kscarbel2

Moderator-

Posts

18,550 -

Joined

-

Days Won

112

Content Type

Profiles

Forums

Gallery

Events

Blogs

BMT Wiki

Collections

Store

Everything posted by kscarbel2

-

Owner/Driver / January 6, 2016 The Freightliner Racing transporter joins the Burrumbuttock Hay Runners convoy. Freightliner Racing transporter driver Paul ‘Stax’ Eddy has swapped his regular load of two V8 Supercars and race equipment for 32 bales of donated hay. Eddy is using the Freightliner Argosy prime mover, still decked out in its 2015 race team livery, to take part in the Burrumbuttock Hay Runners convoy that is delivering hay to drought-stricken farmers in Queensland. Eddy is traveling from the team’s headquarters in Albury to join as many as 120 other drivers at Darlington Point, south of Griffith in New South Wales. The convoy, departing on January 7, will travel to Ilfracombe, near Longreach in central western Queensland, a one way trip of some 1,850km. This convoy, organised by fourth-generation NSW farmer, Brendan Farrell, is the 10th to get underway since February 2014. Those interested in donating to help cover the hefty fuel bill, some $2,000 per truck, can visit the Burrumbuttock Hay Runners page on Facebook for details. Eddy was thrilled to be able to give up some of his off-season holiday and take part in the drought assistance drive. "The farmers are really doing it tough up there," Eddy says. "They have had no rain for so long that they could really do with a little help." Once Eddy returns from hay run, the Argosy prime mover will be fitted out with its 2016 Freightliner Racing livery in preparation for the new season that begins with the Clipsal 500 at Adelaide on March 3. .

-

(HIno) Dakar Rally 2016 Kicks Off in Buenos Aires

kscarbel2 replied to kscarbel2's topic in Trucking News

Trucks Complete Shortened SS with Composure Hino Trucks Press Release / January 5, 2016 Under torrential rain, the team carries out inspections and servicing at the bivouac in preparation for the marathon stage. January 5: On this day again, the SS between Termas de Río Hondo and San Salvador Jujuy―which was originally scheduled to be 314km long―was shortened to 190km due to inclement weather. However, the course was blocked due to an accident in the Cars category which was racing ahead of the trucks, and organizers were forced to cut short the Trucks category's SS at CP3 (check point 3). HINO TEAM SUGAWARA's Car 2 piloted by Teruhito Sugawara and Hiroyuki Sugiura delivered a stellar performance, finishing at 15th overall in the Trucks category and top in the Under 10-litre Class. Car 1 also finished in good form at 48th overall and 4th in its class. The day's SS was similar to yesterday's and primarily consisted of winding gravel roads along the foothills. Road surfaces in some areas were extremely slippery due to rain. This day again, HINO TEAM SUGAWARA's two HINO500 Series trucks delivered excellent performance. Car 2 finished at 20th place overall, and was bumped up to 15th place for the SS after accounting for all penalties accrued over the previous days. Car 1 finished at 49th and was similarly bumped up to 48th place. After the SS, both HINO500 Series trucks traveled a 302km liaison segment to reach the bivouac in Jujuy near the Argentine-Bolivian border. At the bivouac, both trucks underwent extensive inspections and servicing in preparation for the marathon stages that will be starting on January 6. The trucks will compete on a loop course starting out of Jujuy on January 6, and when they arrive at the bivouac at the end of the day, they will be moved to a storage area where no servicing work will be allowed. For this reason, the team has decided to replace all parts that require periodic replacement ahead of time. As drenched as they were from the thundershower that began late in the afternoon, Hino team mechanics were seen coolly carrying out their jobs. Yoshimasa Sugawara: The road surfaces were muddy and there were a lot of slippery areas. So I drove very cautiously. The rain came down so hard on the last liaison that it was difficult to see where we were going at times. I'm relieved that we were able to finish without any incident. Mitsugu Takahashi: We were told that the course was blocked at some point past CP3 and organizers decided to cut the competition short for the Trucks category at CP3. In the end, what was originally scheduled to be a 314km SS was cut down to a mere 130km. Teruhito Sugawara: Today's stage was similar to yesterday's. Today again, I was impressed with the improvement of our truck's performance that came from the engine's greater torque. We will be climbing up to elevations in the 4000m range tomorrow, but we will be fine as we have driven in that area every year. Hiroyuki Sugiura: Navigation itself was not that difficult today, but the speed limit signs posted at villages that we had to drive through were complicated and made things quite difficult. We had to be very cautious as we could have been penalized for simply being wrong with our timing. Photo gallery - http://www.hino-global.com/dakar/latest_news/PD16-14.html -

Dakar 2016: Team Petronas De Rooy Iveco aims for victory

kscarbel2 replied to kscarbel2's topic in Trucking News

-

Fleet Owner / January 6, 2016 Backwards compatibility of the two PC-11 blends is still a big unknown, but Chevron’s resident expert expects that to be worked out over the next six months. With the first licensing date for the new PC-11 truck engine oil standard less than a year away – officially Dec. 1, 2016 – an “all hands on deck” effort is shaping up in the words of Shawn Whitacre, senior staff engineer of engine oil technology at Chevron Lubricants, to square away key specification details, such as “backwards compatibility.” “There’s recognition, as a practicality, to have some backward compatibility, but how far back? To 2010 [model] engines? We honestly don’t know yet,” he told Fleet Owner. “No OEM has formally approved backward compatibility yet, but that should become somewhat clearer over the next six months.” Whitacre, who also serves as chairman of the ASTM [American Society for Testing and Materials] heavy-duty engine oil classification panel tasked with the final development of PC-11 oil requirements, stressed that only one of the two PC-11 blends being developed – CK-4 – will be backwards compatible in that “formal “sense. “CK-4 will be able to claim compatibility with older 15W-40 specifications in terms of viscosity,” he explained. The question is to what extent OEMs will allow the new lower viscosity CK-4 oil – a 10W-30 blend – to be used. “The rule of thumb is that most 2010 engines and up should allow for it,” Whitacre noted. “But pre-2010 engines will only allow for a much smaller substrate of that oil to be used.” He added that CK-4 builds on the prior CJ-4 category, offering improved oxidation stability but in the same viscosity grades end users are used to today. Thus he expects CK-4 oils to be approved for use in many of the same engines and applications that currently recommend CJ-4. The second PC-11 oil blend, however – FA-4 – is of a thinner viscosity than CK-4 and won’t be as backwards compatible. “FA-4 will be at a lower viscosity level than today’s oils, offering more optimized fuel economy for engines that are designed to use these thinner oils,” Whitacre noted. “Like with other low viscosity oils, we don’t expect that engine makers will allow these oils across the board.” He said it seems that OEMs are still working on their own engine test programs at this point to determine to what extent the new FA-4 oils can be recommended – if at all. “This is something that we’ll be watching closely in the coming months, as these positions become clearer,” Whitacre pointed out. “You must understand it’s not just about the thinness of the oil. Engine components themselves are being redesigned as well; part of this effort to gain more fuel economy,” he added, as such fuel economy improvements are being dictated by Phase II greenhouse gas (GHG) emission rules promulgated by the Environmental Protection Agency (EPA) and the National Highway Traffic Safety Administration (NHTSA) in June of last year. “Fuel economy is partly dictated by the internal friction of engine components and the energy needed to push oil around within it,” Whitacre said. Thus by lower the viscosity of the oil – making it “thinner” – reduces internal engine friction and lessens the amount of energy it needs to operate, resulting in fuel savings, he emphasized. Whitacre stressed, however, that the protective properties of the oil are not lessened by moving to a thinner viscosity. Yet engines do need to be designed to operate with such thinner oils – especially the FA-4 blend – which is why the new PC-11 oils may not meet all the lubricant specs established for some older engine models. A few other items Whitacre mentioned as the development of PC-11 oils enters its final stage: - The American Petroleum Institute (API) will allow oils to be marketed with CK-4 or FA-4 “in the donut” starting on December 1, 2016. - Now that the “rules of the game” are officially established, the lubrication industry effectively goes into a commercialization phase for CK-4 and FA-4. “This is when oil companies and our additive suppliers complete the final engine and bench test programs to evaluate the new oils against these more stringent requirements,” he said. - Once the new “recipes” for CK-4 and FA-4 blends are finalized, lubricant production facilities will prepare to make the new products. “We’ll work on necessary revisions to product packaging and sales support materials, and other safety and regulatory compliance aspects associated with introducing a new product,” he noted. - Both PC-11 oils will be formulated to be more resistant to oxidation, meaning that they can stand up to elevated temperature for longer periods of time without breaking down. “This is something that engine makers identified as a priority because of the greater demands that new engines are placing on the oil and because engine makers continue to push for longer oil change intervals,” Whitacre explained.

