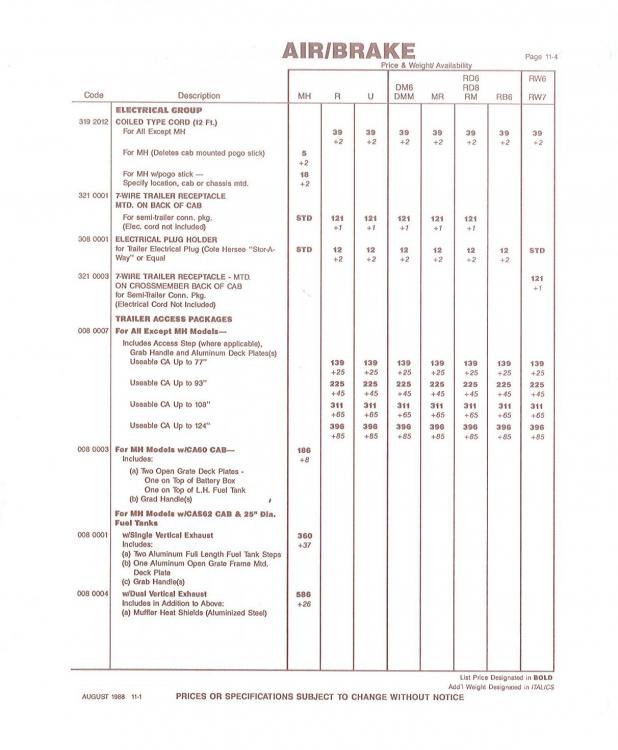

The RB was indeed available with semi-trailer OR full-trailer connection packages as a factory option. Rather than explain it, I think the order book is self-explanatory. Note the RB6 column on page 11-3. . -

Just a quick note, the 2017 Honda Accord "hybrid" sedan is out......49/47/48 mpg (city/highway/combined), No diesel, just brilliant engineering and great fuel economy with an MSRP of $29,605. http://blog.caranddriver.com/refreshed-2017-honda-accord-hybrid-pricing-rises-by-300-900/#more-305203 http://www.greencarcongress.com/2016/06/20160615-accord.html http://www.autoblog.com/2016/06/15/2017-honda-accord-hybrid-comes-with-300-price-hike/

