kscarbel2

Moderator-

Posts

19,100 -

Joined

-

Days Won

114

Content Type

Profiles

Forums

Gallery

Events

Blogs

BMT Wiki

Collections

Store

Everything posted by kscarbel2

-

FTA calls for postponement of French minimum wage rule

kscarbel2 replied to kscarbel2's topic in Trucking News

BC, on another note, it's tragic what happened to MP Jo Cox. Though mankind has demonstrated a learned ability to evolve its inventions from crudely functioning implements into state-of-the-art devices, mankind has NOT demonstrated an ability to evolve itself forward and eradicate violence. Still seemingly trying to annihilate itself, mankind refuses to learn a lesson from thousands of years of wars and violence. -

Mack (Volvo I-See) Predictive Cruise Control

kscarbel2 replied to kscarbel2's topic in Trucking News

Volvo I-See is an imitation of Scania’s "Ecocruise" technology introduced in 2008, "Active Prediction" in 2011, and "Eco-roll in 2013". (Imitation......is the sincerest form of flattery) . http://www.scania.com/global/trucks/main-components/transmissions/transmission-technology/scania-ecocruise/ https://www.scania.com/global/trucks/safety-driver-support/driver-support-systems/active-prediction/ http://www.scania.com/group/en/using-gravity-and-eco-roll-to-lower-fuel-use/ . -

Mack (Volvo I-See) Predictive Cruise Control

kscarbel2 replied to kscarbel2's topic in Trucking News

-

-

Fleet Owner / June 16, 2016 Mack Truck announced an expansion of its fleet management services with the addition of Omnitracs Integrated Telematics (http://www.omnitracs.com/). The factory-installed Omnitracs telematics hardware can boost productivity and safety by providing real-time GPS location information, as well as driver performance data. Mack’s parent company, Volvo Trucks North America, is also launching the availability of Omnitracs Integrated Telematics in Volvo Trucks, a new option for fleet management built on Volvo’s fully integrated Remote Diagnostics hardware. “Omnitracs meets the needs of customers seeking better data capture and analytics to drive increased productivity and safety through improvements in driver performance and behaviors,” Volvo said. “Omnitracs Integrated Telematics gives our customers a new look into their operations, enabling them to more easily see where and how their truck assets are being utilized,” said David Pardue, Mack vice president of connected vehicle & uptime services. “Applying that knowledge helps increase productivity, while also improving the safety of their drivers.” Omnitracs Integrated Telematics uses Mack’s fully integrated GuardDog Connect telematics hardware to capture and relay information such as relative road speed and idling duration and cost. In addition, the system is capable of providing analyses of driver performance based on the data and GPS information captured from the truck. Real-time email or text messages can alert customers to potential issues. “With no additional hardware required, Omnitracs Integrated Telematics provides detailed fleet management data without the need to add to or modify equipment,” said Rich Glasmann, vice president of OEM strategy, sales, and marketing at Omnitracs. “This allows customers to gain even greater value from their existing hardware through data analytics.” Omnitracs Integrated Telematics subscriptions are available for all new Mack Pinnacle, Granite, TerraPro and Titan by Mack models. “Omnitracs combines the vast fleet management knowledge of Omnitracs, LLC with Volvo Remote Diagnostics hardware to unlock productivity and visibility advantages gained from data analytics,” said Conal Deedy, director of connected vehicle services at Volvo Trucks. “It also enables customers to focus on improving road safety by monitoring driver behavior and performance.” Omnitracs for Volvo Trucks captures information such as GPS location, road speed and idle duration and cost. The system can also provide an in-depth analysis of driver performance based on historical and current data and location. In addition, customers can configure real-time text message or email-based alerts for a detailed summary and exception reporting. “Unlike alternative offers, Omnitracs is fully integrated with Volvo’s hardware and requires no additional equipment,” Glasmann said. “This gives fleets direct insight into their operations, allowing them to more efficiently monitor trucks and promote safe driving behaviors among drivers.” Omnitracs is now available as a subscription option on every new Volvo truck and can also be retrofitted on older trucks equipped with telematics hardware.

