kscarbel2

Moderator-

Posts

18,539 -

Joined

-

Days Won

112

Content Type

Profiles

Forums

Gallery

Events

Blogs

BMT Wiki

Collections

Store

Everything posted by kscarbel2

-

B 61 Engine & Trans color

kscarbel2 replied to eddeere's topic in Antique and Classic Mack Trucks General Discussion

Mack "light blue-gray engine", part number 312SX45P2. -

A tremendous amount of bitterness is now flowing throughout the Volvo empire aimed at its board. By choosing an outsider to lead Volvo, the board is effectively saying that Volvo itself in their judgement does not have a single individual qualified to take the helm Not a single person with long experience in the truck industry, a clear vision and a "winning leadership style" (i.e. leadership skills). Certainly, when you look at the unqualified Volvo people now manning the Mack brand, that is indeed true.

-

Press Release / May 7, 2015 Renault Trucks and the Rave group presented Airbus with the keys to their new fleet of six Euro 6 Biodiesel vehicles on Tuesday 5 May. Rave won the invitation to tender launched by the aircraft manufacturer in Toulouse with the Renault Trucks Range D Biodiesel Euro 6 offer of two rigids and four tractors. Rave, in close collaboration with Renault Trucks, won the invitation to tender launched by DHL, on behalf of Airbus, by offering biodiesel vehicles. The invitation to tender concerned four tractors and two rigids, taking into consideration alternative solutions to Diesel. By combining their respective expertise in the fields of commercial vehicles, alternative energies, transport and logistics, Airbus was convinced by the two partners’ arguments and is now expecting the delivery of six biodiesel Euro 6 vehicles on Tuesday 5 May. These consist of two Renault Trucks D 4x2 rigids, a 12 ton model equipped with the DTI 5 240 hp engine and a 19 ton model equipped with the DTI 8 320 hp engine as well as four Renault Trucks D Wide 19 ton tractors fitted with the DTI 8 320 hp engine. These biodiesel Euro 6 vehicles offer identical performance to those of their Diesel counterparts in terms of engine power rating and torque. Their engines can run on up to 100% biodiesel, a fuel made from renewable energy extracted from vegetable oils and animal fat. Airbus found this solution from Rave, in collaboration with Renault Trucks, to be particularly attractive. The Renault Trucks Airbus D and D Wide biodiesel vehicles will be operating in the Toulouse urban area on the brand-new Air-log logistic site, devoted to meeting the logistics needs of all the Airbus assembly sites in the region and its production site at Airbus Saint-Éloi. These biodiesel vehicles will be operating daily rounds between the production sites, the subcontractors and suppliers to pick up parts to be machined or that have been machined and transfer them from one site to another. .

-

Press Release / May 7, 2015 DAF Trucks N.V. has concluded an agreement with Truck World Auto Assembly (T.W.A.A) in Port Klang, Malaysia, for the marketing, sales and service activities of DAF Trucks in Malaysia. DAF Trucks has thus extended its presence in the Far East, building on its success in places such as Taiwan, Indonesia, Singapore and Hong Kong. Malaysia Airlines has directly placed a first order for six DAF CF65 trucks. There are more than a thousand right-hand drive DAF trucks on the roads in Malaysia, imported by T.W.A.A. from the United Kingdom as used vehicles. The Malaysian importer now also wants to meet the demand for new DAF trucks. "DAF has an extremely good reputation in Malaysia", says Goh Tiong Guan, Managing Director of T.W.A.A. "The level of customer satisfaction is unprecedented. DAF trucks are renowned for their quality of construction, reliability and low fuel consumption. We therefore clearly stand out from the competition when it comes to total cost of ownership." DAF will start in Malaysia with three versions of the popular CF-series: a 2-axle CF65 rigid with a 6.7 litre PACCAR GR-engine and two 3-axle CF85 tractor units with a single or double drive and a 12.9 litre PACCAR MX-engine. "There is no lack of ambition", states Goh Tiong Guan. "We will actively serve the Malaysian truck market from the capital Kuala Lumpur. This market comprises approximately 3,500 units. We predict that we will be able to sell at least around 600 trucks per annum within the foreseeable future." .