-

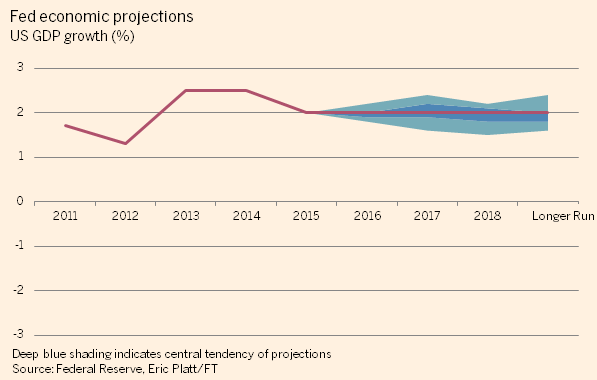

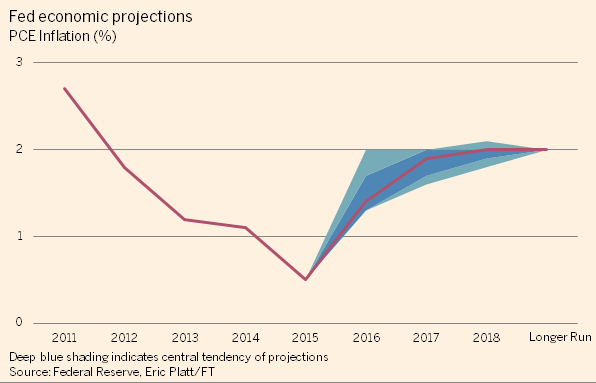

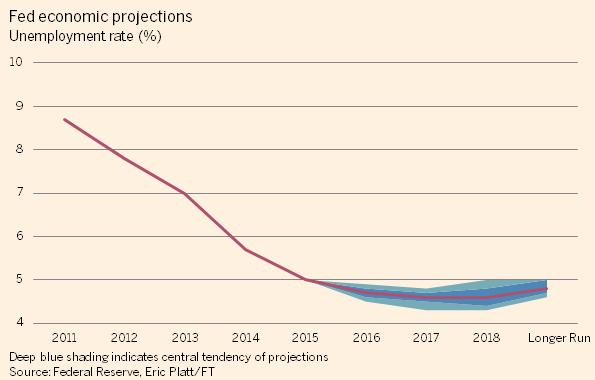

Fed's Yellen acknowledges difficulty of escaping world's low rate grip Reuters / June 15, 2016 Evidence that the U.S. neutral rate of interest remains stalled near zero spurred the Federal Reserve to slow its expected pace of rate hikes on Wednesday, as policymakers signaled their hands may be tied until a rebound in global demand or other forces raise that key measure of the economy’s underlying strength. In a news conference following the Fed's latest meeting, Chair Janet Yellen said the central bank was still coming to grips with the likelihood that the neutral rate - the point at which monetary policy is neither spurring nor restraining economic growth - is stuck at a historic low and could limit the central banks room to maneuver. In the Fed's policy debate, "an important influence is what will happen to that neutral rate," Yellen said, noting that the central bank's "base case" is that the rate should rise alongside an improving economy and as "headwinds" from the 2008-9 financial crisis fade. But "there are long-lasting, more persistent factors that may be holding down the longer-run level of neutral rates," Yellen said. "It could stay low for a prolonged time....All of us are in a process of constantly reevaluating where the neutral rate is going, and what you see is a downward shift over time, that more of what is causing this to be low are factors that will not be disappearing." Policymakers nodded directly at the problem in fresh economic projections that cut median estimates of the long-run federal funds rate to 3 percent, far below the levels common in the 1990s. Since the Fed began publishing policymakers' economic projections in 2012, estimates of the long-run rate have been cut from 4.25 percent. "There could be revisions in either direction," Yellen said. "A low neutral rate may be closer to the new normal." HARD TO PINPOINT Though difficult to pinpoint, estimates of the neutral rate provide a key yardstick to gauge whether a given federal funds level is stimulating or restricting the economy. With the Fed still trying to encourage spending, investment and hiring, a low neutral rate means the Fed has less room to move before that stimulus is gone. Fed estimates published online show little consistent movement in the neutral rate in recent years even as the labor market tightened and growth continued above trend, confounding expectations that it would move higher in an economy expanding beyond potential. Officials cite a variety of possible explanations, but the result is the same: until policymakers are satisfied that the neutral rate is moving higher, they face an effective cap of 2 percent or even less on the federal funds rate. Coupled with a 2 percent inflation rate, the Fed's target, that would put the "real" federal funds rate at zero. If inflation remains below target, the ceiling