kscarbel2

Moderator-

Posts

18,539 -

Joined

-

Days Won

112

Content Type

Profiles

Forums

Gallery

Events

Blogs

BMT Wiki

Collections

Store

Everything posted by kscarbel2

-

The Financial Times / June 29, 2015 General Electric made further progress in its withdrawal from financial services with deals to sell its fleet arm, taking it about a third of the way through its planned disposal programme. The US conglomerate sold its fleet businesses, which provide commercial vehicle financing and fleet management services, in the US, Mexico, Australia and New Zealand to Toronto-based Element Financial, for $6.9bn. Separately, it has also signed a memorandum of understanding for the potential sale of its European fleet businesses to Arval, a subsidiary of French bank BNP Paribas, for an undisclosed amount. The two sales will mean GE is disposing of businesses with “ending net investment” — the company’s measure of assets — of $8.6bn, and taking to about $63bn the value of the various deals it has agreed since the planned exit from financial services was announced in April. It plans to sell $200bn of assets in total. Keith Sherin, GE Capital’s chief executive, said the company was “on track” to reach a total of $100bn in assets sold by the end of the year. He added that GE expected “to be substantially done” with the disposal programme by the end of 2016. Two businesses that have been set as priorities for sale in the near future are healthcare finance and European acquisition finance, which Mr Sherin has said will benefit from a quick resolution of the uncertainty about their future ownership. Other business that are expected to be sold this year include GE’s US and global commercial lending operations and its international consumer business. Jeff Immelt, GE’s chief executive, has set a strategy of focusing on the group’s industrial manufacturing and service businesses, which are less volatile and generally more highly valued by investors. Once the disposal programme is complete, GE Capital, the financial services division that two years ago provided almost half of the group’s earnings, is expected to generate just 10 per cent of its profits. Deals announced already include the sales of a property portfolio for more than $26.5bn, Australian and New Zealand consumer finance businesses for $6.2bn, and US buyout lending operations for $12bn. In total the disclosed sale proceeds have now reached $51.6bn, although there are also a few deals for which the price has not been announced. One measure used by the company is the value of cash released from GE Capital to be paid to the parent group, which, with the fleet deals, has reached $9.3bn, a bit more than a quarter of the way to the target of $35bn.

-

Automotive News / June 29, 2015 Free-trade deals would roll back the tariff In the background of the free-trade debate that has raged in Washington this summer, a sacred cow of U.S. auto and trade policy is under threat. The 25 percent tariff imposed on imported pickups, vans and commercial trucks, known as the "chicken tax," stands to be significantly rolled back through big-ticket trade deals being hammered out with Pacific Rim nations and the European Union. With the legislative pieces now in place, the Trans-Pacific Partnership and Transatlantic Trade and Investment Partnership are closer to becoming reality. The Pacific Rim deal seeks to create a 12-nation free-trade bloc encompassing some 40 percent of the world's economy. The EU deal would lower trade barriers and seeks to align regulations between the U.S. and EU. Both would remove the chicken tax. Critics of the tax say it has priced imported trucks out of the market, shielding the Detroit 3's biggest profit machine from robust foreign competition. The tariff also has had other effects, experts say, such as stifling pickup innovation and motivating Japanese automakers to build U.S. factories. "It has provided a competitive advantage for the domestic pickup producers," says Daniel Ikenson, an economist and trade expert at the Cato Institute, a Washington pro-business think tank. "The response of the Japanese manufacturers has been to invest in production lines here in the United States." After months of heated debate, Congress passed a bill last week that would give President Barack Obama authority to negotiate and send free-trade agreements to Congress for an up-or-down vote, free of amendments. With the so-called fast-track authority ready for Obama's signature, the wheels on the Pacific treaty can shift into high gear, and a final version of the deal could go to Congress by the fall. The EU deal is expected to take longer to finish. Truck lovers have long hoped that removing the tariff would create a flood of new, smaller pickups that today are available only overseas. But trade watchers and auto industry experts agree that a barrage of new pickups would be unlikely. Free-trade deals would roll back the tariff gradually over several years, even decades, they say. Stifled innovation? While Nissan and Toyota have spent billions on their U.S. pickup operations, most brands from South Korea and Europe have stayed out of the U.S. pickup market. Just six brands offer pickups in the United States, compared with 19 that offer compact crossovers and 14 that sell midsize sedans. That contrast shapes the view of John Krafcik, president of TrueCar and former CEO of Hyundai Motor America, who says that the pickup segment "has the least competitive intensity of any segment in the industry." Krafcik says the U.S. would "definitely" get more pickups if not for the chicken tax. The tariff has all but required pickups to be assembled in the United States to be sold here, he said. The cost of installing pickup manufacturing capacity from scratch -- building a plant, paying for tooling, engineering the truck and producing it -- can cost from $2 billion to $3 billion, he said. Such a steep investment requires manufacturing at a large scale. As a result, Krafcik said, product planners create trucks to compete in the full-size segment, where they see the biggest chance of selling at volume. That means automakers can't afford to take a risk on small-volume trucks with different sizes, bed and cab configurations or experimental storage and packaging designs. "I think what is lost the most is low-volume experimentation and innovation in pickups," Krafcik said. "As soon as you get to that level of investment, the risks become so great that the solutions become fairly mainstream." Gradual change The two free-trade agreements would roll back the chicken tax affecting nearly 40 nations -- 11 through the Trans-Pacific Partnership and the 28 that make up the EU, through the Transatlantic Trade and Investment Partnership. So would U.S. showrooms see an array of shiny new imported pickups? Probably not, at least in the near term, industry experts and trade watchers say, for these reasons: First, few countries involved in the talks have pickup assembly plants. Volkswagen builds the Amarok midsize pickup in Germany, but, a company spokesman said, "If you look at where we produce vehicles, to bring an Amarok from Hanover, even if the chicken tax were repealed, would be a bit of a stretch." Much midsize pickup production capacity outside the United States is concentrated in Thailand, but that country isn't involved in the TPP talks. In Thailand, Ford builds the recently redesigned Ranger, Mazda produces the BT-50, Mitsubishi assembles the L200 and Toyota makes the Hilux. But the country could be a wild card -- Thai officials have expressed interest in joining the TPP once the deal is completed, and the TPP is designed to allow other nations to do that. Second, the chicken tax is expected to be rolled back slowly. Obama administration trade negotiators have said the tariff with Japan would phase out on the longest possible timeline, as part of a bilateral U.S.-Japan side deal proceeding alongside the TPP talks, says Matt Blunt, the former Missouri governor who now runs the American Automotive Policy Council, a Washington trade group that represents Ford, Fiat Chrysler and General Motors on trade issues. Blunt said it's only fair because barriers in Japan other than tariffs have effectively kept U.S. automakers out of the country. "We believe it could take as many as 25 years to open up the Japanese market given that it's the most closed market in the developed world today," Blunt said. Third, pickups sold overseas aren't designed to meet rigorous U.S. crash and emissions regulations -- partly due to the high upfront cost imposed by the tariff -- and they're unlikely to resonate with U.S. truck buyers, says Dave Sullivan, an analyst with AutoPacific. It's not uncommon to find Ford, GMC, Chevrolet and Ram pickups loaded with leather interiors, premium audio systems and high-tech features that push the sale price upward of $50,000 -- status symbols as well as cargo haulers. Trucks found overseas are Spartan by comparison, often sold with manual transmissions and turbodiesel four-cylinder engines without the hauling power of full-size American pickups. "When you look at how we treat our trucks and how people do around the world, a lot of them wouldn't be able to withstand some of the same things, and they're not designed with American needs in mind," Sullivan said. "We've come to have a very refined and sophisticated pickup truck buyer." Fourth, some automakers told Automotive News that the chicken tax is not the only barrier keeping their smaller pickups out of the United States. Toyota spokesman Scott Vazin said the size of the Hilux would make it a "tweener" in the U.S., overlapping too much with the full-size Tundra and midsize Tacoma. A Volkswagen spokesman said the company, which has said the tariff was the biggest impediment to selling the Amarok in America, now also doubts whether the truck is the proper size for the U.S. And a Mazda spokesman said the BT-50 would be a mismatch for Mazda's sporty, affordable-premium U.S. brand identity. Despite the challenges, the prospect of fat profits might prompt automakers to adjust to a defanged chicken tax, Krafcik says. Over time, that could mean more competition. "I think it would take some time, but with clarity around that guideline, we would see opportunity for those products," Krafcik said. "You would certainly be creating the conditions for manufacturers with production facilities in [Pacific treaty] countries to provide low-cost compact pickups to U.S. truck buyers." Trucks you would see on the US market after the repeal of Lyndon Johnson’s Proclamation 3564 (aka. The Chicken Tax) > FORD RANGER The Blue Oval brand killed its compact pickup for the U.S. in 2011 but revealed an updated 2016 Ranger for overseas markets in May at the Bangkok auto show. The global Ranger is bigger and beefier than its U.S. predecessor. • Where it's made: Thailand, South Africa > VOLKSWAGEN AMAROK Volkswagen's U.S. dealers and fans alike have clamored for the Amarok, but it's unlikely to arrive stateside anytime soon. The first modern pickup from VW's commercial vehicles unit, the Amarok is roughly the size of a Nissan Frontier. • Where it's made: Germany, Argentina > TOYOTA HILUX The Hilux nameplate left U.S. showrooms in 1976, but it has been a mainstay around the world with some 16 million units sold globally in its nearly 50-year history. Toyota revealed the eighth-generation Hilux in May at the Bangkok auto show. In crew cab configurations, the redesigned Hilux has a few more inches in length and height than the 2015 Tacoma. • Where it's made: Venezuela, Argentina, Thailand, Malaysia, South Africa, Pakistan > MAZDA BT-50 Mazda discontinued U.S. sales of its B-series pickup after the 2009 model year, when it was essentially a rebadged Ford Ranger. Overseas, Mazda's midsize truck is called the BT-50. • Where it's made: Thailand > MITSUBISHI TRITON Mitsubishi discontinued the Mighty Max in the mid-1990s and has not sold an imported pickup in the U.S. since. But the Triton, successor to the Mighty Max, has lived on overseas. • Where it's made: Thailand