-

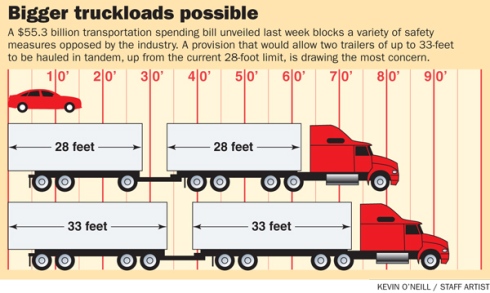

Bloomberg / May 5, 2015 A multimillion lobbying push by FedEx Corp. and other freight carriers may be about to open U.S. highways to a new generation of bigger truck trailers even as watchdogs warn the price will be roadway carnage. A $55.3 billion transportation spending bill unveiled last week blocks a variety of safety measures opposed by the industry, at a time when the rise in truck-related deaths has bucked a trend of overall improvement in highway safety. In addition to the bigger-capacity trucks, the bill would also do away with plans to require trucking companies to carry higher insurance coverage and make it harder for regulators to re-impose more stringent rest requirements for drivers. “Christmas came early for the trucking industry,” said Rep. Nita Lowey of New York, the senior Democrat on the appropriations subcommittee. The trucking industry is a formidable force in Washington, spending $9.85 million lobbying Congress last year, and making $7.96 million in contributions to political candidates, parties and action committees, according to the Center for Responsive Politics. Lowey and others decried how the industry was able to insert sweeping policy changes into unrelated budget legislation. A provision in the appropriations bill that would allow two trailers of up to 33-feet to be hauled in tandem, up from the current 28-foot limit, is drawing the most concern. The longer trucks will be harder for drivers to handle and harder to stop, said Jackie Gillan, president of Advocates for Highway and Auto Safety, a coalition of consumer-rights groups and insurance companies. “This is the most aggressive attack on safety I’ve seen in my lifetime,” she said. She cited research showing double-trailer combinations have crash rates 15 percent higher than single-trailer rigs. FedEx, whose chief executive officer, Fred Smith, has lobbied lawmakers on the issue, cites statistics that tell a different story. A study commissioned by FedEx, Con-way Inc. and other shippers showed that the extra five feet in length of each trailer would save gas and cut carbon emissions and would actually reduce the number of trucks on the road. “There’s no safety issue,” said Dave Osiecki, executive vice president with the American Trucking Associations. “There’s an environmental benefit and a fuel-economy benefit.” The trucking industry is advocating for longer combinations to meet demand, especially for lighter packages like those delivered for online shoppers, according to the Coalition for Efficient and Responsible Trucking. That kind of freight is expected to grow 40 percent over the next decade, from 145 million tons a year to 204 million, according to the group, which includes FedEx, United Parcel Service Inc., Con-way, YRC Worldwide Inc. and five other so-called less-than-truckload companies. Twin 33-foot trailers have already been permitted in Florida and South Dakota, according to the trucking coalition. Attaching the trailer measure and other trucking provisions to a must-pass federal Transportation Department appropriations bill helps to avoid some of the normal congressional vetting and makes it more likely the changes will become law. “Not a single one of these provisions has been subject to a congressional hearing,” Gillan said. FedEx made $2.32 million in campaign contributions to House and Senate members in the two-year cycle ending in the 2014 election, according to the center. That included $84,750 to members of the House Appropriations Committee. Maury Donahue, a spokeswoman for FedEx, referred questions to the Coalition for Efficient and Responsible Trucking. Across all House races, the industry handed out $2.56 million, and 84 percent went to Republicans, according to the Center for Responsive Politics. The appropriations bill approved by a subcommittee on April 29 is still far from a done deal. The full committee is expected to take a vote in May when Congress returns from a recess. The House bill still would have to survive a Senate vote and be signed by the president. Gillan is telling the White House: “You sign this bill, you’re signing a death warrant for American families.” Crashes involving large trucks killed 3,921 people in the U.S. in 2012, an increase of 16 percent from the all-time low in 2009. Trucking deaths have increased in each of the past four years. The trucking industry argues that the long-term trend is still good as fatalities are 21 percent lower today than a decade ago. Transportation Secretary Anthony Foxx declined to comment on whether he could support 33-foot trailers, telling reporters April 28 that his department hasn’t yet completed a comprehensive safety study. He did say the Obama administration is concerned about Congress making policy changes in an appropriations bill. The Coalition for Efficient and Responsible Trucking says safety isn’t an issue. Osiecki added that research also shows stopping distances are the same with 28-foot and 33-foot trailers, and the longer trucks are more stable. Existing twin 28-foot trailers are typically full before they reach the federal weight limit of 80,000 pounds. Even 33-foot trailer combos crammed with packages wouldn’t exceed the standard weight, while they would be able to carry 18 percent more freight. One of the main hurdles for the provision may be public sentiment. About 76 percent of people are against allowing more longer or heavier trucks on the road, according to a poll that safety groups, including Gillan’s, commissioned last year. In addition to bigger trucks, the House bill would add conditions for any attempt by the Federal Motor Carrier Safety Administration to re-institute a 2013 rule forcing drivers to get two nights of sleep in a row after reaching a weekly time limit for driving. That regulation was intended to close a loophole that allowed some drivers to legally stay on the road as long as 82 hours over eight days. Another provision would squash a Transportation Department effort to revisit a rule requiring trucking companies carry a minimum of $750,000 in liability insurance. That level hasn’t been changed since 1980. Regulators haven’t indicated what the new level should be, but have indicated they would like to study the matter. The department has suggested it would take a $3.2 million policy to have the same buying power as $750,000 three decades ago. The House legislation wouldn’t permit any money to be spent on the effort. .

-

Heavy Duty Trucking / May 7, 2015 Kenworth is offering Eaton's 10-speed UltraShift Plus VAS transmission on selected medium-duty trucks for the first time, including the T370, T440 and T470 equipped with the 8.9-liter Paccar PX-9 engine (aka Cummins ISL). The transmission is recommended for construction, refuse, municipal pickup and delivery, and agricultural applications. It provides select Kenworth medium-duty trucks with an alternative to manual or traditional automatic transmissions. By using an electronic clutch actuation system, with a system that enables quick shifts and clutch engagement regardless of engine RPM. The system automatically selects an appropriate start gear and adapts shifts based on driving environment. The transmission can handle the maximum torque rating of any medium-duty engine, according to Kenworth and provides more control of engine and transmission functions for automated shifting and vehicle launches. The UltraShift Plus VAS features Hill Start Aid, creep modes, auto neutral, and engine and clutch over speed protection. The transmission employs grade sensing, weight computation and driver throttle commands for better reliability and performance during launch and shift decisions. “Kenworth has an excellent partnership with Eaton, and our medium-duty truck customers will benefit from the performance and value of the Eaton UltraShift Plus VAS transmission option for the Kenworth T370, T440 and T470,” said Kurt Swihart, Kenworth marketing director.

-

Trailer/Body Builders / May 7, 2015 Fourteen fleets operating more than 53,000 tractors and 160,000 trailers achieved fuel savings of $477 million in 2014 by adopting a variety of fuel efficiency technologies, according to the Annual Fleet Fuel Study released by the North American Council for Freight Efficiency (NACFE). These fleets represent a growing focus on fuel efficiency in the industry. The fleet improvements save $9,000 per year per truck, with an estimated payback period of two and a half years, and reduce their carbon emissions by 19%. This year’s study found the adoption of fuel-saving technologies had increased from 18% in 2003 to 42% in 2014. As a result, the 14 fleets have achieved 7.0 mpg on average for all their trucks, while their 2015-model-year trucks have reached as high as 8.5 mpg. That is well above the national average of 5.9 mpg, reported by the U.S. Department of Transportation’s Federal Highway Administration. The 14 fleets included in the study achieved this high level of fuel efficiency by adopting a combination of nearly 70 currently-available technologies and engaging the resources and guidance of Trucking Efficiency, a joint effort of NACFE and Carbon War Room (CWR). “The dramatic improvement in fuel economy of the leading fleets this year is exciting,” says Mike Roeth, operation lead for CWR’s Trucking Efficiency and executive director of NACFE. “If we can get the owners and operators of the 1.5 million tractor-trailers on the road today to invest in more of these technologies, we will see significant reduction in fuel consumption.” Major trucking fleets like Con-way Truckload, Frito Lay, and Schneider are actively pursuing fleet-wide fuel savings and seeing on-the-road results from adopting recommendations from Trucking Efficiency’s Tech Guide and Confidence Reports on individual trucking technologies. Trucking Efficiency has completed Confidence Reports on tire pressure systems, 6x2 axles, idle reduction, transmissions, and engine parameters. "We have been aggressively pursuing fuel savings and freight efficiency for many years,” says Steve Hanson, director of fleet engineering at Frito Lay. "Through collaboration with tractor builders and aerodynamic-device and fuel-system suppliers, we are now able to get the aerodynamics we desire on our latest tractors. This will help us continue to increase our overall fleet-wide fuel efficiency." Con-way Truckload, another exemplary fleet, saw major success in equipping 48% of their fleet with automated manual transmissions. “We will continue to buy automated manual transmissions as they are providing fuel savings and drivers appreciate their performance,” says Randy Cornell, vice president of maintenance and asset management at Con-way Truckload. Since 2011, NACFE has conducted its Annual Fleet Fuel Study to report on innovative fleets that have committed to improving fuel efficiency. Fleets that participated in the study shared their implementation experiences as well as best practices for using these technologies. The study provides insights to help other fleets make decisions about adding these fuel efficiency technologies and practices in the future. With upcoming Confidence Reports on tires, maintenance, downspeeding, lightweighting, and other technologies, Trucking Efficiency will continue to promote fuel savings opportunities in the industry. "Fleets saved $477 million in 2014 by investing in efficiency technologies. These savings will grow as other fleets learn from their leadership," says Mike Roeth.