-

Fed eyes lasting impediments to growth after rethink on outlook The Financial Times / June 16, 2016 Earlier this month, Janet Yellen, the Federal Reserve chair, struck a broadly positive tone about the US economy. The big picture, she declared in a speech in Philadelphia, was “largely favourable” for an economy that had registered impressive gains since the Great Recession. Forecasts by the Fed on Wednesday tell a more sombre story. While policymakers left their predictions for economic growth and inflation largely unchanged, they now believe that the central bank will have to keep rates even lower to sustain that outlook. What was already set to be the Fed’s shallowest rate-lifting cycle in modern times now looks even more glacial. The reason is that Fed officials have been rethinking the longer-term outlook for the US economy — and drawing some gloomy conclusions. The Fed chair has for much of her tenure been predicting that the post-crisis “headwinds” that are holding the economy back are likely to prove fleeting. On Wednesday, however, she suggested that the economic depressants weighing on US growth and inflation could prove more stubborn than the central bank previously believed. As a result, the so-called “neutral” rate of interest that is needed to keep the economy growing roughly at its trend rate and operating near full employment could stay stunted for a long time. The words helped explain why Fed officials scythed back their interest rate forecasts beyond the current year, with their median prediction for the federal funds rate’s target range falling sharply in 2018 from 3 per cent to 2.375 per cent. The Fed’s median estimate for the longer-run rate now stands at 3 per cent, a full point below where its estimate stood three years ago. Roberto Perli, an economist at Cornerstone Macro, argues Fed estimates for the longer-run target rate may need to be cut further, to as low as 2 per cent. What is leading to the reassessment? A series of long-lasting and persistent factors may be holding down the longer-run neutral rate. The ageing of America’s population is leading to slow labour force growth as well as sluggish rates of household formation, for instance. Crucially, productivity growth is worryingly listless. Analysis from the Conference Board suggests that the US will this year see negative productivity growth for the first time since the early 1980s, a toxic situation that could hamper income growth. The Organisation for Economic Co-operation and Development on Thursday shed light on some of the deep-seated problems driving this story. The Paris-based organisation struck a broadly optimistic tone about the US recovery, pointing out in a survey that output has surpassed its pre-crisis peak by 10 per cent, far outperforming the euro area and Japan, while unemployment is down sharply and the government’s fiscal position is on a better footing. However, productivity growth has been torpid even in so-called frontier firms in industries such as information technology and pharmaceuticals. Part of the problem is a failure of companies to invest, preferring instead to funnel out higher dividends and engage in share buybacks. Lower levels of business start-ups, plus growing market power for industry leaders that is restraining competition, may also be operating as barriers to productivity growth. “Productivity growth has been sluggish since the Great Recession and had been slowing before it. This slowdown has touched nearly every industry,” the report concluded. Lasting impediments to US growth are likely to weigh on the Fed’s policy outlook, perhaps even more than the central bank’s policymakers currently believe. The grimmer outlook suggests that the so-called secular stagnation thesis of lethargic growth and suppressed interest rates espoused by economists, including former Treasury Secretary Larry Summers, may well be gaining currency. “All of us are involved in a process of constantly re-evaluating, where is that neutral rate going,” acknowledged Ms Yellen. “And I think what you see is a downward shift in that assessment over time. The sense that maybe more of what’s causing this neutral rate to be low are factors that are not going to be rapidly disappearing but will be part of the new normal.” Lewis Alexander, chief US economist at Nomura, said: “We believe that persistent structural factors — in effect ‘secular stagnation’ — are more likely to be the core reasons for the depressed level of the neutral rate. Therefore, we doubt the FOMC will be able to raise rates as far as it currently expects.” Ms Yellen remained eager on Wednesday to drive home the message that the economy and inflation will grow enough to merit further rate increases. A second rise in short-term interest rates could come as soon as next month, she insisted, although her language suggested that this is something of a long shot. But more Fed policymakers seem to coming around to the view that has long prevailed in financial markets: that increases in the fed funds rate will be languid at best. .