on the Fed would be that much lower as well. That is a far cry from the 3.5 to 4 percent that the Fed's policy rate has averaged since the 1990s, and means the central bank will treat each move with particular caution, current and former Fed officials say. In their policy projections on Wednesday, Fed officials slowed the pace of expected future hikes from four to three per year. It also means the central bank would be stuck near zero, and more likely to have to return to unconventional policy in a downturn; it could also force discussion of whether to raise the inflation target in order to try to push the entire rate structure higher. The Fed has been waylaid more than once in its rate hike plans by the state of the global economy, and held steady again on Wednesday in part because of Britain's upcoming vote on whether to leave the European Union. But recent data and Fed discussion of the neutral rate show the more chronic influence that low global rates and weak global growth may exert on the Fed. According to the economic model typically cited by Yellen and others in discussing the neutral rate, conditions are ripe for it to move higher and give the Fed the room it needs to raise rates. That model, developed by San Francisco Federal Reserve Bank President John Williams and the board's Monetary Affairs director Thomas Laubach, estimates that the inflation-adjusted size of the U.S. economy moved beyond its potential nearly two years ago, and that the positive "output gap" has been growing larger. In general a larger output gap would produce a higher estimate of the neutral rate. However, in the time since the economy moved beyond potential in 2014, the model's estimate of the neutral rate has remained below zero in all but the first quarter of this year. BONDS DIP TO NEGATIVE YIELDS As the Fed contemplates when to move next, the dynamics working against it were obvious this week when the yield on Germany's 10-year bond dropped into negative territory, helping keep the spread between it and the U.S. 10-year Treasury note near a euro-era high. That gap in risk-free yields, and the United State's general performance relative to Europe and Japan, has driven the dollar higher, curbed U.S. exports, and may have fed through to the recent hiring slowdown in the U.S. industrial sector - all factors that could help depress the neutral rate. A move higher in U.S. target rates risks reinforcing those trends, likely leading the Fed to feel its way forward until Europe and Japan can also move from the zero lower bound - a day that may be far in the future. "If anywhere along this path international conditions or skittishness become such that the dollar takes off and capital flows disrupt a weak world and all of that affects inflation and job gains, then we will have a real fundamental question for them to resolve," said Jon Faust, a Johns Hopkins University professor and former advisor to the Fed board. "How hard do we push on going it alone?"