-

Australasian Truck News (ATN) / May 7, 2015 A greater proportion of heavy vehicles and longer “gap acceptance” times mean road designers should shift their focus away from passenger cars Austroads has completed a four-year research project investigating the impact of more heavy vehicles on the national road network. It has found Australia’s growing heavy vehicle fleet is changing the basic requirements of road design. The project report, Road Design for Heavy Vehicles, analyses data on heavy vehicle crashes from around Australia and New Zealand. It also undertook its own direct field research to analyse the gap acceptance times – the amount of time and space required for a vehicle to turn through oncoming traffic – for heavy vehicles manoeuvring through a range of intersection types. Among its recommendations is a call for road designers to focus more on heavy vehicles than passenger cars. Wider lanes on some arterials roads, for example, will help longer vehicles navigate turns. "Where triple or larger road trains are expected designers should consider wider lanes," the report advises. "Lanes may also need to be widened on curves to allow [the] additional ‘tracking’ required by trucks." Changes to road alignments and grades could also help make driving smoother and safer for heavy vehicles. About 20 per cent of casualty crashes involving heavy vehicles occur on crests and grades in rural areas, Austroads’ research found. Heavy vehicles are also at risk of overheating on particularly steep climbs. "To overcome the operational and safety problems associated with heavy vehicles driving on an upgrade road, authorities often provide truck climbing lanes," Austroads says. "On relatively long or steep downgrades, road authorities may provide truck roadside parking strategically located, to allow drivers to stop and check the temperature of the brakes, and if necessary allow them to cool." Likewise, road shoulders are found to be an important consideration on rural roads. Degraded shoulder conditions, such as excess loose material or steep edge drop-offs, can lead to greater crash risks for heavy vehicles. But Austroads says there is a limit to how much back-up bitumen road designers can provide. "While shoulder sealing provides a marked improvement in safety, increasing shoulder width to greater than 2.5 metres on two lane roads may increase crash risk as some drivers might treat the shoulder as an additional lane." Further factors highlighted in the report include pavement surfaces, the availability of rest areas, and speed differentials between traffic on carriageways and accompanying service roads. The Austroads Road Design Taskforce will now critically review the report and its suggested amendments to the national Guide to Road Design.

-

Cummins to develop natural gas engines with Agility Fuel Systems

kscarbel2 replied to kscarbel2's topic in Trucking News

After Cummins in 2012 began developing a 15-liter spark-ignited natural-gas engine (ISX15 G) outside its joint venture with Westport, the relationship soured. Now that engine has been put on hold, but the relationship still is not as before. Cummins is planning for a total in-house package. -

Cummins to develop natural gas engines with Agility Fuel Systems

kscarbel2 replied to kscarbel2's topic in Trucking News

The relationship between Westport and Cummins has cooled in recent years, possibly because Westport is growing their business (an understandable need for long-term sustainability) by entering into agreements with other global engine makers in addition to Cummins. This is why Cummins is now investing in Agility Fuel Systems. Not that another entity isn't capable of creating a better mouse trap, but I personally still favor Westport's technology. -

Reuters / May 6, 2015 Andreas Renschler, the board member in charge of commercial vehicles at Volkswagen Group, will replace Ferdinand Piech as chairman of truck maker MAN SE. Piech resigned from all his supervisory board posts including the VW chair on April 25 after losing a showdown with VW CEO Martin Winterkorn. Volkswagen said on Tuesday it was creating a commercial vehicles group to align its truck divisions MAN and Scania, pushing its long-standing ambition to become Europe's largest truck maker, which was a pet project of Piech's.

-

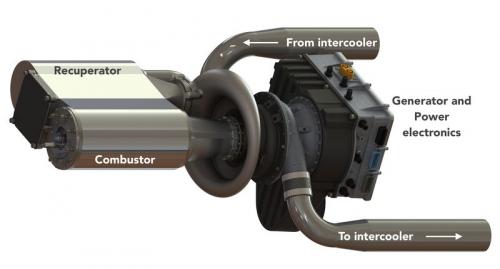

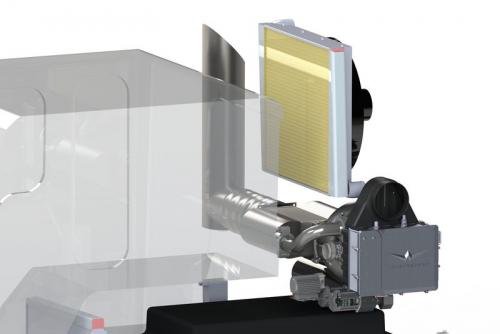

Green Car Congress / May 4, 2015 Wrightspeed Inc., a developer of range-extended electric vehicle powertrains for medium and heavy trucks, has unveiled the Fulcrum, a new proprietary turbine generator for use in its “Route” family of electric powertrains. (Route for Class 3-6, Route HD for Class 7-8) The new 80 kW Fulcrum is a radial inflow, axial turbine, intercooled and recuperated. Fulcrum is a single shaft machine, the generator runs at turbine speed (~100,000 rpm). Weighing in at 250 lbs (113.4 kg), the Fulcrum is approximately 1/10th the weight of its piston generator counterparts and it is designed to have a 10,000-hour lifetime. The Route extended range electric powertrains incorporate a range-extending genset designed to recharge the high-power battery pack (currently from A123 Systems) and Wrightspeed’s own geared traction drive (GTD). Wrightspeed, founded by Ian Wright, one of the original co-founders of Tesla Motors, has used a 65 kW Capstone microturbine in earlier Route powertrains. The 65 kW Capstone unit weighs 300 lbs (136.1 kg), for a power-to-weight ratio of 478 W/kg. By comparison, Wrightspeed’s new Fulcrum microturbine offers a power-to-weight ratio of 750 W/kg. With Fulcrum, on which the company has been working for about 3 years, Wrightspeed now owns 100% of the Intellectual Property of its powertrain products. A two-stage compression process and novel recuperation design make the Fulcrum 30% more efficient than existing turbine generators, while tripling usable power. Its multi-fuel capabilities allow it to burn diesel, CNG, LNG, landfill gases, biodiesel, kerosene, propane, heating oil, and others. In addition, the Fulcrum will make for a smooth, comfortable ride for drivers and a quiet, clean experience for neighborhoods because of its ultra-low vibration. Microturbines operate on the Brayton Cycle. Atmospheric air is compressed and heated (usually by introducing and burning fuel); these hot gases then drive an expansion turbine that drives both the inlet compressor and a drive shaft. Other than the size difference, microturbines differ from larger gas turbines in that they typically have lower compression ratios and operate at lower combustion temperatures. To increase efficiency, microturbines can recover a portion of the exhaust heat in a heat exchanger (recuperator) to increase the energy of the gases entering the expansion turbine, thereby boosting efficiency. There have been a number of problems with automotive applications of turbines, Wright noted, among them fuel economy and efficiency, and cost. While turbines have seen great success in aviation, a fundamental challenge with the use of a turbine as the main traction engine in an on-road vehicle is that turbines are not efficient at low-load points; they are only efficient at full power, noted Wright. In other words, fuel economy is a significant problem. However, he added, the advent of the range-extended EV architecture alters the operational requirements significantly; instead of coping with varying load, the turbine can operate at its most efficient point—similar to the high efficiency large-scale turbines used in power generation—to produce power for the battery pack, which in turn powers the electric motors. The automotive industry is in the midst of a fundamental disruption, with electric vehicles merely symbolizing the beginning of the movement. The Fulcrum, together with our range-extended EV architecture, is perfectly suited for achieving maximum efficiency in extremely high-power stop-and-go applications, such as garbage trucks. For many of the same reasons that aviation changed from piston engines to turbines decades ago, we believe turbines will begin to replace piston engines in range-extended electric vehicle applications. It doesn’t matter what the driver is doing, you operate the turbine only at its most efficient point. It’s only 250 lbs, incredibly clean and also multi-fuel. It has all those advantages. —Ian Wright Further, Fulcrum’s design with its intercooler, recuperator and pressure ratio enables a higher efficiency than usually seen in this class of turbine, Wright said. A further disadvantage for turbines in automotive applications has been cost. Wrightspeed addressed that by deliberately designing Fulcrum for low cost manufacturing, leveraging turbocharger technology with great economies of scale at this point. Wrightspeed emphasizes the use of high-power batteries rather than high-energy batteries in its powertrain. One of the things that enables the story is that the batteries have become extremely reliable and long life, even when at high power. We use the smallest pack we can. In general, we save fuel in three separate ways: first is with a grid charge; second is regenerative braking—we run very high power regen, much, much higher than anyone and we pretty much avoid the use of friction brakes; and third is running the engine at the sweet spot. —Ian Wright None of those three approaches work very well in long-haul trucking in which the big rigs with optimized engines and gearing are cruising for long stretches at an optimal, constant speed. On the other hand, a big rig in an urban environment is just horrible at fuel efficiency, Wright said. As a result, the Route extended range electric powertrain is ideally suited for urban environments. FedEx, which is already running a couple of trucks using the Route powertrain, has ordered 25 more. .