-

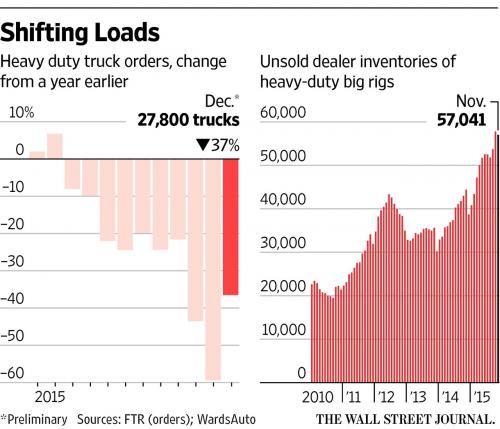

The Wall Street Journal / January 6, 2016 Lackluster demand for hauling freight curbs big-rig purchases; dealer inventories are bulging Trucking companies are buying fewer vehicles amid lackluster demand for hauling freight, triggering job cuts among equipment manufacturers and leaving a near-record number of big rigs gathering dust on dealers’ lots. Many of those unsold trucks were ordered months ago when the economy appeared to be heating up and carriers were expecting higher bookings from retailers and manufacturers. Instead, slower growth this fall spooked fleet owners into scotching expansion plans. Heavy-duty truck orders plunged nearly 37% in December from the same month last year, according to data compiled by industry research firm FTR. Some carriers say they are waiting to see how much consumers spend over the holidays before committing to new vehicles, which can cost more than $150,000 each. The sharp slowdown in truck orders is one of the clouds hanging over the economy heading into 2016. Trucking companies are holding back to see whether consumer demand pushes new expansion. That hesitancy has manufacturers of trucks and parts cutting payrolls and scaling back production, even as sales of passenger vehicles soar and the wider economy is adding jobs. Daimler this week revealed it would cut about a third of its 3,100 workers at a Cleveland, N.C., Freightliner truck assembly factory. Rivals Volvo and Paccar recently disclosed workforce reductions at their U.S. factories. Navistar International reduced its staff by 1,400 in its fiscal year ended in October. Engine maker Cummins said in October it would cut 2,000 jobs world-wide. Meanwhile, dealers are stuck with over 57,000 unsold trucks, according to data provider Wards Auto Group, a number last surpassed in 2006. To entice reluctant buyers, some are offering cash rebates and no money down—incentives normally rolled out during a recession. “It is a buyer’s market,” said Eric Jorgensen, chief executive of JX Enterprises Inc., which runs 19 truck dealerships in the Midwest. “We went from a situation where there seemed to be a shortage of equipment to one where there is more equipment on the road than what’s needed.” Mr. Jorgensen, who also heads trade group American Truck Dealers (ATD), said his dealerships have 150 unsold new trucks, up from under 40 a year ago. He is allowing new customers to defer their first payment until March and offers a $2,500 rebate for parts and service. He last offered such incentives in the downturns of 2001 and 2009, and briefly in 2013. Smaller trucking companies are most reluctant about placing orders, said John Hopkins, chief executive of Truck Center Inc., which operates seven dealerships in the Midwest and is acquiring two more. Some larger companies are scaling back as well. Swift Transportation Inc., the largest U.S. truckload carrier, in October said it would stop expanding its fleet, after growing by about 5% in the previous year. Odyssey Logistics & Technology Corp., which operates a fleet of more than 300 trucks, ordered between 70 and 80 trucks this year but expects to buy half as many next year, said Glenn Riggs, the company’s senior vice president of corporate logistics operations and strategy. Odyssey took advantage of strong customer demand to replace its older vehicles with new, more fuel-efficient models. But with freight volumes down and fuel about 30% cheaper than it was a year ago, there isn’t as compelling a reason to plow so much money into upgrading its fleet, Mr. Riggs said. “We got caught up and now we’re looking to go back to normal” when it comes to ordering new trucks, he said. Dealers, manufacturers and analysts are anticipating a between 10% and 15% drop in sales compared with this year. FTR predicts 260,000 new U.S. truck sales in 2016, said Don Ake, commercial vehicles analyst the research group. Three months ago, FTR had projected sales of 290,000 trucks for the year. In part, carriers have less incentive to upgrade to more fuel-efficient trucks now that diesel prices have plunged. Companies that placed large orders for new trucks last year sold their older models into the used market. That depresses resale prices, a factor in trucking companies’ decision to trade in. Truck makers say retail sales during the holidays will be crucial. Stores held unusually high inventories for much of 2015, a major factor behind this fall’s weak freight volumes. Truck orders picked up in December from November’s lows, indicating the market may be stabilizing, Mr. Ake said. “Our safety net is the macro economy,” said Dennis Slagle, president of Volvo Group Trucks North America, which markets vehicles under the Volvo and Mack brands. “If you believe in 2% or 2.5% growth next year, that means a lot of trucks running around.” In December, Volvo reported North American heavy-duty truck sales fell 2% in November from a year earlier to 4,970. For the year, its sales were up 14%. Navistar reported a 20% decline in heavy-duty truck sales in North America in its fiscal quarter ended in October. Volvo Group executive vice president for Trucks Sales & Marketing Americas’ Dennis Slagle said he expected the industry would need three to six months to work through inventories of unsold trucks before bouncing back. When that recovery comes, however, it is likely to be fast, analysts say. Truck makers will need several weeks to train new workers before they can raise production, meaning distribution channels for trucking customers could get backed up while order backlogs quickly swell if freight demand picks up. “You can’t double production in a day,” said Jeff Sass, senior vice president of North America truck sales and marketing at Navistar. .