-

Netherlands-based truck conversion company Veldhuizen Wagenbouw (http://www.veldhuizen.eu/) has introduced a DAF “FAD” 10x4 vocational chassis with a wide spread driven and steered drive axle bogie. Already available from Veldhuizen Wagenbouw for 8x4 Iveco Trakker vocational chassis the conversion, the rear drive axles are mechanically steered. .

-

This KamAZ model 4326 has a 920 horsepower 16.2-liter Liebherr D9508 V-8 engine. Related reading - http://www.bigmacktrucks.com/index.php?/topic/37840-the-formula-to-a-successful-race-truck-kamaz-4326/?hl=liebherr https://www.youtube.com/watch?v=P3xAZq8jrY4

-

http://www.bigmacktrucks.com/index.php?/topic/40694-remembering-renaults-virages-program-the-magnums-beginning/?p=294983 I have no knowledge as to why Renault chose a set-forward front axle (loosely termed U.S. style). But the flat floor, the industry's first, certainly wasn't inspired by any American COE trucks.

-

Remembering Renault’s VIRAGES Program - the Magnum’s beginning

kscarbel2 replied to kscarbel2's topic in Other Truck Makes

Originally called the “AE” in 1990, it was renamed the Magnum in 1992. From 1996, the Magnum was fitted with the Mack E7, or E9 V-8 rated up to 560 horsepower. EE9-500 16.36 500 @ 1,900 2,000 N.m @ 1,300 Europe – Renault Magnum AE500 EE9-520 16.36 520 @ 1,900 2,250 N.m @ 1,300 Europe – Renault Magnum AE520 EE9-530 16.36 530 @ 1,900 2,250 N.m @ 1,300 Europe – Renault Magnum AE530 EE9-560 16.36 560 @ 1,900 2,450 N.m @ 1,300 Europe – Renault Magnum AE560 Little Known Facts: The Mack E7 E-Tech, when installed in the Renault Magnum tractor, carried the Renault engine designation MIDR 06.24.65. Note the Virage prototype’s staircase for cab access, not unlike the later Freightliner Argosy (an option) Another note, though the Magnum (AE) was launched in 1990, the Renault R-Series COE heavy tractor first launched in 1980 remained in production until 1996. The R-Series was an updated version of the Berliet GR/TR, using a lengthened version of the Berliet KB2400 cab which had been used by Ford Motor Company for the Transcontinental Mk 1 and Mk 2. Renault Press Release / Lyon, June 2013 / 20 Years of Success for the Renault Magnum Legend - http://corporate.renault-trucks.com/media/document/DP-pdf/dp_magnum_20_ans_en.pdf . -

Remembering Renault’s VIRAGES Program - the Magnum’s beginning

kscarbel2 replied to kscarbel2's topic in Other Truck Makes

VE 20 The 6x2 configured VE20 represented a number of firsts in global heavy truck design. Advanced technical features included: The chassis was made of curved extruded aluminum with symmetrical cross membersMcPherson strut-type oil/pneumatic suspension systemCompact powertrainFully automated transmission (AMT) featuring a shift "under torque" capability, allowing gear changes without any interruption in tractionDisc brakes front and rearElectronic surveillance and management functionsWind tunnel-designed cab offering a flat floor with forward and lateral visibility close to maximum possible values.. -

Remembering Renault’s VIRAGES Program - the Magnum’s beginning

kscarbel2 replied to kscarbel2's topic in Other Truck Makes

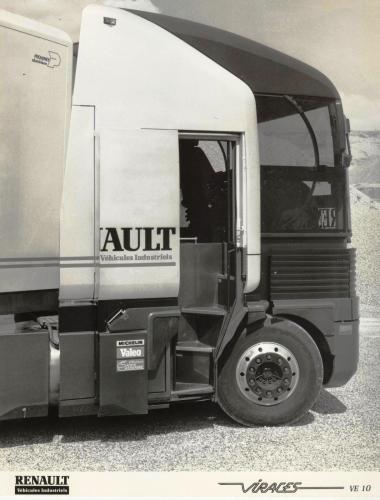

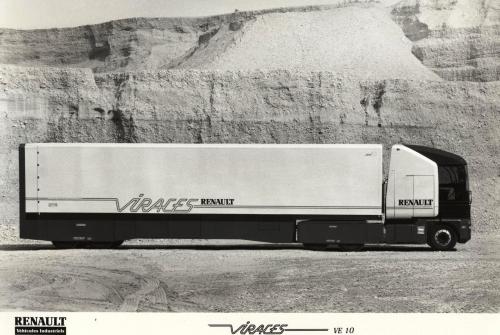

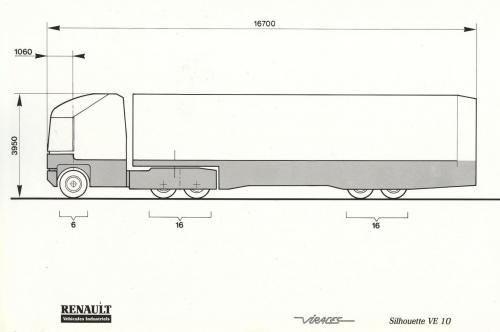

VE 10 With its high mounted cab reached by a spiral staircase and huge, bulbous windshield, the VE 10 prototype presented by Renault Trucks in 1985 made a powerful impression. Highly aerodynamic, the VE10 included a streamlined semi-trailer with trailer tail to reduce aerodynamic drag, and therefore fuel consumption. The original VE10 was a 6x4 tractor with super single tires on the drive axles, an idea later employed on the “AE” production models. The VE10 also stood out for its use of nitrogen gas in the tandem suspension’s air springs, front and rear disc brakes and model B18 automated manual transmission (AMT). From day one, the production “AE” models featured disc brakes on the steer axle. . -

It’s interesting to view photographs of Mack COE concepts of the 1970s, together with the Virages tractor concepts that resulted in the 1990 launch of the Renault AE (Magnum). The Virages program was initiated in 1979, two years after Mack and Renault (represented by the superb Elios Pascual) joined forces to adapt and sell Renault’s proven medium trucks to the North American market. Launched in the 1980 model year, the Mack Mid-Liner became the number one selling medium-duty COE in America by the mid-eighties. Renault, like Scania, were great people to work with. They admired Mack Trucks, the people and its technological prowess, and wanted to work together where synergies could be identified. Along the way to the Magnum, Renault displayed the Virages VE10 concept in 1985 and VE20 in 1988, both advanced COE designs with an American style set-forward front axle configuration. (V.I.R.A.G.E.S. - Véhicule industriel de recherche pour l’amélioration de la gestion de l’énergie et la sécurité, i.e. Commercial vehicle for research into the improvement of energy management and safety) The VIRAGES program was focused on evaluating a number of technologically advanced options to be featured by Renault on future vehicles. This program resulted in the construction of two VE (Vehicle Experimental) prototypes, dubbed VE10 (1985) and VE20 (1988). VIRAGE made it possible for Renault to expand its working knowledge of new architectures and technologies, allowing them to be successfully applied in the AE (short for aerodynamic) in 1990. .