-

Cummins Westport to offer 6.7L Natural Gas Engine in 2016

kscarbel2 replied to kscarbel2's topic in Trucking News

Cummins Westport introducing new ISB6.7 G mid-range natural gas engine Green Car Congress / May 6, 2015 At the opening reception at ACT Expo in Dallas, TX, Cummins Westport Inc. will unveil the ISB6.7 G, a 6.7-liter medium-duty, factory-built dedicated natural gas engine for school bus, shuttle bus, medium-duty truck and vocational applications. The new ISB6.7 G is currently in field trials with full production expected to commence in mid-2016. The ISB6.7 G natural gas engine is based on the Cummins ISB6.7 diesel engine platform, the industry leader in the Cummins medium-duty engine family. The ISB6.7 G will operate exclusively on natural gas (CNG or LNG) utilizing Cummins Westport’s proprietary spark-ignited, stoichiometric combustion with cooled exhaust gas recirculation (SEGR) technology, first introduced with the 8.9-liter ISL G. The SEGR technology was introduced with the ISL G in 2007, and was developed to meet 2010 EPA emission requirements. The cooled-EGR system passes exhaust gas through a cooler to reduce temperatures before mixing it with fuel and the incoming air charge to the cylinder. Stoichiometric combustion in combination with cooled-EGR offers increased power density and thermal efficiency. It also reduces in-cylinder combustion temperatures and creates an oxygen-free exhaust, which then enables the use of a three-way catalyst (TWC) for NOx control. The ISB6.7 G TWC is packaged as a muffler and is maintenance-free. No diesel particulate filter or selective catalytic reduction aftertreatment will be required. The 6-cylinder ISB6.7 G will offer up to 260 hp (194 kW) and 660 lb-ft (895 N·m) of torque, and will be available with both manual and automatic transmissions. The ISB6.7 G shares many base engine components with the ISB6.7 diesel engine and shares the emissions architecture of the ISL G and ISX12 G, including wastegate turbocharger, a high-energy ignition system controlled by the CM2180A Engine Control Module, and similar fuel module design. The ISB6.7 G is expected to be certified at launch to meet the US Environmental Protection Agency and California Air Resources Board emission standards of 0.20 g/bhp-hr NOx and 0.01 g/bhp-hr PM and 2016 US greenhouse gas and fuel economy regulations. Partial funding in support of the ISB6.7 G engine development has been received from California Energy Commission through its Public Interest Energy Research (PIER) Program in conjunction with the Gas Technology Institute. The ISB6.7 G will be manufactured in Cummins’ medium-duty engine plant in Rocky Mount, North Carolina. -

Trucking News / May 5, 2015 Southfield, Mich.-based global supplier Denso has developed a new high-amperage alternator for the medium- and heavy-duty truck market that is smaller, lighter and more efficient than the industry competition. The PowerEdge offers advanced alternator features like Denso’s patented segment conductor technology, which incorporates an innovative square wire copper stator design. By leveraging Denso’s innovative design and manufacturing technologies, the PowerEdge achieves higher efficiency in a smaller, more lightweight design, which translates into improved fuel economy. The product will be available in July. “Denso has harnessed its cutting-edge technology in order to provide a much-needed solution for the commercial truck market,” said Frank Jenkins, senior manager of Denso product and services Americas’ commercial and heavy-duty group. “In addition to its improved efficiency and higher amps at idle, the Denso PowerEdge alternator can be up to 10 pounds lighter than the industry’s competition. This means reduced fuel consumption over the long haul, which can save thousands of dollars per truck per year.” The alternator’s design has been optimized to provide the durability and long life needed to meet the severe demands of heavy- and medium-duty trucks. The alternators offer four output versions: 170amp, 185amp, 205amp, and 220amp. Each unit features the same innovative SC stator, producing higher efficiency and more amps at idle. Additionally, these units are equipped with heavy-duty bearings, advanced long-life brush composition, and remote sense technology to prolong battery life. Not only do these highly efficient alternators offer a small, lightweight design, but also its compact size and weight offer fleet and truck technicians easier handling and installation. The Denso PowerEdge Alternator provides 100 percent coverage for pad-mount applications and offers the following features and benefits: Superior efficiency, providing reduced fuel consumption and mileage savingsDurability, long life, reducing replacement intervals and costsHigher amps at idleRemote sense features, prolongs battery life, reducing replacement costsCompact size and lighter weight, for improved fuel savings and ease of installationDenso, which has supplied alternators since 1962, has been reducing the size and weight of alternators while also increasing their efficiency. .