-

Fed pares back 2017 interest rate forecasts The Financial Times / June 15, 2016 Slower jobs growth and overseas hazards such as a possible UK exit from the European Union prompted the Federal Reserve to keep rates unchanged on Wednesday and trim back its longer-term interest-rate forecasts, in a sign of greater caution at the central bank. The US central bank held the target range for the federal funds rate at 0.25 per cent to 0.5 per cent, where it has been since the Fed lifted rates by a quarter point from near-zero levels in December, as it assesses a mixed set of economic indicators. The median of Fed forecasts suggests policymakers are still expecting two interest rate increases this year, but rate forecasts for 2017 and 2018 have been pared back, as has the Fed’s estimate of the longer-run policy rate. The tempered interest rate path spurred another rally in US government bonds, despite the slightly higher inflation forecasts. The two-year Treasury yield fell 6 basis points to 0.67 per cent, and the 10-year Treasury yield slipped 3 basis points to 1.58 per cent, on course for its lowest closing level since 2012. The US stock market fluctuated before settling at roughly the same level after the revised forecasts and new statement were digested, while the DXY dollar index fell 0.5 per cent, the most since June 3. In a sign of greater caution on the committee, Esther George, the Kansas City Fed chief, dropped her previous dissenting call for higher rates. Until recently a number of Fed rate-setters have been signalling they want to see another rate rise as soon as this month, but Janet Yellen, the Fed chair, stressed in early June that the Federal Open Market Committee had to weigh a range of uncertainties and risks as it gauged when to move. Among the key question marks hanging over the US outlook is the UK’s referendum on its membership of the EU — with Fed officials flagging the danger that a Brexit could ripple back and hit US growth. When asked whether the looming UK vote had been one of the reasons the US central bank kept rates unchanged on Wednesday, Ms Yellen said: “It is certainly one of the uncertainties we discussed and factored into today’s decision.” A vote by the UK to leave the EU would have consequences for conditions in global markets which would in turn have implications for the US outlook, she added. “That would be a factor in deciding on the appropriate path of policy.” Its statement noted that while economic activity and household spending have picked up recently, jobs gains have diminished and market-based measures of inflation compensation had declined — even as surveys of individuals’ inflation expectations remained little changed. Ms Yellen gave a broadly optimistic outlook about the US economy when she spoke in Philadelphia. But she also withdrew earlier guidance that she expected a rate rise “in the coming months”, suggesting the Fed now is firmly in wait-and-see mode. Futures markets were predicting only a one-in-five chance of a move at the central bank’s next meeting in July going into Wednesday’s announcement, with slightly stronger odds in September. Forecasts released by the Fed showed policymakers expect two rate rises this year, leaving their median prediction for the target range centred on 0.875 per cent. Notably, however, six of the 17 participants in Wednesday’s meeting thought there may only be scope for a single increase this year. In 2017, the median forecast is now for rates to rise to 1.625 per cent, down from 1.875 per cent in March, pointing to three rises. The median projection for 2018 is centred at 2.375 per cent, down from 3 per cent before. Policymakers are now expecting the longer-term fed funds rate to be lower as well, with forecasts pointing to around 3 per cent compared with 3.25 per cent before, as a sluggish growth outlook weighs on forecasts. Officials shaved back their median expectation for growth this year to 2 per cent from 2.2 per cent, and to 2 per cent in 2017 from 2.1 per cent. Core inflation is seen slightly higher this year than previously, at 1.7 per cent, but the Fed still does not see inflation returning to its 2 per cent target until 2018. Unemployment forecasts were little changed, with policymakers seeing the jobless rate at the end of the year at 4.7 per cent, in line with its most recent reading. Debate in the FOMC on Wednesday likely focused heavily on the jobs market, which has lost some of its lustre despite 75 straight months of expanding payrolls. Policymakers would need to see decisive evidence in the coming weeks that dismal jobs numbers in May were a one-off fluke rather than a serious setback — coupled with an end to Brexit jitters in markets — if they were to feel confident enough to lift rates as soon as the Fed’s July meeting. Markets are putting higher odds on a move by the FOMC later in the year. .