-

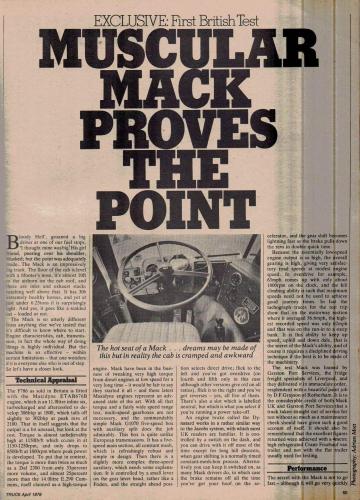

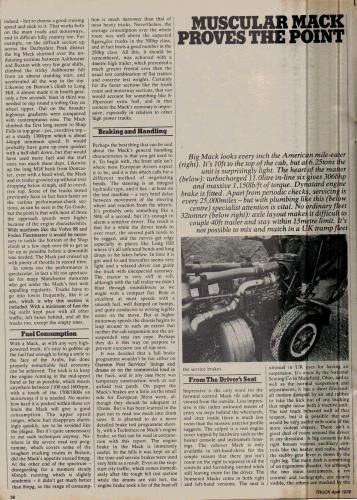

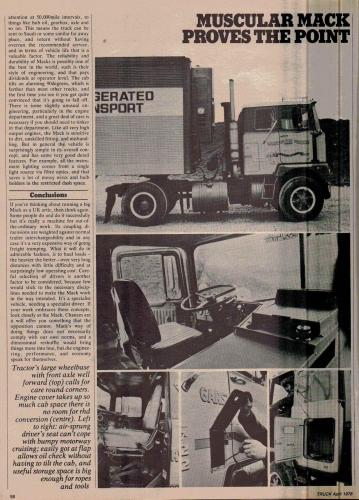

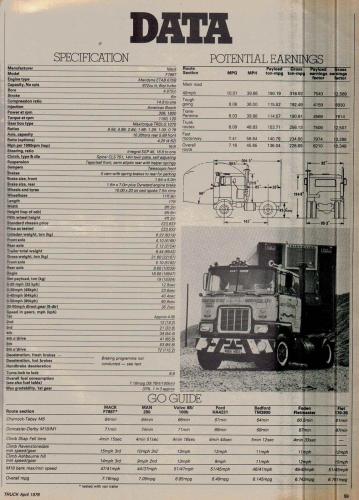

A great read brought to my attention by our UK truck industry veteran, BC Mack. Note the not-so-well-known Mack Maxitorque 7-speed overdrive transmission. .

-

General Motors introduces futuristic gas turbine heavy truck concept

kscarbel2 replied to kscarbel2's topic in Trucking News

New GM Gas Turbine for Heavies Commercial Motor / April 10, 1964 A new 280 horsepower regenerative gas turbine designed specifically for heavy-duty commercial vehicles has been developed by General Motors Research Laboratories and will be exhibited at the New York World's Fair, which opens on April 22 and closes on October 18. The new engine is known as the GT-309, and is a fifth-generation design with more than 15 years of research and development behind it. It will be recalled that one of the first G.M. gas turbines for vehicle use was' installed in the Turbocruiser bus in 1954. The new engine has the same basic components as previous turbines—compressor, gasifier turbine, power turbine and regenerator—but a new system termed Power Transfer is incorporated whereby a variable coupling or clutch transfers a predetermined amount of power from the engine's gasifier turbine to the output shaft, This maintains a virtually constant turbine-inlet temperature over most of the engine's operating range, it is claimed. When the vehicle is decelerating, the Power Transfer couples the transmission line to the turbine compressor and provides two to three times the braking power of a comparable petrol or diesel engine. According to Dr. Lawrence R. Hafstad. vice-president in charge of the General Motors Research Laboratories, the Power Transfer improves the new turbine's part-load fuel economy, and also gives better acceleration, limits the power-turbine speed and makes the use of manual or automatic transmissions possible. The GT-309 develops its rated 280 horsepower at an output shaft speed of 3,600 r.p.m., this being stepped down from a power-turbine-shaft speed of 30,480 r.p.m. It has a falling torque curve, with maximum torque near the stall speed, and it is claimed to occupy one-third less space and to weigh less than half the weight of a diesel engine of equivalent performance. The gas temperature at the gasifier-turbine inlet is 927°C. (1,700°F.), and the single regenerator results in exhaust temperatures in the 150°-260°C. (300"-500°F.) range, and salvages more than 90 per cent of the recoverable exhaust-system heat. Several GT-309 gas turbines are being evaluated under a variety of operating conditions in vehicles and on G.M. test beds. -

GM Press Release / April 8, 1964 A turbine-powered freight hauler which could carry containerized cargoes at new peaks of efficiency on tomorrow’s express highways is being shown by General Motors at the New York World’s Fair. Named the Bison, it shows a sleek new design for heavy cargo vehicles combining power, speed and utility with outstanding appearance. The Bison anticipates the day when much of our freight may be moved in standardized containers which can be automatically loaded, unloaded, sorted and stored by electronically-controlled equipment. The Bison was designed and built by General Motors Styling under the direction of GM Vice President William L. Mitchell. The cab, “power pod” and trailer total 50 feet in length. Gas Turbine Power The vehicle would have a twin-turbine powerplant providing 1,000 horsepower from two gas turbines of 280 and 720 horsepower, based on the GT309 gas turbine developed by General Motors Research Laboratories. The two gas turbines are enclosed in a pod mounted behind the cab over the “fifth wheel” (trailer attachment point) and the four driving wheels. This location improves aerodynamic flow by filling the gap between the tractor and trailer roofs, and provides cleaner air for the gas turbine engines. The engines can be lifted off individually for service or replacement. The 280 horsepower gas turbine, a regenerative type, would provide power for normal highway cruising conditions. The non-regenerative 720 horsepower gas turbine would add its power when needed for acceleration or climbing grades, or for pulling two or more trailers. Power could be distributed to all axles on both tractor and trailer units by a turbine electric system. General Motors’ experience with vehicular gas turbine design dates back almost two decades Today’s GT309 represents the latest development in a series of heavy duty vehicular, dual shaft, regenerative gas turbine engines. The GT309 features a single-stage centrifugal compressor, rotating regenerator, single can-type direct-spray burner and two axial turbines. To improve partial load fuel economy and provide engine braking, “Power Transfer” technology is employed, which connects the gasifier and power turbine shafts through a controlled torque coupling. A patented development of the GM Research Laboratories and Allison Division. “Power Transfer” transmits a scheduled amount of power from the gasifier turbine to the output shaft, thus stabilizing the turbine inlet temperature over much of the engine operating range. A direct result is improved fuel economy at partial throttle, where the engine operates most of the time. When the vehicle decelerates, power transfer couples the driving wheels to the compressor, providing engine braking power two to three times greater than that of a conventional diesel-powered truck. For example, the power transfer system of the 280 horsepower GT-309 gas-turbine engine provided over 1000 lb. ft. of torque at stalled output rpm. Power transfer allowed trucks to make faster and safer descents, controlling downhill speeds while extending service brake and wheel-end life. Another function of Power transfer was to prevent turbine overspeed if the load suddenly is disconnected from the engine. Futuristic Cab Design The Bison’s cab provides comfortable seating for two, ahead of the engines and wheels. Windshield and side windows are combined in a single panoramic window giving uninterrupted vision to the operator. Easy entrance and exit is provided by a forward-tilting canopy, and a step which folds down when as the canopy opens. The Bison is steered with two coupled hand grips on a console extending over the driver’s lap. To turn the vehicle, the grips are tilted from side to side. Also located on the driver’s console are the steering option selector lever, speedometer and a maintenance monitor indicator lamp which illuminates green while all systems are okay, amber when something requires attention at the next service opportunity, and red when a malfunction renders the Bison inoperable. Revolutionary Steering Technology Unique engineering features of the Bison include a trailer locking device, and a four-option steering arrangement. This provides the stability and safety advantage of a straight (rigid) truck on the highway, while also making possible exceptional maneuverability in urban traffic and freight terminals. With an adaptor, the Bison could also handle present day semi-trailers. The four steering options are: Single front axle steering, for operation as a semi-trailer rig on city streets.Tandem front axle steering (twin-steer), with all four front wheels turning parallel and the fifth wheel locked to make the Bison a rigid chassis truck for the highway.Opposed steering, with front and rear wheels turning in opposite directions for close turns at low speeds.Single rear axle steering, for trailer spotting.A combination jack and sander is housed in a cylinder between the driving wheels. It is actuated by the air-oil suspension system and can be controlled as a jack from either inside or outside the cab. The sander distributes sand to both wheels to provide traction in both forward and reverse directions. The Future of LTL – Standardized Containerization The Bison’s trailer is designed around a standardized container system using rigid weatherproof containers if eight by eight-foot cross sections in 10, 20, 30 and 40 foot lengths. This system has recently been approved by the American Standards Association, and is already in use. Containers could be removed individually, and new ones added, as the Bison calls at various freight terminals on its programmed route. At the terminals, the containers could be transferred by automatic equipment to smaller local delivery trucks or other modes of transport, or stored in open, pigeon hole-type buildings. The entire terminal operation could be automatic, with loading and unloading of vehicles, and sorting and movement of containers, all controlled by electronic equipment. The GM Futurama Exhibit – 1964/65 World’s Fair at Flush Meadows Park, New York The Bison, painted a bright orange color, is on display in the lower product plaza of the General Motors Futurama exhibit. The GT309 gas turbine engine is being exhibited at the Futurama by General Motors Research Laboratories. Applications of the vehicle’s containerization principles are demonstrated in scale models in the Futurama ride’s “City of Tomorrow” exhibit, and in a Metro-Mobility exhibit in the lower product plaza. Related reading – (GT309 gas turbine) http://www.bigmacktrucks.com/index.php?/topic/31898-the-gas-turbine-chevrolet-turbo-titan-iii/ http://www.bigmacktrucks.com/index.php?/topic/31891-the-gas-turbine-general-motors-bison-iii/ .