-

The Wall Street Journal / January 6, 2016 Strong growth in tractor orders from November suggests stability in fleet planning after a steep downturn Heavy-duty truck orders rebounded in December, in a sign the freight market may be stabilizing after hitting a rough patch last fall, analysts with FTR said Wednesday. Trucking companies ordered 27,800 big rigs last month, a 70% increase from November, when orders plunged to multiyear lows for that month. December orders were still about 37% lower than they were a year earlier, the freight industry research group said. Many carriers spent heavily to expand and upgrade their fleets starting in late 2014, anticipating strong customer demand as the economy expanded. But when freight volumes fell below forecasts in recent months, some of those new trucks sat idle. That led to a steep decline in new truck orders, with companies holding off on buying new vehicles until they had a clearer view of future demand. December’s relatively strong orders for new Class 8 rigs, as the biggest trucks are called, indicate trucking companies are returning to historic norms when it comes to investing in their fleets, said Don Ake, an FTR analyst. “For first time in a long time we are coming back into a rational, reasonable market,” Mr. Ake said. However, orders are unlikely to return to the highs reached in late 2014 and early 2015, analysts say. All the major truck manufacturers have announced layoffs, suggesting plans to reduce production. Daimler AG , which owns Freightliner, the top North American brand by sales, said this week it planned to cut jobs at a plant in North Carolina. Stifel, an investment bank, predicts 250,000 truck orders in 2016, down 24% from last year. “We view the rebound in orders as a reassuring signal that production should not fall off a cliff … but do not believe the orders indicate that the industry will soon be off to the races again,” Stifel analysts wrote in a research report. “The headwinds facing the industry in 2016 are still significant.”

-

Agency tasked with enforcing Obama's gun control measures has been gutted The Guardian / January 6, 2016 The beleaguered federal agency charged with bringing to life much of Barack Obama’s new roster of gun controls faces an uphill task to deliver meaningful change. At the heart of the president’s executive action was a proposal to reinforce the Bureau of Alcohol, Tobacco, Firearms and Explosives (ATF) with 200 new agents and investigators. Though badly needed, the extra staff would be just enough to keep pace with the number of veteran agents who are eligible or almost eligible for retirement in the coming years, according to attrition estimates from a 2014 government report. And the personnel concerns are just one of the longstanding challenges the agency faces. For decades, restraints, inadequate funding, impotent leadership and a lack of political constituency have stymied the agency from carrying out its core mission. Two years ago, a review by the Government Accountability Office found the agency lacked the resources needed to adequately track the outcomes of thousands of investigations involving improperly purchased firearms despite such cases being a “top priority”. The same report identified serious personnel concerns, noting that ATF’s staffing was at its lowest level in nearly a decade, the result of a four-year hiring freeze and stagnant funding that “did not keep pace with the cost of employee salaries and benefits”. ATF currently has 624 industry operations investigators in the field, who are tasked with conducting compliance inspections of more than 140,000 federally licensed firearms dealers in the US, the agency said. In broadening the definition of who should be classified as a gun dealer, Obama’s plan would likely add many thousands more to that total. Now the agency is projected to lose a number of veteran agents who are near or already eligible for retirement. “ATF is facing a reduction in its number of special agents, who according to management officials, are critical to carrying out its mission of reducing violent crime,’’ the report stated. More than a quarter of ATF’s special agents qualified for retirement in 2013 and an additional 20% will become eligible through 2018, the report found. The president asked Congress to fund 200 more agents and investigators to cope with the extra work, but the staffing figures make clear that even if Congress were to agree, the chances are that the workforce will stand still at best. On Monday, the US attorney general, Loretta Lynch, told reporters that providing ATF with the additional resources is crucial piece of the plan. “We hope that Congress will see the wisdom of supporting this,” she said. But that already seems unlikely. Republican lawmakers and presidential candidates were quick to condemn the president’s executive actions. House speaker Paul Ryan accused the president of trampling on the second amendment. “No matter what President Obama says, his word does not trump the second amendment,” Ryan said in a statement, adding that the measures would be challenged in court. Presidential candidate Marco Rubio pledged to repeal the plan if elected. “On my first day, it’s gone,” he said. Hamstrung by the industry it’s supposed to regulate The ATF is charged with regulating America’s multibillion-dollar gun industry. But many say it is the industry that dominates the agency. “If you can strangle the chief agency charged with carrying out gun laws, it’s the equivalent of not having those laws in place,” said Robert Spitzer, author of The Politics of Gun Control and a political science professor at the State University of New York. “It’s a backdoor way to reduce gun regulations.” Critics of the ATF, in particular the nation’s largest gun organization, the National Rifle Association, have successfully lobbied for laws and regulations that have effectively “crippled” the agency, Spitzer said. Spitzer pointed to the series of “riders” attached to annual appropriations legislation at the behest of the gun lobby, he said, that have effectively hobbled the agency from completing even core functions of its mission. One rider, for example, restricts the ATF from consolidating and computerizing its data in a modern manner. Another imposes prohibitions on its ability to regulate and oversee firearms dealers. “ATF is the ‘whipping boy’ of the gun community,” Spitzer said. “And that’s how it’s been for decades.” The ATF has long drawn the ire of conservative lawmakers and the gun lobby. Wayne LaPierre, the executive vice-president of the NRA, once referred to ATF agents as “jack-booted thugs” and compared them to Nazis, prompting former US president George HW Bush, a lifetime member, to resign from the organization in outrage. In 1980, Ronald Reagan pledged during his first presidential campaign to abolish ATF. More than 35 years later, such calls are still circulating. Last year, Representative Jim Sensenbrenner of Wisconsin called the agency an “affront to the second amendment” when he reintroduced legislation that would abolish the ATF and transfer its core functions to other agencies. There is now fresh concern that some conservative members of Congress would retaliate against Obama’s actions by trying to strip funding from the bureau. “In the past, at times, when Congress didn’t like something that was proposed in gun legislation or regulation, they actually took money from the bureau’s budget and really hurt them more than anything else,” said Joseph Vince, a former ATF special agent and a partner at the Maryland-based consulting firm Crime Gun Solutions. “That’s a possibility and that could occur.” Comparisons have been drawn between the ATF and family-planning organization Planned Parenthood, which has periodically had its federal funding threatened by conservative members of Congress amid controversy. The agency’s reputation was further imperiled after the botched gun operation, known as “Fast and Furious”, when ATF agents lost track of nearly 2,000 guns, two of which were recovered at the scene of a murdered US border patrol agent. But many of Obama’s measures outlined in an emotional speech on Tuesday, including his proposal to hire 200 ATF agents and investigators, will require funding increases that the Republican-led Congress is almost certain to deny. “Whenever the ATF tries to move the ball forward and better enforce the laws and regulate the industry, you often see a response from some members of Congress to try to prevent them from doing so,” said Chelsea Parsons, vice-president for guns and crime policy at the Center for American Progress (CAP), a left-leaning thinktank in Washington. Yet Parsons said the president’s endorsement of the agency and its mission sends a clear message. “This is an agency that has historically been bruised and battered in Congress, and has had to fight and scrape for every resource that it gets,” Parsons said. “Having the support of the administration at the highest level is certainly a very strong statement.”