-

The Wall Street Journal / June 15, 2016 The Federal Reserve held short-term interest rates steady and officials lowered projections of how much they'll raise them in the coming years, signs that persistently slow economic growth and low inflation are forcing the central bank to rethink how fast it can lift borrowing costs. Wednesday's moves marked a stark reversal from just a few weeks ago, when several Fed officials, including Chairwoman Janet Yellen, dropped strong hints they might raise rates in June or July. Instead, she emphasized the central bank's uncertainty about when they'll act and where rates are headed in 2018 and beyond. "I can't specify a timetable," about when rates will next be raised, she said at a press conference following the Fed's two-day policy meeting. "We are quite uncertain about where rates are heading in the longer term." Those metrics don't add up to a booming economy, but the expected performance is better than that of other large developed markets, including Japan and the European Union, which are struggling with slower growth and lower inflation. The expected growth also marks a steadiness that stands in contrast to China's economic slowdown. The combination of relatively stable economic projections and a lower interest-rate outlook suggests officials are coming to the conclusion that the economy simply can't bear very high interest rates, even to achieve the mediocre growth and low inflation officials have in mind. Ms. Yellen previously said she believed temporary headwinds were holding back the economy. She conceded Wednesday that such drags, such as slow productivity growth, might persist. Moreover, new ones, such as China's slowdown, are emerging. Notably, Ms. Yellen won a unanimous vote on Wednesday's policy statement. Kansas City Fed President Esther George, who dissented in March and April in favor of a rate increase, instead voted with the majority. Fed officials have been weighing whether the economy's equilibrium interest rate—a rate at which the economy is in balance, growing with stable inflation and low unemployment—has fallen because of long-running trends holding back growth and beyond the Fed's control, such as the retirement of older workers and low productivity growth. Paul Willson, chairman of the $550 million-asset Citizens National Bank in Athens, Tenn., worries an increase in interest rates now could knock the economic expansion off course. Mr. Willson likens the Fed's low-rate policy to an aircraft flying low to the ground: With rates so close to zero, the risks of a policy misstep are greater. "We've got enough viable air speed but we don't have much altitude," he said of the U.S. economy. "And that worries me. Any missed input could screw things up." The Dow Jones Industrial Average retreated after the Fed's release, finishing the day down 34.65 points, or 0.2%, at 17640.17 after trading in positive territory leading into the release. Yields on 10-year Treasury notes, which tend to go down when investors become risk-averse or pessimistic about growth, dropped to 1.594%, the lowest level since December 2012. The central bank in December lifted its benchmark federal-funds rate up from near zero to between 0.25% and 0.5%. Officials indicated then they expected to push rates up four times in quarter-percentage-point increments this year to 1.375% at the end of 2016. Instead, their rate target has been unchanged since December and they have cut in half their expectations for rate rises this year. The economy and financial markets haven't cooperated with the Fed's plans. Early in the year, market turbulence and slow economic growth gave officials pause. Growth appears to have picked up and markets have largely settled down, but now hiring and expected inflation are a cause of concern for officials. "Recent economic indicators have been mixed, suggesting our cautious approach to adjusting monetary policy remains appropriate," Ms. Yellen said Wednesday, while noting that observers should not read too much into any one report. The new projections released Wednesday showed officials expect the fed-funds rate to rise to 0.875% by the end of 2016, according to the median projection of 17 officials. That implies they see two quarter-point rate increases this year, as they did in March. However, a greater number of officials now see just one increase, rather than two moves. In March, just one official saw one rate increase this year and seven saw three or more. Now six officials see one increase this year and two see three or more. Ms. Yellen said a rate increase at the Fed's next meeting in July is "not impossible." The tone of the Fed's official statement, its projections and her comments suggest officials would need to see a quick turnaround in economic data and evidence of market resilience if they were to move so soon. "We need to assure ourselves that the underlying momentum in the economy has not diminished," she said. The new projections also show central-bank officials see the fed-funds rate at 1.625% by the end of 2017 and 2.375% at the end of 2018, both lower than their March estimates. In the longer run, Fed officials now expect the benchmark rate to reach 3%, lower than the 3.25% they saw in March. Jeremy Ames, president and co-founder of Guidant Financial in Bellevue, Wash., said Fed officials may still be too optimistic in their projection that short-term rates will rise above 2% in the next couple years. "I think that assumes everything is going well and everything is going swimmingly," said Mr. Ames, whose firm finances small-business startups and acquisitions. "If they hit those time frames, I would be surprised." Traders on the Chicago Mercantile Exchange placed a 7% probability on a Fed rate increase in July and a 23.9% probability on at least one increase by September. Though most Fed officials see at least two quarter-point rate increases before year-end, traders see a 57% probability that it won't. The June 23 U.K. vote on whether to leave the European Union was one factor in Fed officials' decision to leave rates unchanged, and "clearly could have consequences" for economic and global financial markets, Ms. Yellen said. Fed officials last month appeared poised to raise rates in June or July. Ms. Yellen said in late May a move was probable "in the coming months" if the economy continued to strengthen—wording she has not repeated in her two public appearances since the Labor Department released a disappointing May employment report. Employers added just 38,000 jobs last month and payroll growth in April and March was revised lower. The share of Americans participating in the workforce also declined, and the number of employees stuck in part-time jobs rose, the report showed. Still, the number of Americans filing first-time claims for unemployment insurance remains at historically low levels.

-

The Mack remanufacturing center no longer offers E9 heads ?

-

Marios in Northampton has great Philly cheesesteaks and the best pizza around (851 Main street). Bob Dahmer (red C-model 4x2 tractor) lives down the street and would probably agree.

-

PACCAR Australia Pty Ltd Press Release / September 26, 2012 Related reading: http://www.kenworth.com.au/trucks/k200/ http://www.kenworth.com.au/wp-content/uploads/2015/04/K200_web-PDF.pdf .