-

The New York Times / May 5, 2015 In what might be construed as a blow to Gallic pride, the French Army will soon be patrolling La Belle France, the land of Renaults and Peugeots, in Ford Ranger pickups. The army is buying 1,000 of the Ford trucks as part of a “crash program” to begin replacing its fleet of off-road vehicles, said Pierre Bayle, a spokesman for the Defense Ministry. The army’s Peugeot P4 jeeps went into service in 1983 and are becoming obsolete, he said. Two other vehicles were considered, Mr. Bayle said: PSA Peugeot Citroën’s Berlingo, and the Dacia Duster, made by Renault. But Ford got the nod for the first replacement order because of its large payload capacity, he said. The truck can carry five adults and a ton of cargo, more than the French vehicles. “It’s not a question of America versus France,” Mr. Bayle said, as not one of the three vehicles in question was made in either country. The Ranger is made in South Africa, the Duster in Romania and the Berlingo in Spain. The work of replacing the fleet will continue over the next few years, Mr. Bayle said, and French vehicles could be chosen for other roles. Related reading: http://www.bigmacktrucks.com/index.php?/topic/39372-ford-unveils-2015-global-ranger/?hl=ranger

-

Riding in Freightliner’s autonomous Inspiration Truck Truck News / May 6, 2015 After a flashy prime time introduction of its Inspiration Truck atop the Hoover Dam, Freightliner today offered further details on how the world’s first road-legal autonomous truck works, and how it will benefit the North American trucking industry. Martin Daum, president and CEO of Daimler Trucks North America (DTNA) stressed it was customers that drove Freightliner to develop a truck that will help improve safety and trucking industry efficiency. “The easy things are already invented,” he said of truck efficiency, noting it’s time now to push the envelope on innovation and to help shape future regulations as well. When it comes to autonomous trucks, it’s the regulatory obstacles that may be more difficult to overcome than any technical challenges. In Nevada, Freightliner found a like-minded government willing to help develop autonomous vehicles by putting a regulatory framework in place to allow their use. There, drivers of autonomous trucks must have a commercial driver’s licence and also take a course developed by the truck manufacturer and approved by the Nevada Department of Motor Vehicles (DMV). “DTNA elected to debut the Inspiration Truck in Nevada, because of the fact the Nevada government has regulatory requirements for needing a licence to test autonomous vehicles on public roads in this state,” said Sean Waters, director of compliance and regulatory affairs with DTNA. “We wanted to do it in a regulatory environment that sets standards.” Daimler conducted 10,000 miles of testing on its Inspiration Truck to satisfy the state that the technology is safe. Nevada requires a data recorder to be installed in autonomous vehicles that will store at least 30 seconds of data in the event of a crash, however Daimler captures and stores all the data generated by the vehicle over the course of its entire life, far surpassing the minimum requirement. In the event of an accident, this data will be vital in determining who – or what – was at fault. Until other states come on-board, the Inspiration Truck can only be operated in the state of Nevada. Daum said more states and provinces must follow suit to make autonomous trucks more widely viable. The truck can only be operated in autonomous Highway Pilot mode when it’s being driven on Nevada freeways and interstate highways. Mechanisms are in place to prevent the driver from operating in autonomous mode when and where it’s not permitted. While the driver is able, under certain conditions, to relinquish control of most driving responsibilities to Highway Pilot, he must remain in the driver’s seat and must always be in position to take back control of the truck when necessary. Still, Waters said when Highway Pilot is active, the driver will eventually be able to complete paperwork, plan their next load or take care of other responsibilities, effectively allowing them to make better use of their downtime once their driving shift is completed. A driver will always be required to oversee the operation of the truck, Daum added. “Will it make the driver obsolete? I don’t see that,” he said. “The human brain is still the best computer. We want to give the driver a tool that enhances their capability significantly.” The brains of the Highway Pilot system are a collection of advanced cameras, radars and sensors, integrated with the truck’s engine, transmission, braking system and electronics. The Inspiration Truck is defined by the Highway Traffic Safety Administration (NHTSA) as a Level 3 autonomous vehicle, explained Martin Zeilinger, director of advanced engineering with DTNA, meaning it “enables the driver to cede full control of safety-critical functions, including steering, in certain traffic or environmental conditions.” There are four levels of autonomous vehicles, the fourth being a true driverless truck, but that’s not the technology Freightliner is currently developing. “Freightliner is not interested in pursuing a full self-driving vehicle,” said Al Pearson, chief engineer, product validation for Freightliner. Zeilinger added one of the biggest myths around autonomous driving is that it is ‘driverless’ – a frequently used, but misleading description. “An autonomous highway truck is not a driverless vehicle,” Zeilinger emphasized. “We still require a qualified truck driver with a CDL to be in the cab and at the controls.” In fact, since the technology is so new, Nevada currently requires two people to be in the cab of an autonomous truck at all times. One can only assume that condition will be lifted in time, otherwise it would certainly offset any productivity gains the industry hopes to achieve. While the driver will not be eliminated by the technology, there are still benefits to be had, officials pointed out. Since 90% of crashes are caused by driver error, Freightliner officials said autonomous trucks have the potential to reduce crashes. They profess the technology can also improve fuel efficiency, reduce the strain on components, improve traffic flow and reduce driver stress and fatigue in monotonous driving situations. The Inspiration Truck also boasts platooning capabilities, where further fuel savings can be achieved by linking up several such trucks via vehicle-to-vehicle communications. They can then travel in a tightly packed convoy with the braking activities of the lead truck causing the following trucks to slow or stop in unison. This technology has shown a 5.3% average fuel savings among the trucks in a three-truck platoon and a 6% average fuel savings in a five-truck platoon, chiefly by minimizing the air pressure zones between the trucks. The Highway Pilot system – while impressive and far more advanced than any other such systems – still has some concerning shortcomings. It requires clearly visible lane markings to function, so it won’t be usable in snowy conditions – not likely to be an issue in Nevada – or when lane markings are difficult to discern. Also, the camera/radar combination can’t yet identify non-metallic objects and then apply braking, so a driver who’s reading a book or making dinner reservations on his iPad when he comes upon a sizable piece of tire debris or a deer, moose or pedestrian in his path…well, that could be an issue. However, it seems a fix to this is already in the works. Zeilinger noted as the system is further developed, it will eventually be able to recognize non-metallic objects through technology he referred to as “sensor fusion” – the combining of camera and radar capabilities to recognize a wider variety of objects. Since it’s not yet clear when the Inspiration Truck will be production-ready, this will likely have been sorted by then. With the technical sessions complete, it was time to climb inside the Inspiration Truck for a journey on Nevada highways. The tractor-trailer was buffeted by powerful, gusty crosswinds, which put the Highway Pilot system to the test. At one time, the system did ask the driver to take control but we were never at risk. The driver obliged and after a few seconds placed it back into Highway Pilot mode. The truck held its course remarkably well while driven autonomously. The route was pre-programmed into the GPS so when we approached the intended highway exit the system reminded the driver to take the reins. While on Highway Pilot, the driver was able to remove a tablet from the dash to perform non-driving tasks. During our drive, the truck always felt completely safe and in control, even when the driver’s feet were planted firmly on the floor and his hands were off the steering wheel. Highway Pilot will eventually be able to use sign recognition abilities to maintain the posted speed limit but for now, the driver programs in the desired cruise speed. The truck adjusted its speed as required to maintain a safe following distance. It was able to effortlessly handle any scenario that it encountered on our short drive. Daimler, so heavily invested as it is in autonomous trucking technology, is hoping regulators across North America will be equally impressed and convinced. Once more states allow the use of autonomous trucks, DTNA’s Daum said the hope is the technology can be used to drive further productivity gains for the industry. These could come in the form of longer driver hours-of-service due to the reduced fatigue they experience when driving autonomous vehicles, or larger, longer truck and trailer combinations, which will be safer than ever to operate because of the safety benefits automation brings.