-

CNN / January 6, 2016 Donald Trump says he's sick and tired of the United States acting as the world's policeman. The day after North Korea claimed that it had conducted its first-ever successful hydrogen bomb test, the Republican presidential front-runner pointed the finger at China. His message: Pyongyang is Beijing's problem to fix. "China should solve that problem and we should put pressure on China to solve the problem," Trump said in a wide-ranging interview with CNN's Wolf Blitzer on "The Situation Room" Wednesday at Trump Tower in midtown Manhattan. "If they don't solve that problem, we should be very tough on them on trade -- meaning, start charging them tax or start cutting them off. You'd have China collapse in about two minutes." Trump also demanded on Wednesday that South Korea pay up. The United States has thousands of troops stationed in South Korea, which has been in a state of armistice with North Korea since the 1950s. "South Korea is a money machine. They pay us peanuts," Trump said. "South Korea should pay us and pay us very substantially for protecting them."

-

Associated Press / January 6, 2016 The leader of an American Indian tribe that regards an Oregon nature preserve as sacred issued a rebuke Wednesday to the armed men who are occupying the property, saying they are not welcome at the snowy bird sanctuary and must leave. The Burns Paiute tribe was the latest group to speak out against the men, who have taken several buildings at the preserve to protest policies governing the use of federal land in the West. "The protesters have no right to this land. It belongs to the native people who live here," tribal leader Charlotte Rodrique said. She spoke at a news conference at the tribe's cultural center, about half-hour drive from Malheur National Wildlife Refuge, which is being occupied by some 20 men led by Ammon Bundy. Ammon Bundy is demanding that the refuge be handed over to locals. Rodrique said she "had to laugh" at the demand, because she knew Bundy was not talking about giving the land to the tribe. The 13,700-acre Burns Paiute Reservation is north of this remote town in Oregon sagebrush country. The reservation is separate from the wildlife refuge, but tribal members consider it part of their ancestral land. As with other tribes, the Burns' Paiute's link to the land is marked by a history of conflict with white settlers and the U.S. government. In the late 1800s, they were forced off a sprawling reservation created by an 1872 treaty that was never ratified. Some later returned and purchased property in the Burns area, where about 200 tribal members now live. The Burns Paiute tribe has guaranteed access to the refuge for activities that are important to their culture, including gathering a plant used for making traditional baskets and seeds that are used for making bread. The tribe also hunts and fishes there. Rodrique said the armed occupiers are "desecrating one of our sacred sites" with their presence at refuge. Jarvis Kennedy, a tribal council member, said: "We don't need these guys here. They need to go home and get out of here."

-

Seinfeld Puts Obama Behind the Wheel of a ’63 Corvette Sting Ray

kscarbel2 replied to kscarbel2's topic in Odds and Ends

For proprietary reasons, Sony Pictures has blocked the video from being shown on Youtube. So, I have attached the link (above) to the video on the Comedians In Cars Getting Coffee website. -

(HIno) Dakar Rally 2016 Kicks Off in Buenos Aires

kscarbel2 replied to kscarbel2's topic in Trucking News

Race Finally Begins in Earnest Hino Trucks Press Release / January 5, 2016 Car 2 finishes at 23rd overall in great form, and Car 1 comes in at a solid 47th. The course for January 4 took contestants from Villa Carlos Paz to Termas de Río Hondo, both in Argentina. While yesterday's SS had to be canceled due to bad weather, competition was given a green light this day albeit on a shorter course than scheduled. The race is finally on, three days after its starting day. For the first part of the day, contestants raced northward on intermountain roads along the foothills of the Sierra Nevada Mountains. The rest of the day also featured winding roads that snaked between the hills, reminiscent of WRC courses. In order to make better time, contestants had to attack blind corners at high speeds. Intense dust was also a problem in many areas, making this a day of high-risk racing. Changes were also made to the course―including its truncation at CP4 (checkpoint 4) towards the end―shortening it to 373km from 510km, which would have made it the longest SS in this year's rally. HINO TEAM SUGAWARA's two HINO500 Series trucks finished this stage with strength to spare. Car 2, crewed by Teruhito Sugawara and Hiroyuki Sugiura, finished the day at 23rd overall in the Trucks category, and top in the Under 10-litre Class. Car 1, crewed by Yoshimasa Sugawara and Mitsugu Takahashi, finished at 47th overall and 4th in the Class. Although their later start times meant that Car 2 and Car 1 would only arrive at the bivouac at roughly 11pm and 12pm, respectively, both crews were in good shape and neither truck showed any signs of significant problems. On January 5, trucks were originally scheduled to race a 314km SS en route from Termas de Río Hondo to Jujuy. However, bad weather has once again forced organizers to shorten the day's competition to 190km. Yoshimasa Sugawara: I used extra caution driving in narrow and hazardous sections. It was a long day. The truck is doing great so I will give it my best again tomorrow. Mitsugu Takahashi: The race began in earnest today, and I was naturally a bit nervous, but I also had a lot of fun. I made some mistakes that one might expect from a novice navigator, but our driver is a seasoned veteran so things were under control. Teruhito Sugawara: We were able to race at a very good pace. Taking into account the sections where we had to slow down due to the dust, I think there's room to shave off another 10 minutes from our time. The engine is also easier to handle, including how the greater torque now allows me to go on 4th gear in situations where I would have had to use 3rd gear in the past. Hiroyuki Sugiura: Today's route posed no challenges in the way of navigation thanks to course branches being marked with tape and other measures that were taken. In terms of the truck, hitting our bumper in the bush was about as serious as things got today, so we had no problems to speak of. Photo gallery - http://www.hino-global.com/dakar/latest_news/PD16-13.html -

PacLease Adds Kenworth B-Double Rated Equipment to Rental Fleet

kscarbel2 replied to kscarbel2's topic in Trucking News

Defining Tomorrow..........The Kenworth K200 Brochure - http://www.kenworth.com.au/wp-content/uploads/2015/04/K200_web-PDF.pdf -