-

You're exactly right.

-

New Kenworth T680 brochure has "latest, comprehensive" info

kscarbel2 replied to kscarbel2's topic in Trucking News

That's another big issue I have with Paccar. Why ARE they afraid to use real photos? Photoshop photographs do nothing for anyone. Like the toy truck design theme, PS pictures look ridiculous. -

Here's a selection.....473s seem to be rare. https://www.google.com/search?q=willys+pickup&newwindow=1&biw=1280&bih=882&tbm=isch&tbo=u&source=univ&sa=X&sqi=2&ved=0ahUKEwiKvfvQ0azNAhVMHGMKHSzNCqMQsAQIGw Since you're independently wealthy, I imagine you'll simply pay these folks to restore it for you so as not to take time away from your golfing..................http://willysamerica.com/restorations/trucks/index.html http://midwestjeepwillys.com/truck-wagon-parts.html

-

Boy, I haven't thought about these in a while. I assume this is a 475 (1953-1965) with an F-head?(4-cyl), but the 3 horizontal chrome grille bars are missing. The 4T (1947-1950) had a flat grille the the MB and CJs. 473s (1950-1952) are rare (with 5 horizonal grille bars), only built a couple years.

-

The North American-style axle-forward Scania COEs

kscarbel2 replied to kscarbel2's topic in Other Truck Makes

Paul, I perhaps should have posted it here with the other MCR info...................http://www.bigmacktrucks.com/topic/30466-when-mack-roamed-europe-the-middle-east-africa-and-western-asia/?page=3#comment-179932 -

The North American-style axle-forward Scania COEs

kscarbel2 replied to kscarbel2's topic in Other Truck Makes

Worth noting, a nice New Zealand MCR tractor with at 44 rears. Note the RHD instrument panel is altogether different, not the exact opposite if the LHD version. New Zealand got special builds, including their unique RB, a glossed over example of the 1978 Brockway 760 "Super-Liner" prototype (ahead of the MCR, Mack Australia got the MIR model, which used the former Brockway N527 "Huskiteer" cab ). . -

The North American-style axle-forward Scania COEs

kscarbel2 replied to kscarbel2's topic in Other Truck Makes

-

June 16, 2016 A congressman had to lead a 14 hour filibuster to 2:11am in the morning to get his colleagues to agree to hold a vote on an amendment to expand background checks and ban gun sales to suspected terrorists. https://www.theguardian.com/us-news/2016/jun/16/enough-senate-filibuster-ends-as-democrat-claims-gun-control-victory

-

A Mack was a custom-built truck. Fuel tank size was specified by the customer. Typical of DM690S...................... Available left side options were 50, 65 or 80 gal rectangular. A right-side rectangular 40 gal was an option as well. Round tanks were a special order option. Your fuel tank should have an identification plate stating: 1. The fuel tank's Mack "2MB" part number 2. The tank's date of manufacture 3. The tank's overall capacity 4. The tank's usable capacity

-

New Kenworth T680 brochure has "latest, comprehensive" info

kscarbel2 replied to kscarbel2's topic in Trucking News

Paul, I completely agree with you. The North American market Kenworth T680 and Peterbilt Model 579, which share a cab, look like a couple of plastic toys. I despise their droopy nose styling theme. Now as we all know, it's the performance that counts. However, when one can blend form with function, then you've got something. An attractive looking truck can be a valuable sales tool (free advertising), and also help immensely in driver retention (a truck that driver's want to get behind the wheel of). I don't like the new cheaper-for-Paccar shared cab. I've been all over it at the plant......it's cheap. They're making more profit, but the customer's purchase price didn't fall. Note how truckmakers are promoting hideous* looking trucks in the US, and yet the same truckmakers are selling attractive looking trucks in Australia. Yes, the American market requires cutting edge aerodynamics to reduce emissions and fuel costs, but those purpose-designed trucks can still look attractive. * http://www.westernstartrucks.com/Trucks/5700/default.aspx versus https://westernstar.com.au/western-star-5800-ss/ https://westernstar.com.au/western-star-4800-fxb/ https://westernstar.com.au/western-star-4900-fxc/ -