-

Commercial Carrier Journal (CCJ) / May 5, 2015 A recent decision by a federal court denied the California Construction Trucking Association’s appeal of the EPA’s greenhouse gas standards based on a lack of standing. The CCTA has been at the forefront of challenging EPA regulations on the trucking industry in California and nationally, and the group says the “EPA neglected to comply with a nondiscretionary statutory duty” to provide its greenhouse gas emissions standards to the Science Advisory Board, an expert body charged with providing scientific advice to EPA, prior to issuing them. The U.S. Court of Appeals for the District of Columbia Circuit found CCTA was unable to demonstrate how it and truck buyers were actually harmed by the rule and how vacating it would provide them with relief. The CCTA says the new standards have increased the price of trucks, making them unaffordable for smaller businesses and truck owners. CCJ spoke with CCTA Director of Governmental Affairs and Communications Joe Rajkovacz recently about the ruling and what’s next in the litigation. Here’s the Q&A: CCJ: What is it about these greenhouse gas regulations that is creating such a problem for truck owners, and why did the CCTA file suit? Rajkovacz: When the EPA was in the process of coming up with these GHG regulations, they claimed they were working with the trucking industry, but in reality, they were working with the manufacturers of the heavy duty equipment and the engine manufacturers. The reason we filed suit is twofold. When the EPA makes regulations that claim, in this case, the cost of the regulation is offset by improved fuel efficiency, they have to run it through the Science Advisory Board. They didn’t do that, which is a violation of procedure. No one will argue with improved fuel efficiency, but the claims of this offset have never come through. The EPA regulations have increased the price of trucks dramatically in the last decade, and we have a view that when fuel is the No. 1 cost for truck owners, that’s a strong enough economic incentive to use your resources wisely without having regulations imposed. CCJ: What does the CCTA hope to accomplish through litigation? Rajkovacz: The key thing is that what is going on in the U.S. is nothing more than a revamping of the entire trucking industry under the guise of environmental regulations. They want to reshape the industry, and this regulatory assault isn’t going to stop. They want the world to transition away from fossil fuels. What’s the cost of this? Owner-operators will be choked out with these rulemakings. Not many one-truck guys can afford a $300,000 or $400,000 truck, but that’s where we’re heading. I bought a 1997 Peterbilt new for $97,000 and sold it in 2006 for $23,000. A lot of guys don’t buy new because they can buy used for a fraction of the cost. Now, a used truck is going to cost $100,000 because it was so expensive new. That’s why we keep fighting. CCJ: What’s next in the litigation process after this setback? Rajkovacz: There’s going to be a petition filed for a hearing before the entire D.C. circuit. This was in front of a narrow panel of judges. We’re going to ask for a full rehearing. Nothing about the merits of the case were ever discussed. It was thrown out because of the issue of standing. Did we have standing to sue? They basically said the end user – the truck owner – is not a stakeholder. They said these are manufacturers standards. The thing is, the cost of the standards is being passed on to the buyer. Manufacturers aren’t fighting the standards because, in the end, it forces the customers to buy new equipment and they pass on the cost of the regulations to their customers. Truckers have nobody at the table. CCJ: Since there was never a hearing on the merits of the case, do you feel like if you can get past the standing issue you can win the case? Rajkovacz: The EPA violated its own rules by not sending the rule to the Board. We like our chances if we ever get to a hearing on the merits.

-

Commercial Carrier Journal (CCJ) / May 6, 2015 I just finished a drive into the future. And it was pretty uneventful. I mean that in the most positive sense possible. Freightliner showcased both the $80 million SuperTruck it previewed at the Mid-America Trucking Show this year. And I was able to take a short circuit behind the wheel of this futuristic truck, skirting the perimeter of the wind-swept Las Vegas Motor Speedway today. Between the high-tech trucks on the road and the U.S. Air Force fighter-bombers roaring overhead, it was a pretty dramatic scene. But fun and educational. Before I got the chance to climb behind the SuperTruck’s wheel, I rode shotgun in the company’s new Inspiration Truck, which was unveiled last night at a dramatic show at historic Hoover Dam. The Inspiration is, of course, the first fully licensed/road-legal autonomous truck in North America. But in the cab, the vibe was more familiar than futuristic. Aside from some very high-tech instrumentation and information centers, the truck feels very comfortable and similar to any luxury-spec’d Cascadia on the road today. I wasn’t able to take the wheel, because the state of Nevada requires an autonomous vehicle CDL endorsement first, but the ride was enlightening just the same. Our driver, Freightliner technical engineer Jim Martin, demonstrated the autonomous drive function on a stretch of I-15 running past the speedway. And it performed exactly as advertised. When in autonomous mode, the truck drove smoothly and safely. And apart from the fact that the steering wheel was swirling around around on its own without any human input, the feel was very much the same as having a human in control. Of course, an actual human driver must be behind the wheel at all times in a Level 3 autonomous vehicle such as the Inspiration Truck. And Martin showed how easy it was to switch between driver and autonomous control — it as easy as flipping on cruise control or simply reaching out and grabbing ahold of the steering wheel. The system is intuitive and appears to work seamlessly. Martin noted that drivers can drive as much — or as little — as they prefer behind the wheel, noting that the system works to help alleviate fatigue by allowing drivers to cede control of the truck to the truck for long periods of time. Approaching the Freightliner SuperTruck up close for the first time, I was struck by how sleek this vehicle is. Nothing juts out into the windstream. Even the door handles are tucked away underneath the door panels to maintain the high aerodynamic efficiency offered by this advanced design. The grill of the SuperTruck opens and closes based on various data points to improve fuel economy. Behind the wheel I was faced with more high-tech instrument graphics presented in a decidedly Old School style: Large, round gauges inhabit the driver cluster. The center console cluster is more modern, with an advanced driver information system and screen dedicated solely to the hybrid drive system performance. Views over the nose are insanely good. The hood slope is so dramatic, you have to strain your neck to catch even a glimpse of it. Views to the side are equally good. However, this is one area where the Super Truck has outpaced current highway laws. In its test form, the truck relies on aerodynamic rear-view cameras. But these systems are not yet road legal. So my test vehicle was equipped with limited-view mirrors supplemented by rear-view monitors inside the cab. Vehicle launch was surprisingly smooth in a way that only a hybrid drivetrain can deliver. The Super Truck’s 11-liter diesel engine only produces 375 horsepower. But any expected lack of low-end grunt is more than offset by the powerful electric motor. You feel the low horsepower a bit when accelerating up a graded on-ramp. But let’s be honest: If big-bore horsepower and single-digit MPG is your passion, you probably stopped reading this article a couple of paragraphs ago. To reduce aerodynamic drag, the SuperTruck only uses limited-view rearview mirrors and provides truck operators instead camera feeds from small cameras mounted on the mirrors. The truck drives great with excellent throttle and steering response and all the controls are more familiar than futuristic. Sitting in the passenger seat overseeing the test drive was Freightliner engineering technician Jason Gray, who told me that all the futuristic features aside, at the end of the day, SuperTruck drives and handles like a really well-engineered truck. And he’s right. Freightliner likes to say the SuperTruck is more of an evolution than a revolution, and my time behind the wheel reflected that sentiment. The wind was really blowing hard out in the desert. But even a heavy crosswind didn’t rattle the SuperTruck on my drive. The truck is so aerodynamically clean that the wind barely registers at all from the driver’s seat. This sleek profile has other advantages as well: Between the advanced drivetrain and the super-sleek design, this has to be the quietest cab interior I’ve ever experienced. SuperTruck was a blast to drive, and not just because of the quizzical looks I got from truckers on I-15. It’s a shame this exact truck won’t go into production because it looks so distinct and handles so well. And yet, before my drive was over, I found myself wondering what it would be like to be behind the wheel of a SuperTruck with Level 3 autonomous vehicle control. And I’m pretty sure we won’t have to wait long to find the answer to that question. Photo Gallery - http://www.ccjdigital.com/?p=113661