Oregon standoff: memory of botched Waco siege shapes federal response The Guardian / January 5, 2016 The shadow of Waco and other botched law enforcement sieges of the 1980s and 1990s is looming large over the standoff in south-eastern Oregon, where federal agents are avoiding anything that smacks of confrontation with the armed anti-government activists who have occupied a remote wildlife refuge since the weekend. Where once federal law enforcement agencies might have been itching to meet the activists’ defiance head-on, now they are virtually invisible – apparently believing they have much more to lose from triggering violence than they have to gain by waiting the protesters out. The reason, according to former federal agents and experts on rightwing extremism, is a vivid institutional memory of the bloodshed that marked standoffs with radical rightwingers in Ruby Ridge, Idaho, in 1992 and at Waco, Texas, the following year. Those operations not only led to loss of life on both sides – more than 80 people died in the fire that ended the siege of the Branch Davidian religious compound outside Waco – they also provoked scandal, investigations, congressional hearings, and years of further confrontations with radical groups outraged by the way the federal authorities behaved. “What we’re seeing is definitely related to lessons learned at Ruby Ridge and Waco and Marion, Utah and other sieges since then,” said Mark Pitcavage, director of the Anti-Defamation League’s Center on Extremism. “From a law enforcement perspective, if you try to use force to resolve the situation, there’s a risk that one or more of the extremists involved may be killed and turn into martyrs. You can end up spawning far more retaliatory acts of violence than whatever harm the initial incident could have caused.” At least one Waco veteran, an FBI hostage negotiator who has long since retired, has been hired back as a government adviser on the Oregon standoff. Another, the former head of the FBI’s Hostage Rescue Team, Danny Coulson, said it was gratifying to see the bureau take what he called a “laid-back posture”. “Less is better here,” Coulson said. “Let ’em talk … The commander on the ground should be engaging in very close dialogue with the group’s leader, person to person. Sooner or later, the wives are going to get sick of the sight of their husbands screwing around out there, or they’ll need to go get cigarettes. It will end the right way.” The Oregon standoff is a relatively low-stakes conflict because no shots have been fired in anger, nobody has been hurt or taken hostage and no evidence has emerged that one or more of the protesters is being sought for other offences. They could scarcely be in a more remote area, and they are occupying a building entirely devoid of strategic importance. Nonetheless, the feds’ approach is a sea-change from the early 1990s, when a macho paramilitary culture and aggressive rules of engagement approved at the highest levels were ingrained in the FBI and contributed to disasters the bureau is now anxious never to repeat. Ruby Ridge started out as a failed attempt to lure an Idaho survivalist, Randy Weaver, into committing a gun charge so the feds would have leverage to persuade him to inform on his friends at the Aryan Nations compound down the mountain. By the time it was over, in September 1992, a US Marshal and Weaver’s 14-year-old son had died in a shootout and an FBI sharpshooter had killed Weaver’s wife while she cradled a 14-month-old baby in her arms. The Waco siege began six months later when the Bureau of Alcohol Tobacco and Firearms (ATF) mounted an assault-style raid on the Branch Davidian compound and tried to arrest the cult leader, David Koresh. Four ATF agents and six Branch Davidians were killed. As a siege got under way, heavy-handed FBI commanders disregarded the advice of their own hostage negotiators and steadily escalated the tension – deploying military Bradley fighting vehicles, blasting the compound with high-power lights and playing everything from Tibetan chants and the sound of dying rabbits to Nancy Sinatra singing These Boots Are Made for Walkin’, all at maximum volume. With all avenues for a peaceful resolution closed, the feds moved in to end the siege by force after 51 days. A fire set by the Branch Davidian leadership as they saw the FBI coming killed almost everyone inside. Gary Noesner, one of the FBI hostage negotiators at Waco later wrote a book in which he reflected: “The harder we push, the more likely we are to be met with resistance.” He said the art of managing a standoff was to apply just the right amount of pressure – not so little that the subjects gain in confidence and not so much that it triggers a firefight. Noesner was unavailable for interview for this story because the FBI, unusually, has called him out of retirement to advise them directly on the Oregon situation. The principle he invoked was put to good use in 1996, when a standoff with a group called the Montana Freemen ended peacefully after 81 days, and again in 1997 in a week-long drama involving hostages held by a group calling itself the Republic of Texas. Patience, not aggression, has been the watchword of law enforcement ever since. When a New Hampshire couple, Ed and Elaine Brown, barricaded themselves in their mountain home in 2007 rather than return to court for their sentencing hearing in a tax evasion case, state and federal law enforcement sat pat for more than six months. The couple was heavily armed with weapons and explosives and their property was effectively a mini-fortress, with an observation tower, bunkers, tunnels and booby-traps set on approaches to the house. They relied on a steady stream of supporters – including Randy Weaver – to bring them food and other supplies. Eventually, two undercover US Marshals got inside by posing as sympathizers and arrested them without incident. In Oregon, the strategy appears to be to cut off electricity to the wildlife refuge and wait until the protesters run out of generator fuel – following Noesner’s principle of applying some pressure but not too much. Coulson said the FBI would probably seek to impress on Ammon Bundy and his cohorts that a hot-headed resort to violence would be in nobody’s interest. “A conversation’s a hell of a lot better than a gunfight,” Coulson said. Law enforcement’s soft approach is not immune from criticism, especially when police agencies appear to treat white men with guns one way and black people and suspected Muslim extremists another. Authorities in Texas have all but given up on one heavily armed fugitive, John Joe Gray, who has been holed up on his 47-acre property south-east of Dallas since 2000. They say it’s not worth risking the life of a single deputy just to make the arrest. There has been criticism, too, of the Bureau of Land Management’s decision to back off from confiscating cattle belonging to Ammon Bundy’s father, Cliven Bundy, because he has not paid grazing fees and fines on his Nevada ranch since the early 1990s. Bundy issued a call to arms in 2014 and attracted so many supporters the BLM decided the risks of enforcing the law were too great. “It’s a pretty complex calculation of risks versus benefits,” Pitcavage of the ADL said. Would the advantages of confiscating Cliven Bundy’s cattle be worth possible casualties, or future acts of violence? “Certainly, there are negative consequences to backing down, but sometimes there are equal if not greater negative consequences in going forward.”

-

The Washington Post / January 5, 2016 Republican presidential candidate Jeb Bush apologized Tuesday night for conflating his gun rights record by suggesting that he received an award from the National Rifle Association that doesn't exist. The Bush campaign admitted on Monday that the former Florida governor was "mistaken and conflated multiple events unintentionally" when discussing an award he said he received from the NRA. On several occasions in the past year, Bush has said he received the group's Statesman of the Year award and was handed a rifle by former NRA president Charlton Heston at the group's annual convention. But the NRA doesn’t give out a statesman award, and Bush didn’t receive a rifle from Heston. Instead, he was given a rifle for being the keynote speaker at the NRA’s 2003 annual convention in Orlando. Asked by reporters on Tuesday why he made the mistake, Bush said: "I don’t know, I thought.......I just read it."

-

The Belarusians have started in Dakar 2016 MAZ Trucks Press Release / January 5, 2016 Sergey Vyazovich’s crew of MAZ-SPORTauto Team started on January, 3 in a prestigious rally-raid DAKAR-2016 at the 8th position. Alexander Vasilevskiy’s crew began the race at the 12th position, while the fast technical truck of Vladimir Vasilevskiy started at the 40th position. On the first day the racers had to overcome 600 km between two Argentinean cities – Rosario and Villa Carlos Paz, but due to the poor weather conditions the special area in 258 km including speedy areas and rough routes in a sloping area was turned down. There are 55 crews in trucks category. Earlier MAZ trucks had taken part in a traditional podium, after which they had to go for a Prolog – small spectacular route that would define crews’ start positions. But this stage was cancelled due to the tragic incident – the Chinese racer rushed the spectators crowd at her Mini Cooper. 10 people suffered, three of them are in hospital in a bad condition. Thus sport trucks began the rally-raid according to the board numbers. The Russian crew under Airat Mardeev’s piloting was the first one (the truck is under 500 board number). Belarus is represented by three sport trucks - two main crews and one “fast technical truck” to assist during the race. No. 507 is crewed by Sergey Vyazovich, Pavel Garanin and Andrey Zhigulin. The 512th truck crew includes Alexander Vasilevski, Valery Kozlowski and Anton Zaporoschenko, while the 541st “fast technical truck” is manned by Vladimir Vasilevski, Dmitrij Vihrenko and Aleksey Neverovich. The aim of the team is to be among leading crews, while the minimum task is to overcome the whole route and be among the top-10. The sport trucks have been tuned before Dakar start: the suspension, fuel tanks, transmission and steering control were improved. Besides, a new technical truck that functions as a “fast technical truck” was assembled. Truck 507 is 300 kg lighter now and equipped with 930 horsepower engine rated at 4,200 N-m of torque. .