-

Owner/Driver / June 15, 2016 At the recent Alexandra Truck, Rod and Ute Show Larsen’s Truck Sales’ boss David Larsen rolled up with a rare ‘Smokey and the Bandit’ Kenworth W925 model. Peter and Di Schlenk took the chance to find out how he came by it This year’s running of the Alexandra Truck, Rod and Ute Show, held on June 12, had a host of impressive machinery on display, but none were as striking as a Smokey and the Bandit-themed 1976 Kenworth W925 model with its accompanying Pontiac TransAm. Both vehicles were part of the Larsen’s Truck Sales stand at Alexandra, the 20th running of the event. "It is just something different and it’s eye catching, especially for a show like this," company founder David Larsen explains. Larsen’s Truck Sales, the major sponsor of the Alexandra Truck, Rod and Ute Show, had nine on display, including the W model. David has little knowledge of the old Kenworth’s history. He had purchased it from another truck wholesaler in rust free condition. He then set about doing it up as a replica of the Smokey and the Bandit truck which featured in the 1977 movie. After all, it was of the same vintage, plus the TransAm which appeared in the movie was a ’77 model. "I want to thank those who helped transform the W925," says David, acknowledging the good industry relationships he has built over the years. "The truck was purchased 12 months ago and we have spent in excess of $100,000 on it." The Kenworth has a 335hp Cummins up front, a 15 speed Road Ranger gearbox and six-rod suspension. It’s a well-specced truck and David is hoping that someone will give it a great home. "Andrew Steffenson from Transmatt Truck Detailing was the main organiser who put it all together, while Shane Sluka from Total Diesel Services (TDS) did the mechanical work. "Ray Moyle from Prime Refinishing painted it, so it has been a joint effort by everybody and a good advertisement for us," David explains. TDS went through the truck from front to back, rebuilding what needed to be done, including installing a new clutch. David has had his trucks painted by Prime Refinishing for 23 years, and he has known Andrew 20 years. "I have been friends with these people for a long time," David says. "It’s the same with selling trucks; making sure that you do the right thing. It is a big industry but a very small world." David expected the Smokey and the Bandit W model Kenworth to some attention, but was surprised when it quickly attracted 1300 ‘likes’ on the Larsen’s Truck Sales Facebook page. "It certainly appeals to a lot of different people," David says. "People my age, in our 50s, recognise it and my boys do too. It’s a very iconic truck." Photo gallery - http://www.ownerdriver.com.au/industry-news/1606/rare-smokey-and-the-bandit-kenworth-w925-hits-alexandra/

-

KamAZ Trucks Press Release / June 14, 2016 The truck leasing subsidiary of KamAZ Group is supplying 100 model 5490 tractors to ITECO, one of Russia’s largest freight companies. Painted emerald green, the KamAZ-5490 tractors will be delivered between August and November. All the trucks are equipped with auxiliary heaters and electronic tachographs units featuring CIPF (Cryptographic information protection facilities) modules. This is ITECO’s third truck order with KamAZ-Leasing since 2014, as part of a planned fleet upgrade effort. ITECO took new 50 tractors in 2014, and another 50 units in 2015. According to the program "Recycling + Leasing" - "recycling" using leasing schemes - the customer will receive a discount of 400 thousand rubles for each acquired a truck. The "Trade-in + Leasing" will allow the lessee to take advantage of a discount of 350 thousand rubles for each truck. An additional benefit is advance payment on the program "Grace Leasing", in which the customer saves 10% of the cost of truck Versus the global brands, the KamAZ-5490 remains the best value in Russia’s truck market today. It features a comfortable, spacious and modern cab, and a powerful, fuel-efficient Euro-5 428 horsepower Mercedes-Benz OM457LA powerplant. For more information about KamAZ’s truck leasing programs, click here www.kamazleasing.ru. .