-

Transport Topics / May 6, 2015 Truck makers’ increasing emphasis on powertrain integration and remote diagnostics will have a heavy influence on the telematics industry in the years ahead, an official at Daimler Trucks North America said. Matthew Pfaffenbach, DTNA’s director of telematics, said he envisions original equipment manufacturers developing telematics offerings that complement the services provided by third-party technology suppliers rather than duplicating them. “Our focus as OEMs should be on information about your truck which only we can provide,” Pfaffenbach told attendees at the ALK Technology Summit here May 5. Much of the data that could be most useful for fleet customers tends to be proprietary, he said, but that’s not necessarily information that engine and transmission manufacturers want to share with each other. “This is where I see OEMs playing a much larger role,” Pfaffenbach said. “Once they have both the engine and the transmission working in concert, that data blockage no longer exists.” In DTNA’s case, the integration of its in-house Detroit brand engines and transmissions has put the truck maker in a position where it is gathering more and more data, he said. However, Pfaffenbach drew a distinction between the types of services that will be provided by OEMs versus those provided by telematics firms. He said he has “no desire” to develop “traditional” telematics offerings such as those already on the market, including driver performance monitoring and reporting. “What’s been developed in the telematics industry is already well-established, and not only is it well-established, it’s well-integrated with customers’ back-office systems,” he said. “OEMs do not need to replicate anything.” The role of the OEM, he said, will focus more on “connectivity,” including more advanced vehicle diagnostics, vehicle-to-vehicle and vehicle-to-infrastructure communication and autonomous driving. DTNA introduced its Virtual Technician remote diagnostics system in 2011. That offering, developed through a partnership with telematics company Zonar Systems, proactively monitors fault codes to help fleets better manage maintenance and repairs on their Freightliner and Western Star trucks. Chris Hines, Zonar’s executive vice president, pointed to the growth of vehicle diagnostics systems in the trucking industry in the years since then, saying that “everyone else has gotten into the game.” All of the major North American heavy-duty truck makers have introduced their own remote diagnostics systems. Pfaffenbach said DTNA’s vision for its Detroit Connect telematics platform, which includes Virtual Technician, will focus on safety, fuel efficiency, uptime and performance, and will connect with multiple telematics providers. Today, remote diagnostics technology enables fleets and dealers to streamline repairs, but the next step could be the ability to predict when particular components will fail and prevent problems before they occur. “These things are ideas that we definitely have in mind and are working on,” he said. That predictive failure analysis also could lead to flexible service intervals and strategies for vehicles in the future, he said. Pfaffenbach also said truck makers will need to develop integrations with telematics service providers. He said OEMs have an opportunity to help the industry by establishing platforms that can run software provided by third-party telematics firms and allow fleet customers to select which applications they want to run on the vehicle. That approach , Pfaffenbach said, could help fleets solve the challenge of managing their telematics hardware as they replace their vehicles.

-

Heavy Duty Trucking / May 6, 2015 PACCAR Leasing Company (PacLease) will begin offering a medium-duty leasing program called the PacLease Value Spec, the truck maker has announced. "We're seeing continued growth in the U.S. and Canadian medium-duty lease market, especially in the Class 6 segment since drivers are not required to have CDLs," said Rick Walden, PacLease’s director of sales. "By working with our suppliers, and the applications engineers at Kenworth and Peterbilt, we’ve been able to package a cost-effective lease program that is extremely competitive in the marketplace. What’s more, the spec was done with weight in mind. These trucks are very low in weight to maximize payload." Paccar plans to offer its Peterbilt Model 330 and Kenworth T270 as primary leasing options to fill this niche. The vehicles are powered by the PACCAR PX-7 engine, rated at 220 hp and matched with an Allison 5-speed automatic. The PacLease Value Spec program is especially suited to the food and beverage industry, according to the company. "We’re working with body suppliers and we have a fast-tracking program in place so our customers can get the bodies installed typically within two weeks," said Walden. "That means a customer can custom order a Value Spec truck from us and have it delivered weeks if not months sooner than if they were to order the stock truck themselves. If a customer needs a medium-duty truck immediately, our franchises are well-equipped with rental units – that means we can very likely get them into a short- or long-term rental to meet immediate delivery needs." PacLease will offer the full line of heavy- and medium-duty Kenworth and Peterbilt models from Class 5 to Class 8, including cabover models in Class 6 and 7 for those customers needing a truck with a tight turning radius for inner-city deliveries, Walden said. Industry studies have shown a shift toward full-service leasing, especially with private fleets, according to the 2014 NPTC benchmarking study, cited by the company. More than 66 percent of NPTC members use full-service leasing to some degree, up from 59 percent five years ago. A recent Beverage World magazine fleet survey pointed out that five years ago, about 32 percent of beverage operators leased some of their trucks. Today, 42 percent lease some trucks. Leasing by bottlers, which was only 11 percent five years ago, has reached 43 percent.

-

Car & Driver / May 6, 2015 For all Pontiac’s performance-driven success in the 1960s, the division never built a true sports car—at least not until the Fiero in the 1980s or, if you don’t count that, then the Solstice 20 years later. John Z. DeLorean, however, definitely had the inkling. Under his watch, Pontiac commissioned the Banshee, a lithe, fiberglass-bodied two-seater. And now that piece of Pontiac history is coming up for sale. The Banshee XP-833 concept arose out of Pontiac’s desire for a two-seat sports car, a notion that many automakers toyed with in the 1960s. (The original Ford Mustang I concept from 1962, for example, was a two-seater.) This silver coupe was built using modified chassis bits from the ’64 Tempest and fitted with Pontiac’s then-new 230-cubic-inch OHC straight-six hooked to a four-speed manual transmission. Unfortunately, the Banshee never made it past the concept stage, as it was shot down by GM brass, perhaps fearing in-house competition for the Corvette. Some of the design elements lived on however, in the Opel GT, the C3 Corvette, and the ’67 Firebird. Two Banshees survived: this silver coupe and a white convertible. They were stashed away by Pontiac employees who later bought the cars in 1973. Now this coupe is heading to the Dragone Auction taking place near the Greenwich Concours on May 30. Previously a no-sale at $325,000 (RM, Amelia Island 2010) and $400,000 (Mecum, Monterey 2010), the Banshee has a pre-sale estimate of $600,000–$650,000. It last sold for $214,500 at Barrett-Jackson, Scottsdale, in 2006. Photo Gallery - http://www.caranddriver.com/photo-gallery/ultra-rare-1964-pontiac-banshee-concept-headed-to-auction