-

When you called Volvo's Mack brand customer service desk at 866-298-6586, how did they offer to help resolve your issue? How did they attempt to do so?

-

1975 IH Transtar 4100 Conco Cabover on Ebay

kscarbel2 replied to bulldog man's topic in Other Truck Makes

Perhaps improper on my part, but I always thought of the Transtar 4100 ConCo as a successor to the "Sightliner". -

When you called Volvo's Mack brand customer service desk at 866-298-6586, how did they offer to assist you?

-

Lillesand, Norway-based Birkeland Transport (Bendiks) operates a fleet of DAF, Scania and Volvo tractors, as well as a Mack E9 V8-powered Magnum. Here’s the Magnum last month at Alashankou land port, at the border of Kazakhstan and northwest China (a long way from Norway). Bendiks website - http://bendiks-transport.no/bilparken/ Past photographs of this truck - http://hankstruckforum.com/htforum/index.php?topic=56444.105 .

-

Transport Engineer / June 25, 2015 TNT UK has taken delivery of 20 Euro 6 Iveco Stralis Hi-Road 4x2 tractors, after the vehicle came out top in a six-month, 80,000km trial by the operator. Supplied by dealer Sherwood Truck & Van, each Stralis has a Cursor 11 engine delivering up to 420bhp between 1,600 and 1,900 rpm, and up to 1,900Nm of torque between 900 and 1,550 rpm. The vehicles were also specified with Iveco's 12-speed fully automated EuroTronic transmission. Feedback on the trial vehicle was "very positive", confirms Steve Davis, TNT's national engineering manager. "In addition to its good fuel economy, we heard only good reports on maintenance and reliability, while drivers also praised the cab." Fuel efficiency, says Iveco, comes from HI-SCR, its high-efficiency selective catalytic reduction system, which achieves lower emission levels without the use of EGR (exhaust gas recirculation). According to the manufacturer, this is a less complex yet highly efficient technology, which delivers weight reduction, lower exhaust temperatures and better durability. The new Stralis AT440S42T/Ps will operate with dry freight box van trailers from three locations in the south – Byfleet, Alton and Southampton – to other TNT hubs throughout the UK. .

-

Renault Press Release / June 25, 2015 On 18 June, Bruno Blin, the President of Renault Trucks, presented keys to 32 Renault Trucks T vehicles to Jacky Perrenot, Chairman-Founder of the Zamenhof Group. The trucks are 4x2 models spec’d with 11-liter 460 horsepower DTI Series engines. Jacky Perrenot chose to have them fitted with the Fuel Eco pack, which combines several intelligent technologies designed to reduce fuel consumption: power mode inhibition, the eco-cruise control with the Optiroll controlled freewheeling mode, the disengageable air compressor, the variable flow steering pump and the automatic engine cutout. The partnership between Renault Trucks and Jacky Perrenot continues. After acquiring 33 Renault trucks vehicles last year, this frontline haulier is reasserting its confidence in Renault by making further acquisitions in the course of the coming year. The Renault T Series was voted International Truck of the Year for 2015 and boasts the official “Guaranteed Made in France” label. “Driven by strong growth over the last few years, the Zamenhof Group now has a workforce of over 4,000, generates revenues of €600 million, runs 70 sites in France and internationally and has over 3,500 engine registration cards,” explains Jacky Perrenot. “We are delighted to strengthen our association with Renault Trucks, which began several years ago. It was important for our company to acquire vehicles made in France, and particularly at Bourg-en-Bresse. These 32 vehicles will be allocated to La Flèche Bressane, a recently established Group subsidiary also based in Bourg-en-Bresse. Furthermore, our ongoing fleet renewal policy (with vehicles’ average age of under three years), concern for our environmental impact and our proactive SER all underpinned our decision to purchase these Renault Trucks Euro 6 vehicles, voted International Truck of the Year for 2015.” For his part, Bruno Blin said: “We are very pleased to consolidate the close relationship we have long had with the Jacky Perrenot Group and its management. Jacky Perrenot’s decision to add more Renault T Series tractors to its fleet is further proof of the vehicle’s qualities and the confidence that exists between him and Renault Trucks.” .