-

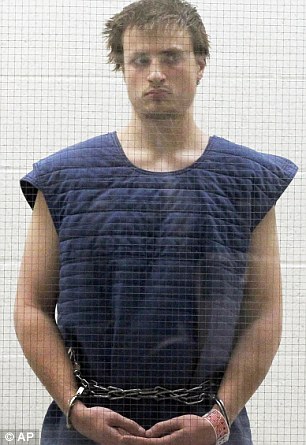

Reuters, AP / June 15, 2016 A 20-year-old Indiana man who was found with guns and explosive chemicals in his car on the way to a California gay pride parade has been formally charged. James Wesley Howell, who was ordered held on $2million bail, faces three felony counts of unlawful possession of an assault weapon, high capacity magazines, and explosives. Howell told police he was headed to the pride festival in Santa Monica around 5am on Sunday, just hours after the Orlando massacre began. Authorities have said there is no apparent link. Howell appeared at the Airport Courthouse in Los Angeles Tuesday, where he pleaded not guilty. In addition to the three felonies, he also faces a misdemeanor for the possession of a firearm in a car. Officers responded to reports of a man knocking on a window and found Howell sitting in his white Acura on Sunday morning. Howell was found with a high-capacity assault rifle, two other loaded rifles, magazines, a Taser, buck knife, handcuffs and security badge in his car when he was arrested. There was also a five-gallon container of gasoline in the white Acura, and a 25-gallon container of a commercially sold explosive was two-thirds full. The explosive, composed of two chemicals, had already been combined, and the assault rifle was loaded with a 30-round magazine, which had another inverted 30-round magazine taped to it. Deputy District Attorney Sean Carney said gun enthusiasts don't mix Shoc-Shot until it's ready to be used, as federal regulations require, and the amount that Howell had 'far exceeds any amount that would reasonably be used.' Alone, each item found in Howell's car might not indicate anything sinister, Los Angeles County Superior Court Judge Keith Schwartz said. But together, they 'just don't pass the common sense test.' 'I cannot in good conscience think of any reasonable reason that somebody would be traveling across the country with all of these things,' he said. Howell recently drove from Indiana to Los Angeles because of pending charges against him in his home state. Friends in Indiana described Howell as a gun enthusiast with a short temper. In October, he twice was accused of pulling a gun and making threats, once against his then-boyfriend and once against a neighbor. Howell was convicted in April of misdemeanor intimidation for the incident with his neighbor. Under the terms of his probation, Howell was not allowed to have weapons or leave Indiana. Howell’s attorney said a black hood found in his car was 'just a clothing item,' and nothing indicated Howell planned to use it as a mask, as police contended was a possibility. James Wedick, a former longtime FBI agent, said the manipulation of the gun magazines would allow someone to reload 30 rounds in less than 2 seconds. 'It doubles your killing capacity by 100 percent,' he said. For a civilian to have a weapon rigged as such, 'it suggests his purposes are deadly.' The FBI took the lead in the investigation and its probe continues. Federal agents searched Howell's Jeffersonville, Indiana, home Monday. On Tuesday, the sheriff's office in Clark County, Indiana, said Howell also is the subject of a sexual assault investigation. The alleged incident occurred May 31, about two weeks before Howell's arrest in California. Howell can face a sentence up to nine years and four months if found guilty on all charges. .

-

Associated Press / June 15, 2016 The top Democrat on the House Intelligence Committee says he wants to explore the potential for a system that would trigger an alert when someone who was previously on a terrorism watch list wants to buy a gun. Rep. Adam Schiff of California says an alert would allow law enforcement officials to consider anew whether an investigation ought to be reopened to determine whether the person who had expressed "radical thoughts is at the point of taking those into action." ------------------------------------------------------------------------------------------------------------------------ What's to "explore"? What's to debate? Make the change, effective immediately. An alert should have been standard protocol for decades, if not since 911.

-

I've always liked air starters. They've long been popular in Australia. AuStart offers an air starter for nearly every engine, including old Mack and Buda. http://austart.com/product-catalogue IR: http://www.ingersollrandproducts.com/am-en/products/air-starters/turbine-starters/150t-f-series http://www.ingersollrandproducts.com/am-en/products/air-starters/vane-starters/150bm-series

BigMackTrucks.com

BigMackTrucks.com is a support forum for antique, classic and modern Mack Trucks! The forum is owned and maintained by Watt's Truck Center, Inc. an independent, full service Mack dealer. The forums are not affiliated with Mack Trucks, Inc.

Our Vendors and Advertisers

Thank you for your support!

.jpg.2fe2e9b86508d9297f5c58565330bf18.jpg)

.jpg.5eab6e3f1e488349ff0c1b6c790ca1b3.jpg)

.jpg.845e13e58e63e5b753d26e2a5e8da664.jpg)

.jpg.a20ae4a54e447fbe6ee25a15ef304c6a.jpg)