-

The Belarusians became 11th at the first special area in Dakar 2016 MAZ Trucks Press Release / January 5, 2016 Sergey Vyazovich’s crew came to 11th place at the happened stage of the rally-raid DAKAR-2016. All three Belarusian trucks got to the finish. The second stage was intended to be one of the longest at this DAKAR race. But the organizers decided not to risk and reduced the special area from 510 to 387 km. The race took place along the rather speedy route with a big number of bumps and water barriers. Sergey Vyazovich’s truck overcame it in 4 hours 30 minutes. The Belarusian crew lagged behind the leader Hans Stacy (Holland) in almost 12 minutes. Three KAMAZ crews stood higher the Belarusians in a fixture table. Alexander Vasilevskiy’s truck finished the second stage at 21st place. It took him 4 hours 44 minutes to overcome the special area. Its lagging behind the winner was 25 minutes 29 sec. The technical truck of Vladimir Vasilevski finished at 33rd position – it took him more than 5 hours to overcome the distance and 45, 5 minutes of lagging behind Hans Stacy. The speedy stone route had not became a serious problem for the Belarusian crews. “Everyone had performed a good work – the racers and the trucks as well. Sergey Vyazovich went with a good speed, but tried not to risk without a clear reason. Such areas are rarely decisive for the race result, but let one silly mistake occur and the crew will pay a high price for it. There was a number of examples when the trucks have been just thrown out the race. The main stages are ahead, that’s why we have to take care of people and trucks before the forthcoming trials”, – was marked by the team. At the same time the sickness of Sergey Vyazovich somehow had affected the team’s performance. Alexader Vasilevskiy’s MAZ truck had passed the turn, and thus lost some time. Besides, while overcoming the narrow part of the road, the truck had touched the tree, and the windscreen was knocked out. The core is that competition for “golden Bedouin” began with the second stage. The first stage was cancelled by the organizers due to extreme weather conditions – heavy rain and zero visibility produced high risk for the crews. Earlier the trucks prolog had been discontinued when the Chinese female racer rushed the crowd of spectators as she failed to handle driving her Mini Cooper – 10 people suffered, 3 of them are in hospital in bad condition. The third stage includes quite small special area (only 190 km) between cities Termas de Rio Hondo and Jujuy. It will be much more speedy, but with mountains areas. As a rule such routes hide a lot of “surprises”. .

-

Lafayette Journal & Courier / January 1, 2016 The Indiana Department of Transportation will test license plate-tracking technology next year to monitor "unpermitted overweight vehicles," the agency said Tuesday. Officials said INDOT will pilot the technology after an overweight semi passed over Interstate 65's southbound Wildcat Creek bridge in Tippecanoe County. Crews spent three days repairing damage to the structure, finishing on July 1 — about a month before construction on the northbound bridge caused a monthlong detour from Lebanon to Lafayette. To monitor violators, a camera system will work in tandem with one of about a dozen "weight-in-motion" sensors embedded in the asphalt. The sensors weigh vehicles as they travel across Indiana's interstate system, said Scott Manning, strategic communications director for INDOT. When the sensor records an overweight load, the nearby camera — which will be installed on I-94 in LaPorte County — will snap a photo of the violator's license plate, Manning said. Since INDOT is not charged with enforcing laws and the program is only a pilot, Manning said the agency would send an "awareness letter" to rule-breakers. "The intent would be to use what we've learned from the pilot to ultimately get to a state statute standpoint, where we would be able to ... actually send a letter with an accompanying fine," Manning said. If the pilot in LaPorte County is successful, more cameras could be rolled out as INDOT may "recommend legislative changes" to state lawmakers, according to a press release. Kapsch, a company specializing in transportation technology, agreed to provide pilot equipment — which could be installed by spring 2016 — at no cost, Manning said. Once damage to the southbound Wildcat Creek bridge was discovered, the agency "inspected all bridges of similar design" across the state "and found no systemic problems" — except damage to one bridge near downtown Indianapolis, according to a timeline provided by INDOT said Ann Rearick, director of bridges. After repairs were finished, Purdue University and INDOT experts retroactively inspected weight-in-motion data from a sensor in Merrillville to determine a 58-ton truck had likely caused the damage to the bridge when it crossed sometime in May, Rearick said. Trucks weighing more than 40 tons must receive a permit from the state to ensure the load is properly configured; in this case, a single axle on the truck was bearing nearly 72,000 pounds, Rearick said. "It was definitely running illegal, and the load was distributed very poorly," she said. Manning said it's difficult to assign a number to how often overweight trucks drive on Indiana roads, saying in an email that "vehicles can cause both specific damage, like in the case of the I-65 bridge, and accelerated degradation to pavement or structures." A 40-ton truck, for example, causes as much pavement damage as 9,600 cars, according to a press release. The program could keep trucking companies honest, creating a "competitive playing field for businesses that desire to follow state permit rules," the press release states. Manning called the incident a rare occurrence, but noted "there's only going to be more trucks on our roads in the next few decades. "And trucks are carrying more and more weight, so this has the potential to be more of a challenge," he said. "It kind of behooves us to be proactive and address this early." One overweight vehicle could spell trouble for aging state bridges in Tippecanoe County, including one spanning Wildcat Creek on Indiana 26. INDOT announced in October it would replace the bridge— built in 1941 about 3 miles east of I-65 — after inspections revealed its support structure was unsatisfactory. The bridge's deck is rated a five, its superstructure a three and its substructure a four, according to inspection reports from May. Ratings below five indicate a need for repairs or replacement. The May inspections indicate the deck, superstructure and substructure of I-65's north and southbound bridges over Wildcat Creek were rated six, five and four; and six, five and five, respectively. Officials said those ratings haven't changed as of December. When I-65 was reopened in September, ending a 33-mile detour that snarled interstate traffic, the stretch of road became a focal point of efforts to secure funding for improvements to Indiana's aging transportation infrastructure. State Sen. Brandt Hershman, R-Buck Creek, proposed a bill Dec. 10 that would send $418 million now held in reserves for local governments back to those communities for road and bridge improvements. Hershman worked closely with Gov. Mike Pence's office on this bill, which is intended as a counterpart to a plan that will be authored by Sen. Carlin Yoder, R-Middlebury. Hershman's bill, however, funds local roads, where as Yoder's proposed bill would fund state roads, Hershman said. Pence unveiled his $1 billion 21st Century Crossroads plan in October, which would cobble together reserve funds, new spending, trust fund interest and new bonds for state-owned infrastructure improvement. But complicating the issue are nearly 200 recently completed pavement projects that could crumble years ahead of schedule because of critical mistakes contractors made mixing asphalt, according to an investigation by the Indianapolis Star. But Manning noted 95 percent of INDOT inventory is in "fair or better condition." "In order to improve on our metrics in terms of bridge condition and pavement condition," he said, "one of the aspects that we need to be mindful of is making sure the vehicles that use our state network are doing so in compliance."