-

Oshkosh Wins Contract to Restore Army’s Heavy Tactical Trucks

kscarbel2 replied to kscarbel2's topic in Trucking News

US Military Adds Heavy Trucks Under FHTV-III Defense Industry Daily / June 19, 2015 Oshkosh Defense was awarded a $780.4 million contract to recapitalize over 1,300 Heavy Expanded Mobility Tactical Trucks, 435 palletized load systems (PLS) and over 1,000 new palletized load system trailers, as well as other equipment. The contract will run to 2022, with the multi-year contract incrementally funded. In 2009, with its bridge buy of FMTV medium trucks in place, and initial awards for the potential JLTV Hummer replacement designs underway, the next order of business on the US Army’s agenda was a new Family of Heavy Tactical Vehicles multi-year contract: FHTV-III. That multi-billion dollar FHTV-III contract has been awarded – not as a re-compete like FMTV, but as a single-source solicitation. Oshkosh has provided the core of this capability for over 20 yeas now. Its Heavy Expanded Mobility Tactical Trucks (HEMTT) and their 13-ton payloads are the mainstay of the FHTV fleet, serving in variants that include M977/985 Cargo, M978 Fueler, M982/983 Tractors, and M984 Wrecker/Tow; they also serve as heavy transporters for Patriot and THAAD air defense systems. M1074/75 Palletized Load Systems (PLS) and PLS trailers (PLST) are best known for their automated container/pallet loading arms, and for their Universal Power Interface Kit (UPIK) that can add modules for firefighting, construction, cranes, cement mixing, etc. The M1000/1070 Heavy Equipment Transporters (HET) are flatbeds that can transport a 70-ton Abrams tank – or anything less – in order to save wear and tear on expensive armored vehicles and on the roads. A specialized FHTV truck called the M1977 CBT can lay bridges. Most of the US Army’s HEMTT trucks are the A2 version; Oshkosh delivered the 20,000th HEMTT truck on Feb 14, 2008. The HEMTT A4 is the latest improvement to the line. HEMTT A4 will be produced in several models, including the the basic M997A4 cargo truck, M982A4 and M983A4 tractors for use as tractor-trailers, an M984A4 recovery truck fitted with cranes and winches, the M978A4 fuel servicing truck (tanker), and the M1120A4 load handling system variant, whose loading-assist arms & winch system is lighter than the M1074/75 PLS. The hybrid drive HEMTT A3 variant is still in development. It claims to offer the same 13-ton cargo capacity and C-130 transportability, with a 20% improvement in fuel economy thanks to diesel-electric propulsion. Its configuration also gives the vehicle an on-board generator that can export 100 kW of military-grade power to power devices, weapons and sensors, or even a small remote installation. The A3’s electrical power potential was attractive to Raytheon’s Mobile Centurion prototype, for instance, which mounts a modified Phalanx radar-guided, electrically-driven 20mm gatling gun turret on the truck in order to shoot down incoming mortars, rockets, and artillery rounds. The new HEMTT A4 production variants feature a 500 hp Caterpillar C-15 engine, an Allison 4500 SP/5-speed automatic transmission, rated for 600 hp, power-train upgrades to 1,750 pounds of torque, suspension upgrades, and major changes and additions to the cab. The HEMTT A4 shares common cab, parts, and support with the new palletized load system (PLS-A1) truck, reducing the need for separate spares. An improved climate control system that can handle tropical conditions is built into that cab, rather than requiring a retrofit as is the case for the HEMTT A2s. A corresponding HEMTT A4 Light Equipment Transporter (LET) adds a special “hitch” for light trailers, etc. For heavier hauling, the new HET A1 features numerous upgrades to the M1070 HET, including a 700-horsepower engine and an Allison 4800SP transmission, as well as better diagnostics, improved seats, higher capacity front suspension, standard air conditioning and an available 3rd door. HET trucks often use the M1000 heavy-duty trailer. Many of these upgrades actually revolve around the US Army’s Long Term Armor Strategy (LTAS). This LTAS-A armor can be augmented with a standardized, bolt-on LTAS-B kit for greater protection, and an integrated mounting allows fast installation of a protected gunner position (GPK) and machine-gun mount on the cab roof. HEMTT-A4 and their forthcoming companions the PLS-A1 and HET-A1 will come off the assembly line fitted with upgraded suspensions, the engine improvements noted above, different cab designs, and integral composite armor. Oshkosh Defense’s director, Army Tactical Vehicle Programs Mike Ivy is quoted in AUSA’s April 2008 article as saying that Israeli firm Plasan Sasa played a large role on designing the FHTV LTAS-B armoring kit, but Finmeccanica’s DRS will be the main supplier for the program. The Army’s new medium FMTV-A1P1 trucks that are currently produced by BAE Systems have their own LTAS-A and LTAS-B kits, extending the LTAS up-armoring approach across the US Army’s entire truck fleet. LTAS-related changes aren’t the only updates under consideration. A J1939 databus gives the new HEMTT trucks the same kinds of capacity for self-diagnosis and automated troubleshooting that the FMTV medium truck fleet has used so effectively. C4ISR updates are also under consideration. Ivy: “We are installing in one of our prototype trucks, located at Aberdeen Proving Ground, Md., a number of installation kits for the suite of C4ISR [command, control, communications, computers, intelligence, surveillance and reconnaissance] systems that soldiers expect to see in vehicles today… That includes things like the Movement Tracking System, GPS, Battle Command System [DID: Blue force Tracker] the whole suite of systems that gives the soldier increased situational awareness. Although there is nothing inherent in the A4 for the Future Combat System-equipped brigade, it could easily be adapted to that, given the right installation kits.” The integration of the installation kits by Oshkosh will allow the Army to test a range of potential C4ISR capabilities for the new platforms.” Some FHTV-III orders are defined as RECAP orders, however, and won’t be new build machines. RECAP is part of the US Army’s planned sustainment triad of RESET, RECAP, and Replace. Recapitalization is depot-level maintenance activity that completely rebuilds the vehicles from the frame up, inspecting all parts and replacing worn items, while adding selected enhancements to benefit from more modern parts and technologies. Under the HEMTT overhaul/ remanufacturing contract, for instance, Oshkosh integrates LED marker lights, two-piece wheels, engine and transmission upgrades, and air ride seats. Ancillary equipment such as cargo bodies, cranes, and fifth wheels are also overhauled and reassembled for use on the remanufactured vehicles. The tires and all electronics, such as wire harnesses, gauges, etc. are replaced with new. The vehicles are reassembled on the same integrated vehicle assembly line as a new truck, with a new “zero hours/zero miles” bumper-to-bumper warranty. All at significant savings over the cost of building a new vehicle. All contracts are issued to Oshkosh Corp. in Oshkosh, WI, and managed by the U.S. Army’s Tank-automotive and Armaments Command (TACOM) in Warren, MI, unless the entry says otherwise. June 19, 2015: Oshkosh Defense was awarded a $780.4 million contract to recapitalize over 1,300 Heavy Expanded Mobility Tactical Trucks, 435 palletized load systems (PLS) and over 1,000 new palletized load system trailers, as well as other equipment. The contract will run to 2022, with the multi-year contract incrementally funded. Jan 9, 2012: Icahn Proxy battle. The proxy skirmish with Icahn for control of Oshkosh turns into a war. Icahn’s SEC DFAN14A materials express concern about the coming FHTV re-bid, and identify Oshkosh’s FMTV win strategy as 1 of 2 devastating strategic mistakes (the 2006 JLG acquisition being the other) that have consumed management’s attention and driven down profitability, even as other business segments have floundered and need focus: “We believe that the FMTV represents the single largest problem with the future of this company… We believe this unprofitable contract represents management’s unrealistic attitude and poor planning, as well as the board’s lack of oversight on a product that represents over half of segment revenue.” The expressed fear is that Oshkosh’s strategy of wildly underbidding and creating an unprofitable contract will be followed again with FHTV, destroying the company’s military segment in the pursuit of market share over viable business. The company responds by raising serious questions about Icahn’s Board choices, ethics, and lack of an expressed strategy – a charge Icahn also makes about company management, as he advocates divesting JLG and exploring a merger with Navistar. Meanwhile, an analysis from the Lexington Institute sounds a cautionary note for the US Army: “The company finds itself in this predicament because it made some ill-timed acquisitions at the top of the sub-prime real estate boom (most notable lift-maker JLG), and then sought to compensate for its error by bidding very aggressively on Army truck contracts… Oshkosh executives apparently thought they could win more favorable terms on the Army work by proposing design enhancements, but the customer insisted on sticking with the original contract terms… [A commercial suppliers strategy] ignores the loss of control implied for the Army customer. When you are by far the biggest source of demand for a company’s products, then you can pretty much dictate the terms of the relationship. When you are only one of many customers, you have less influence… The fact that submerging Oshkosh into the Navistar culture will give the Army fewer competitive options in the future is fine with [icahn]; that’s how you get pricing power.” Dec 30, 2011: An $11.7 million firm-fixed-price contract modification to buy HEMTT A4 Light Equipment Transporters. The LETs have a special “hitch” for light trailers, etc., and already serve in the HEMTT A2 configuration. Work will be performed in Oshkosh, WI with an estimated completion date of Dec 31/13. One bid was solicited, with one bid received (W56HZV-09-D-0024). July 20, 2011: Oshkosh Defense announces that they will recapitalize 160 FHTV trucks to HEMTT A4 and PLS A1 standards, under a “more than $50 million” order from the U.S. Army. Work is expected to begin in March 2012, and end in September 2012. June 9, 2011: Oshkosh announces an award for “more than 730″ FHTV trucks, including new and recapitalized HEMTT A4s and new HET A1s. Production of the new HEMTT A4s and HETs on these awards is expected to begin in April 2012, and be complete in September 2012. Recapitalization of the HEMTT A4s began in May 2011, and is scheduled to be completed in September 2012. Together, these orders have a value of “more than $252 million.” Jan 19, 2011: A $22.6 million firm-fixed-price contract for 301 HEMMT LRAS B-Kit Armor Sets. Work will be performed in Oshkosh, WI, with an estimated completion date of June 30/11. One bid was solicited with one bid received (W56HZV-09-D-0024). Dec 23, 2010: A $21.4 million firm-fixed-price contract for 368 M1076 PLS trailers. Work will be performed in Oshkosh, WI, with an estimated completion date of Sept 30/11. One bid was solicited with one bid received (W56HZV-09-D-0024). Dec 6, 2010: Oshkosh Defense and the U.S. Army commemorate the rollout of the 1st production FHTV HET A1 and Palletized Load System A1 heavy trucks. Oct 13, 2010: A $389.6 million firm-fixed-price contract for 1,054 “new palletized load systems trucks M983A2 LETs,” under the FHTV-III contract. Work is to be performed in Oshkosh, WI, with an estimated completion date of Sept 30/12. One bid was solicited with one bid received by TACOM in Warren, MI (W56HZV-09-D-0024). Subsequent queries to Oshkosh Defense reveal that this order is not for PLS or HET trucks, but represents the initial HET A1 contract they discussed on Oct 6/10. In other words, the Pentagon release is mistaken and misleading. Oct 6, 2010: Oshkosh Defense announces a $440 million contract for over 1,000 HET A1 trucks – the 1st production order for the new HET A1 configuration. Production will take place in Oshkosh, WI, and is scheduled for completion in June 2012. Oct 4, 2010: A $70 million requirements contract for 139 new HEMTT M984A4 wreckers, and 7 new HEMTT M983A4 LET trucks. Work is to be performed in Oshkosh, WI, with an estimated completion date of Sept 30/11. One bid was solicited with one bid received (W56HZV-09-D-0024). June 30, 2010: Oshkosh announces 2 delivery orders from the U.S. Army TACOM Life Cycle Management Command (LCMC) worth over $600 million. Order #1 is worth $584.9 million, and extends production for 1,726 new and recapitalized severe-duty HEMTT A4 vehicles (1,274 new, 452 refurbished), and 98 Palletized Load System (PLS) trailers; it was announced by the Pentagon on July 2/10. The second award was announced by the Pentagon on June 16/10, and is noted below. HEMTT deliveries will begin in July 2010, and continue through September 2011. PLS A1 trailer production will start in June 2011, and continue through October 2011 (W56HZV-09-D-0024). June 16, 2010: A $24.3 million firm-fixed-price contract for 439 palletized load system trailers. The M1074/75 PLS has a high-capacity automated loader for heavy gear Work is to be performed in Oshkosh, WI, with an estimated completion date of Sept 30/12 (W56HZV-09-D-0024). June 15, 2010: A $6.1 million firm-fixed-price contract adds 5 HEMTT M984 A4 wreckers without their winch, but with Carwell rustproofing. Another 15 HEMTT M983 A4 tractors would have both a winch and Carwell rustproofing. Work will be performed in Oshkosh, WI, with an estimated completion date of Jan 31/11 (W56HZV-09-D-0024). June 11, 2010: A $34.8 million requirements delivery order contractor 90 RECAP “M11220 A4″ and 50 RECAP M977 HEMTT A4 cargo trucks, with associated boxed engines and the ability to order missing parts as required. The first designation is actually a typo, and should refer to M1120 A4 HEMMT Load Handling System trucks, with an automated loader for heavy gear. Work is to be performed in Oshkosh, WI with an estimated completion date of June 30/11. One bid was solicited with one bid received (W56HZ-09-D-0024). June 8, 2010: A $138.8 million firm-fixed-price contract, adding additional vehicle variants and accompanying US Federal Reserve excise tax for those vehicles to the FHTV-III contract. The tax is related to vehicle weight, and applies to trucks used in the USA; it’s 100% pass-through, where one branch of government pays another. The vehicles in question are 481 HEMTT M983A4 light equipment transporters, and 1 HEMTT M1120A4 load handling system. Work is to be performed in Oshkosh, WI, with an estimated completion date of Sept 30/11. One bid was solicited with one bid received (W56HZV-09-D-0024). May 7, 2010: A $6 million firm-fixed-price contract for 25 Heavy Expanded Mobility Tactical Truck (HEMTT) M983A2 light equipment transporter trucks. Note that these are the A2 version, not the A4 version; but they are on the FHTV-III contract (W56HZV-09-D-0024). Work is to be performed in Oshkosh, Wis., with an estimated completion date of Sept 30/12. May 3, 2010: Oshkosh Defense announces 2 contracts. The