-

Car & Driver / May 4, 2015 Tom Hoover, whose work at Chrysler included development of the legendary Max Wedge and 426 Hemi V-8 engines, the 1970 Plymouth AAR ’Cuda, and the 1978 Dodge Li’l Red Express truck, has died. Hoover passed away on April 30 after a long illness. He was 85. Often credited as the “Father of the Hemi,” Hoover trained as a physicist at Juniata College in his hometown of Huntingdon, Pennsylvania. He received his master’s degree from Penn State and later earned a master’s degree in automotive engineering from the University of Michigan while working for Chrysler. Hoover joined Chrysler in 1955 just as Carl Kiekhaefer’s Mercury Outboard–sponsored Chrysler 300s were dominating NASCAR stock-car competition with little aid from the manufacturer itself. But while Chrysler was reluctant to go racing, a group of young engineers within the company was eager to hit the track. Hoover became one of the leaders of this group of about eight drag-racing-fanatic engineers that, by 1958, had formed itself into the Ramchargers team. That led to “High and Mighty,” a 1949 Plymouth Business Coupe, which the team campaigned into 1960. “Even in those days,” Hoover related in a speech at the Chryslers at Carlisle event, “it became evident that if you really wanted to get serious about setting some national records, participating at the big meets and so forth, you couldn’t do it in a car that you drove to work every day in the winter of Detroit. The two are incompatible.” The Ramchargers success with “High and Mighty,” including several national speed records, led in 1961 to the team receiving direct support from Dodge. And by the spring of 1962 that led to the development of a drag-racing performance package for 1962-model Dodges: the Maximum Performance Wedge 413-cubic-inch engine, which was soon shortened down to Max Wedge. By 1963, that engine grew to 426 cubic inches. While the Max Wedge engine was instantly successful in drag racing, it wasn’t competitive against GM and Ford engines in NASCAR racing. By that time Hoover was head of the Race Engine Group at Chrysler and under the direction of the corporation’s new president, Lynn Townsend, he was tasked with winning the 1964 Daytona 500. Although development of the 426 Hemi didn’t start until April of 1963, progress was rapid. The basic idea was to use the Wedge engine’s block with new cylinder heads that took advantage of Chrysler’s successful hemispherical-shaped combustion chambers from earlier engines. In particular they used what were basically the combustion chambers designed for the stillborn “A-311” Indy racing V-8 developed in the early ’50s. “For high output and high air-flow configuration we knew the most about and had the most confidence in the Hemi,” Hoover told Hemmings Motor News in 2006. “We recommended in very short order that we adapt the Hemi to the raised B engine. Jack Charipar and some of his people made a presentation then to the executive council shortly thereafter. We got the approval. So, beginning in April of ’63, we set out straightaway to win the Daytona Beach NASCAR race in February of 1964—and we did, with the 426 Hemi.” In fact, the Hemi was so successful in NASCAR that Richard Petty’s victory in the 1964 Daytona 500 was but one of nine victories he’d take that year in Plymouths as he cruised to his first season championship. And it led NASCAR to change its rules for 1965 that effectively banned the Hemi engine and led to Chrysler’s boycott of the series for most of that year. But NASCAR changed its rules again and that led Chrysler to develop the 426 “street” Hemi for the 1966 model year in order to homologate the engine for NASCAR competition. Soon the Hemi-powered Dodges and Plymouths became legendary performers on the street and the most cherished (and most valuable) of collectible muscle cars. While the Hemi continued to dominate NASCAR—in 1967, Petty won an amazing 27 races driving Plymouths—it was also proving a sensation in drag racing. The 426 Hemi soon dominated the Super Stock classes while supercharged versions running on nitromethane became so overwhelmingly successful that today virtually all Top Fuel and Funny Car engines are based on the 426 Hemi design. Hoover retired from Chrysler in 1979 and went on to work for several other companies before settling back down in his hometown when he was finally done with work. What Hoover did was bring enthusiasm with him into the workplace. Under his leadership, a small group of engineers working within the smallest of Detroit’s “Big Three” automakers produced true legends. The greatness they fostered springs to the fore every time a classic Hemi-powered machine is auctioned for big bucks, and it’s the same elixir that today’s Chrysler taps to market its current generation of Hemi V-8s. .

-

Freightliner introduces first US market autonomous driving truck

kscarbel2 replied to kscarbel2's topic in Trucking News

Daimler granted license from Nevada to test self-driving trucks Automotive News / May 6, 2015 Daimler AG has been granted a license by Nevada to test self-driving trucks on public roads, as the U.S. and Europe race to establish a regulatory framework for autonomous vehicles. While companies such as Google have dominated the headlines with advances in driverless cars, Daimler board member Wolfgang Bernhard told reporters autonomous trucks were likely to hit the roads first. That is partly because more trucks operate "in a less complicated traffic environment" out on the open road, while passenger cars spend more time in urban areas, he said. Truck operators also have a big financial incentive to adopt the technology, as it would bring savings in wages and fuel. "It makes the most sense to them," Bernard said in Las Vegas on Tuesday. "These guys have to make money." Despite making significant progress with the technology, automakers face a battle to bring their advance prototype vehicles to market in Europe and the U.S. due to regulatory hurdles and questions about product liability. The "tipping point" to commercial viability of autonomous trucks will be reached when enough U.S. States allow them on their roads to make interstate commerce viable, Bernhard said. "We need more than (a few states) and it will take some time," he said. Bernhard said no customers had yet made a commitment to buying Daimler's self-driving trucks. "We think once the legislation is there and once the regulatory environment is there, we'll be approached by customers," he said. "We're not at that point yet." Europe too is working on establishing test routes for autonomous trucks, although it will take time before freight companies can cross the continent with such vehicles. "I think ... the regulatory environment can be done in the next five years," in Europe, Bernhard said. One of the challenges for autonomous driving proponents is meeting safety concerns while persuading lawmakers that accident liability can still be established. Questions over who is in charge of a vehicle require trucks to have a driver present, even while it operates in self-driving mode. Bernhard said other U.S. states -- California, Arizona, Michigan -- had shown an interest in self-driving trucks, but more states would need to get on board before the federal government took up the issue. -

Mack offered the Signet-produced unit in the R/U/DM cab from the early 80s, which evolved into the Red Dot. However on R/U/DM glider kits, the Kysor (of Byron) "Mini Brute" was the offering (Bergstrom bought Kysor in 2000). (For example: http://www.polarmobility.com/truck+aftermarket+air+conditioners.html) Beige (Mack vendor code 7979) 3375011 Grey (Mack vendor code 7979) 3375012 Note: While the Red Dot and Kysor AC retrofit kits came with compressor mounting brackets, they were both inferior to the factory brackets (Mack didn't allow either supplier to use Mack-designed brackets........they had to do something different). So you might want to source the brackets from Mack.

-