-

Dakar 2016: Team Petronas De Rooy Iveco aims for victory

kscarbel2 replied to kscarbel2's topic in Trucking News

Iveco on the Podium in Dakar 2016 Stage 2 Iveco Press Release / January 5, 2016 The Dakar Rally finally got underway with the fast-moving Villa Carlos Paz-Termas de Río Hondo section. The Iveco trucks performed very well, with four finishing in the top 10 and one just outside. The Dakar 2016 got underway after the difficulties of the first two days, and was again affected by bad weather, with 90 kilometres having to be cut out of the original route. In spite of the difficult terrain conditions, the Team PETRONAS De Rooy Iveco placed three trucks in the first 10 and one just outside, while first time pilot Team La Gloriosa De Rooy’s pilot Federico Villagra closed in 5th place. The Iveco team got off to a strong start, with Gerard De Rooy’s Iveco Powerstar quickly closing in on title defender Ayrat Mardeev and finishing with the team’s best performance, in third place just 1 minute and 51 seconds from stage winner Hans Stacey. Federico Villagra surprised everyone by dominating the race until past the halfway mark. The Argentine pilot, who was driving the Team La Gloriosa De Rooy's Iveco Powerstar, came in 5th place, followed by Aleš Loprais behind the wheel of his Iveco Powerstar, who was ahead of Ton van Genugten, who crossed the finish line 3 minutes and 40 seconds after the winner. The Spanish pilot Pep Vila stuck with the Kamaz trucks and drove his Iveco Trakker across the finish line to take 12th place, 12 minutes and 8 seconds behind the winner. To learn more about Iveco's teams and vehicles and to follow Iveco day-by-day throughout the race, visit www.iveco.com/dakar -

From Kim Davis to Oregon, the GOP’s love affair with lawbreakers The Washington Post / January 4, 2015 Ammon Bundy and the other armed militants occupying a federal facility at a wildlife refuge in Oregon have a beef with the administration — the Teddy Roosevelt administration. “It has been provided for us to be able to come together and unite in making a hard stand against this overreach, this taking of the people’s land and resources,” proclaimed Bundy, son of Cliven Bundy, the Nevada rancher who led a similar armed rebellion against the government two years ago. “If we do not make the hard stand, then we will be in a position where we won’t be able to as a people.” But this “taking of the people’s land,” the “overreach” that moved these rebels to take up arms, occurred 108 years ago, when Roosevelt — a Republican president and a great conservationist — established the Malheur National Wildlife Refuge, one of 51 such refuges he set aside, “as a preserve and breeding ground for native birds.” So why have the militants chosen this moment, more than a century after the fact, to “unwind all these unconstitutional land transactions,” as Bundy put it? Perhaps it’s because they think the political atmosphere now condones such anti-government activity. You can see why they might think so. Several of the Republican presidential candidates have been encouraging lawbreaking, winking at it or simply looking the other way. A few months ago, Ted Cruz, Mike Huckabee and others rushed to defend Kim Davis, the Kentucky county clerk jailed for refusing to obey federal law. A federal judge had held her in contempt of court for refusing to recognize same-sex marriages, and the Supreme Court specifically declined to give Davis relief. But Cruz identified her jailing as “judicial tyranny” and said Davis was operating “under God’s authority.” Donald Trump has put at the center of his campaign an extra-constitutional ban on admitting Muslims into the country. Marco Rubio said that if the law conflicts with the Gospel, “God’s rules always win,” and that “we are called to ignore” the government’s authority. Huckabee and Rick Santorum signed a pledge not to “respect an unjust law that directly conflicts with higher law.” Huckabee floated the notion of using federal troops to block people from getting abortions and questioned the Supreme Court’s authority. And, of course, there was the 2014 standoff in which Cliven Bundy, who refused to pay grazing fees for his use of federal land, got support or sympathy from Cruz, Trump, Huckabee, Rand Paul and Ben Carson. Cruz denounced the federal government for “using the jackboot of authoritarianism.” The rancher lost much of his support when he delivered a racist rant. But not all of it: Last summer, Paul had a private meeting with the elder Bundy that the rancher said lasted 45 minutes. As my colleagues Katie Zezima and David Weigel noted, Paul and Cruz have both campaigned to transfer federal lands in the West to private ownership. Flirting with extremists helps conservative candidates harness the prodigious anger in the electorate. A poll released this weekend by NBC, Esquire and Survey Monkey found anger is particularly intense among Republicans: Seventy-seven percent said the news makes them angry at least once a day (compared with 67 percent of Democrats). Seventy-three percent of white Americans are angered daily (vs. 66 percent of Hispanics and 56 percent of African Americans). So when some very angry people led by Ammon Bundy took over the (unoccupied) compound at the wildlife preserve over the weekend, the Republican presidential candidates reacted mostly with silence. A scan of tweets from Republican lawmakers also found nary a peep about the armed takeover of the federal facility. An admirable exception (and one whose low standing proves the rule) was John Kasich, whose strategist John Weaver suggested “a good federal compound for Bundy and his gang: a U.S. penitentiary.” Finally, in a radio interview Monday, Marco Rubio said the militants “cannot be lawless” — though he added that he agrees with their complaints about federal lands. And Cruz, responding to a question, said he hoped Bundy’s gang would “stand down peaceably” because “we don’t have a constitutional right to use force and violence.” That was mild criticism — Bundy had said he has no intention of using violence — but better than the usual wink. As it happens, Cruz also released a TV ad Monday protesting inadequate enforcement of the border. “The rule of law,” he says in the ad, “wasn’t meant to be broken.” That’s a fine sentiment. But to live under the rule of law we must follow all laws — not just those we like.