first $8 million contract will supply more than 90 HEMTT A4 “B-kits” for additional armor, over and above factory-installed “A-kit” armor. The B-kits can be installed in-theater, and delivery is expected to be complete by September 2010. A second award valued at more than $5 million will apply self-sealant coating to more than 300 new and recapitalized M978 A4 Tankers, continuing work that began in December 2009 and extending it to September 2010. The coating seals punctures from small-arms fire or other small, high-velocity objects – which sounds like a pretty good idea if you’re driving a truck loaded with diesel fuel. April 20, 2010: Oshkosh Defense announces a US Defense Logistics Agency (DLA) award worth more than $6 million to supply 600 axles for the HEMTT A4. Production is expected to begin in October 2010 and be complete by January 2011. March 18, 2010: Oshkosh Defense announces an $11.4 million delivery order for “more than 40″ next-generation HEMTT A4 heavy trucks to the United Arab Emirates. The HEMTT variants included in this contract are the Patriot tractor, wrecker and guided missile transporter. The vehicles will be built and delivered July through September 2011, and the order was issued under the FHTV-III) contract to take advantage of volume pricing. Feb 22, 2010: A $13 million delivery order to supply more than 35 HEMTT A4 trucks to the US Army Reserve. The variants include M984A4 wreckers and M1120A4 load handling systems. Production is expected to begin in September 2010 and be complete in June 2011. Feb 11, 2010: Oshkosh Defense announces a $5 million delivery order for “more than 15″ HEMTT A4 trucks. Vehicles include M985A4 guided missile transporters (GMT) that deliver missile 4-packs to THAAD launchers using an integrated crane, M977A4 electrical power plant (EPP) trucks , and large repair parts transporter (LRPT) cargo trucks. Production is expected to begin in July 2010 and be complete in September 2010. Feb 5, 2010: DRS Sustainment Systems, Inc. in St. Louis, MO receives a $93.7 million firm-fixed-price delivery order for 275 HET M1000 trailers. Work is to be performed in St. Louis, MO, with an estimated completion date of May 30/12. One bid was solicited with one bid received (W56HZV-09-D-0107 #0002). Feb 1, 2010: The US DoD releases its FY 2011 budget request. It includes a total of $741.9 million for the FHTV-III program, split $553.2 million in the regular defense budget, $188.7 in “OCO” supplemental funding buys, and $3.5 million for Research, Development, Testing & Evaluation. The request must pass through Congress and be approved before it translates into actual appropriations. Jan 28, 2010: Oshkosh announces a $21+ million delivery order under FHTV-III, to produce more than 60 recapitalized M984 HEMTT A4 wrecker trucks, plus components and engines. Production is expected to begin in January 2011, and be complete in April 2011. The heavily used vehicles are returned to Oshkosh, stripped to their frame rails, completely rebuilt to like-new condition, and upgraded to the new A4 configuration. Jan 21, 2010: Oshkosh announces 4 awards from the US Defense Logistics Agency, valued at $89 million, for its M-ATV MRAPs and FHTV trucks. When asked, Oshkosh representatives break out the contracts, explaining that the contract for 2,400 HEMTT A2 and A4 axle assemblies is worth over $25 million, and the contract for “more than” 430 HET engines is worth over $13 million. Work under these orders is expected to be complete by December 2010. Jan 6, 2009: Oshkosh Defense and Boeing announce that the HEMTT A4 has been selected as the platform for the U.S. Army’s High Energy Laser Technology Demonstrator (HEL TD) program. Boeing officials received the HEMTT A4 in December 2009 , and integration of the HEL TD system will begin in spring 2010 at Boeing’s Huntsville, AL facility. With its critical design review complete, Boeing will now attempt to build a rugged beam control system on the widely used truck. The beam control system includes mirrors, high-speed processors and high-speed optical sensors for the electrically powered, solid state laser. The system must acquire, track, and select an aimpoint while the system receives the laser beam from the laser device, them reshape and align the beam, and focus it on the target. Boeing completed a vehicle trade study for HEL TD, and identified the HEMTT A4 as the best solution for this demonstrator phase. Boeing representatives added that the hybrid drive HEMTT A3 is a viable candidate for the future objective system if it’s fielded, and that its extra onboard power capacity would be seen as a plus. Dec 29, 2009: A $258.4 million firm-fixed-price contract for 728 new M1075 Palletized Load System (PLS) trucks (W56HZV-09-D-0024). Work is to be performed in Oshkosh, Wis., with an estimated completion date of Sept 30/12. Dec 29, 2009: A $31.9 million firm-fixed-price requirements contract to change another 728 M1075 PLS trucks from the A0 configuration to the A1 configuration. Work is to be performed in Oshkosh, WI, with an estimated completion date of Sept 30/12. As noted above, the PLS A1 is the most current design, with a Long Term Armor Strategy (LTAS)-compliant cab, a 600-hp engine, the Oshkosh-patented TAK-4® independent front suspension, and a demountable flatrack cargo bed with 16.5-ton payload capacity. Dec 29, 2009: Oshkosh received a $31.75 million firm-fixed-price requirements contract for the purchase of 110 new M977 HEMTT A4 trucks under the existing FHTV-III contract (W56HZV-09-D-0024). Work is to be performed in Oshkosh, WI, with an estimated completion date of Sept 30/12. Dec 18, 2009: Oshkosh Defense announces a $56 million delivery order from US Army TACOM LCMC, to supply the Army with the first set of 207 M983 HEMTT A4 Light Equipment Transporters (LET). The LETs have a special “hitch” for trailers, etc., and already serve in the HEMTT A2 configuration. These are the first A4 configuration vehicles for this model. Unusually, the Oshkosh announcement precedes the Pentagon’s Dec 29/09 announcement of this $56.4 million firm-fixed-price requirements contract. Work is to be performed in Oshkosh, WI, with an estimated contract completion date of Sept 30/12. Production and delivery is expected to be complete in September 2010. The award brings the U.S. Army’s total Family of Heavy Tactical Vehicles (FHTV) contract to more than $3.2 billion, under the FHTV-III contract (W56HZV-09-D-0024). Dec 16, 2009: Oshkosh Defense announces an order valued at more than $63 million from the U.S. Army TACOM LCMC, to supply more than 1,150 Palletized Load System (PLS) trailers. The trailers feature a removable cargo bed (flatrack) with a 16.5-ton payload capacity. Production is expected to be complete in June 2011. Oct 21, 2009: Oshkosh Defense announces a $35 million contract modification from for 102 HEMTT A4 heavy trucks, on behalf of the US Army’s National Guard units. The vehicles will include HEMTT M985A4 cargo truck and M1120A4 load handling system models, and will be delivered by March 2010. Sept 29, 2009: Oshkosh announces an $801 million delivery order from the U.S. Army TACOM LCMC for more than 1,190 new next-generation HEMTT A4s, more than 180 new HEMTT A2s and more than 80 Palletized Load System Trailers for the U.S. Army. Oshkosh also will deliver more than 1,020 recapitalized HEMTT A4s. Total: over 2,470 new and recapitalized HEMTT and PLST trucks. Work is expected to be complete by May 2011. Sept 8, 2009: Oshkosh Defense received a delivery order worth more than $23 million from TACOM LCMC for 45 HEMTT M984 A4s wreckers. Production will begin in March 2010 and is expected to be completed by May 2010. The Oshkosh HEMTT M984 A4 wrecker is a heavy duty tow truck equipped with a crane and winches to recover disabled vehicles. The wrecker can tow disabled vehicles as well as perform vehicle maintenance in severe off-road conditions. July 7, 2009: Oshkosh Defense announces a $9.4 million contract modification from TACOM Life Cycle Management Command to begin durability and performance testing of the new Heavy Equipment Transporter (HET) A1 model. Testing will take place at Yuma Proving Ground, AZ. Once testing is completed, full-rate production of the Oshkosh HET A1 is scheduled for early 2010. June 18, 2009: Oshkosh Corp. in Oshkosh, WI received a maximum $31.1 million firm-fixed-price, indefinite-delivery/ indefinite-quantity contract for HEMTT engines, on behalf of the US Army. There was originally one proposal solicited with one response, and contract funds will expire at the end of the current fiscal year on Sept 30/09. The contract itself will run until June 19/12, managed by the Defense Logistics Agency Warren (DSCC-ZG) in Warren, MI (SPRDL1-09-D-0025). June 15, 2009: Oshkosh Defense announces a $38+ million delivery order for more than 100 new HEMTT M978A4 fuel tanker and M985A4 cargo trucks, on behalf of the U.S. Army National Guard. The U.S. Army Tank-automotive and Armaments Command (TACOM) Life Cycle Management Command (LCMC) will be managing this order. May 21, 2009: DRS Sustainment Systems received a $103.9 million firm-fixed-price contract for 274 M1000 heavy equipment transporter semitrailers. DRS Sustainment will perform the work at its facility in Saint Louis, MO, with an estimated completion date of May 30/12. One bid was solicited and received by TACOM-Warren, AMSCC-TAC-ATBC, in Warren, MI (W56HZV-09-D-0107). The M1000 semitrailer carries armored vehicles and other heavy equipment loads weighing up to 80 tons. The M1000 is able to load, unload, and transport the M1 Abrams tank and other heavy equipment on-road, off-road and cross country, in all weather conditions. May 21, 2009: Oshkosh Defense announces a delivery order with the U.S. Army Tank-automotive and Armaments Command Life Cycle Management Command (TACOM LCMC) for more HEMTT trucks and trailers. The delivery order, valued at more than $28 million, includes M1120A4 Load Handling System (LHS) and M978A4 fuel tanker trucks. The US Army Reserve will receive more than 70 HEMTT A4s, and more than 30 Palletized Load System Trailers (PLST) with an automated loading arm. The US Marine Corps will receive 30 PLSTs, which will be integrated with their Oshkosh LVSR heavy trucks. May 20, 2009: Oshkosh Defense announces a $40 million delivery order for “more than 130″ HEMTT A4 trucks. Most will be new-build, but 3 vehicles will be RECAP. April 20, 2009: A maximum $8.3 million firm-fixed-price, 5-year contract, covering transfer cases with containers for the Heavy Expanded Mobility Tactical Truck (HEMTT). This was originally a sole source competition, and the date of performance completion is April 20/14. TheDefense Logistics Agency in Warren, MI manages this contract (SPRDL1-09-D-0007). Feb 25, 2009: Oshkosh Defense announces a $477 million delivery order calls for more than 1,350 HEMTT A4s (750 new, 600 RECAP) and more than 1,000 of the Palletized Load System Trailers (PLST) that help with loading and unloading. This latest order pushes the total value of the FHTV-III contract so far to more than $2.1 billion. Feb 25, 2009: Oshkosh Defense unveils its new HET A1 variant at the Association of the United States Army (AUSA) Winter Symposium and Exposition in Fort Lauderdale, FL. Dec 31, 2008: Oshkosh Corp. in Oshkosh, WI received a maximum $1.121 billion firm-fixed-price, indefinite-delivery, sole source contract for heavy and medium tactical truck support, if all 9 option years in this 10-year contract are exercised. Under the contract, Oshkosh Defense will supply the DLA with replacement parts to support Oshkosh’s medium and heavy tactical vehicles, which include the US Marines’ Medium Tactical Vehicle Replacement (MTVR) truck, and the Army’s FHTV Heavy Expanded Mobility Tactical Trucks (HEMTT) and Palletized Load Systems (PLS). Oshkosh also supplies replacement parts for other manufacturers’ medium and heavy-payload vehicles. The first contract order is valued at $17.5 million and is for approximately 2,300 replacement part numbers to support Oshkosh’s tactical vehicles. This follows the previous 8 year contract, which was structured as a one-year contract with 7 option years, each of which were exercised, that ended in December 2008. There were originally 2 proposals solicited, but only one response. The contract’s base year will end on Dec 31/09, but options could continue this agreement to 2018. The US Defense Logistics Agency’s Defense Supply Center Columbus (DSCC) in Columbus, OH (SPM7LX-09-D-9008) manages these contracts. Dec 22, 2008: Oshkosh Defense announces a $5 million contract modification to RECAP approximately 30 M1977 Common Bridge Transporters (CBT). Under the modification, Oshkosh Defense will tear down the 10-year-old HEMTT A0-derived CBTs, and upgrade them to HEMTT A2 Load Handling System (LHS) equivalents with computer-controlled engines and transmission systems, as well as a lighter load handling system. Dec 15, 2008: Oshkosh Defense announces a $9.4 million contract modification with the U.S. Army Tank-automotive and Armaments Command (TACOM) for continuing research and development of their diesel-electric drive HEMTT A3 variant. The contract modification will fund additional improvements to the current HEMTT A3 technology demonstrator, by upgrading the vehicle’s engine horsepower and incorporating the U.S. Army’s LTAS armoring strategy. Under this contract, the firm will end up delivering 2 new HEMTT A3 vehicles. One will be provided to the U.S. Army for a 20,000-mile durability test at its Aberdeen Test Center. The 2nd vehicle will be benchmarked for performance against the current HEMTT A2/A4 production vehicles. Oshkosh Defense President John Stoddart described this contract as: “…among the first steps that could establish the HEMTT A3 as the Army’s next-generation support vehicle.” Time will tell. Nov 26, 2008: Oshkosh Defense announces a $51 million contract with the for more than 660 LTAS-B up-armoring kits for HEMTT A4 trucks. The $51 million contract includes a recent $15 million armor kit contract modification. The LTAS-A kit is armoring installed at the factory, and delivered with the trucks. The LTAS-B kit is the add-on armor which the HEMTT A4 has been designed from the outset to carry, if necessary. It can be installed by a 2-soldier crew with no special tools, other than the required lifting devices to get the pieces into position. Since Oshkosh’s Palletized Load System (PLS) A1 trucks will share a common cab with the HEMTT A4 , they will also be able to use these armor kits when they are fielded. Nov 4, 2008: Oshkosh Corp. in Oshkosh, WI received the new FHTV-III multi-year contract, which will add more than 6,000 upgraded vehicles to the U.S. Army’s FHTV fleet. The initial delivery order is a $1.267 billion requirements contract firm-fixed-price contract to buy 2,285 new HEMTT-A4 trucks, 768 HEMTT RECAP trucks, and to upgrade a lower model truck. Work will be performed in Oshkosh, WI with deliveries expected to begin in November 2008 and an estimated completion date of Sept 30/12. One bid was solicited and one bid was received by TACOM in Warren, MI (W56HZV-09-D-0024). A series of orders that were issued in February and March 2008 raised initial HEMTT A4 orders to 1,745 new and 292 RECAP trucks, with production slated to begin in July 2008. The initial delivery order under FHTV-III will more than double this total. -