The North American-style axle-forward Scania COEs

kscarbel2 replied to kscarbel2's topic in Other Truck Makes

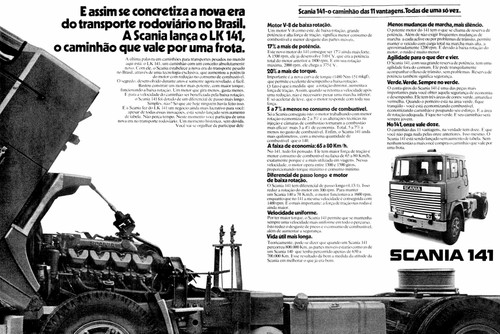

How long to Scania LKs last? Nobody knows. None have ever worn out. Though the last one was produced in 1981, these 14.2-liter Scania DS14 V8-powered example demonstrates their durability. Once you become accustomed to all that V8 power, anything else is........less. Ask BC Mack about his experience with the DS14 V8 in a Scania 141 (if his pills are nearby). . -

The North American-style axle-forward Scania COEs

kscarbel2 replied to kscarbel2's topic in Other Truck Makes

There pictures will surprise many. This is one of a fleet of axle-forward Scania 2-Series conventionals, operated by British Petroleum in New Zealand. Looks like an American "west coast" truck with the steer tires just behind the bumper, Scania Model T112MC (New Zealand spec) Lightweight chassis / Set-forward steer axle Engine Model 11-litre 333 horsepower DSC11-01 Transmission Scania 10-speed GR871 Production 1985-1986 Wheelbase 4,790mm (188.6 inches) Tires 11R22.5 GCW 48,000kg (105,822lb) . -

The North American-style axle-forward Scania COEs

kscarbel2 replied to kscarbel2's topic in Other Truck Makes

Of course Scania wasn’t the only truckmaker to sell axle-forward versions of European COEs in Australia. In 1997, Western Star introduced an axle-forward version of ERF’s superb EC Series, dubbed the Commander 7564. Many were sold in Australia and New Zealand. . -

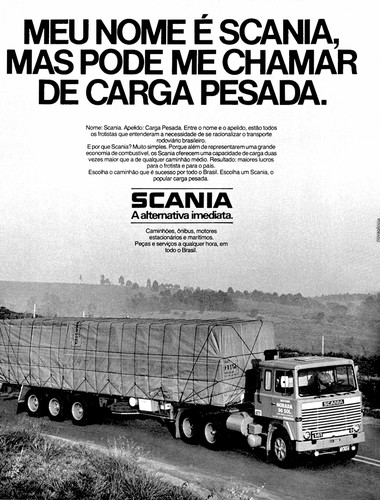

Although most Scania COEs have a European-style "axle-back" steer configuration (like the popular Mack FM), the Swedish truckmaker had in the past produced North American-style axle-forward steer COEs. Below is a photo a 1-Series in Australia. Designated model "LK", 3,833 were sold in Brazil from 1975 to 1981, and 686 were delivered to Australian customers during the 1976-1981 period. The steer axle was relocated forward 415mm (16.34 inches). I humbly feel the set-forward position makes for a nice looking truck. .