-

Sanders takes aim at Wall Street, Clinton in speech

kscarbel2 replied to kscarbel2's topic in Odds and Ends

The Guardian / January 5, 2016 Bernie Sanders sought to rekindle the anger of the Occupy Wall Street movement in a major policy speech in New York on Tuesday that revealed how he would aim to dismantle much of the modern investment banking system within months of taking office. Amid a slew of new pledges were proposals ranging from seizing control of credit rating agencies to turn them into not-for-profits, capping credit card and ATM fees, and preventing banks from earning interest on deposits made at the Federal Reserve. Declaring that the “business model of Wall Street is fraud”, the Democratic presidential hopeful also fleshed out longstanding promises to jail bank executives and introduce a sweeping new transaction tax on speculation. “Greed, fraud, dishonesty and arrogance, these are the words that best describe the reality of Wall Street today,” Sanders told supporters in midtown Manhattan. “To those on Wall Street who may be listening today, let me be very clear. Greed is not good. In fact, the greed of Wall Street and corporate America is destroying the fabric of our nation.” The uncompromising language is a familiar feature of the Vermont senator’s fiery stump speech, but Tuesday’s address included detailed policy proposals for the first time, some of which suggest he would use executive actions rather than wait to achieve consensus in Congress before acting if elected to the White House. Within 100 days of taking office, Sanders said he would require the Treasury Department to compile a “Too-Big-to-Fail list of commercial banks, shadow banks and insurance companies whose failure would pose a catastrophic risk to the United States economy without a taxpayer bailout”. These, he claimed, would then be broken up within a year under existing authority granted to the president under Section 121 of the Dodd-Frank Act. The Vermont senator also stepped up his previously guarded criticism of frontrunner Hillary Clinton, ridiculing her claims to be tough on Wall Street reform and quoting the former labor secretary Rob Reich blasting the secretary of state for “finagling” on the subject. “My opponent says that, as a senator, she told bankers to ‘cut it out’ and end their destructive behavior,” teased Sanders. “But, in my view, establishment politicians are the ones who need to ‘cut it out’.” Earlier in the campaign, Sanders pulled an attack ad accusing Clinton of selling out to Wall Street donors, but his promise to avoid negative campaigning appeared further strained as he reminded the audience of her large speaking fees from bank appearances. “My opponent, Secretary Clinton says that Glass-Steagall [bank reform] would not have prevented the financial crisis because shadow banks like AIG and Lehman Brothers, not big commercial banks, were the real culprits. Secretary Clinton is wrong,” he claimed, pointing to the role of traditional banks in financing the riskiest lending. “Secretary Clinton says we just need to impose a few more fees and regulations on the financial industry. I disagree,” he added. Though Sanders has long stressed that his version of “democratic socialism” should not be seen as wanting to nationalise industries, he also pledged to turn multibillion-dollar credit rating agencies such as Moody’s, Standard & Poor’s and Fitch into not-for-profit institutions that would have exclusive power to assess the health of corporate debt. “We cannot have a safe and sound financial system if we cannot trust the credit agencies to accurately rate financial products,” he said. “And, the only way we can restore that trust is to make sure credit rating agencies cannot make a profit from Wall Street.” And the senator listed half a dozen prominent cases where he says bank executives unfairly escaped prosecution, claiming it was an outrage that banks had been fined $204bn since 2009 but no one had gone to jail. Sanders also called for a national “usury law” to regulate interest rates charges by lenders. “The Bible has a term for this practice. It’s called usury. And in The Divine Comedy, Dante reserved a special place in the Seventh Circle of Hell for those who charged people usurious interest rates,” he said. “Today, we don’t need the hellfire and the pitchforks, we don’t need the rivers of boiling blood, but we do need a national usury law.” Many of these measures would cause palpations in the business community if ever enacted but mirror the demands of campaigners for financial justice who came to prominence after the 2008 banking crash in so-called Occupy protests across the world. Though Sanders continues to trail Clinton by a large margin in national opinion polls, his top advisers insisted they were “well positioned” in both the Iowa caucus and New Hampshire primaries, during a separate briefing call for reporters. “If elected president, I will rein in Wall Street so they can’t crash our economy again,” concluded Sanders in his speech. “Will they like me? No. Will they begin to play by the rules if I’m president? You better believe it.” -

Although Sanders is arguably too old to run, he brings a lot of important points to the table (and is clearly genuine). Wall Street.......amounts to being a government-supported scam. ----------------------------------------------------------------------------------- Reuters / January 5, 2015 U.S. Democratic presidential candidate and Vermont Senator Bernie Sanders warned on Tuesday that financial-sector greed was "destroying the fabric of our nation" and said the starting point of any Wall Street reform effort is breaking up "too big to fail" banks. "If a bank is too big to fail, it is too big to exist; when it comes to Wall Street reform, that must be our bottom line," Sanders said in a blistering speech. He said allowing banks that are too big is essentially providing them with a "free insurance policy" to make risky investments knowing the U.S. government will prevent their collapse. Sanders also called for structural reforms to the Federal Reserve, making credit rating agencies nonprofit entities, and a tax on speculative investments. He urged increased penalties for financial fraud or malfeasance by institutions, calling fraud the business model of Wall Street. His remarks were laced with direct and indirect criticisms of the policies and track record of primary campaign front-runner Hillary Clinton, whose constituency when she was a U.S. senator from New York included the financial industry. The former secretary of state, however, has taken a tougher stance against Wall Street as a presidential candidate. Sanders and Clinton have tussled over the best way to curb the risky behavior on Wall Street that caused the 2008 financial crisis and triggered the worst U.S. economic slump since the Great Depression. Sanders favors breaking up too-big-to-fail banks and reinstating a version of the Glass-Steagall Act, a Depression-era law that prohibited commercial banks from engaging in investment banking activities. Clinton has endorsed an approach that would break up large banks if they take excessive risks. She also believes that reinstating Glass-Steagall, an idea popular with progressive Democrats, would not address the types of institutions that have risen since the law was written in the 1930s. Glass-Steagall's main provisions were repealed in 1999 during the presidency of her husband, Bill Clinton - a fact that Sanders highlighted in his speech. The back-and-forth between Sanders and Clinton over breaking up banks and regulating the so-called shadow banking sector intensified this week, with one of Clinton's top Wall Street advisers, former U.S. financial regulator Gary Gensler, criticizing Sanders as not focusing on regulating non-bank institutions such as hedge funds and insurance companies. Sanders said Tuesday that if elected, "Goldman Sachs and other Wall Street banks will not be represented in my administration." Gensler, before serving as chair of the Commodity Futures Trading Commission under President Barack Obama and a U.S. Treasury Department official under Bill Clinton, was an investment banker at Goldman Sachs. Former Treasury Secretaries Robert Rubin and Henry Paulson were also Goldman alumni. Sanders highlighted how he has pushed for legislation to reinstate Glass-Steagall alongside Democratic Senator Elizabeth Warren of Massachusetts, a favorite of progressives. He also quoted another progressive icon, former U.S. Labor Secretary Robert Reich, as criticizing Clinton's proposals to regulate Wall Street as too weak. On the Federal Reserve, Sander said it should not pay financial institutions interest for the money they keep at the Fed and that such institutions should instead pay the U.S. central bank a fee. He also said he would not put financial industry executives on the Fed's presidentially appointed board. Individual companies were also name checked by Sanders. He said that JPMorgan Chase & Co, Bank of America Corp and Wells Fargo & Co are nearly 80 percent bigger than when they accepted money from the U.S. government during the 2008 bailout.

BigMackTrucks.com

BigMackTrucks.com is a support forum for antique, classic and modern Mack Trucks! The forum is owned and maintained by Watt's Truck Center, Inc. an independent, full service Mack dealer. The forums are not affiliated with Mack Trucks, Inc.

Our Vendors and Advertisers

Thank you for your support!