Trucking News / June 22, 2015 The U.S. Army has awarded Oshkosh Defense, a five-year requirements contract to recapitalize its Family of Heavy Tactical Vehicles (FHTV). Oshkosh will bring the Army’s fleet of Heavy Expanded Mobility Tactical Trucks (HEMTT) and Palletized Load Systems (PLS) to the latest model configuration and the same zero-mile, zero-hour condition as new production vehicles. Overall, the contract’s potential value is $780 million for the recapitalization of an estimated 1,800 FHTVs, in addition to the production of about 1,000 trailers. All work performed under the contract will be completed in Oshkosh, Wis., with deliveries occurring from 2015 to 2019. “As the OEM, we will recapitalize the U.S. Army’s heavy vehicles to like-new condition in order to achieve the required levels of operational readiness,” said John Bryant, senior vice president of defense programs at Oshkosh Defense. “Because the heavy fleet is the logistics backbone for a spectrum of operations, Oshkosh has worked with the Army to restore more than 12,000 heavy vehicles since 1995 – providing soldiers with the latest safety features and improved reliability for in-theater operations.” Through recapitalization, heavily used vehicles are returned to Oshkosh, stripped to the frame rails and completely rebuilt to like-new condition. Recapitalized vehicles are assembled on the same production line as new vehicles, and put through the same extensive performance tests and inspection procedures as new vehicles. The vehicles also receive the latest technology and safety upgrades and are delivered with a new bumper-to-bumper warranty. With a 13-ton payload and multiple variants for a wide range of operations, the HEMTT is the backbone of the Army’s logistics fleet. Oshkosh’s latest configuration, the HEMTT A4, brings significant improvements in power, maintenance and safety to the battlefield, traversing even the most challenging environments easier and more efficiently. The Oshkosh PLS supports the Army’s distribution and resupply system by providing unparalleled performance for loading, unloading and delivering ammunition and other critical supplies needed in battle. The PLS carries a wide range of cargo, and is specially designed to load and unload a variety of flatrack or ISO compatible containers on its own. The latest configurations of FHTV trucks also include air-conditioned and armor-ready cabs, electrical upgrades, and anti-lock braking to keep soldiers safe. Related reading - https://oshkoshdefense.com/vehicles/hemtt-a4/