-

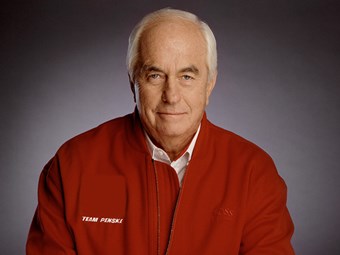

Steve Brooks, Owner/Driver / June 16, 2016 In his first interview in three years, Roger Penske exclusively talks to Steve Brooks about his history, the Penske brands, Detroit Diesel, the Australian market, and everything in-between Automotive industry mogul and car racing icon Roger Penske insists he has a long-term strategy to forge a significant stake in the Australian and New Zealand truck and diesel engine markets. In his first and only interview since taking control in 2013 of Transpacific’s commercial vehicle group comprising Western Star, MAN and Dennis Eagle brands for a reported $219 million, and soon after acquiring the MTU Detroit Diesel Australia engine business, Penske says his main goal for now is to achieve a 10 percent stake of the Australian heavy-duty truck industry. Renaming the businesses Penske Commercial Vehicles and Penske Power Systems respectively, he concedes the past two years have been difficult, particularly for the flagship Western Star brand with fiercely competitive pricing cited as the major reason for a considerable slide in sales. It is, however, an emphatic Penske who says, "This is a long-term investment. Not everybody wants to get into this business and for me it’s about building a team of responsible, qualified people. What we need to do is train and build the best team and if we do that, we’ll be a winner. "I feel really good about it. I like the country, I like the people and to me it’s an extension of what we already do. "We have a truck fleet in the US of around 230,000 vehicles, so a few more out here just adds on to that." Viewed by some industry executives as the man with the Midas touch, and with personal wealth estimated at several billion dollars, the 79-year-old Penske remains a dynamic businessman and automotive entrepreneur with a sharp eye for opportunity and potential. Perhaps Penske’s greatest success came when he took control of Detroit Diesel from General Motors in the US in the late 1980s. Recognising the incredible potential of the then newly developed Series 60 engine, he took Detroit Diesel to the top of the North American heavy-duty diesel engine business before selling the entire operation to Daimler. As the chairman of Penske Automotive Group, he controls an operation which around the time of the purchase of Transpacific’s commercial vehicle operation had almost 350 retail automotive franchises representing 39 different brands, with the group selling more than 402,000 vehicles (cars and trucks) and generating revenues of US$13.2 billion. His commercial vehicle interests include ownership of Penske Truck Leasing which operates more than 230,000 vehicles servicing customers in North America, South America, Europe and Asia, and is one of the largest purchasers of commercial trucks in North America. Many of those vehicles are Daimler products and his ties with the German giant remain strong. In the Australian and New Zealand markets, he makes no secret of an intention to expand his current Penske Truck Rental operation and, similarly, grow the truck leasing business. "We are totally committed to this market," he asserts. Despite considerable speculation, Penske denies that his ultimate goal is to take control of Freightliner in Australia. "We are the number-one customer in the US for Freightliner and we wanted to grow the commercial vehicle side of our business, so a couple of years ago Daimler contacted me and said this business might be available," he says. "I had some idea of Transpacific and the (commercial vehicle) business looked like something that fitted our plans over the longer term. "And quiet honestly, I like this marketplace, I knew a lot of the customers, so it was a perfect fit. "Then, as part of our plan here, we had the opportunity to get Detroit Diesel," he continues. "Combined with the MTU engine business, it gave us a thousand people and probably a 500 to 600 million dollar business operating in marine, defence, on-highway and off-highway, power generation, and it really fits our plan, particularly in service and parts. "When I look at our business, 30 per cent of our revenue generates 70 or 80 per cent of our gross margin and that comes from service and parts. "So when you put it all together, I wouldn’t trade it with anybody. Not at all," a determined Roger Penske concludes. .

BigMackTrucks.com

BigMackTrucks.com is a support forum for antique, classic and modern Mack Trucks! The forum is owned and maintained by Watt's Truck Center, Inc. an independent, full service Mack dealer. The forums are not affiliated with Mack Trucks, Inc.

Our Vendors and Advertisers

Thank you for your support!

.thumb.jpg.12b8f50f84866f8bc8ce0907e2d93a70.jpg)

.thumb.jpg.ecd931f994bc8e38f9b54eab0866a528.jpg)

.jpg.af3b7b3bba58aad077c4ead73c681266.jpg)

.jpg.85a6286b742f7c1c8ffc254344f0aef6.jpg)

.jpg.2c2cdb2661bcdb8b9b4699c111a45ae8.jpg)

.jpg.333f54ef312018f6f32a5c433bd0800a.jpg)