-

Navistar Trail Magazine

-

- 1

-

-

Prime Mover Magazine / June 25, 2015 According to the State Government of South Australia, the stimulus package includes $70m to improve critical road infrastructure; $40m to improve the safety of roads; and $55m for a new 2.8 kilometre road in Gawler East. Transport and Infrastructure Minister, Stephen Mullighan, said the critical road infrastructure funding would provide for more than 150 road upgrades throughout the State. State Treasurer Tom Koutsantonis said the extra $70 million over four years for critical road infrastructure is on top of the more than $330 million already budgeted for maintenance works over the forward estimates. “Roads are the arteries of our economy, which is why we are embarking on a targeted approach to rehabilitate key roads to maximise economic and safety benefits for communities across the State,” he said. “This is in addition to a joint State and Commonwealth $1.5 billion investment to build both the Torrens Road to River Torrens upgrade and the Darlington Interchange.”

-

Heavy vehicle fuel excise to be frozen for another year

kscarbel2 replied to kscarbel2's topic in Trucking News

Despite excise freeze, trucking will still be overcharged: ALRTA Owner/Driver / June 26, 2015 ALRTA welcomes freeze to fuel excise, but says industry still faces rip-off on registration fees. Australia’s livestock transport sector has greeted news that the fuel excise will be frozen next financial year, but has taken a shot at state and territory governments for jacking up vehicle registration fees. The Federal Government announced yesterday the excise will remain at 26.14 cents per litre in the 2015-2016 financial year, despite the National Transport Commission (NTC) recommending a 0.6 per cent increase to heavy vehicle charges. Australian Livestock and Rural Transporters Association (ALRTA) president Grant Robins says it is great news for transport operators and regional economies and will save the industry $11 million next financial year. "While state and territory governments have gone ahead and increased heavy vehicle registration charges in line with the NTC’s recommendation, the Federal Government has done the right thing by industry and frozen the road user charge at the current level for another year," Robins says. Along with the Australian Trucking Association (ATA), the ALRTA sought a freeze to truck charges on the basis the system used to calculate them is flawed. Australia’s transport ministers agreed last year the system had led to overcharging and that a new methodology would be introduced from 2016-2017. "It is a sad fact that Australian governments have chosen to continue overcharging industry for the past two years - by more than $200 million during 2013-14 and $117 million in 2014-15," Robins says. Federal infrastructure minister Warren Truss says the excise freeze will reduce business costs for trucking operators. He says the Federal Government decided to freeze the excise after consulting extensively with the trucking industry. -

Australasian Transport News / June 25, 2015 Drivers will be able to work for up to 14 hours at a time, with a range of risk offsets in place. Livestock transporters have welcomed a new, more flexible fatigue management template for their sector. The National Heavy Vehicle Regulator (NHVR) developed the Advanced Fatigue Management option in consultation with the industry. It will apply from July 1 this year. Previously, any operator wishing to work outside the regular fatigue management rules was required to submit their own research and case to the NHVR. With the new ruling, livestock operators will be able to access the specially-developed option. "The new approach to the management of fatigue under the Advanced Fatigue Management option uses a prototype or template to help livestock transport operators to appropriately manage their work and rest hours in a way which is suitable to the unique demands faced by these operators," NHVR’s productivity and safety director Geoff Casey says. "Up until now, operators had to invest significant time and money into developing their own separate safety case to apply for the advanced fatigue management option." The option allows accredited operators to work for up to 14 hours each day on a fortnightly cycle. The hours are subject to "risk-offsetting" restrictions for journeys that include travel between midnight and 4.00am. Casey anticipates the scheme will be extended to allow operators access to longer work days and the ability to pool hours across multiple days. The Australian Livestock and Rural Transporters Association (ALRTA) has welcomed the changes. Its vice president Graeme Hoare says the organisation particularly appreciates the close consultation it was able to be involved in, and says the new template provides a safe but flexible alternative to the existing fatigue management regime. "The template will deliver much needed flexibility for livestock transporters to complete their often unpredictable tasks in remote environments, and take better quality rest at more convenient times and locations," he says. "This will improve productivity, driver safety and animal welfare outcomes in the Australian livestock supply chain." He says the ALRTA supplied real world data to demonstrate that a more flexible arrangement could still be low-risk.

-

Owner/Driver / June 25, 2015 The fuel tax for the trucking industry will remain at 26.14 cents per litre. A freeze to the heavy vehicle fuel excise will continue until at least the end of June next year, the Federal Government has announced. Federal infrastructure minister Warren Truss says the charge will remain at its current level of 26.14 cents per litre next financial year, extending a freeze already in place. Truss says the decision is good news for the trucking industry, but operators are still due to pay higher vehicle registration fees from next week. "It will reduce the cost of doing business for operators and support productivity in those sectors of the economy that rely on heavy vehicles to supply business inputs and deliver products to markets," Truss says. "The annual saving to industry in 2015-2016 is estimated to be $11 million and follows findings by the National Transport Commission (NTC) that the road user charge has been over-collecting in recent years." Truss says the Federal Government reached its decision after extensive consultation with the trucking industry earlier this year. The NTC recommended in February that the excise should increase to 26.3 cents per litre and for registration fees to rise by 0.6 per cent. The Australian Trucking Association (ATA) lodged a submission with the NTC in April arguing against the increase in fees, claiming it would lead to the industry being overcharged $117 million in 2015-2016. ATA CEO Chris Melham has welcomed Truss’s announcement and says it will benefit Australia’s 49,000 trucking operators. The ATA says the model used to calculate heavy vehicle charges is outdated. "The NTC’s charging model is supposed to ensure that the fuel tax and heavy vehicle registration charges cover the cost of the truck and bus industries’ use of the road system," Melham says. "But the NTC has conceded that its model is flawed, because it underestimates the number of heavy vehicles on the road. It loses about 52,000 vehicles. As a result, the calculated charge on each vehicle is too high, as is the total amount collected. "The Government’s decision to freeze our fuel tax for the second year running will reduce the level of over-recovery. It is a great result."

BigMackTrucks.com

BigMackTrucks.com is a support forum for antique, classic and modern Mack Trucks! The forum is owned and maintained by Watt's Truck Center, Inc. an independent, full service Mack dealer. The forums are not affiliated with Mack Trucks, Inc.

Our Vendors and Advertisers

Thank you for your support!